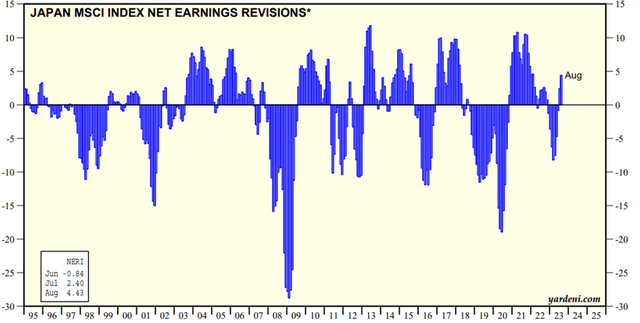

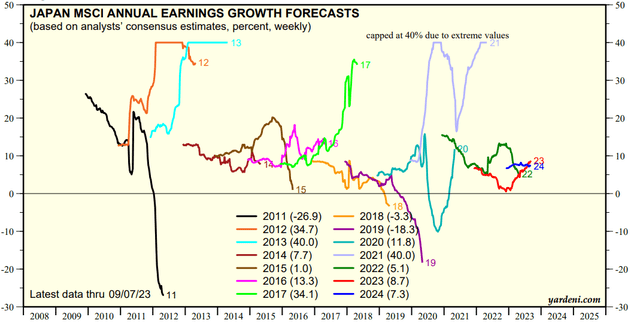

Following a brief pause, Japanese stocks have continued their resurgence this month, rising on the back of strong Q2 earnings results. While the tailwinds from yen weakness remained key for export-oriented sectors, the strength has extended to domestic companies as well, many of which have been able to pass through cost inflation via increased prices. In tandem, the July/August period saw the first set of positive net revisions to earnings expectations for Japanese large caps. On top of the improving capital returns (dividends and buybacks), driven by growing pressure from the Tokyo Stock Exchange (TSE) to implement widespread governance reforms, it’s perhaps unsurprising that Japan has been among the best-performing markets in Asia this year.

Yardeni

On the other hand, not all of the YTD rally is down to fundamentals; the massive role of foreign inflows must also be acknowledged. Throughout the year, Japanese stocks have attracted significant foreign investor interest, with inflows stepping up again last quarter, significantly re-rating the major indices (Nikkei and Topix).

Columbia Threadneedle

I would be cautious about joining the momentum at this stage, though, as these flows tend to be fickle and could easily reverse, particularly with China-exposed names beginning to show some weakness in Q2. Also, yet to fully play out are wage inflation pressures (note even after the recent round of hikes, wages remain negative in real terms), which could weigh on the P&L of corporates without the requisite pricing power.

Bloomberg

At the current mid-teens P/E, there isn’t much margin of safety for Franklin FTSE Japan ETF (NYSEARCA:FLJP) investors, particularly with underlying growth rates still lingering in the high-single-digits %. Ahead of emerging monetary policy normalization risks and a further slowdown in the Chinese economy, I remain cautious about Japan.

Fund Overview – A Highly Diversified, Ultra Low-Cost Japanese Large-Cap Vehicle

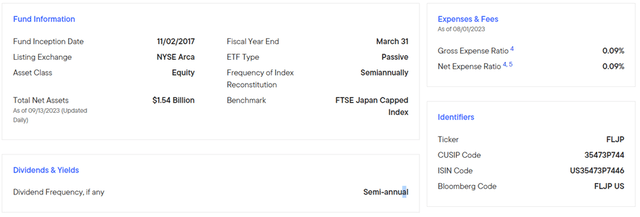

The US-listed Franklin FTSE Japan ETF tracks a basket of large and mid-cap Japanese equities via the FTSE Japan Capped Index subject to concentration limits (<20% cap for a single constituent). While FLJP’s asset size trails its iShares counterpart, the iShares MSCI Japan ETF (EWJ), its net asset base has expanded to ~$1.5bn on the back of this year’s outperformance for Japanese stocks. Like most other Franklin international funds, FLJP’s net expense ratio is best-in-class at 0.1% (vs. 0.5% for EWJ).

Franklin Templeton

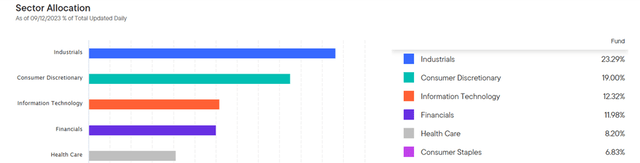

The fund’s 515-stock portfolio is far larger than its counterparts, with EWJ’s portfolio featuring half as many holdings by comparison. That said, the portfolio compositions are broadly similar, with export-oriented sectors like Industrials (23.3%) and Information Technology (12.3%) topping the list. On the other hand, the fund also maintains a similar exposure to domestic-oriented sectors like Consumer Discretionary (19.0%) and Financials (12.0%), though these have lost some ground over the last quarter. FLJP will also appeal to defensive investors, given its lower volatility vs. the S&P 500 (SPY) and comparable funds like EWJ, helped by its broader portfolio.

Franklin Templeton

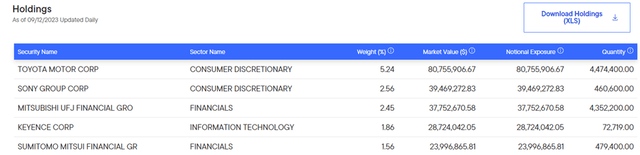

The single-stock composition is also broadly in line with other Japanese large-cap funds, though the weightage caps keep FLJP’s concentration relatively lower than its counterparts. Automotive leader Toyota Motor (TM) is the top holding at 5.2%, along with tech/media company Sony (SONY) at 2.6% and Mitsubishi UFJ (MUFG) at 2.5%. Tech companies like Keyence (OTCPK:KYCCF) and Tokyo Electron (OTCPK:TOELY) still feature heavily in the portfolio despite underperforming recently, while major industrials like Hitachi and Mitsubishi are also notable top holdings. Valuations are largely similar to EWJ as well, with the fund currently on offer at ~15x earnings, a wide premium to historical levels.

Franklin Templeton

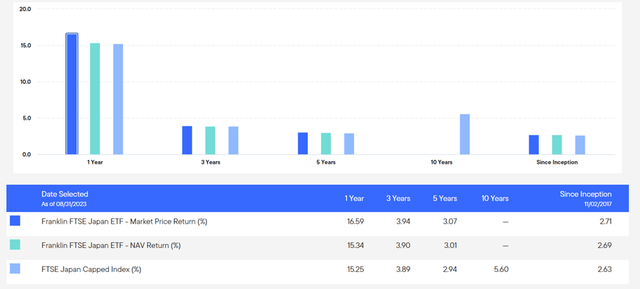

Fund Performance – Strong YTD Return Bucks the Long-Term Trend

With the H1 2023 outperformance extending into Q3 thus far, FLJP is now up +14.1% on a year-to-date basis, boosting its rate of compounding since inception to +2.7% in market price and NAV terms. This year’s performance contrasts notably with figures across longer timelines as well, with the three- and five-year track records at +3.9% and +3.0%, respectively. Where FLJP shines is its tracking error, which has been maintained at a relatively tight ~13bps through the last five years, helped by its industry-low expense ratio.

Franklin Templeton

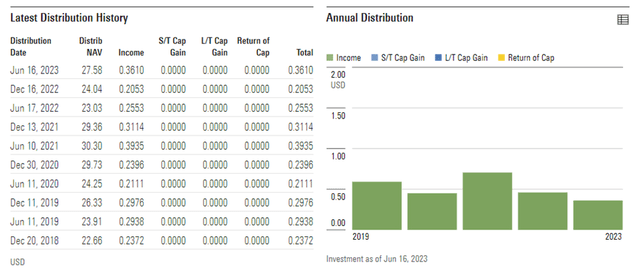

The FLJP distribution is also industry-leading, with last year’s $0.46/share payout moving the overall trailing yield up to ~2% (vs <1% for EWJ). With the fund’s H1 2023 distribution already pacing well ahead of the prior year’s levels as well, helped by TSE-led governance reforms, expect upside to the yield this year. Hence, investors looking for steady earnings growth and don’t mind bearing any FX-related swings related to the yen will find this ETF a great fit.

Morningstar

Too Far Too Fast for Japanese Equities

After years of underperformance, Japan’s rally this year has been a major surprise. The market strength has further extended into Q3 as well, with a combination of yen weakness and pricing power boosting overall corporate earnings (most Japanese large caps depend on external vs. domestic demand). Domestic stocks have also benefited somewhat from inbound tourism post-reopening, with the all-important bank sector earnings (the fourth largest FLJP exposure) particularly resilient.

Yet, the pace of the valuation re-rating has outpaced earnings, and I would be cautious about underwriting more upside from here. Foreign inflows have rocketed this year, no doubt buoyed by Berkshire’s (BRK.A) (BRK.B) optimism on the Japanese trading houses, and as a result, Japanese large caps now trade at a premium ~2x PEG (15x fwd P/E vs 7-8% fwd earnings growth).

This leaves investors little margin for error as wage growth accelerates post-negotiations (still negative in real terms) and the full extent of a Chinese slowdown eventually hits earnings. Plus, the BoJ is in the early stages of unwinding years of ultra-loose monetary policy, and the resulting yen appreciation threatens to reverse a sizeable chunk of the gains made in recent years. Net, I see better alternatives to allocate capital in Asia and remain neutral here.

Yardeni

Read the full article here