Investment Thesis

Farfetch Limited (NYSE:FTCH) is about to report its Q2 results on Thursday after hours. To say that one of the drawbacks of investing in Farfetch is its history of operating losses and high marketing expenses as it strives to capture a larger share of the luxury e-commerce market, doesn’t bring anything new to the table.

In fact, the reason why I’m downwards revising my rating of Farfetch from neutral to a sell is that I’m struggling to believe that new investors considering this name will regard its stock to be sufficiently undervalued that it warrants them to part with their hard-earned capital to invest in Farfetch.

Meanwhile, for their part, Farfetch continues to declare that it is turning around its operations.

The reality is, Farfetch made sense when investors were investing first and asking questions later. However, those times have now well and truly dispersed.

Today, investors are asking first, then asking more questions, only to subsequently demand a large margin of safety. With all this in mind, I struggle to remain neutral on this stock.

Why Farfetch? Why Now?

Farfetch is an online luxury fashion retail platform that connects consumers with a global network of high-end boutiques and brands.

Its value proposition lies in providing access to a vast selection of luxury fashion items and unique pieces from around the world, offering a seamless online shopping experience and curated content for fashion enthusiasts.

Putting aside its narrative, I don’t see enough value at hand to entice investors to chase this stock any time soon.

Revenue Growth Rates Don’t Inspire Much Optimism

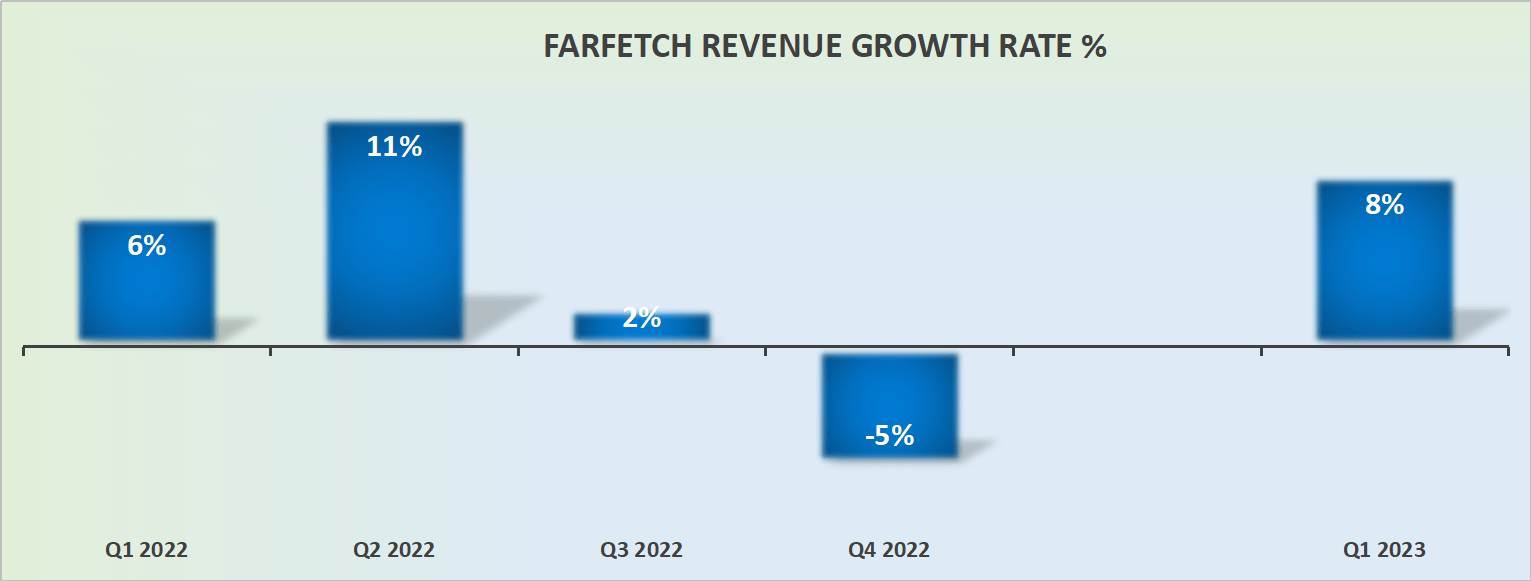

FTCH revenue growth rates

There’s a lot that can be said about Farfetch’s luxury platform.

However, what cannot be said is that Farfetch is a rapidly growing company. Even though Farfetch’s outlook should dramatically improve as it heads into the second half of 2023, I believe that analysts are too optimistic about Farfetch’s prospects.

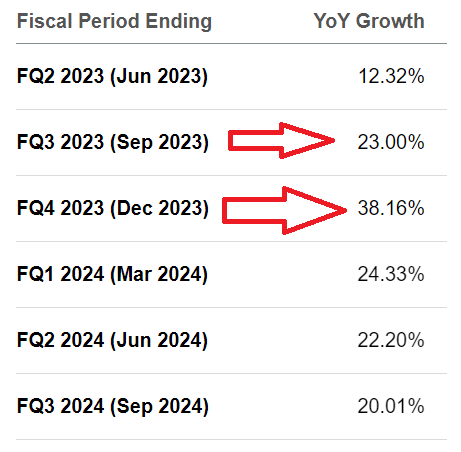

SA Premium

As you can see above, analysts are expecting Q3 to deliver close to mid-20% CAGR, with Q4 2023 expected to see 40% y/y growth rates. Given the weak macro environment in China and Europe, I don’t believe this is a suitable backdrop for Farfetch to end up delivering against these sorts of revenue expectations.

Even as I recognize the easier comparables with H2 of last year, I still struggle to see a path towards these sorts of growth rates that analysts expect.

In other words, I believe that Farfetch’s earnings call will provide analysts with a more accurate framework of how they should view the remainder of 2023, and this will translate into a ”downwards walk” of analysts’ expectations.

FTCH’s Valuation? Doesn’t Look Great

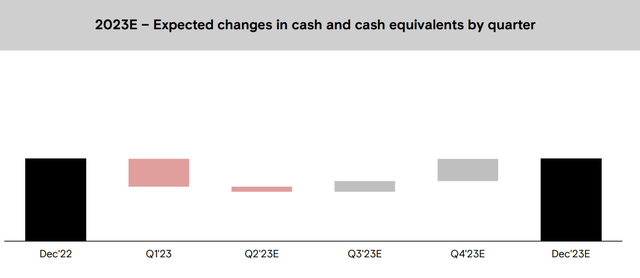

This is the bull case for Farfetch: Farfetch will exit Q4 2023 with strong free cash flows. But I’m not sure those strong cash flows from the seasonal strong quarter will sufficiently negate what’s likely to be a meaningfully negative H1 2023.

Perhaps Farfetch will be able to declare that it has significantly improved its cost structure to the point that 2024 will be able to be free cash flow positive each quarter of the upcoming year? Nevertheless, I’m not convinced that’s a likely outcome for Farfetch.

Furthermore, I believe that the bull case is counterbalanced by not only its disagreeable growth prospects but also an unappetizing balance sheet.

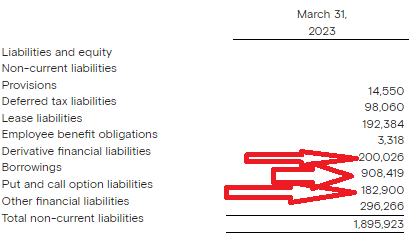

FTCH Q1 2023

More specifically, I believe that Farfetch’s cash balance sheet in Q2 will be around $450 million. Meanwhile, its borrowing base is more than $900 million.

FTCH Q1 2023

As you can see in the red arrows above, Farfetch’s cash balance of less than $500 million in cash (not shown above) is up against borrowings of $900 million, plus there are plenty of other derivatives liabilities of approximately $380 million.

For a business that’s valued at $1.8 billion, its balance sheet is too leveraged, with too much restriction.

The Bottom Line

As Farfetch prepares to release its Q2 results, I’m downgrading my rating from neutral to a sell due to concerns about its history of operating losses and high marketing expenses, coupled with a lack of sufficient undervaluation to justify this investment.

Despite its luxury fashion platform connecting consumers to high-end boutiques worldwide, its financial outlook doesn’t inspire optimism. Analyst expectations for robust growth seem unrealistic, especially given the challenging macroeconomic environment.

Additionally, Farfetch’s balance sheet appears leveraged and restrictive, further diminishing its appeal to potential investors. In light of these factors, I find it difficult to maintain a neutral stance on Farfetch Limited stock.

Read the full article here