The GM Investment Thesis Remains Excellent, Despite The Uncertain Macro Events

We previously covered General Motors (NYSE:GM) with a Buy rating in June 2023, discussing its decision to not participate in the ongoing US price war, in order to maintain its profit margins. Thanks to the premium line-up, the automaker had also been able to raise its FY2023 guidance moderately in the FQ1’23 earnings call, further aided by the “strong cost discipline and lower capital spending.”

For now, GM has delivered an exemplary double beat FQ2’23 performance, with automotive revenues of $41.25B (+12.5% QoQ/ +26.4% YoY) and adj overall EPS of $1.91 (-13.5% QoQ/ +67.5% YoY).

This is on top of the automaker’s (further) raised FY2023 EBIT guidance to $13B (-10.3% YoY), adj EPS to $7.65 (+0.7 YoY), and automotive Free Cash Flow to $8B at the midpoint (-23.8% YoY), compared to the previous EBIT guidance of $12B (-17.2% YoY) and FCF of $6.5B (-38% YoY) at the midpoint.

The raised guidance is attributed to GM’s strategic approach by focusing on its premium/ high-performance segment and popular heavy-duty/ mid-sized pick ups, resulting in over 70% of its US retail sales in FQ2’23.

The robust consumer demand has also triggered improved Average Transaction Prices [ATP] per unit by +$1.6K QoQ/ +$1.89K YoY, or the equivalent of +3.2% QoQ/ +3.6% YoY based on the average price of $52.24K.

Given the notable ATP improvement compared to the market averages of +$251 in May 2023, it seems apparent that the management has made the right choice of going with flat incentives indeed.

On the one hand, GM still reported expanding global deliveries at 1.58M units in the latest quarter (+14.4% QoQ/ +11.2% YoY), with the recovery mostly attributed to the robust US demand growing by +18.9% YoY.

On the other hand, while its EV production seems promising at 50K units by H1’23 while targeting for 100K by H2’23, the automaker is likely to miss its ambitious cumulative target of 400K by H1’24. Due to the delays in ramping up, its assembly capacity has also been underloaded, likely to impact its economy of production scale thus far.

Then again, it appears that the net effect is still somewhat positive, with GM’s automotive gross margins remaining stable at 11.2% (-0.8 points QoQ/ +1 YoY) in FQ2’23.

This is impressive indeed, compared to Tesla (TSLA), whose automotive gross margins have been impacted to 19.2% (-1.8 points QoQ/ -8.7 YoY) by the latest quarter, thanks to the focus on market share growth instead.

With GM already guiding doubled EV output in the second half of the year, we believe its scale and gross margins may gradually improve from here, boosting its bottom line as per the raised FY2023 guidance.

Cruise Remains An Interesting Opportunity For The Legacy Automaker

In the recent earnings call, GM also reported on its progress in the robo-taxi segment, with its fleet growing to 390 units (+61.1% QoQ) and expected to scale by “several times” within the next six months.

With Cruise already hitting its next million miles within 49 days and over 10K rides a week, we believe the robo-taxi segment may further grow tremendously, since user retention is reportedly nearing incumbent ride share services.

Its operational scale is also improving with cost per mile declining by -15%, led by optimizations in infrastructure and automation. This may further extend the amortization of its machine learning costs, especially since Origin is expected to eventually reduce its cost per mile to below $1, “a magic threshold at which robots actually become cheaper for most people than owning a car,” as highlighted by Kyle Vogt, the CEO of Cruise.

However, we do not expect these to occur in the near term, since Cruise EBIT losses have expanded to -$611M (-8.9% QoQ/ -12.5% YoY) and EBIT margin worsened to -23.5% (-1.1 points QoQ/ -1.78 YoY) in the latest quarter. Combined with the planned expansion to three new cities within the next quarter, we may see its operating losses momentarily increase as well.

Therefore, we must warn investors that while the Cruise top-line may improve moving forward, break-even/ profitability remains a long-term goal.

So, Is GM Stock A Buy, Sell, or Hold?

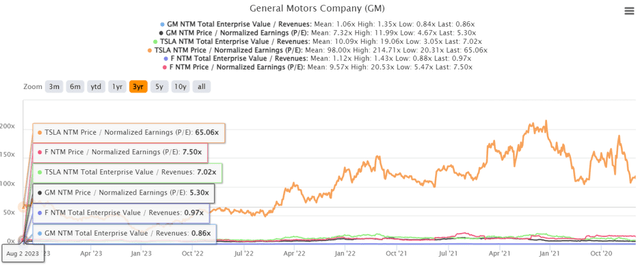

GM 3Y EV/Revenue and P/E Valuations

S&P Capital IQ

For now, GM’s valuations remain impacted at NTM EV/ Revenues of 0.86x and NTM P/E of 5.30x, compared to its 1Y mean of 0.90x/ 5.78x and its 3Y pre-pandemic mean of 0.94x/ 6.21x.

With the stock trading below Ford’s (F) valuations of 0.97x/ 7.50x, TSLA’s 7.02x/ 65.06x, and the automotive sector mean of 0.62x/ 8.11x, it appears that the marked pessimism has yet to lift.

Based on GM’s lower valuations and the market analysts’ FY2025 adj EPS projection of $7.38, we are also looking at a moderate price target of $39.11, suggesting a minimal upside potential from current levels.

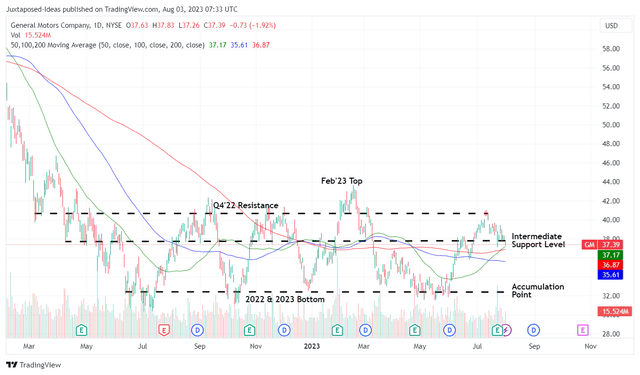

GM 1Y Stock Price

Trading View

For now, GM continues to trade sideways after the recent earnings call, despite the raised guidance, suggesting that the stock may not be suitable for those seeking a quick recovery.

In the long-term, assuming the success of its Ultium platform and the robo-taxi segment, we may potentially see Mr. Market upgrade its valuations nearer to the automotive mean, consequently boosting our target price target to $59.

This is attributed to the GM management’s FY2025 revenue target of $225B, expanding at an excellent CAGR of +12% from FY2022 levels of $156.73B, compared to normalized CAGR of 0% between FY2016 and FY2022.

However, that [very] bullish projection is also only suitable for those with a long-term investing trajectory, due to the stock’s sideway performance over the past few quarters and the higher borrowing costs impacting its near-term automotive sales.

For now, the average interest rate for auto loans on new cars has risen tremendously to 7.18% by July 2023 (+0.04 points MoM/ +2.34 YoY), compared to 2019 averages of 4.63%.

The tightened discretionary spending has triggered GM’s bloated inventories of $17.91B (+0.9 QoQ/ +6.2% YoY), compared to FY2019 levels of $10.39B, with its US dealer inventory also rising to 428K units by the latest quarter (+3% QoQ/ +71.2% YoY).

Depending on when the Fed pivots and the macroeconomic outlook normalizes, many automotive stocks may underperform the wider market’s and tech stocks’ YTD rally, in our opinion.

Then again, this situation may be suitable for those looking to swing trade, due to the GM stock’s robust support at $32 and resistance at $40 over the past year. In addition, we believe that the automaker’s intermediate/ long-term prospects are still bright, as discussed above.

Therefore, we continue to rate the GM stock as a Buy here. For an improved margin of safety, investors may want to add at our recommended accumulation point of $32.

Read the full article here