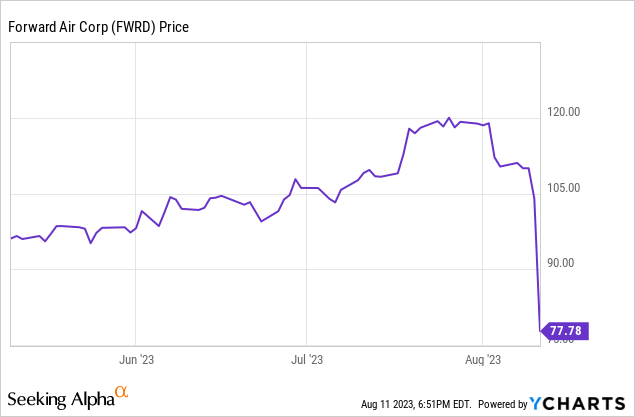

Forward Air Corporation (NASDAQ:FWRD) just surprised the market with the announcement that it would combine with privately owned Omni Logistics. Forward has a history of making acquisitions but this is a much bigger deal than usual that affects the business in a big way. I was surprised to see Forward’s stock only down a few percentage points the day this was announced as it adds uncertainty to Forward’s outlook on top of the uncertainty in the freight market. The next day however when the news was digested a bit more, the market reacted in a much larger way as the stock was down 25%+.

Prior to this announcement, Forward had a story that the market understood well. Things are now much more murky. In general, I think this deal creates too much uncertainty in Forward’s outlook while the expected benefits are too optimistic, too far into the future, and too small given the current price of Forward’s stock. While I believe there is a price for everything, I expect the market will take a “wait and see” approach to this deal that will lead to more sellers than buyers in the near term.

This may hurt those that are currently invested in Forward but it creates an opportunity for those that are more optimistic about both the synergies between Forward and Omni, and the strength of the freight market going forward. Additionally, with the added risk from the leverage taken on by Forward as part of the deal, there is now much more reward if management’s estimates for the new company are accurate.

Using my bull and bear case assumptions, I am assigning the stock with a 2 year price target of $95. This would provide investors with an 11% CAGR over the next few years which I don’t think is enough to justify an investment in the stock given the risk.

Business Overview and Financial History

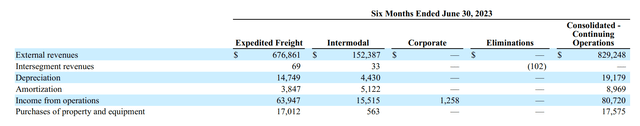

Forward is a freight provider of less-than-truckload (LTL), truckload, final mile, and intermodal drayage transportation services across the United States, Canada, and Mexico. The business can be broken down into two segments: expedited freight and intermodal.

H2 2023 Results by Segment (Forward Air Q2 10-Q)

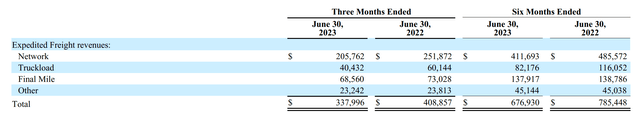

With the majority of revenue and operating income, expedited freight accounts for most of the value in the business. The following is the breakdown of revenue within that segment.

Q2 2023 Expedited Freight Results (Forward Air Q2 2023 10-Q)

The main strategy of the business is relatively straightforward. They plan to grow earnings through increasing the amount of freight transported in their network and through increasing the revenue per pound of freight transported through their network.

A large part of accomplishing this goal will be the growth of the smaller parts of the expedited freight segment, such as final mile and LTL. If they are able to grow these even during a freight recession, they will be able to offset some of the reduced earnings from the general lower volume.

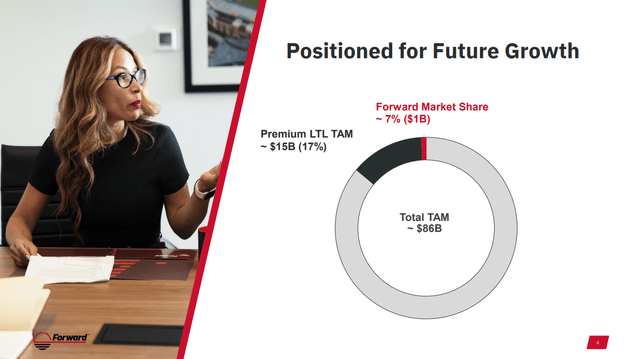

Forward Air’s Growth Market (Forward Air Investor Presentation)

This was a point made on the most recent Q2 earnings call as CEO Tom Schmitt referenced that Forward needed to take a larger slice of the freight market pie because the size of the pie is not going to grow in H2 2023.

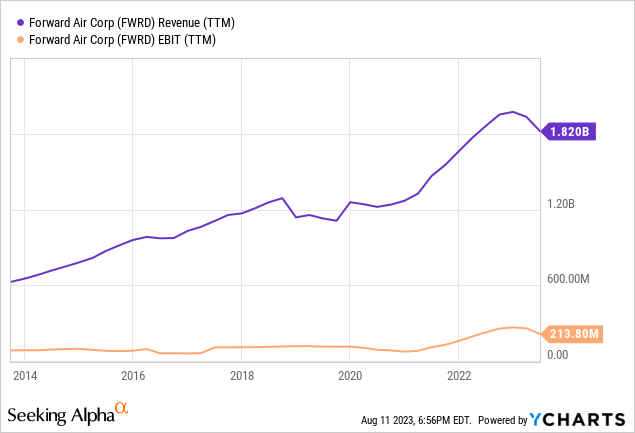

Forward has largely been successful with these efforts. Over the past decade, both revenue and EBIT have grown at a 13% CAGR. Much of this growth can be attributed to acquisitions, but Forward has done well integrating these acquisitions efficiently while not diluting their equity holders and while maintaining low leverage ratios. Forward has also returned $635mm to shareholders in that time via dividends and share repurchases.

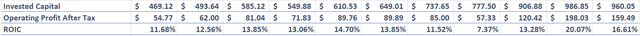

Additionally, Forward’s ROIC has been consistent and relatively high compared to other businesses in the freight transportation industry.

Forward Air’s ROIC (Created by Author)

These are all signs that point to the fact that Forward is a competitively advantaged and well-run business.

Business Combination with Omni

This history of consistency and moderate use of debt makes the business combination with Omni a bit of a headscratcher.

The press release is touting the synergies and the estimated revenue and EBITDA opportunities from the addition of Omni’s customers to Forward’s network and Omni’s footprint in the U.S. logistics space. While there may be some solid synergies, the deal looks questionable and risky for Forward’s equity holders.

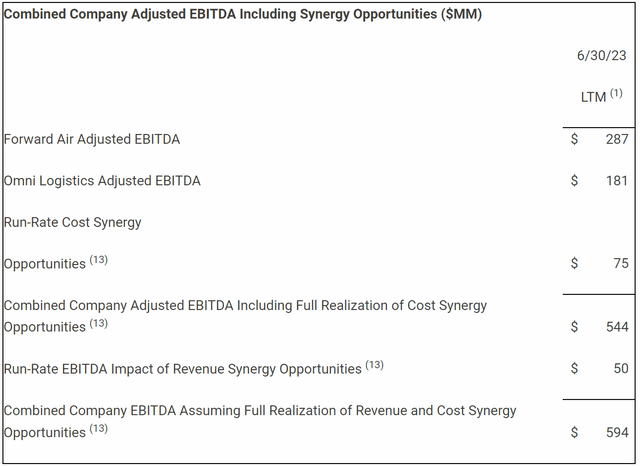

As of June 30, Forward’s and Omni’s combined LTM revenue was $3.46 billion and combined LTM EBITDA was $468 million, of which Omni would contribute $1.64 billion and $181 million respectively. Management is estimating potential revenue synergies of up to $240 million, and potential EBITDA synergies of up to $125 million on top of the actual LTM numbers.

For these earnings and synergies, Forward is paying Omni shareholders $150 million in cash and convertible preferred stock that is equal to 37.7% of Forward’s equity on a fully diluted, as-converted basis. This comes out to potentially 16 million of new shares of Forward equity issued, which would lead to a fully diluted share count of 42.5 million.

Forward and Omni Combined LTM Results (Forward and Omni Deal Press Release)

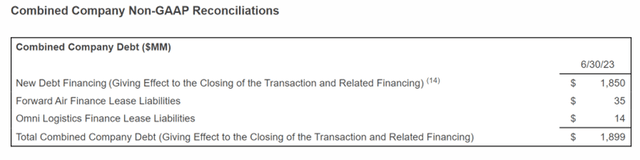

On top of this, the newly combined company will have total debt of $1.9 billion as Forward will take on new commitments to refinance the debt of both companies, and to pay Omni shareholders $150 million in cash.

Combined Company Debt Profile (Forward and Omni Deal Press Release)

After the effects of this deal, Forward’s fully diluted market cap will be around $3.3 billion with the stock at around $77 per share. Add to this the combined company debt of $1.9 billion, and the newly formed company’s EV will be about $5 billion assuming the company holds $200 million in cash. This means that the new enterprise will trade at about 10.7x combined LTM combined EBITDA, which is slightly under the 10 year average multiple. This EBITDA figure also includes the elevated EBITDA from 2H 2022.

Trailing EBITDA by the end of 2023 will be much lower as management is guiding for revenue to drop 10-20% year-over-year in Q3. All of this is to say, the newly created Forward does not seem cheap even after the recent 25% sell-off. Before the sell off when Forward’s stock was above $100 per share, the deal seems even worse for Forward shareholders.

Potential Outcomes and Price Target

Management is clearly optimistic about this merger and is using headline figures of $600 million in combined EBITDA and a 3.5x net debt to EBITDA ratio using that same EBITDA estimate. The $600 million in EBITDA includes estimated synergies that would arise from the business combination, which makes this $600 million less reliable. Using the actual LTM EBITDA of $468 million, the net debt to EBITDA ratio is around 4x.

The press release is also touting the combined company’s strong cash flow generation which will lead to deleveraging to a 2x net debt to EBITDA ratio within 2 years.

For a bull case, if the company is able to achieve $600 million in EBITDA by the end of year 2, at 11x EBITDA the EV would be $6.6 billion. Assuming net debt is $1 billion (2x EBITDA), and there are still 42.5 million shares outstanding, Forward’s stock would trade at $131 per share and 70% above the current share price.

For a bear case, if EBITDA is $450 million by the end of year 2, at 9x EBITDA Forward’s EV would be $4.05 billion. Assuming the company has net debt of $1.350 billion (3x EBITDA), and there are 45 million shares outstanding, Forward’s stock would trade at around $6o.

Taking the midpoint of these scenarios leads to a price target of $95.5, or about 22% higher than today’s stock price for an 11% CAGR for the next two years. Given the fact that I believe there are better opportunities available and due to potential upcoming weakness in the freight market over the next 6-18 months, I am rating the stock as a sell.

From a numbers perspective, it is difficult to see how this deal made sense to Forward’s management especially when the stock was trading over $100 per share. However I don’t have a grasp on all of the synergies that will come from this combination especially over the long term so this could end up working out well for patient investors.

Additionally, Forward has a history of being run very well with a shareholder friendly capital allocation framework. Those that have trusted management have done well so far and if management’s optimistic numbers end up being the true numbers, the stock should perform very well from here. But it’s this same history of good management that makes this deal even more confusing.

Final Thoughts

The market reacted negatively to the recent announcement that Forward will combine with privately owned Omni Logistics. I believe the market reacted this way due to the high price that current Forward shareholders are paying, the uncertainty in the freight market over the next 6-18 months, and the large amount of leverage that the newly formed entity is taking on.

It is quite different from what current Forward shareholders are used to as the business has a history of using little debt, and a history of shareholder friendly capital allocation decisions. It is no surprise that some of these shareholders sold with the announcement of this deal.

I am assigning the stock with a sell rating and a price target of $95 per share by 2025 based on my bull and bear case scenarios. From the stock’s current price, this does not provide adequate returns given the uncertainties I described above.

I can envisage some scenarios where the stock could provide great returns now that it has dropped 25%, but making this deal with the stock at $105 does not make much sense to me. There may also be longer term synergies that I am missing which may lead to great returns for more patient investors.

Read the full article here