fuboTV (NYSE:FUBO) was one of the high-flying stocks that have crashed back down to earth given the situation in the market. Recently though fuboTV stock has rallied yet is still trading at a fraction of its price just two years ago. Is now a good time to enter?

fuboTV Liquidity Not as Good as It Seems

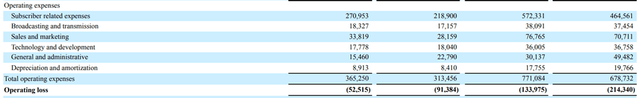

fuboTV had an outstanding Q2 2023 delivering results past analysts’ estimates. The company’s revenue grew by a massive 40.9% to $312.7 million versus analysts estimates of $302 million. fuboTV was able to narrow down its operations loss from $91.4 million the prior year to $52.5 million this year. The company also made significant strides with regard to its liquidity position. Free cash flow burn improved from $84.5 million the prior year to $75.7 million in Q2 2023. This translates to a roughly $9 million improvement in Cash usage for operating activities.

So looking over these results, let’s start with the good news. It’s definitely good news that Fubo management has taken steps to ensure that it has at the bare minimum the liquidity to survive. The company is targeting to be Cash Flow positive by 2025. With $299.7 million in cash and equivalents, the company should have enough liquidity to make it to 2025.

Another piece of good news is that digging through the company’s financials it can be seen that the bulk of the cost savings for the last 6 months have come from General and Administrative expenses. I like seeing cost reduction coming from G&A as it highlights that the company is operating leaner or more efficiently (instead of cannibalizing future revenue by gutting marketing and technology expenses). The company’s G&A dropped by nearly $19 million YTD from $49.5 million to $30.1 million.

Fubo costs (Fubo 10-Q)

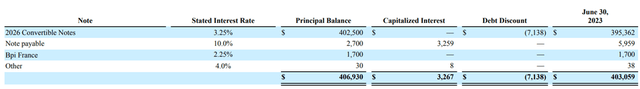

However, on to the bad news, the company has a total long-term debt of $403 million, the bulk of which is from its 2026 Convertible Notes. These notes have a conversion price of about $58 per share so I doubt these will be converted to equity anytime soon given that FUBO stock has been trading below $10 for close to 2 years now.

Fubo debt (Fubo 10-Q)

The company has total assets of $1.24 billion which at first glance makes it seem that Fubo should be safe in covering its debt. However, there are two issues that I am seeing, The first is that a significant portion of the company’s assets are in Intangibles and Goodwill. The company’s intangible assets are $166.4 million and its Goodwill is $621 million for a total of $787.4 million. Taking these out from the company’s $410 million in equity would turn it negative.

The second issue is that the company expects to be cash-flow positive by 2025. Meaning we could be seeing at least 4-5 more quarters of cash burn. Therefore, we can expect its cash position of $299.7 million to be further watered down.

These convertible notes have a very low rate of 3.25%. These notes will most probably be refinanced at a much higher rate in 2026. Therefore I expect Fubo’s business to be difficult even if it becomes cash flow positive in 2025.

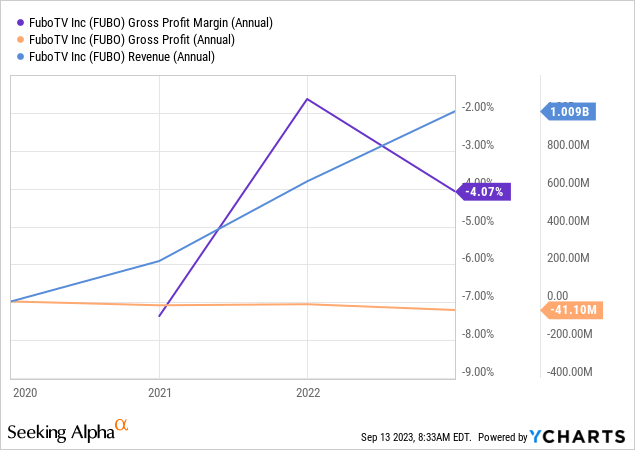

Fubo’s Gross Margin is Really Low

Having a large amount of debt is fine if the company is making enough cash to cover these expenses. However, the issue facing Fubo is that it is operating what is fundamentally a low-margin business on a Gross Profit level. In other words, as the company’s revenue increases, so do its costs making it difficult to generate cash. Historically speaking the company has grown its revenues exponentially at a CAGR of more than 4x but Gross Profits have been negative until recently.

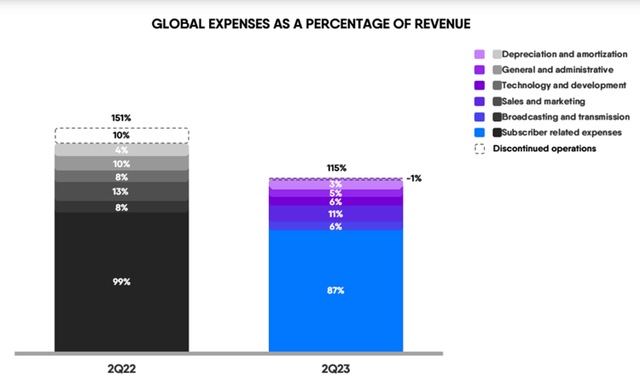

That being said, Fubo has shown improvements in its Margins in Q2 2023. Year-over-year Gross Margins rose from -6% to 7%. While an improvement, I don’t think anyone should break out the champagne just yet for Fubo. This simply means it is not losing money per revenue which is a small victory. The biggest issue is that content costs are still very high. While these costs have come down this quarter it still represents 87% of revenue.

Subscription costs (Fubo presentation)

As detailed in the company’s 10-Q, Fubo runs the risk of cost increases in the future as long-term contracts may be renewed at higher prices. Having control over content costs is the main reason why Netflix (NFLX) has decided to get into the movie production industry. In terms of streaming, content is king, and companies that control this content have a lot of power over Fubo. It’s the classic, “Power of Suppliers” dilemma from Porter’s 5 forces.

There is a lot of competition in the sports streaming industry with Hulu TV (DIS) and YouTube TV (GOOG) as other alternatives. Content providers can easily move to these platforms which would give Fubo little room in terms of negotiations.

There is also a limit in terms of the amount of these costs that could be passed on to consumers. fuboTV is already one of the more expensive offerings in the market. A Fubo package costs $75 which is in line compared to Disney’s $70 package of Hulu, Disney +, and ESPN. Due to these factors, I believe that future improvements on Fubo’s Gross Margin will be constrained.

Valuation

Fubo management is guiding for full-year 2023 of 1,565,000 to 1,585,000 subscribers in North America and 380,000 to 400,000 subscribers internationally. This represents a growth of 9% and 7% respectively. Full-year revenue for 2023 is expected to be approximately $1.3 billion which is around a 30% improvement from the 2022 number of $1 billion.

However, it is my view that this headline figure of $1.3 billion is misleading. Given the nature of Fubo’s business, I would make the argument that Fubo’s true “Net Revenue” is actually only 13% of that amount. Taking out content-related costs would give me a Net revenue of $169 million. Considering that Fubo now has a Market cap of $746 million this would imply a Price to Sales Ratio of 4.4x.

I believe that this is an expensive price to pay for a business in the competitive streaming industry that is saddled with high debt. While FUBO stock could still rally from these levels due to good headlines and momentum, long-term-oriented investors might be better off on the sidelines.

Read the full article here