Introduction

I don’t really like regional banks. I mention that in most articles about this industry. My main issue with regional banks is the poor risk/reward. It’s a bit like picking up pennies in front of a steamroller.

While the performance during bull markets isn’t half bad in most cases, economic downturns tend to have major impacts on banks. After all, they are highly cyclical and rate-dependent.

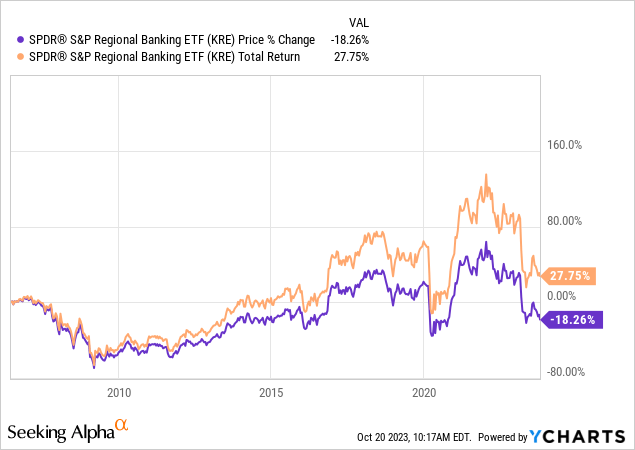

Since its inception in 2006, the regional bank ETF (KRE) has returned just 28%. Excluding dividends, it has lost almost a fifth of its value.

The main reason for this is the Great Financial Crisis, which we are unlikely to repeat soon.

However, it also didn’t help that banks sold off in 2015, during the pandemic, and in 2022 and 2023, caused by tremendous pressure on deposits, the implosion in bond prices, and other economic headwinds.

Despite this, I keep spending time researching regional banks. Why? Because there are two good reasons for that (I think):

- Regional banks tell us a lot about the state of the economy. Listening to their earnings calls is a valuable source of intel for people like me.

- Beaten-down regional banks make for terrific investment vehicles (buy low, sell high). In 2020, I bought Huntington Bancshares (HBAN). Now, I’m looking for new opportunities. After all, regional banks are down 33% year-to-date.

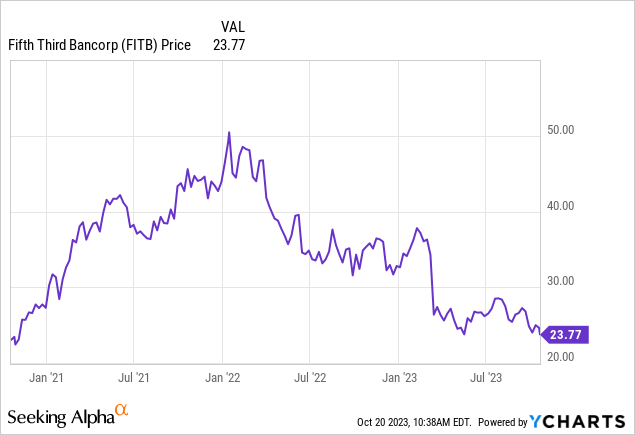

One of the stocks I have an eye on is Fifth Third Bancorp (NASDAQ:FITB), which I discussed in an article titled Fifth Third: Banking Crisis Bargain With A 5.6% Dividend Yield on May 12.

As the company recently announced its earnings, it’s time to dive in again as I’m impressed by its resilience, which paves the wave for significant returns in the future.

The problem is getting the timing right.

So, let’s get to it!

Resilience & Market Share Gains

Although its stock price may not suggest it, the company is doing rather well.

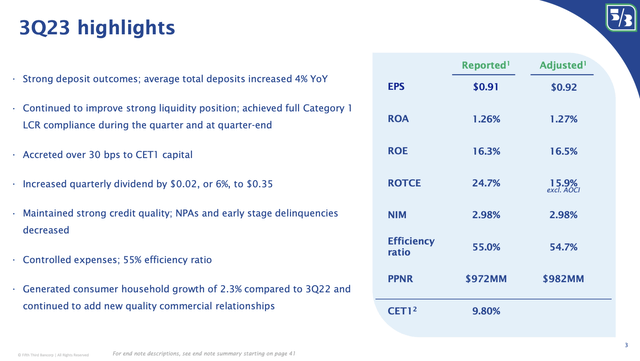

In the third quarter, the company reported earnings per share of $0.91, excluding a one-set impact from a Visa swap, reflecting robust pre-provision net revenue (“PPNR”) results and favorable credit outcomes.

The bank achieved an adjusted return on tangible common equity ex-AOCI of nearly 16%, a 50 basis points sequential increase, and a return on assets of 1.26%.

Fifth Third Bancorp

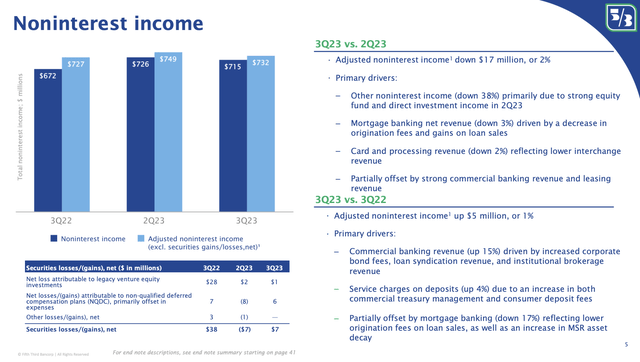

The bank also experienced significant fee growth, supported by a diversified fee income stream, including treasury management, capital markets, and wealth management.

Adjusted non-interest income increased 1% year-over-year. The bank believes its ability to generate strong capital markets revenue sets it apart from peers.

Fifth Third Bancorp

Furthermore, despite investing in new branches, technology, and acquisitions, Fifth Third managed expenses effectively, maintaining the lowest expense growth rate among peers in the last four years, according to the company.

In the third quarter, the bank’s total non-interest expenses increased by less than 2% compared to the year-ago quarter, resulting in an adjusted efficiency ratio below 55%. Full-time equivalent employee headcount decreased by 3.5% since March.

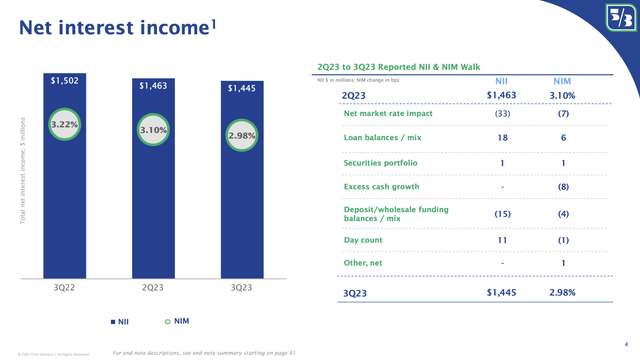

Net interest income decreased 1% sequentially due to defensive positioning in the uncertain economic and regulatory environment. The bank also held a substantial cash position, affecting the net interest margin, which dropped to 2.98%.

Fifth Third Bancorp

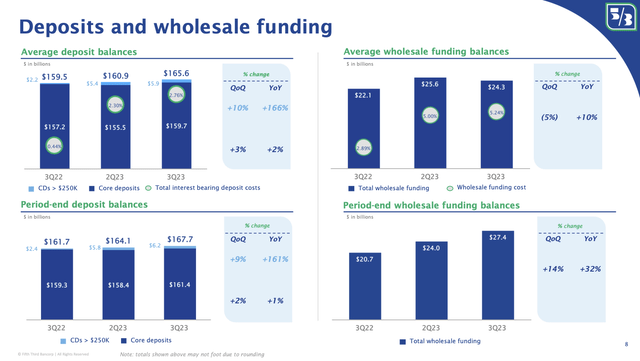

With that in mind, the bank excelled in one important area: deposits.

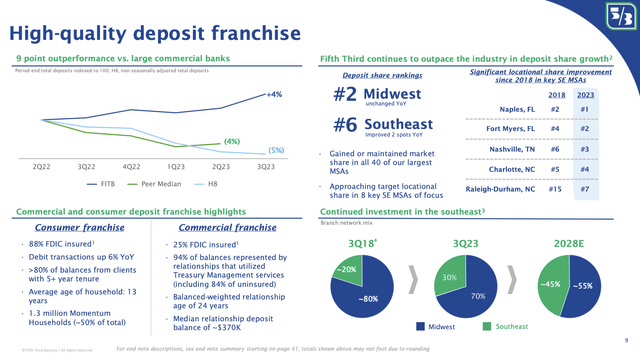

Fifth Third achieved a 4% average deposit growth rate compared to the previous year, while the industry experienced a 5% decline.

Consumer households grew more than 2%, with a strong 6% growth in the Southeast. The bank has also made substantial gains in new middle-market relationships, surpassing last year’s base by 25%.

Fifth Third Bancorp

But wait, there’s more good news – especially when it comes to its footprint in its industry.

Fifth Third improved or maintained its market rank in all 40 of its largest metropolitan service areas. This includes holding the #2 position in the Midwest, following JPMorgan Chase (JPM), and achieving or nearing target locational share in 8 of the original 11 focused markets in the Southeast.

The bank plans to continue opening approximately 35 branches annually until 2028, with nearly 50% of branches located in Southeast markets.

Fifth Third Bancorp

With that in mind, there’s more good news.

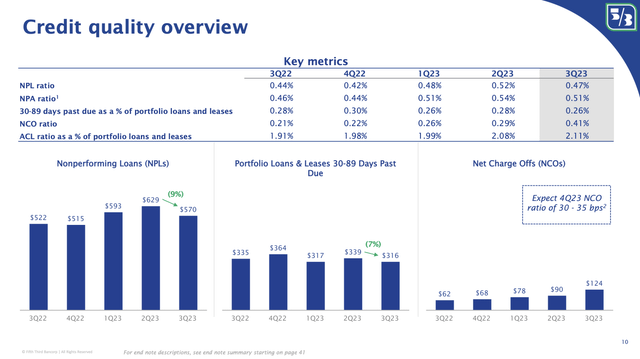

Credit Quality & Balance Sheet Strength

Despite economic headwinds, key credit metrics remained strong during the quarter, with charge-offs in line with expectations. Early-stage delinquencies and non-performing assets even improved sequentially, and the allowance for credit losses (“ACL”) increased by three basis points due to slight changes in Moody’s macroeconomic forecast, which many banks use as a benchmark.

Fifth Third Bancorp

The bank also made progress in adapting to expected changes in the regulatory framework. They ended the quarter with $103 billion in total liquidity sources and achieved full Category 1 LCR compliance in both August and September.

Additionally, the bank made progress on its risk-weighted asset (“RWA”) optimization initiative, with total RWA declining by 1% compared to the prior quarter.

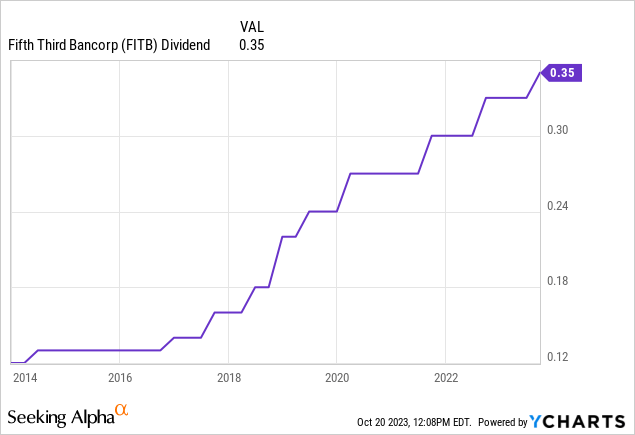

They created over 30 basis points of CET1 capital during the quarter and raised the quarterly dividend by 6%.

The bank now yields 6%! The five-year dividend CAGR is 14.5%.

The CET1 ratio is 9.8%, which is expected to be hiked to at least 10% by the end of this year.

Furthermore, the bank, which enjoys a BBB+ credit rating, has no debt maturities in 2023 and just 15% commercial mortgage exposure in its commercial loan book.

It also needs to be said that the company’s balance sheet is a bit more volatile, as it classifies its securities as AFS – available for sale – instead of HTM – held to maturity.

If you break it down between real world and regulatory world, that’s really how we are looking at this in the real world with really the economic risk. Whenever you have a fixed rate asset, whether that’s in AFS, HTM or in the loan portfolio, you have that economic risk to higher rates. We have elected to hold our securities in AFS, and we’ll continue to do so, given that it gives us better flexibility and opportunity to reposition as the environment changes. But when you are in the real world managing the balance sheet, how we approach balance sheet management is in totality. And you can look at our strong NII results, our interest-bearing liability results, any of the measures relative to peers, the total balance sheet is performing very well. We’re going to grow NII this year, 3% to 5%. Others are shrinking. So our philosophy is paying off in the real world. – FITB 3Q23 Earnings Call

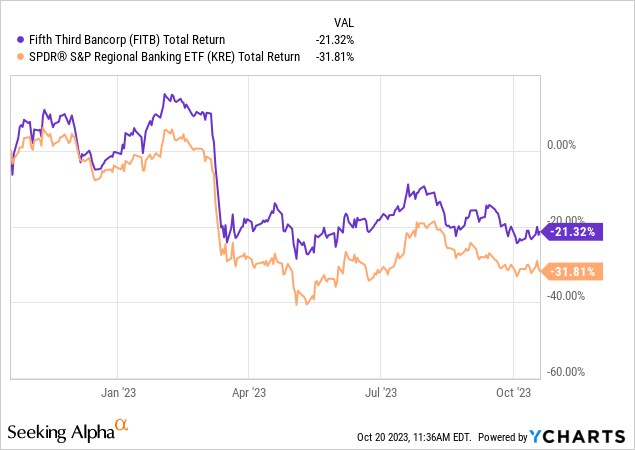

The company’s higher market share, outperforming NII growth, and stronger deposit base have allowed its stock price to outperform its peers as well over the past 12 months.

So, what about the valuation?

Valuation

For the fourth quarter, Fifth Third expects a decline in average total loan balances by 2% to 3% sequentially, reflecting a cautious economic outlook and continued RWA optimization.

- Deposits are expected to increase slightly. NII is expected to decline due to the ongoing balance sheet dynamics.

- Adjusted non-interest income is expected to increase, and non-interest expenses are predicted to remain stable to slightly increase.

- The bank also expects net charge-offs to gradually normalize and the change in the ACL to be stable to up $25 million.

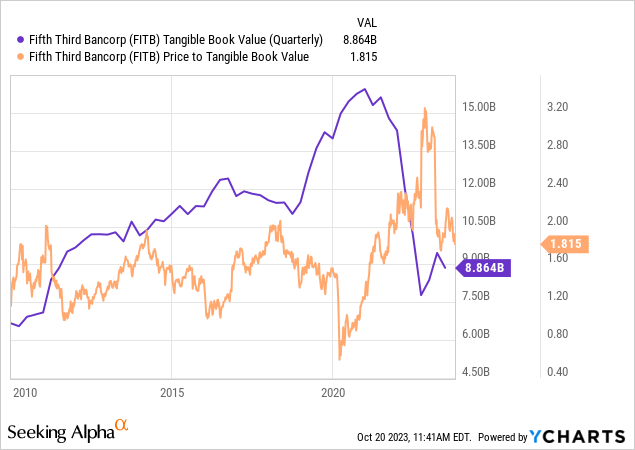

The company now trades at a tangible book value multiple of 1.8x. That’s slightly above the longer-term median, as the decline in its tangible book value has erased the valuation “benefits” of a lower stock price.

The book value is expected to drop from $29.4 per share in 2021 to $22.7 per share in 2023, followed by a gradual recovery to $27.1 in 2025.

If this rebound comes with a valuation increase to 1.3x its book value (that would be a normalization), the stock has room to run to $35 through 2025.

The current stock price target is $32.

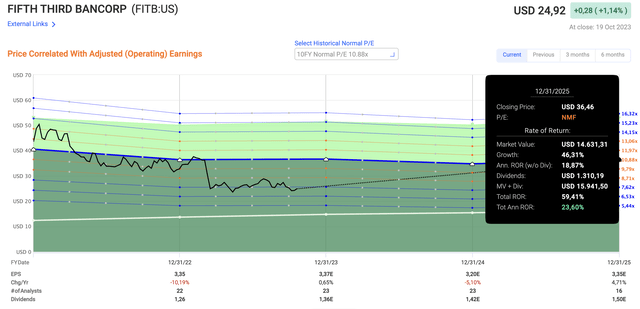

Furthermore, the stock is now trading close to 7.4x earnings. Its 10-year average is 10.9x earnings. A return to that valuation could result in 24% annualized returns through 2025 – even without (average) earnings growth, as seen in the overview below.

FAST Graphs

Having said all of this, FITB is one of my favorite regional banks. It has a juicy 6% yield, outperforming deposit growth, high credit safety, and an aggressive expansion strategy that will make it an even more relevant player over the next 5 to 10 years.

Nonetheless, while I will maintain a Buy rating, it needs to be said that this company is not out of the woods yet. The same goes for its peers as well.

Inflation is sticky, economic growth is weak, and Fed rates are not expected to come down anytime soon. This is putting tremendous stress on the market, which means that FITB could fall further. It could even fall below the $18 to $20 range if the housing market starts to crack.

I’m not saying it will happen. I’m just saying investors need to be careful. If you want to invest in banks, buy gradually. Do not jump in all at once.

Gradual buying allows investors to average down if the stock price continues to trend South.

Especially in this environment, it’s the way to go.

On a longer-term basis, I have little doubt that this strategy will pay off.

Takeaway

With a solid deposit base and strong market share, FITB sets itself apart. The company’s credit metrics remain robust, and it has strategically positioned itself in terms of liquidity and risk-weighted assets.

This, combined with an attractive 6% yield, outperforming deposit growth, and a prudent expansion strategy, makes FITB an intriguing prospect for the next 5 to 10 years.

However, it’s essential to remain cautious in the face of ongoing economic uncertainties.

Inflation, weak economic growth, and persistent Fed rates pose potential risks.

Gradual investing is likely the best way to go to reduce timing risks without giving up on the bank’s promising long-term potential.

Read the full article here