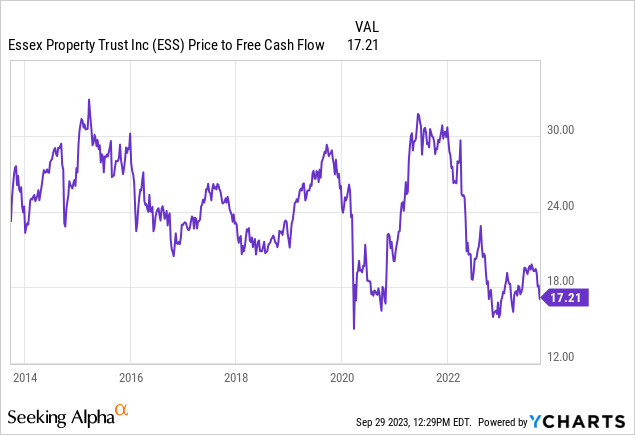

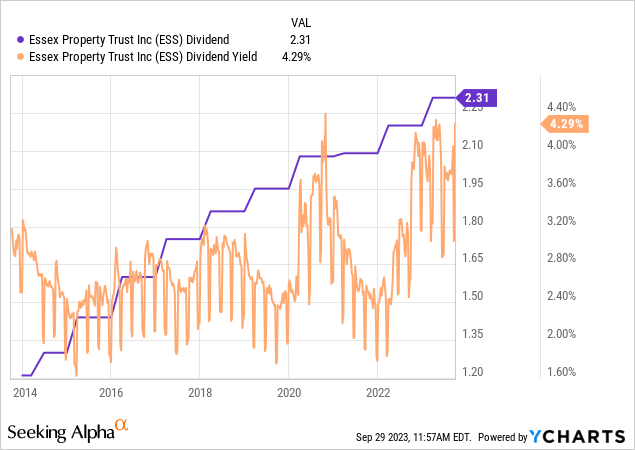

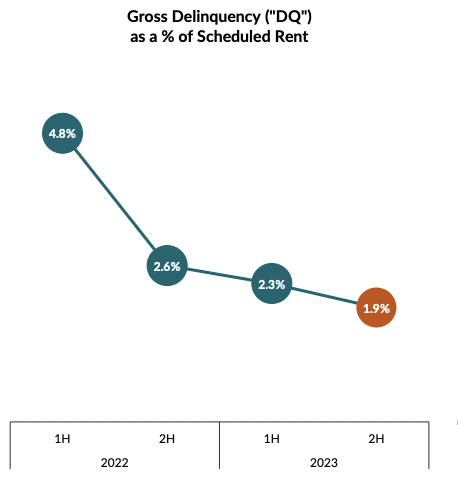

Essex Property Trust (NYSE:ESS) last declared a quarterly cash dividend of $2.31 per share, in line with its prior payout and for a 4.34% annualized forward yield. The last time ESS sported a yield this high was during the pandemic when stay-at-home orders and widespread eviction moratoriums drove up delinquent payments and sparked a broad selloff of the common equity. ESS is now trading hands at a price to free cash flow of 17.21x, its lowest level in years. Bears would be right to flag that its trailing 12-month funds from operations of 14.16x is still around 24% higher than its peer group median and that the current record yield still pales in comparison to safer choices.

To be clear, investors could swap out ESS for a certificate of deposit with yields of up to 5.6% and with no risk of losing their principal. This competition with safer income investments for investors has also played a part in driving down the price of the apartment REIT, especially against a macroeconomic context still defined by uncertainty around inflation and the direction of the economy. Looming student loan repayments could also have a not immaterial impact on delinquent payments as unemployment faces forecasts for its rise through 2024.

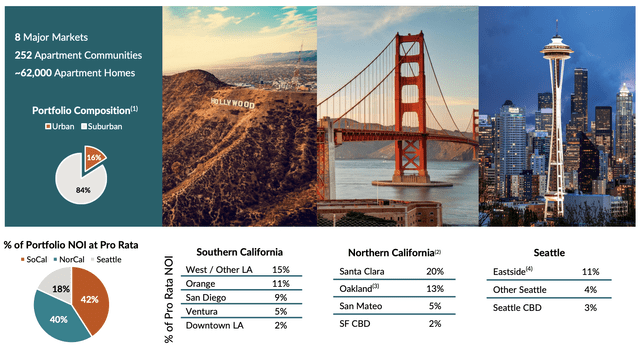

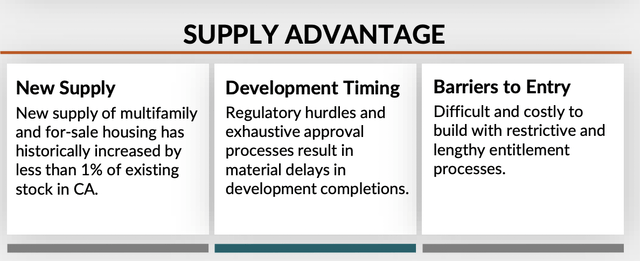

However, ESS has grown its dividend by a 3.72% compound annual growth rate over the last 3 years and has set the backdrop for further growth. The REIT hiked its core FFO guidance by $0.22 at the midpoint to a range of $14.88 to $15.12 per share. This would imply a 62.1% payout ratio when set against the current annualized dividend payout. ESS focuses on the supply-restricted West Coast market with just two states, California and Washington, accounting for 100% of its portfolio net operating income.

West Coast Focus

Essex Property Trust September 2023 Investor Presentation

It’s not hard to see why this concentration matters with California widely poised to overtake Germany as the fourth-largest economy in the world after usurping France in 2015 and the United Kingdom in 2017. Critically, an economy backstopped by technology and venture capital places California and the forefront of technological innovation, and ESS flagged the growing AI industry and recovering Bay Area VC fundraising as macrotrends driving renewed economic growth and drawing people to their West Coast locations. This is set against a growing return-to-work office trend that is running counter to bearish arguments that remote work will push workers out of the West Coast and into cheaper markets across the US.

Essex Property Trust September 2023 Investor Presentation

Same-property revenue was up 4% during ESS’s last reported fiscal 2023 second quarter with net operating income growing by 3.6% to $280.79 million. Both of these were also up 1.4% and 2.4% respectively on a sequential basis over the first quarter. The REIT, which forms one of the three REIT tickers on the S&P Dividend Aristocrat list, reported net income per share of $1.55, up from $0.87 in the year-ago quarter. Whilst this growth was mainly driven by income derived from marketable securities and the REIT’s non-core co-investments, core FFO grew by 2.4% to $3.77 per share from $3.68 per share in the year-ago period.

Fortress Balance Sheet

Essex Property Trust September 2023 Investor Presentation

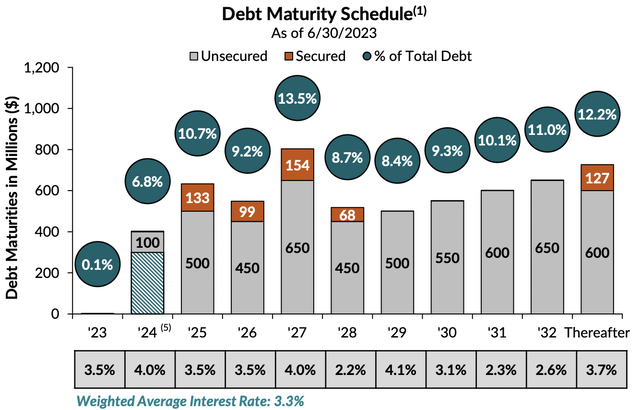

$14 billion market cap ESS held $1.6 billion in total liquidity as of the end of its second quarter with a net debt-to-EBITDA ratio of 5.6x. This liquidity profile included $738.4 million of investments in debt and equity securities for a new fortress positioning when set against what’s set to be $403 million in debt maturing next year, around 6.8% of its total debt balance. Critically, total debt came with a weighted average interest rate of 3.3% and was broadly fixed. New funds will have to be raised at higher rates with ESS closing on a $298 million 10-year secured loan at a fixed rate of 5.08% post-period end.

Essex Property Trust September 2023 Investor Presentation

Gross delinquency as a percent of scheduled rent came in at 2.3% for the first half of the year, maintaining a downtrend in place as pandemic-era tenant rent moratoriums fully get peeled back. Los Angeles lifted the last of its eviction moratoriums earlier this year on March 31 with tenants who owe back rent incurred from March 2020 and October 2021 only required to pay in full by August 1. ESS’s physical occupancy at the end of the second quarter stood at 96.7% with the REIT flagging strong corporate housing activity associated with the large tech companies supporting seasonal demand. We could see continued weakness with the commons against the Fed’s higher for longer mantra but the underlying fundamentals of the REIT are strong with the ticker a cautious buy.

Read the full article here