Genie Energy (NYSE:GNE) has experienced a surge in price over the last year. But, although the price seems to be high in comparison to the firm’s past, I believe that Genie Energy is currently a buy due to the firm’s ability to remain deleveraged in tough macro environments, the firm’s expansion to tap into new markets, and undervaluation assuming my DCF figures.

Business Overview

Electricity and natural gas are distributed to homes and small businesses worldwide by Genie Energy Ltd. and its subsidiary firms. The two primary sections of the business are Genie Retail Energy and Genie Renewables. Along with providing electricity, Genie Electricity Ltd. also develops, establishes, and runs solar energy businesses for its own portfolio as well as for commercial and industrial clients. The business also provides energy consultancy, and brokerage services, manufactures and distributes solar panels, and works on projects relating to the planning and administration of solar installations.

Financials

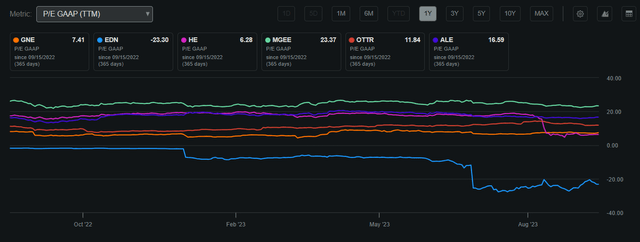

Genie Energy’s current market valuation stands at $420.41 million, with shares trading at $14.74, closely mirroring its 50-day moving average of $14.49. The company’s GAAP P/E ratio rests at 7.41, indicating that the stock is presently trading at a reduced rate compared to its industry peers. This suggests a potential undervaluation, a point elaborated on in detail in the valuation segment of this analysis.

Genie Energy P/E GAAP Compared to Peers (Seeking Alpha)

Genie Energy offers a dividend of 1.96%, showcasing a prudent 12.36% payout ratio. This reflects the company’s dedication to delivering consistent income and value to its shareholders.

However, it’s important to note that while the firm provides a secure dividend, it has considerably increased its share issuance over the years, leading to shareholder dilution and a reduction in overall shareholder value. I believe that this strategy of issuing shares is sensible in terms of financing, especially in a high-interest rate environment, coupled with a soaring share price. This approach positions the firm to potentially outshine competitors, resulting in robust future cashflows that will compound in the long run.

Annual Shares Outstanding (Trading View)

Share Performance (Seeking Alpha)

Earnings

During Q2 2023, Genie Energy showcased robust financial performance, reporting an EPS of $0.45 and revenues totaling $93.46 million. The standout aspect of this report was the remarkable revenue growth of 39.6% year-on-year. This notable growth underscores the company’s capacity to not only extend its operations but also enhance the potential for compounded cashflows in the foreseeable future. Such a financial trajectory positions Genie Energy to sustain its expansion efforts and fortify its defensive position, particularly when confronted with macroeconomic challenges.

Performance Compared to the Broader Market

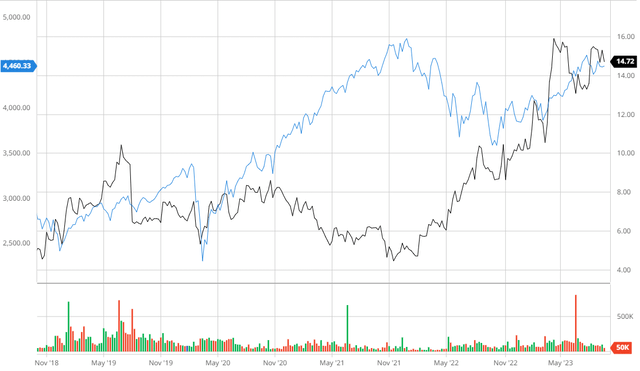

In the last five years, Genie Energy has shown superior performance compared to the S&P 500, when factoring in dividends. This showcases the company’s proficiency in leveraging cashflows to drive growth, as exemplified by an impressive 32% Return on Invested Capital.

Genie Energy Compared to the S&P 500 (Created by author using Bar Charts)

Analyst Consensus

Presently, analysts have designated Genie Energy as a “hold,” with a one-year price projection of $7.5, indicating a potential downside of 50.8%. It’s noteworthy to mention that this assessment is based on a lone rating provided a year ago, implying that it might undergo revisions in the upcoming period.

Analyst Consensus (WSJ)

Balance Sheet

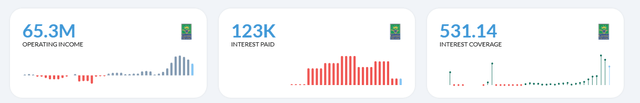

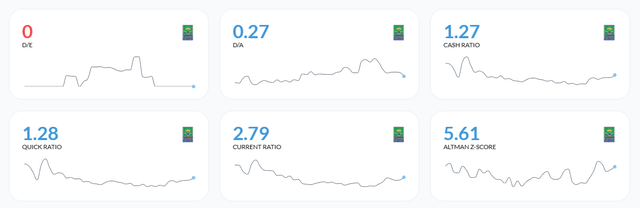

Genie Energy boasts a remarkably robust balance sheet, characterized by substantial liquid assets and a complete absence of debt. Consequently, the company achieves an exceptional interest coverage of 531.14, alongside solvent ratios of 2.79 for the Current Ratio and 5.61 for the Altman-Z-Score. These impressive metrics signify that Genie Energy possesses significant flexibility to leverage if necessary, particularly in light of the firm’s fluctuating profitability. This, in turn, allows for the continued stability of dividends and core operational functions.

Financials (Alpha Spread)

Interest Coverage (Alpha Spread)

Solvency Ratios (Alpha Spread)

Valuation

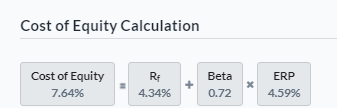

To find an appropriate fair value for Genie Energy, I must first calculate the firm’s Cost of Equity to locate an accurate discount rate. Assuming a risk-free rate of 4.34%, Genie Energy has a Cost of Equity of 7.64% which is the relative risk of holding the firm’s equity.

Cost of Equity Calculation (Created by author using Alpha Spread)

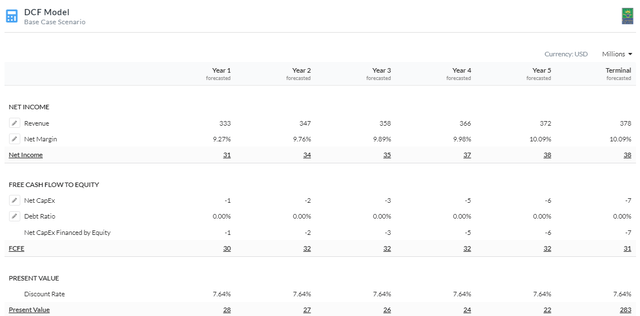

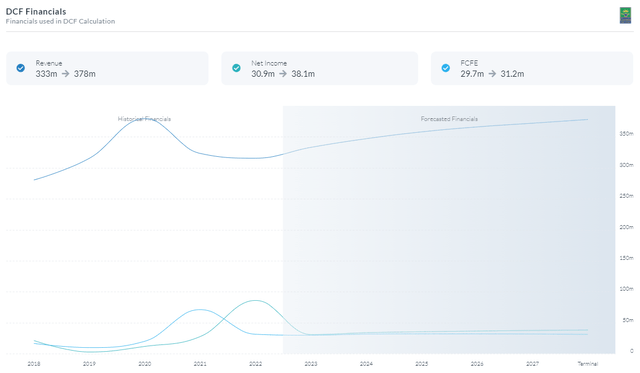

With the determined discount rate in hand, I proceeded to develop a 5-year Equity Model DCF utilizing Free Cash Flows to Equity. Through this approach, I arrived at a fair valuation of approximately $15.72, signaling the stock to be undervalued by approximately 5%. In terms of the discount rate, I opted for 7.64%, considering the firm’s unleveraged position and its promising prospects as interest rates are anticipated to decline. Additionally, my projections for revenue and margin growth aligned with the estimates provided by the company.

5Y Equity Model DCF Using FCFE (Created by author using Alpha Spread)

Capital Structure (Created by author using Alpha Spread)

DCF Financials (Created by author using Alpha Spread)

International Expansion Resulting in Compounding Growth

To enter new areas and increase its clientele, Genie Energy is actively pursuing an international growth strategy. Their entry into the European market, where they have pushed into offering energy solutions, is one significant illustration of this technique. Genie Energy wants to use its experience and skills in the energy industry to meet the various energy needs in other locations by expanding its reach beyond its home market in the United States. A thorough study of the legislative landscape, energy consumption trends, and cultural facets of the target locations serves as the foundation for this expansion.

With this tactical move, Genie Energy is putting itself in a position to compete on a worldwide basis, expanding the scope of its client service while also diversifying its revenue sources and minimizing its reliance on any one market. The company’s goal of dominating the world energy market and advancing sustainable energy solutions on a worldwide scale is in line with its international expansion.

I am of the opinion that this strategy will permit Genie Energy to mitigate the impact of price fluctuations in any single market and provide the company with diverse cash flows and opportunities for growth. Ultimately, this approach will be advantageous for the company’s long-term cash flow stability which will result in compounding growth in several regions.

Risks

Regulatory and Compliance Risks: The business in which Genie Energy works is very regulated. Changes in laws, rules, or compliance standards, particularly in the energy industry, may have an effect on business’ operations, expenses, and earnings.

Political and Geopolitical Risks: Changes in political regimes, geopolitical tensions, trade conflicts, or international conflicts could have a negative impact on Genie Energy’s operations, investments, and market access because of the various regions in which it works.

Conclusion

To summarize, I believe that Genie Energy is currently a buy due to the firm’s ability to remain deleveraged in tough macro environments, the firm’s expansion to tap into new markets, and undervaluation assuming my DCF figures.

Read the full article here