Thesis

For investors new to our work on Fairfax, please see ‘Fairfax Financial: Unappreciated Earnings Power’ for a more detailed look at the overall company. Below is our primary thesis on the company.

We think investors are not appreciating the underlying earnings power of Fairfax because they are fixated on certain historical issues.

Fairfax Financial (OTCPK:FRFHF) is in an environment in which it should thrive – the insurance business has grown 3x, the investment portfolio is mostly short duration fixed income while interest rates have increased dramatically, and the remainder of the portfolio needs to simply do fine to produce a rewarding ROE.

If the company consistently executes over 12-18 months, we think the multiple is likely to rerate closer to peers trading over 1.5x P/B vs where Fairfax is today at 0.9x. This would produce gross investment returns of 2x – 3x over 5 years.

If the multiple does not re-rate, we expect management will continue to buyback stock (share count is down by ~17% over the last 5 years), resulting in faster EPS and BVPS growth.

(all amounts in USD unless noted)

Q3-23 Results Very Strong

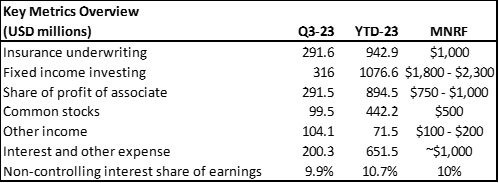

FFH financial statements, MNRF analysis

The above table highlights the key metrics we think drive value for Fairfax shareholders (our figures are for full year). Keep this in mind if you compare YTD results (which are for nine months) to the MNRF column. The above figures won’t reconcile completely to the financials because these are just the key metrics.

As you can see, YTD results are tracking very well. One thing to note is that given how the quarterly disclosure runs, interest and dividend income is lumped together in fixed income in the table above. This means, relative to our expectations, the fixed income number is too high and common stock total returns are too low. For scale, dividends last year ran ~$100M in 2022.

We think it’s important to talk about the fixed income total returns, as they appear to be trending below expectation. Reducing total return are fixed income losses, both realized and unrealized thanks largely to rising interest rates in 2023. Recently the Federal Reserve said is not even considering or discussing rate reductions but they did hold rates steady. It feels like the Fed is pausing to let the economic ripples catch up with the dramatic rise in rates. On the flip side of that coin, Fairfax’s interest income has been growing throughout 2023. Case in point, in the current quarter interest and dividend income was $512.7M and for the YTD period it was ~$1.36B. If one were to take the current quarter run rate, it appears that interest and dividend income might be running at ~$2.0B annually. If interest rates pause here or even pull back a bit due to market forces, this will put overall fixed income total returns in our expected range if we look ahead.

As for the remainder of the results, it’s difficult to find too much where we can be genuinely critical. It was just a really good quarter and it’s looking to be a banner year for Fairfax.

Insurance

Fairfax’s insurance business continues to do very well. Premiums written are up 5% in the quarter and almost 8% YTD (after growing double digits the last couple years). Consolidated combined ratios are around 94%-95% (which is good), thanks to better catastrophe experience, rate increases and higher volume.

We expect the insurance business growth to continue into 2024. The company acquired the substantial remainder of Gulf Insurance which will add to growth in 2024 (the Gulf deal is expected to close Q4-23 and should add $2.7B in premium). Also, Fairfax is slowly buying out non-controlling interests in other businesses like Allied world where they increased ownership from 82.9% to 83.4%. The company continues to work on acquiring majority control in Digit which doesn’t appear to be in the cards soon but over time, if regulations allow for it, Fairfax should be able to do so without competition due to its compulsory convertible preferred share holdings and current 49% stake. It looks like the company is able to get rate increases along with higher business volumes in its other insurance business, however clearly at a slower pace.

Looking ahead past 2024, the growth road map for the insurance business has more whitespace. With Gulf wrapped up, Digit being worked on, the non-controlling interests in the owned insurance companies slowly being chiseled away and, perhaps, a moderating of some of the hard market conditions, it may allow Fairfax to direct additional capital and deal making attention to the non-insurance businesses. International insurance remains a great area for additional growth.

We aren’t saying Fairfax is done growing its insurance business but that, clearly, a strong global foundation has now been laid. Now, given the size of the business, organic growth can be more meaningful potentially providing more resources for the non-insurance businesses. We think that is an exciting idea.

Portfolio Positioning

Fairfax looks to have tippy-toed duration out a little further but still quite low as half the bond portfolio is less than 3 yrs plus. The company announced earlier this year it bought $2B of first mortgages from Pacific Western Bank with an average annual expected return of 10%+ but those are shorter maturities.

The fixed income portfolio is 70% government bonds and the remainder high-quality short-dated corporates.

Partially Owned Businesses

YTD share of profit in associates is up and a healthy ~$900M which puts the company on track to have another billion plus year in profits from this portfolio. We mentioned previously Poseidon earnings might be challenged and they are trending downwards. Poseidon will be adding new ships to the fleet so volume could offset price pressures. Digit earnings are starting to show through at around ~$26M YTD. Still significantly underrepresenting the value of this asset (as discussed in our previous article) but nice to see. Eurobank is doing very well, as is EXCO (thanks oil prices).

Restaurants and retail segment, primarily driven by Recipe, showed a decline in income as volume and higher menu pricing was unable to totally offset food and labor inflation.

At the end of Q4-23 Fairfax India performance fee will be settled and, if a fee is due, should increase FFH’s ownership in Fairfax India as it is invested in shares.

Market Still ‘Pouty’ on FFH

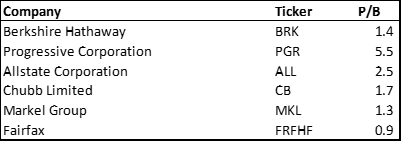

Fairfax and competitor price-to-book ratios (Yahoo finance)

Despite the continued excellent performance, the valuation remains moribund. We won’t pretend to know what the market is thinking. Obviously we don’t. When you have companies like Morningstar proposing that Fairfax should trade at 0.9x book because investment performance has been ‘spotty’, this is clearly a failure (in our view) to even look at what the company is doing.

Current results put Fairfax on track to earn around 20% ROE for 2023. How does it make any sense for a company that is earning a 20% return on equity (off of Treasury bonds and insurance) to trade for less than book value?

We don’t know.

If you’ve ever caught yourself looking at a historical chart or case study of a company that was at one point trading so cheaply that ‘if only you could go back in time you’d buy as much as you can’ and ‘why couldn’t everyone see it’ — now you know what if feels like to be in that moment of opportunity.

The good news is that Fairfax continues to take advantage of the market and is buying back more stock. At this point the company has reset shares outstanding to around 2016 levels (when it was 3x smaller). All that growth has accrued to patient business owners, stock markets be damned.

Book value per share is now $876.55 and we are expecting ROE’s of 13%-14% structurally over the medium term. With long bonds at ~5% and Fairfax at a discount to book, investors are set to earn a nearly 10% spread to treasuries as book value grows.

MKL recently reported its Q3 results and noted that, in the 5-year period ended September 2023 it compounded book value at 8%, yet MKL trades at 1.3x P/B well above where FFH trades even though FFH has grown faster. Given where peers are trading and Fairfax’s results, we think it is entirely reasonable for Fairfax to trade at least at 1.3x P/B or ~$1,150/share today.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here