Over the past 3+ years, I’ve written about 100+ companies, and Tidewater Inc. (NYSE:TDW) is certainly not a traditional growth stock. However, TDW not only gives me diversification and exposure to the energy industry, but the company also has strong fundamentals and trades at a reasonable valuation.

At the time I’m writing this, I have a 3.5% position in TDW, and I will add on pullbacks as long as the fundamentals remain strong and the valuation remains compelling.

I began digging into Tidewater in late 2022 and started my position after the company reported impressive Q4 2022 earnings with 74.6% YoY revenue growth, expanding margins, and achieving profitability on both Adjusted EBITDA and net income basis, along with providing robust guidance for 2023.

Author’s message to subscribers (Seeking Alpha)

In the next several weeks, I spent a considerable amount of time reading about the company and the industry, talking to other people familiar with the drilling space, and listening to what Tidewater’s CEO was saying. This led to a full deep dive for my subscribers, published in late March.

The stock had a solid run since then, up almost 55% from $43.40 at the time of publishing the deep dive. But based on my investment model, I see much more upside in TDW, and I will go further in detail in this mini writeup on why Tidewater should be in everyone’s portfolio as not a direct energy play but closely linked to it.

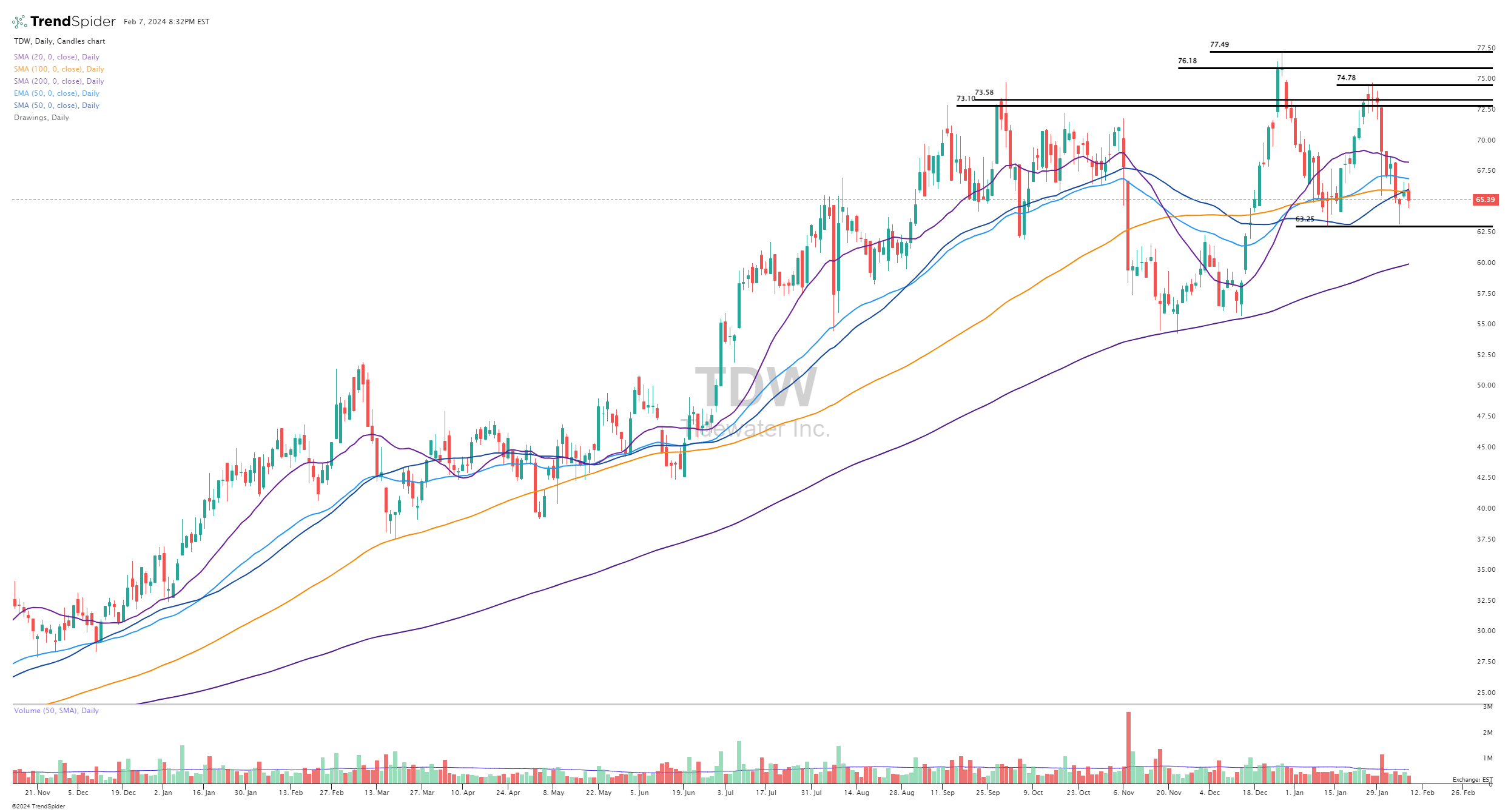

I added several times since then, but sold my entire position in September 2023 in the high $60s. Then, in November 2023, when the stock pulled back to the 200d sma, I restarted a position. Now that TDW has pulled back to the 50d SMA, I thought it was worth doing this mini writeup.

TDW (TrendSpider)

Investment Thesis

As I noted above, Tidewater is not directly an energy play but provides exposure to the oil and gas industry without getting into the more traditional names like Chevron (CVX), Exxon Mobil (XOM), and others.

Tidewater is not involved in exploring, drilling, refining, or transporting. Rather, those companies are TDW’s clients.

Tidewater is the world’s largest OSV (Offshore Support Vessel) operator that services offshore oil and gas exploration and drilling companies.

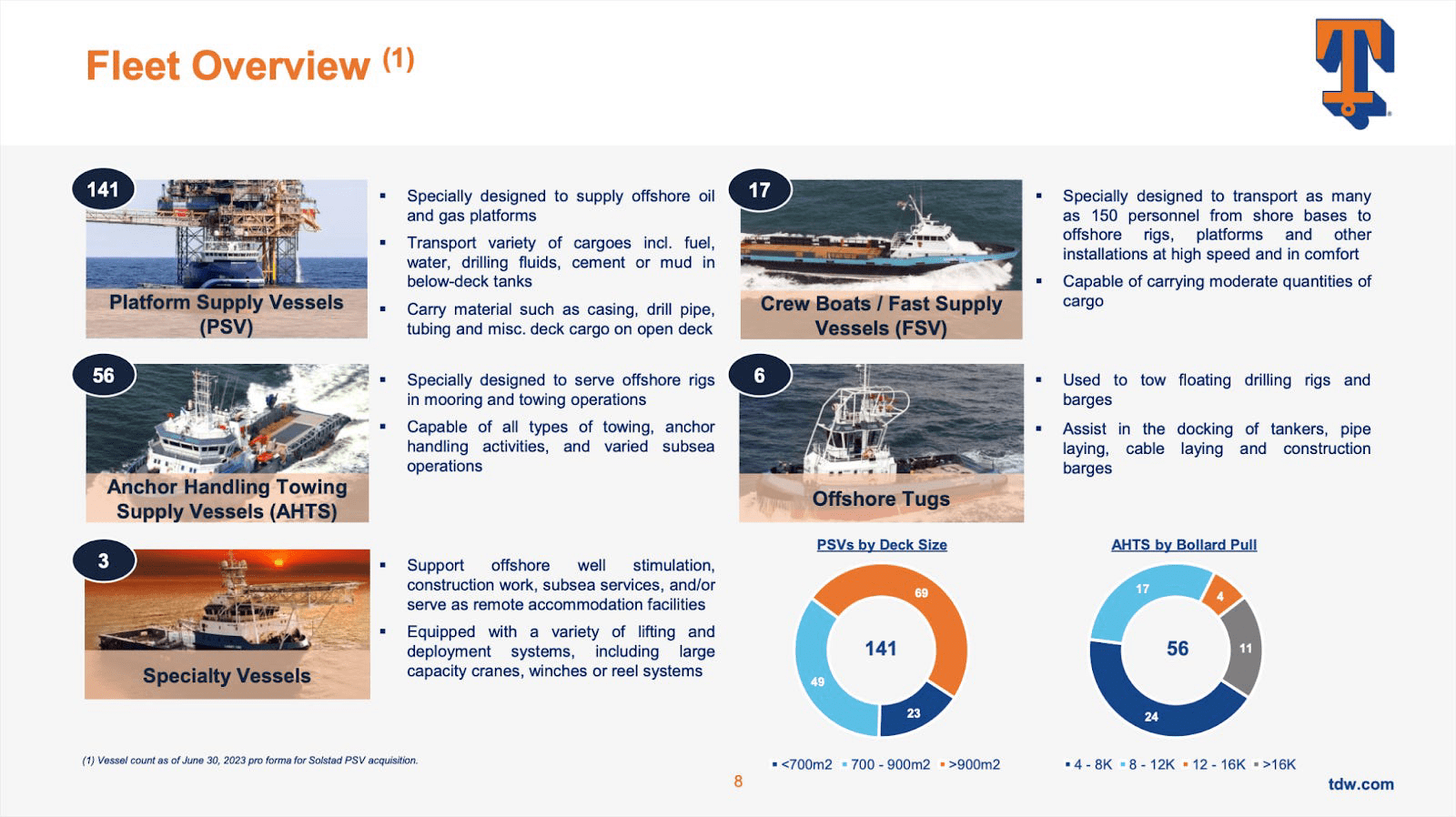

Its fleet with 223 vessels (including 141 platform supply vessels (PSV), 56 anchor handling towing supply vessels (AHTS), and other boats, maintenance vessels, and tugboats) transport supplies, materials, and people from land to offshore rigs across all major offshore regions.

Investor Presentation (Tidewater)

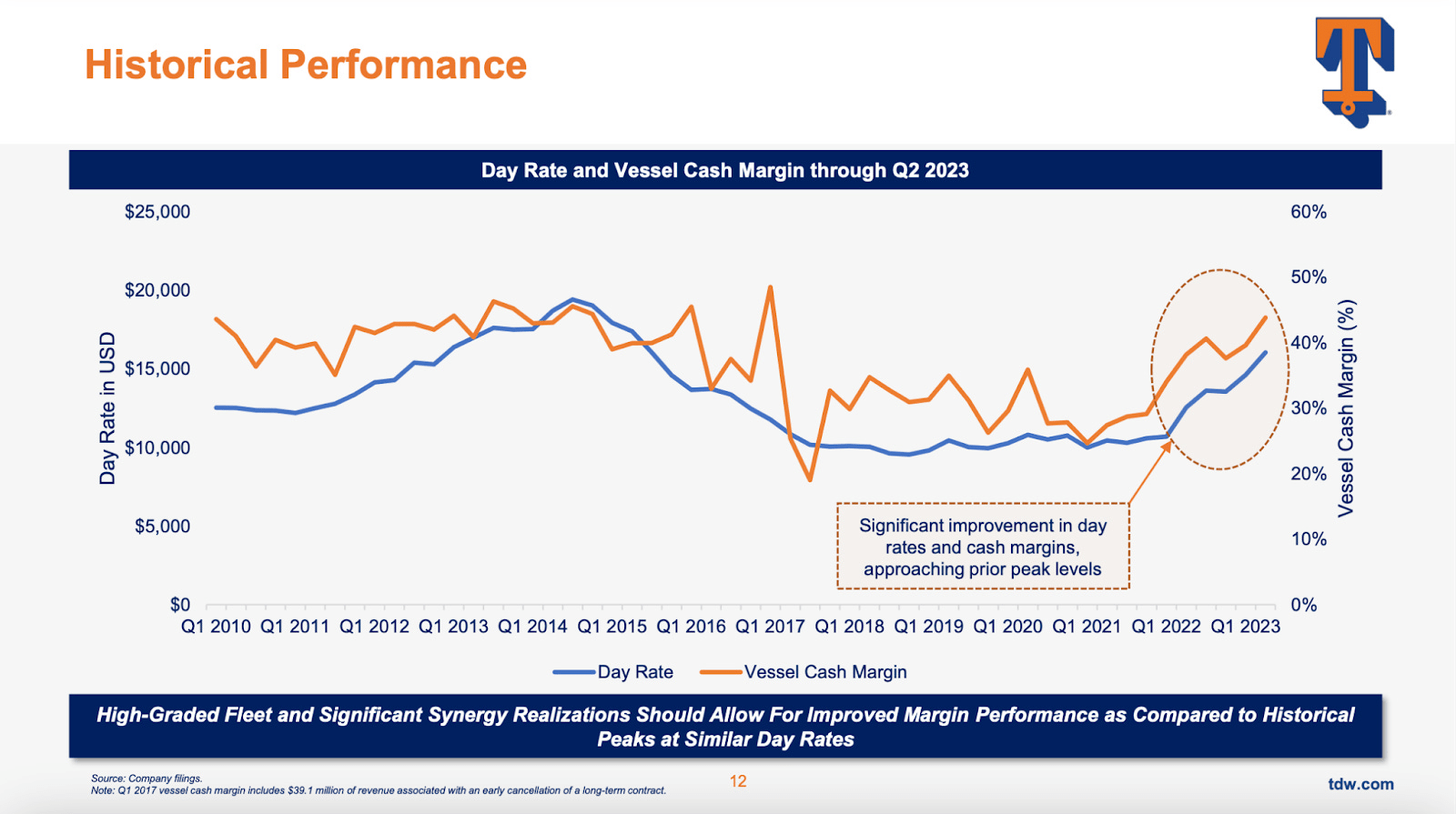

2022 marked the long-awaited inflection point in the offshore vessel market when day rates and cash margins began growing again after years of stagnation (the prior peak was in late 2014).

Investor Presentation (Tidewater)

This industry is primarily driven by day rates, which, in turn, depend on the oil prices. The dependence on oil prices is the weak side of the Tidewater investment thesis. However, I would argue that tremendous tailwinds in the form of constantly increasing demand for energy, mixed with current supply disruptions (Russia, Israel) and potential ones in the future, will support the high oil price in the coming years.

The need for more energy means higher offshore investments, leading to higher demand for drilling rigs. Most industry experts believe that the offshore drilling industry is at the beginning of a new cycle, which drives back the increased need for OSVs.

Indeed, day rates continue to rise in the OSV market. They were up $2,400 in 2022 and another approximately $3,000 per day in 2023. In Q3 2023, average day rates increased to $17,865 per day from $16,042 in Q2 2023 and $13,606 in the same quarter a year ago.

Day rates are growing (and are expected to grow further in 2024) in all operations regions, and so is the revenue. In Q3 2023, revenue in the Americas, for example, surged 80% YoY and 40% QoQ to $70.3 million, while in Europe/Mediterranean, revenue grew to $70.3 million, up 96% YoY and 98% QoQ. Tidewater expects to exceed $1 billion in revenue in 2023, which is 12.78% more than the $900 million guided at the start of the year, representing approximately 56% YoY vs. 39% YoY forecasted previously.

In Q3 2023, the company provided its guidance for CY2024, expecting revenue in the range of $1.4 billion to $1.45 billion. The current consensus for 2024 is $1.41 billion, which implies a 39.1% increase from CY2023.

I believe the management is probably leaning conservative here; however, not all of their customers and revenues are locked into contracts, so there’s still some risk that day rates decrease over the next 6+ months, which could hurt TDW. I still think there’s a good chance we will see a revenue number for CY2024 above $1.5 billion.

There are two big risks for TDW; one is a global recession that hurts demand and drives oil prices down, so companies cut back on their exploration & production budgets, which means less need for OSV support from TDW.

The other big risk was introduced a couple of weeks ago when Aramco (the largest oil company in the world) said they were going to cut back on production — and we all know it’s because they want higher prices. These companies want oil to be in the $80-90 range because that’s when they can maximize profits without hurting demand. Once oil gets over $100 and consumers see gas prices at $5+ per gallon, they start to cut back on their driving, which drives demand lower, which is not good for the oil companies. When oil is under $70, their profit margins start to get squeezed. Right now, oil is hanging out in the $70-75 range, but I guarantee Aramco wants it $10-20 higher.

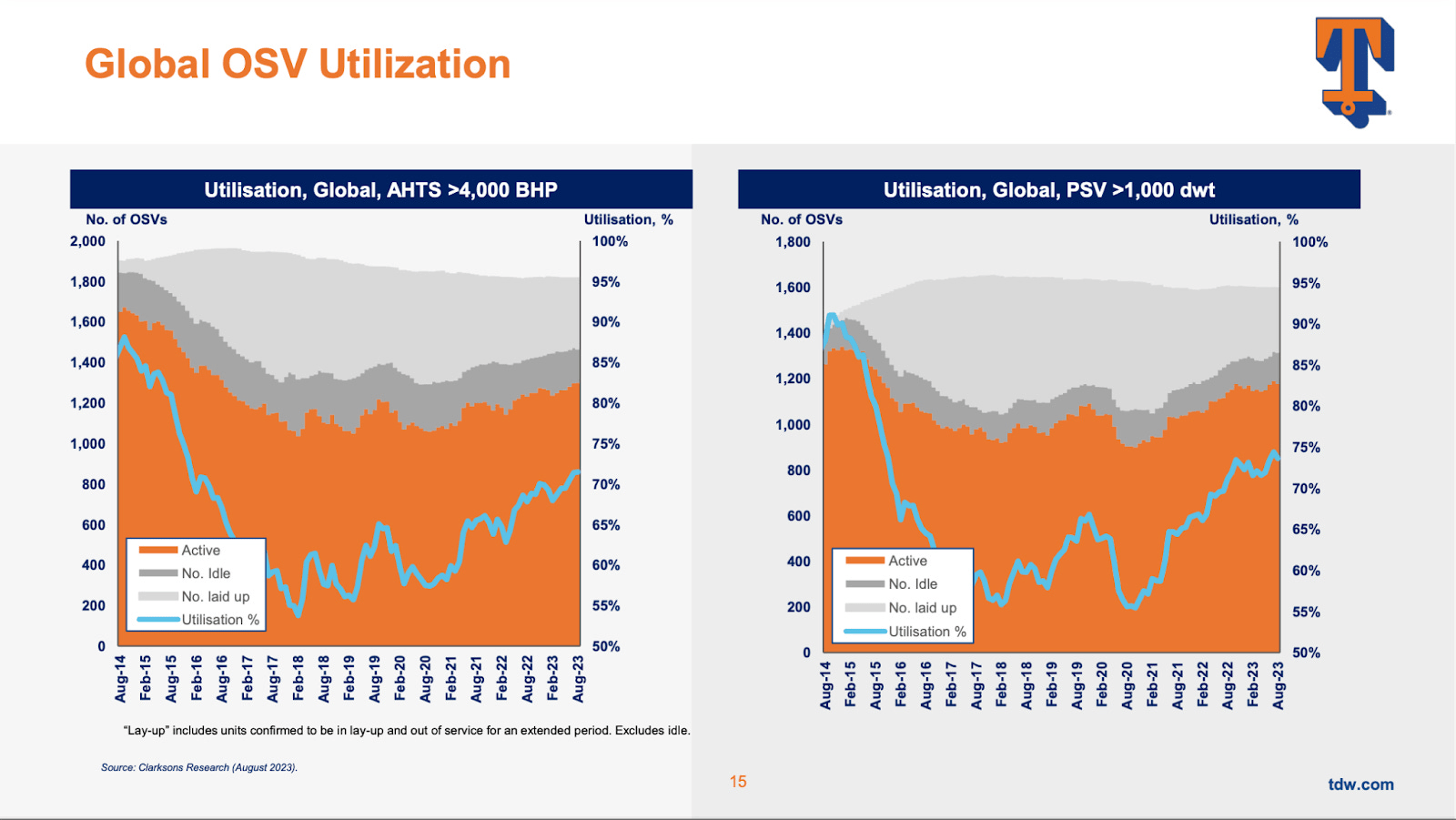

While the market might be oversaturated with OSVs, many of them will never return to the waters, keeping the supply tight. This drives the strong utilization rates. Tidewater also benefits from a large number of contracts that will renew in 2024, allowing the company to hike prices.

Last summer, TDW bought 37 OSVs from Solstad, which allowed them to strengthen their fleet in several key markets.

Investor Presentation (Tidewater)

The growth opportunity for Tidewater goes far beyond the gas and oil industry. Major energy companies are actively exploring renewable energy sources, particularly offshore wind. Offshore wind energy is taken from the force of the sea winds, which is then transformed into electricity and sold to the grid operators.

Investments in offshore wind projects were approximately $40 billion in the past several years. They are projected to rise to $50 billion in 2024 and could surpass the investments in oil and gas by 2028. The offshore wind industry may end up being a more significant growth driver for TDW and other OSV owners in the future, especially if the demand for fossil fuels decreases as more consumers switch from ICE vehicles to electric vehicles.

Currently, most offshore wind projects are in shallow waters with fixed energy-generating facilities, but more investments are rushing into floating wind projects, which move further offshore. These types of projects require higher-spec vessels, where Tidewater excels.

The addition of offshore wind projects substantially increases the global OSV market, which was estimated to reach $22.6 billion in 2023, up from $14.5 billion in 2021, and further grow at approximately 7% CAGR to $31.4 billion by 2028. Despite being the largest OSV provider, Tidewater’s current market share is still no more than 5%.

Tidewater does have $600+ million of debt (due to several strategic acquisitions, including the recently completed acquisition of Solstad for $577 million). However, TDW has almost $300 million of cash on the balance sheet, plus they generate a significant amount of free cash flow (FCF).

In fact, I believe TDW will generate at least $1.5 billion of FCF over the next 3 years, with a shot at $1.0 billion between the start of 2024 and the end of 2025.

FCF is vital in paying off the debt; it could be used for more M&A deals that will further cement Tidewater’s market-leading position and, of course, could be used for returning capital to shareholders in the form of stock buybacks and/or dividends. Just recently, management authorized a $35 million stock buyback plan to offset the dilution from previous acquisitions.

Tidewater could potentially become a monopoly in the OSV market while growing revenues in the teens, which isn’t super exciting, but they have the potential to hit 30% FCF margins in the next 2-3 years.

Right now, the enterprise value is under $4 billion, and I think they could generate more than $1.5 billion of FCF over the next 3 years, which means even after they pay down the debt, they’ll still have plenty of cash left over for stock buybacks and potential dividends.

Valuation

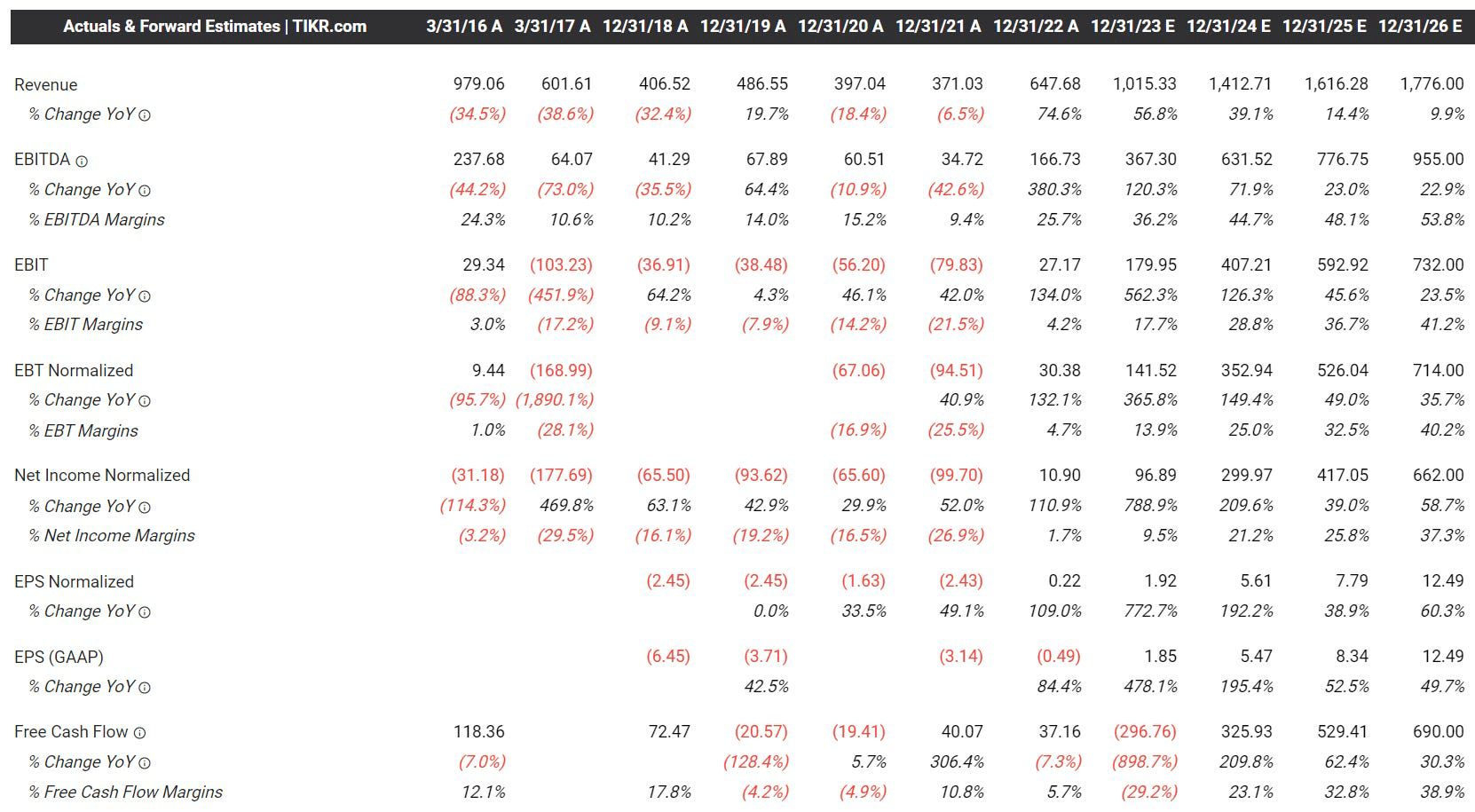

I do believe TDW’s valuation is compelling, which is why I’m adding to my position on this recent pullback. As you can see from the chart below, TDW is coming off two very strong years of growth, although some of that came from acquisitions, so it’s not all organic.

Analysts think TDW can do $5.61 in non-GAAP EPS this year and $5.47 in GAAP-EPS. With the stock at $65.39, it means TDW is currently trading at 11.6x 2024 EPS (which is growing triple digits) and approximately 11.9x 2024 EV/FCF, which is ridiculously cheap given the expected FCF growth rates over the next few years.

I know this is not an apples-to-apples comparison, so don’t take it too seriously (just trying to make a point)… but I sold PLTR yesterday after it jumped 32% on earnings because, after the crazy rally, the stock was trading at 45x FCF with lower growth rates than TDW. With regards to PLTR, I just don’t like the risk/reward at 45x FCF because I don’t see the catalyst for much more multiple expansion, whereas with TDW, it would be justified if the stock was trading at 25x FCF or higher. Now, I know PLTR is a software company, and TDW is an energy services company (can be very cyclical), but I honestly think it’s more likely that TDW’s FCF multiple expands from 11.9x to 17.8x (50% increase) than PLTR’s FCF multiple expanding from 60x to 90x (50%).

Not many companies out there are trading at 6.3x EBITDA, with 72% EBITDA growth expected for this year. Obviously, that growth rate is not sustainable, but it means limited downside, in my opinion, unless we see big exploration & production cuts for the oil industry and big capex cuts for the alternative energy industry.

TDW Estimates (TIKR)

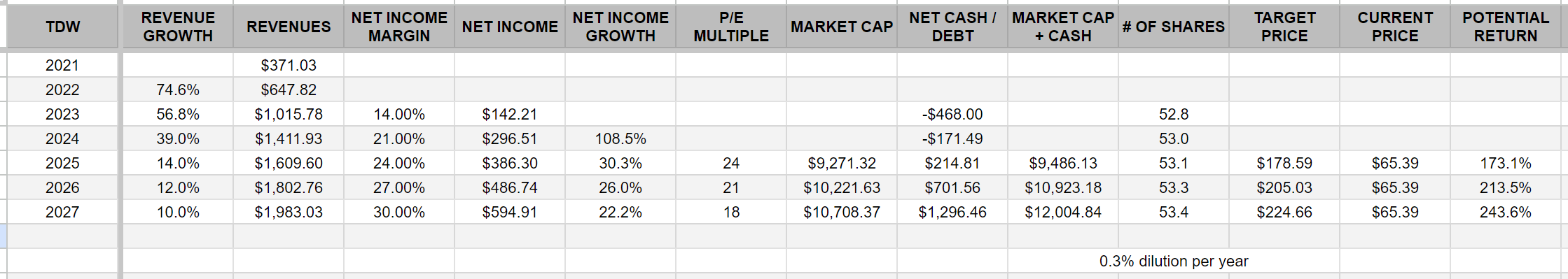

Here is my investment model for TDW, which shows 243% upside potential over the next few years, but that would mean investors need to give TDW a fair P/E multiple, and I’m not sure that could ever happen because the company is part of a cyclical industry that has historically traded at lower multiples which doesn’t really seem fair but it’s the truth. It’s very possible that TDW’s P/E multiple never gets above 15x, which certainly reduces the potential upside over the next few years.

Author’s Investment Model (Lupton Capital)

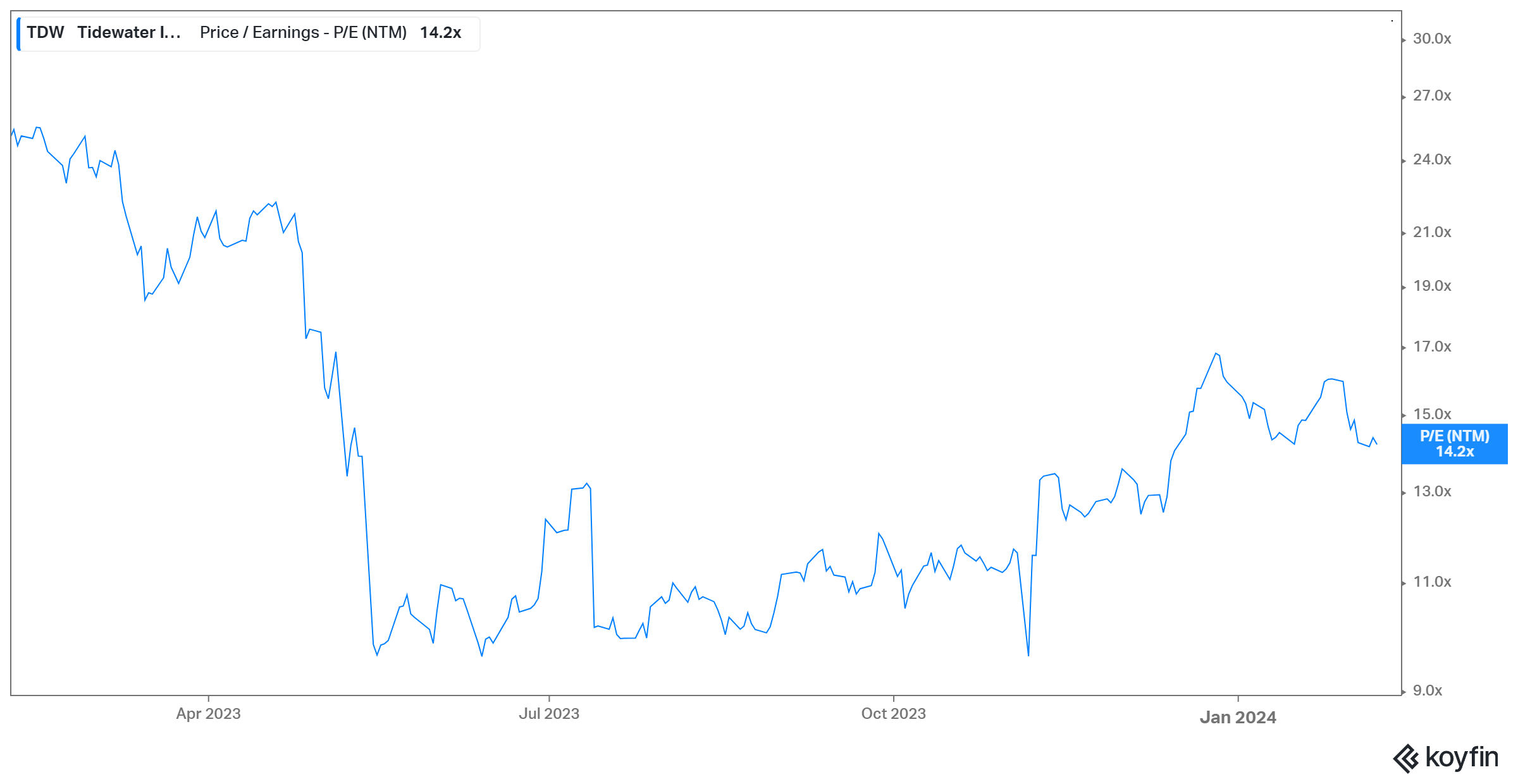

However, in the past year, TDW did trade at a forward P/E multiple above 20x, so it’s definitely possible and could make for some awesome returns if it happens again.

TDW P/E (Koyfin)

Conclusion

I don’t have an exact earnings date for Tidewater Inc. yet, but it will probably be late February. As long as they reiterate or raise their full-year guidance, then I’ll stay in the stock. If they lower their guidance, then it changes my outlook and puts my investment thesis at risk.

If we see additional companies cut their E&P plans, it might not hurt TDW right away because of contracts, but it could impact them in the back half of 2024 and going into 2025.

There’s a reason why I don’t own any traditional energy stocks in my investment portfolio, but I still believe Tidewater Inc. is a unique story that remains compelling because of fundamentals and valuation. It’s not too hard to see a path to 100% upside or more within 3 years, but I’ll need to continue monitoring the company and make sure that day rates are holding up.

I’m glad that TDW has been able to diversify away from just oil & gas clients and into the alternative energy offshore market, which seems to be growing nicely. Very few growth investors would ever look at a company like TDW, but that doesn’t mean there’s not an opportunity to make money over the next few years, especially if we see FCF margins expanding to 30% or higher.

Even though I’m currently bullish on TDW, I don’t think I’d let the position get bigger than 4% of my portfolio… unless they report blowout earnings and give monster guidance for CY2024… in this scenario, if the market was slow to react I’d probably take my position up to 5%.

Read the full article here