Last year I started covering Eve Holding (NYSE:EVEX) and I’m charmed by their approach toward creating a future for eVTOLs (electric vertical takeoff and landing) and urban air mobility (“UAM”) with significant knowledge leverage that should help the company create a successful product. In this report, I will have a look at the most recent milestones that are achieved and also highlight the risks of disruptive technology.

The Risks Of Urban Air Mobility

One risk I’m seeing with coverage of UAM or eVTOL names is that the disruptive technology is often equated to value creation. This is not necessarily the case.

In a previous report, one of the article bullet points was the following:

The eVTOL development is in its early phase and it’s likely that many of the eVTOL designs won’t enter the market or create sustained success.

That remark will apply for the foreseeable future. In some ways, urban air mobility at the current stage is not much different from biotech or disruptive technology applied in commercializing space. There’s a disruptive technology which needs to be tested thoroughly, and UAM solution providers need to develop their product, test, and then scale up production. With the many UAM players active, there’s no doubt that some will not be able to deliver on their prospects and might run out of liquidity runway even before the product is launched.

Eve Has Huge Advantages

Eve has several advantages that give it an edge. The biggest and most obvious one is its ties with Embraer S.A. (ERJ) giving them access to Embraer engineers.

Eve Urban Air Mobility

I previously pointed out that Eve would likely be co-locating with Embraer leveraging their production experience. Earlier this year, Taubaté was selected as the production location and we see that Eve indeed is leveraging part of the potential with Embraer. It does not mean that the company will have no capital expenditures to add to plants and equipment, but it surely does provide some advantage over eVTOL manufacturers that have to build their facilities from the ground up.

So, Embraer is a strong partner in this, and I would say the strongest partner that any urban air mobility company has at this point. While the R&D phase is cash intensive, the initial production phase is most often loss making, but with the existing experience and footprint of Embraer, Eve can somewhat de-risk the production phase.

Eve Ticks Off Milestones

Eve Urban Air Mobility

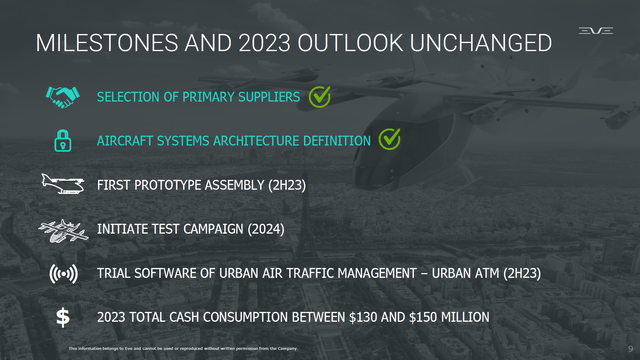

Eve already indicated that it would freeze the design and start selecting primary suppliers in H1 2023, which I view as vital to keep any hope on a certification by 2025 alive. The company’s eVTOL product will be able to carry four passengers plus luggage in a piloted setting and up to six passengers in an autonomous setting with a 100 km range.

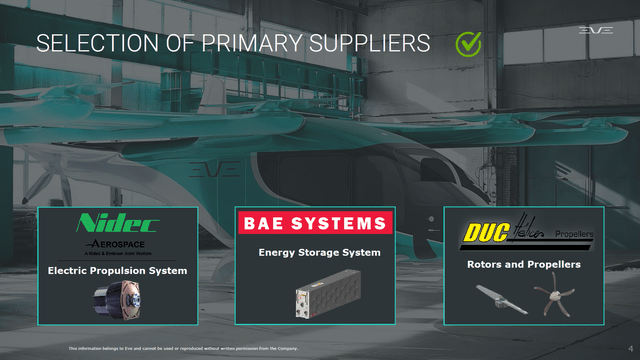

Furthermore, Eve has selected Nidec Aerospace for the electric population system, BAE Systems (OTCPK:BAESF) for battery, and Duc Hélices for the rotors and propellers. Besides this allowing the company to increase its development, it also gives more certainty about actual operating costs. I won’t be making comments about the actual operational costs or advantages versus competition on that end as it’s too early for that and the initial estimates by OEMS tend to skew advantages in their favor. Overall, we see the freeze of the aircraft system architecture and selection of primary suppliers right in line with the indications Eve has provided to enable a 2025 certification.

The company has also completed the first carbon laminate materials and continues wind tunnel scaled tests.

Eve Urban Air Mobility

Looking at the milestones, we see that Eve has ticked the boxes for two milestones and the first prototype assembly also should have started in August and I’m expecting conformation on that in upcoming quarterly results. So, what’s left to do is finishing the assembly and the software milestone in 2H23. The test campaign is set to start in 2024. In my May 2023 I already noted that the unofficial guide of a 2025 certification might be optimistic as conventional aircraft developments have often taken 2-3 times the initial estimated development time which would point more towards 2026. This also was somewhat confirmed earlier this year when Embraer’s co-CEO stated that 2026 was the most likely year in which eVTOLs would be built. Given that OEMs don’t want to increase build rates when the aircraft is still not certified, it’s somewhat of an indication that 2026 is also the year in which Eve’s product could be certified.

I would be surprised to see Eve’s product being certified by 2025, but also don’t see a certification by 2026 as a major setback.

Eve Urban Air Mobility

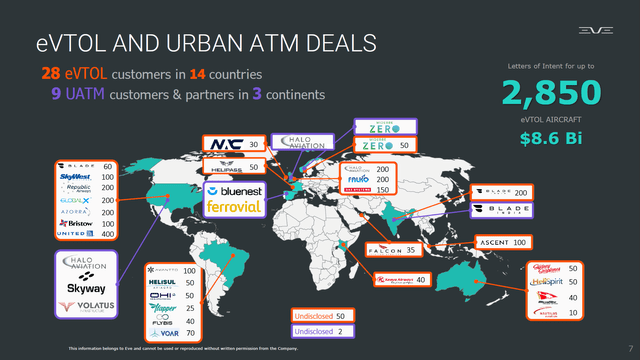

The pipeline for Eve remains huge, with an $8.3 billion pipeline with partnerships for eVTOL orders as well as traffic management solutions. We see, for instance, United Airlines Holdings, Inc. (UAL) as a customer for 400 eVTOLs, giving Eve a big airline customer. The UAM solutions will open up new opportunities with fully closed end-to-end solutions that also will appeal to airlines, so having airline customers is big and it’s important. Airlines currently rule the skies, and it’s expected that they will be important to the backlog of UAM companies going forward as they develop new products and services, of which eVTOLs are part.

What we also see is interest from the defense industry and partnerships on technology and logistics. So, Eve is aligning product development with markets, logistics, infrastructure and technology in a way we don’t see with many other players. With its UAM traffic management system, the company is working towards a full solution suite.

The big question of course is when the LOIs (Letter Of Intent) will start materializing and resulting in cash flows for the company. There seemingly are two conditions for that. The first is that for each customer, prior to firming orders, the needs and readiness will be assessed, or putting it in other words, Eve will start compiling a list of customers that are ready to firm up and build their eVTOL business. Once the order is firmed, a downpayment will likely be made and then over the course of 18 months prior to delivery, program payments will be made. So, while pre-delivery payment are often not directly tied to each other it will likely be the case that as we see more visible and progress on certification more customers will make a decision to proceed with their eVTOL plans or not, and that should result in the backlog firming and in some cases be deflated.

Eve Urban Air Mobility

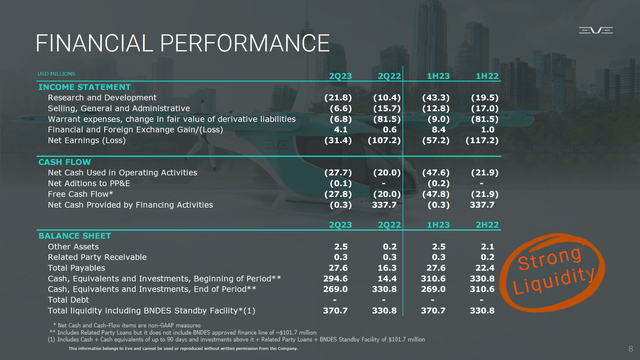

Right now, if you’re looking for profits or positive cash flow, UAM companies are not your cup of tea. These companies are in the stage of bleeding cash and are fully focused on pacing development with the available liquidity. Eve has no operational revenues and some of its positive cash flows come from returns on cash investments (marketable securities).

The company has $370.7 million in liquidity including the standby liquidity from which it would start drawing in September. In 2023, the cash burn will be between $130 million and $150 million and there already has been a cash burn of around $50 million year-to-date, leaving $80 million to $100 million for the balance of the year, which would bring the liquidity position down to roughly $270 million by year and using the high cash consumption figure. At a cash burn rate of $100 million going forward, the company would be funded into 2026 and into 2025 on a $150 million burn rate per year.

What is clear is that the BDNES Standby Facility of $107 million that was arranged earlier this year is more of a de-risking necessity than a luxury to the liquidity position of the company. As sight on certification should improve this year and mostly next year, there will be some positive cash flows related to downpayments, and while those might be small, every bit of positive cash flow that can be generated at this stage means a dollar less to eventually borrow. And a better cash position also will allow Eve to secure long-term loans to finance initial production and growth which will likely also require additional capital expenditures.

So, I wouldn’t say that there’s absolutely no liquidity concern in the sense that it’s not certain that funding into 2026 will be sufficient to execute the plans. Whereas some companies are forced to dilute shareholders to even have a chance of certifying their product, this does not seem to be the case for Eve and I also would think that with strong backing from Embraer from expertise perspective chances of arranging finances are higher. This, however, does not mean there’s no dilution risk as outstanding warrants, which by my calculations are around 67 million in total, could potentially dilute investors by almost 25%. However, it’s not a given that this dilution does happen as some of the warrants also have strike prices significantly below today’s share price.

So, dilution is no imminent risk and the need for long-term financing would mostly be tied on scaling production which would be a sign that things are going in the right direction for Eve. What Eve likely will be doing a lot better than many other eVTOL manufacturers is arranging liquidity before it needs it, because arranging additional liquidity before it’s needed keeps multiple financing options open.

Eve Positions For A Futuristic Future

Effective September 2023, Eve’s leadership has changed which I would think also is somewhat of a sign that the company is actively looking at the commercialization of eVTOL manufacturing and services and putting the right people at the right spot. The company has appointed Johann Bordais, President and CEO of Embraer Services & Support, as its new CEO. At Embraer, Bordais oversaw the establishment of Embraer’s services business which became the most profitable business line.

For Eve, there are various reasons to add Bordais to the leadership team. The first one is because it puts someone from Embraer with Embraer experience at the head of the company, which will be important given the close ties with the Brazilian jet maker. Secondly, the company needs to scale its business from a manufacturing perspective and Bordais has been able to head a profitable business before. Third, and likely not on the mind of the investor right now but probably should be, Eve wants to derive a significant portion of its revenues from aftermarket sales and Bordais has experience in this having transformed Embraer’s aftersales business model and globalizing its solutions. With an envisioned global operation base of eVTOLs and a competitive market offering global cost efficient solutions that drive value to the OEM as well as the customer is important.

Is Eve A Good Stock To Buy?

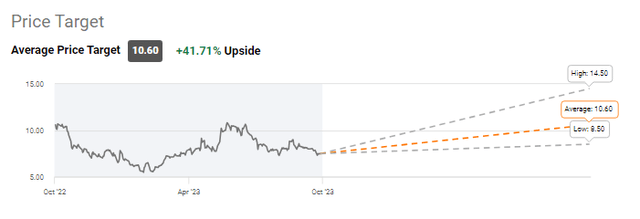

Seeking Alpha

Whether Eve is a stock to buy depends on your risk appetite. If you expect value creation any time soon without any risks, then this is not your cup of tea. If you believe in the technology and the timeline that Eve has stipulated, then it might be worth taking a speculative buy position. Wall Street analysts have a $10.60 price target providing more than 40% upside, though it’s hard to really value the company, as it has no significant revenue stream yet and it burns cash for the years to come.

Since I have a buy rating on EVEX stock, the stock price has increased by nearly 25%, easily outperforming the markets.

Conclusion: Eve Stock, Like Any UAM Or eVTOL Company, Is High Risk And High Reward

Investment in UAM companies is for those with patience and who believe in the disruptive opportunities paying off over the long term. For now, I believe that Eve Holding, Inc. is positioned very well with a diversified application base for its eVTOL product, while it has solid backing from Embraer with funding through 2025 and the company also should have financing options that will not dilute shareholders. Eve might eventually be late to the market or late to the market relative to the projections of competitors, but I believe its business plan comes better together to eventually build a profitable business.

However, the risk of delays in development of certifications should be kept in mind next to any constraints that might exist in the operational field of traffic management and infrastructure as well as manufacturing infrastructure. We’re getting a bit more insight in the timeline now and I’m seeing more signs that Eve already is looking beyond certification, and what I’m seeing is quite charming. With that in mind, I mark Eve Holding shares a speculative buy, with the note that investors should be extremely well aware of the risks of timelines sliding and of excessive cash burn.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here