Investment Thesis

Global Medical REIT Inc. (NYSE:NYSE:GMRE) is a small-cap healthcare real estate investment trust, or REIT.

GMRE’s strategy is to effectively underwrite small to mid-size properties in secondary markets. This yields a higher cap rate portfolio than the institutional investment grade properties, on-or-near a hospital campus in a top metro area, targeted by their much larger competitors.

Management has delivered superior returns with this strategy. However, GMRE’s five years of steady post IPO growth was interrupted by rising interest rates, which also challenges the safety of their generous dividend.

While slower growth and a potentially reduced dividend may mean returns over the next few years will be merely competitive, investors may find that over the longer term, GMRE’s strategy will provide an attractive, indeed superior, alternative among health care REITs.

Introduction

The information in this article comes primarily from the 2022 Annual Report, published March 2023, the 2023 Q2 10-K Quarterly Report published 04 August 2023, the last three earnings calls, and the company web site.

Abbreviations used in this article include: MOB for medical office building, IRF for inpatient rehabilitation facility, LTACH for long term acute care hospital, ASC for ambulatory surgical center (i.e. the patient goes home the same day), ABR for annual base rent, LTIP for long term incentive plan, SF for square feet, and LSF for leasable square feet. In discussing financial terms, “w.a.” is weighted average.

For quarterly results, Y/Y means current quarter / year ago quarter. Quarterly results are end of quarter, unless stated otherwise.

In this article we will provide an overview of GMRE, a more detailed look at their portfolio, results for recent quarters, debt, dividend, capital recycling, valuation, some analysis, and wrap up with an investor takeaway.

Global Medical REIT Overview

GMRE went public on 29 June 2016, offering 13 million shares at $10 per share. They owned 12 properties at that time. Initially externally managed, GMRE converted to internal management in July 2020.

The Prospectus describes their initial strategy: owning state of the art, purpose built facilities, that provide a “factory” for delivering medical procedures, with a focus on six areas – cardiovascular, cosmetic plastic surgery, eye surgery, gastroenterology, oncology, and orthopedics – to single tenants, under triple net leases.

GMRE’s strategy has shifted a bit, with rehabilitation replacing cosmetic surgery in the list, and broadened, adding opportunistic investments in acute care, health system corporate offices, and other areas, but retaining the focus on secondary markets.

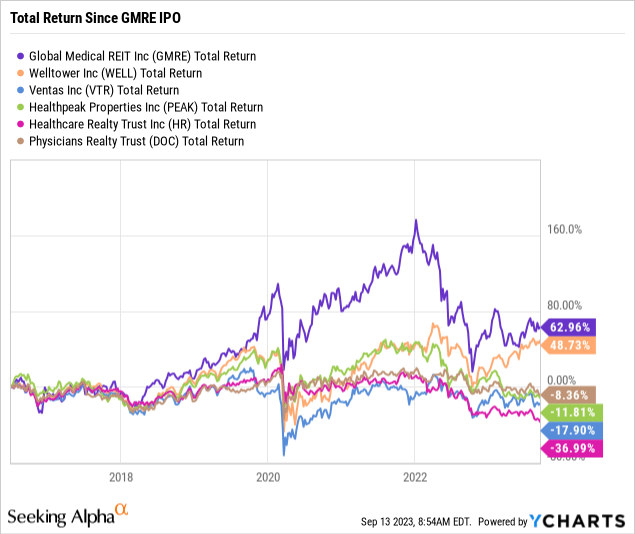

This strategy appear to have been a success, with GMRE delivering the best total returns among the health care REITs with significant MOB footprints, in large part based on a generous dividend.

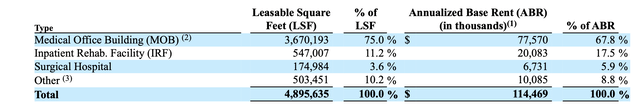

By the end of Q2 2023, the GMRE portfolio had grown to 186 properties with 4.8 million LSF, and a weighted average 7.8% cap rate. MOBs account for about 70% of the portfolio, by LSF and ABR.

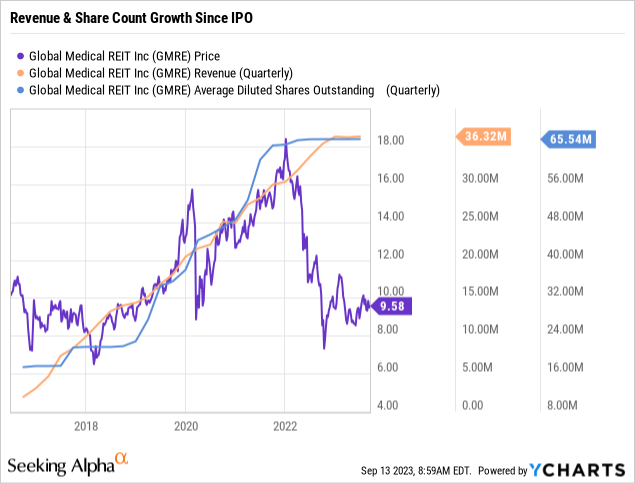

While the property count has grown 15X since the IPO, revenue and share count have both grown about 7x. GMRE operates with 29 employees.

The common stockholders of GMRE own 93% of the Operating Partnership which actually owns the properties, with the other 7% owned by holders of LTIP units, and third parties who contributed property or services.

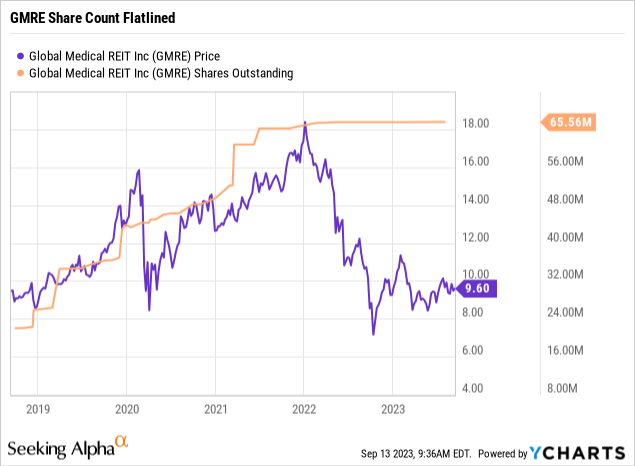

On 04 August, GMRE had 65.6 million common stock shares, 3.1 million preferred shares yielding 7.5%, 2.2 million OP units, and 2.8 million LTIP units outstanding.

With a $650 million market cap, GMRE ranks number 13 in market cap among Seeking Alpha’s 14 Health Care REITs.

The other major players in the MOB space are Welltower Inc. (WELL), Ventas, Inc. (VTR), Healthpeak Properties, Inc. (PEAK), Healthcare Realty Trust, Inc. (HR), and Physicians Realty Trust (DOC).

All are much larger than GMRE, and all focus their MOB investments toward properties located on or near a hospital campus. DOC and HR, GMRE’s smallest and most direct competitors with near 100% MOB assets, are respectively 5X and 10X larger by market cap.

Also differentiating GMRE from their competitors, they target 7.5-8.0% acquisition cap rates, and tenants including physician groups in addition to national and regional health care organizations.

Global Medical REIT Portfolio

At year-end 2022, GMRE owned 189 properties with about 4.9 million leasable square feet. The composition of the portfolio by LSF and ABR is summarized in the table below.

GMRE Portfolio Summary EOY 2022 (GMRE 2022 Annual Report)

The MOB category here includes, in addition to actual offices, facilities for surgery, imaging, labs, urgent care, dialysis, and plasma centers.

The 8.8% of ABR in the “other” category includes 2.3% of healthcare administrative office, 2.2% acute-care hospital, 2.2% long term acute-care hospitals, 1.2% behavioral hospital, 0.9% free standing emergency care.

Geographic diversification appear reasonable, with just over 60% of ABR from 7 states, with Texas (18%) and Florida (10%) the two largest. The total footprint includes 35 states.

Tenants

GMRE has about 268 tenants. Most properties are leased to single tenants under triple net leases.

Three tenants provided notable ABR concentration: Lifepoint Health (private) (6.6% of ABR), Encompass Health Corporation (NYSE:EHC) (6.4%), and Memorial Healthcare System (private) (4.8%).

Lifepoint operates a network of acute care, rehabilitation, and behavioral health facilities. They acquired Kindred Healthcare Corporation in 2021.

Encompass is the largest owner and operator of inpatient rehabilitation facilities in the U.S., providing “inpatient rehabilitation for stroke, brain injury, hip fracture and other complex neurological and orthopedic conditions.” They own 150+ in-patient rehabilitation hospitals.

Portfolio Details

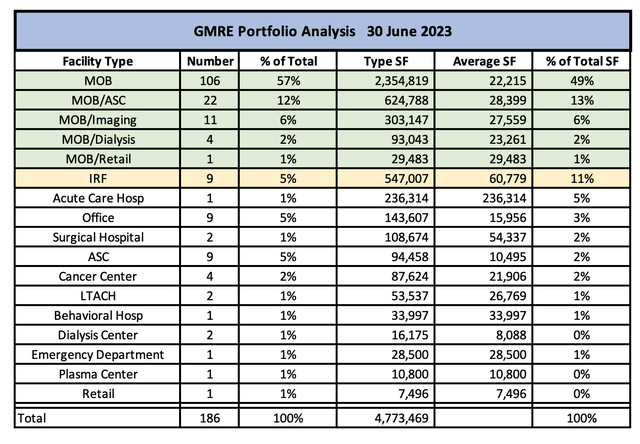

GMRE provides on their website a complete list of their properties, sorted into 17 facility types. This list was updated at the end of Q2. The table below is compiled from an analysis of that data. The green tint denotes MOBs, the yellow IRFs.

GMRE Portfolio Analysis (company data, table by author)

The median MOB type property is about 16,000 SF, the median MOB/ASC type about 20,000 SF.

To get a better sense of the GMRE portfolio, we will look further at the largest facility types, and some specific larger properties.

Medical Office Buildings (MOBs)

MOBs of all types account for about 70% of the LSF and ABR of the total portfolio, and about 77% of the property count.

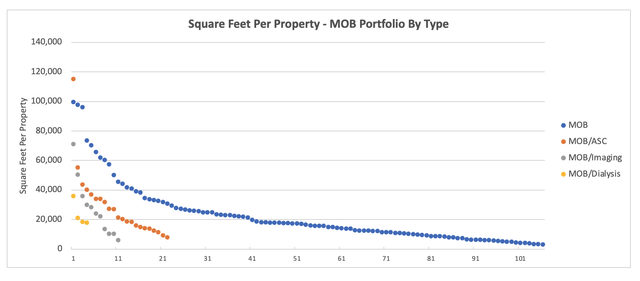

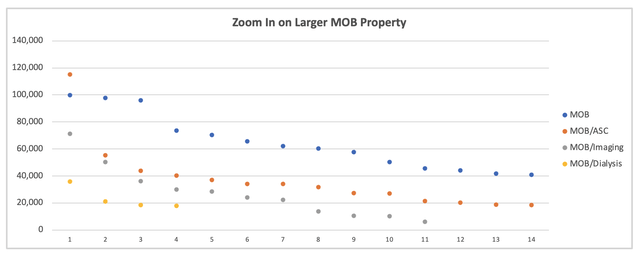

The plot below shows the distribution of properties by size for the four largest types of MOB facilities. The blue dots are pure MOB, the tan dots MOB/ASC, grey MOB/Imaging, gold MOB/Dialysis.

MOB Facilities by LSF (Data from company website, graph by author)

We can zoom in for a more detailed look at the larger MOB properties.

Detail – Largest MOBs by Type (Data from company website, graph by author)

We can see that there are a small number of significantly larger properties; only four MOB (of all types) properties above 90,000 SF, and 20 above 40,000 SF. We will look at three of the largest.

The largest MOB property is 99,718 SF; the Dumfries Health Center in Dumfries, Virginia. This A-rated 2009 multi-tenant building currently has 7,300 SF of space available (see property details here). Spectrum is noted as the primary tenant. Per their website, “Spectrum® Healthcare Resources (Spectrum) provides permanent, civilian-contracted medical professionals exclusively to U.S. Military Treatment Facilities (MTFs), Veteran Affairs clinics, and other agencies of the Federal government.” Spectrum’s parent company is TeamHealth (private).

The largest MOB/ASC property is 115,142 SF; the MercyOne Clinton North Health Plaza, in Clinton, Iowa. The facility includes two floors with lab and radiology services. MercyOne is a large private health care provider in Iowa.

The largest MOB/Imaging property is 71,219 SF; Marina Towers, in Melbourne, Florida. This class B building was built in 1994. Currently 13,972 SF are available (see property details here). Tenants appear to include First Choice Medical group (dba Emerge Healthcare) and Total Spine and Orthopedics (private).

Inpatient Rehabilitation Facilities

GMRE owns nine IRFs (table below). They comprise 11% of the LSF, and contribute 17% of ABR. This is by far the most significant property type after MOBs.

| Facility | City | State | LSF |

| Encompass IRF – Mechanicsburg | Mechanicsburg | PA | 78,836 |

| Encompass IRF – Altoona | Altoona | PA | 70,007 |

| Carrus Hospital – Sherman | Sherman | TX | 69,352 |

| Mercy Rehabilitation Hospital | Oklahoma City | OK | 63,896 |

| Central Texas Rehabilitation Hospital | Austin | TX | 59,258 |

| PAM IRF – Surprise | Surprise | AZ | 54,575 |

| Encompass IRF – Las Vegas | Las Vegas | NV | 53,260 |

| Encompass IRF – Mesa | Mesa | AZ | 51,903 |

| SJRMC IRF – Mishawaka | Mishawaka | IN | 45,920 |

There are about 1,150 IFRs nationwide, serving about 360,000 Medicare beneficiaries per year. About 75% of IRFs are in acute care hospitals, and 25% are free standing. Average duration of stay is ~ 12 days. About 58% of patients are Medicare fee for service (which is the highest revenue tier of patients).

This data on IRFs is from the March 2021 Medicare MEDPAC report to Congress, which included a chapter on Inpatient Rehabilitation Facilities. For an investor who wants a detailed look at IRFs, this is a good place to start.

From GMRE’s point of view, one could conclude that the number of potential high quality additional IRF opportunities is fairly large, should GMRE desire to expand their footprint in that area.

Four of the nine GMRE properties are operated by Encompass, accounting for 36% of GMRE’s IFR LSF. Encompass Health is the largest chain operator, owing ~ 40% of freestanding IRFs.

Carrus Rehabilitation is in Sherman, Texas, is operated by Carrus Health (private), a Texas and Oklahoma regional provider. This was a Q2 2-17 purchase, for $26 million, with at 8.8% cap rate.

Mercy Rehabilitation Hospital in Oklahoma City, OK is operated by Mercy, the 6th largest Catholic healthcare system in the US. This facility won a Top 10% award in 2020, and the assessment process provides information on both this facility and national average. Stroke, brain injury, and hip fracture are responsible for about half of IRF admissions.

Central Texas Rehabilitation Hospital was purchased in September 2017 for $40.7 million with an initial 7.1% cap rate. The operator is a joint venture between Kindred Healthcare and Seton Healthcare, which is part of the Ascension Health System.

The Los Vegas, Surprise, Oklahoma City, and Mishawaka IRFs were acquired in April 2019 as a 207,000 SF portfolio for $94 million at an initial cap rate of 7.1%.

Acute Care Hospital

The one acute care hospital in the GMRE portfolio is White Rock Medical Center (previously City Hospital of White Rock), near Dallas, Texas. The largest single property in the entire portfolio at 236,000 SF, it comprises about 5% of portfolio LDF, and about 2% of ABR. It was acquired in Q1 2018 for $23 million, with a 9.7% cap rate. The operator is Pipeline Health, LLC, (private).

From the 2022 Annual Report: (edited for brevity)

On October 3, 2022, Pipeline Health System, LLC (“Pipeline”), filed for Chapter 11 bankruptcy. At [that] time, Pipeline operated seven hospitals in three states, including the White Rock Medical Center in Dallas, Texas, an acute-care hospital owned by the Company where Pipeline is the sole tenant.

The primary reason for the bankruptcy filing relates to Pipeline’s facilities in Chicago, Illinois, and not the White Rock Medical Center. While in bankruptcy, Pipeline sold its facilities in Chicago, Illinois. Pipeline agreed to assume our leases at White Rock Medical Center with certain amendments to facilitate its emergence from bankruptcy and new operating plan, effective as of February 6, 2023.

GMRE reported the terms of the lease assumption here, noting that the amount of rent and lease terms were unchanged.

Recent Quarters

Absent special circumstances such as M&A, I think for investors an annual rather than quarterly assessment cadence is appropriate for most stocks.

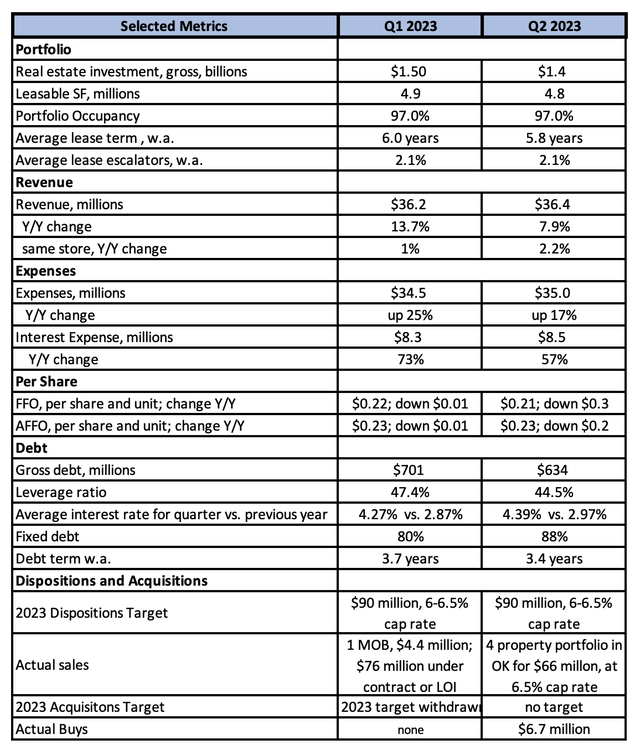

But there can be useful information in the earnings calls, particularly regarding management intent and direction. To that end, I reviewed the last three quarterly reports and earnings calls, and summarized selected metrics from the last two quarters in the table below.

Last 2 Quarters – Selected Metrics (GMRE Earnings Calls, table by author)

It’s worth discussing the 2023 dispositions and acquisitions intent and activity in more detail.

Dispositions

GMRE began 2023 with the plan to sell $90 million of assets at a 6-6.5% cap rate in the first half of the year. Management’s intent was that the cash from these sales “would reduce variable debt to approximately 10% of total debt, while also reducing leverage to a target range of 40% to 45%.”

In Q1, they sold one MOB in Jacksonville, Florida for $4.4 million, and had an additional $76 million under contract or letter of intent. They noted that buyers in the current market were primarily private equity.

In Q2, they sold a four property portfolio in Oklahoma City, OK. for $66 million, at a 6.5% cap rate. This portfolio included a surgical hospital. The buyer was private equity. The resulting debt reduction let them meet their 40-45% leverage target.

Subsequent to the end of Q2, they sold one MOB in North Charleston, South Carolina for $10.1 million, at a 5.3% cap rate.

This achieves 89% of their 2023 disposition target, on their “first half of the year” schedule. Going forward, they have said they are open to additional sales, and have expressed a preference to sell higher acuity facilities to increase their MOB weighting.

Acquisitions

In parallel, GMRE began the year intending to buy $100 million worth of assets, using in part OP units, “targeting mid to high sevens and potentially even eight caps”. As a point of reference, had they acquired 14 properties in 2022, spending about $157 million.

By the end of Q1, they abandoned their 2023 plan, citing unfavorable conditions.

In Q2, they bought 2 MOBs, with 18,698 SF, in Redding, California for $6.7 million, with a 7.6% cap rate. OP units, valued at $11, funded 90% of this purchase.

Funding Acquisitions

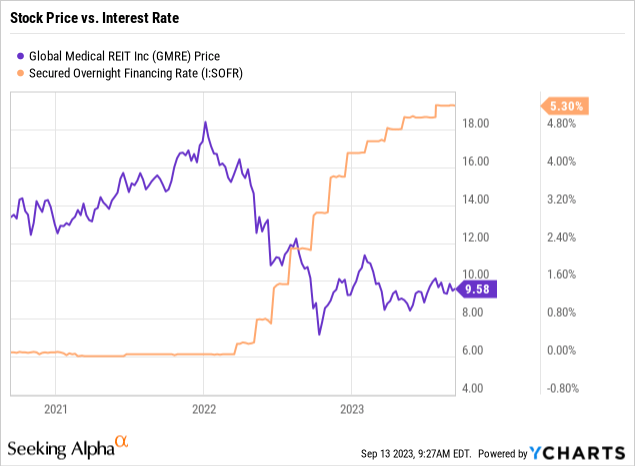

It’s very clear that rising interest rates have depressed the stock price and made it less attractive for GMRE to sell stock to fund acquisitions.

The standard reference rate for lending, Secured Overnight Financing “SOFR” is the basis for GMRE borrowing. The figure below nicely illustrates the correlation between interest rates and GMRE’s share price.

GMRE established a $300 million at-the-market agreement in March 2022. No stock has been sold under this agreement in 2023. In hindsight, they were probably a few months late here.

One can see in the chart below that share count essentially flatlined in mid-2021, and that management might be reluctant to sell shares near current prices.

CIO Alfonzo Leon commented on funding these acquisitions:

We do prefer doing it in equity, but in case we can’t do it in equity, we can sell more. I don’t want to add to the debt.

And Jeffery Busch,

And when we’re back in the market, I’d rather use more like 60% equity or more in the purchases — in my calculation for the purchases. But for a little while, equity and debt may be almost the same, I’d rather use all equity to keep bringing down debt.

The use of OP units provides some tax advantage to sellers in some cases,

Bob Kiernan in the Q1 call, commenting on OP unit use:

They took the OP units at a premium because of the tax advantage, sometimes they’re willing to add a couple of dollars into the OP units.

It ultimately comes down to very unique and idiosyncratic decisions and context of the seller — it’s a wealth management strategy for them. Historically, it’s been the smaller $5 million, $10 million deal where the physicians have a very low tax basis.

In the Q2 call, they discuss their assessment that acquisition prices may improve further:

We feel right now that cap rates are going up. So we want to be patient.

GMRE Debt

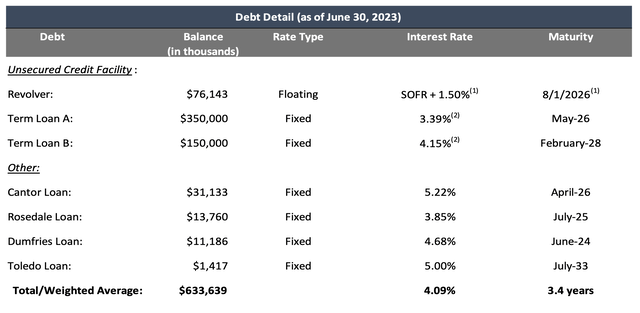

The Q2 Supplemental offers a concise summary of the debt situation.

GMRE Q2 2023 Debt Summary (Q2 2023 Supplemental)

The magnitude of the debt issues depends on an investor’s assessment of “higher for longer”; how much higher, how much longer.

Looking out to May 2026, if we are still in a higher interest rate environment, and the Term Loan A were to reset to say 6.39%, that would add another $10.5 million to annual interest rate costs.

It would also reduce by 73% the margin between the cost of debt and a 7.5% target acquisition cap rate.

Only 12% of the debt is now floating rate, but it’s still $76 million.

The June 2023 investor presentation notes that the rate on floating rate debt was 6.44% on 31 March 2023, but that

Due to the Company’s forward swap structures, the weighted average interest rate on fixed debt will improve over the next few years. [The current 3.75%] weighted average interest rates on the Company’s fixed debt are expected to decrease to approximately 3.67% in 2023, 3.50% in 2024, and 3.43% in 2025, based on the Company’s current leverage.

It’s very clear that management wants to reduce the debt burden. From the Q2 call:

So from a longer-term planning perspective, we’re really looking to bring our leverage down.

And I’d rather be using things like ATM and OP units to buy new assets and grow and bring down debt by leveraging less what I buy in the future.

GMRE Dividend

In the most recent quarter, GMRE paid $13.8 million in dividends to common stock holders, $1.1 million to non-controlling interests (unit holders), and $1.5 million to preferred stock holders. In round numbers, $15 million per quarter, to common and unit holders.

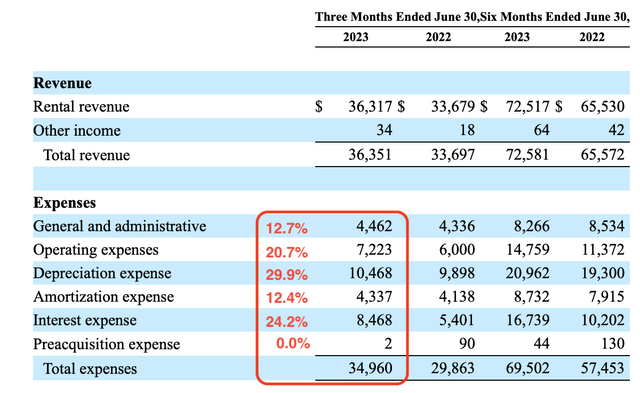

A brief inspection of the Q2 results shows size of the other numbers in play.

GMRE Revenue and Expense Summary (GMRE Q2 10-Q)

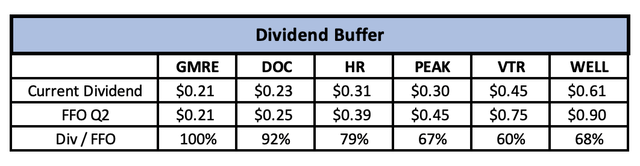

GMRE’s ability to afford the current dividend can also be compared to the other health care REITs we have noted. Its most direct competitors DOC and HR are paying ~80-90%, the larger REITs ~ 65%. One can argue AFFO vs. FFO, but the situation is little changed, GMRE is maxed out.

Dividends / FFO – Selected Health Care REITs (Seeking Alpha data, table by author)

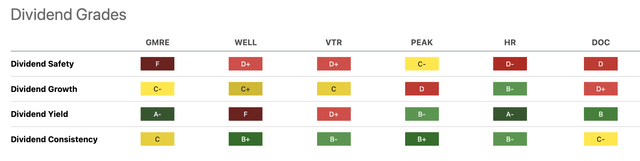

Seeking Alpha provides a convenient dividend comparison. None of the heath care REITs look very good, but unsurprisingly, GMRE stands out.

Dividend Grades – Select Healthcare REITs (Seeking Alpha)

The current dividend appears, at best, barely sustainable. An investor might anticipate a dividend cut of ~ 30% to $0.15 per quarter. If an investor demanded an 8% yield on cost, that would imply a post-cut stock price of $7.50.

However, that would free up ~ $17 million in cash per year, that could be used for debt reduction.

The Potential for Capital Recycling

We can do a back-of-the-envelope estimate of the potential of a systematic capital recycling program.

GMRE’s initial 2023 plan was to sell ~ $100 million at 6.5% or better cap rates, and buy ~ $100 million at ~ 7.5% or better cap rates. That’s about 7% of their portfolio by value.

In response to a question in the Q2 call about exceeding their 2023 $90 million disposition plan:

Yes, we would consider it. We do have groups out there interested in our assets. We would consider selling more if the right opportunity came up. We like to reduce our debt.

Assuming they could maintain a $100 million a year volume, and a 7.5% buy vs. 6.5% sell spread, a systematic capital recycling program might generate $15 million a year for debt reduction, or one additional fully paid for $15 million property with a 7.5% cap rate.

That’s probably a maximum number.

We went through a process … to identify assets that we felt were liquid in this current environment. Those are typically assets that are simple; single tenants versus multi-tenant properties with a clear credit story and longer lease terms.

We don’t know the results of that assessment, but a more realistic estimate of a sustainable recycling program might be half of that, say $8 million a year.

This would take a lot of work, but no new capital.

GMRE Stock Valuation

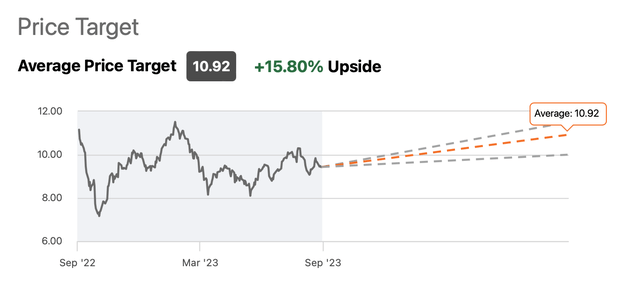

Per Seeking Alpha, Wall Street has a fairly weak Buy rating, with eight analysts equally divided between Buy and Hold, and an average price target of $10.92

GMRE Wall Street Price Target (Seeking Alpha)

On a forward Price/FFO metric, GMRE at 11.2 looks roughly in line with DOC at 13.2 and HR at 10.3, per Seeking Alpha numbers.

GMRE has 1.6% short interest vs. 4.9% for DOC and 3.2% for HR, 2.1% for PEAK, 2.3% for VTR, and 2.5% for WELL. One might view that as an expression of some confidence in GMRE’s current price.

Another data point is that management was willing to use $11 OP units as currency for an acquisition.

An $11 target price and the current dividend would provide a 7.6% yield. With a dividend reduced to $0.60 per year, it would still be a reasonable 5.5% yield at that price.

Analysis

Considering all the data above, there are several observations that one might offer.

1. GMRE’s secondary markets strategy appears to work. Management seems to be able to do the astute underwriting required. They have created a 7.8% cap rate portfolio, and it appears to have performed well.

There are echoes here of the secondary market strategy of STAG Industrial, Inc. (STAG) in the industrial warehouse space.

Management indicates the investment opportunities are still there. Responding to a question on the current market, Alfonzo Leon, CIO, said on the Q1 call:

for the types of facilities that we’ve acquired historically, I mean those are trading in the mid to high-7s.

And on the Q2 call:

So for the type of assets that we like, it’s north of mid 7s. There are some assets that we’ve seen that are trading as like low 8s.

2. The current level of debt, combined with the current (and possibly increasing) level of interest rates, present a significant hurdle to growth.

There is little or nothing they can do about interest rates. The options to reduce debt are painful. The current approach seems to be to wait for a stock price high enough to sell shares without significantly diluting current shareholders.

From the Q2 call, Jeffery Busch, President and CEO

The primary reason for the decline in both the FFO and AFFO was an increase in interest cost due to the elevated interest rate environment.

and Alfonzo Leon, CIO

The transaction market for our target medical facilities, which align with our investment criteria remains constrained due to the impact of higher interest rates and a wide bid-ask spread.

They have stated consistently that they would strongly prefer to be able to make acquisitions with equity (i.e. sell stock via ATM) rather than take on additional debt.

There are assets on the market at attractive prices, but they are unwilling to take on debt to buy them. From the Q2 call:

we’re waiting for our stock price to get to a better range where we can start buying accretively. And right now, we’re not within range.

The emphasis remains on debt reduction:

I’d rather pay down the debt right now than buyback stock.

So from a longer-term planning perspective, we’re really looking to bring our leverage down.

3. The current dividend is probably not sustainable, and certainly problematic.

In my view, the current $0.21 per quarter dividend should be reduced. A revised $0.15 quarterly dividend (a 29% reduction) would free up ~ $17 million in cash per year, and (with current FFO) bring the dividend / FFO payout ratio down to about 71%, which should be sustainable.

The downside is that the current generous dividend is an important, if not the main, attraction for many investors. A reduced dividend would probably lead to at least a temporary decline in share price. But at some point, they may have little choice.

Investor Takeaway

GMRE is a small cap healthcare REIT with a 70% weighting in MOBs.

Their value proposition is astute underwriting of small to mid-sized properties in secondary markets, producing a higher cap rate portfolio, and higher total returns, than their larger peers. Their track record is good.

However, as with many REITs, higher interest rates have made accretive growth difficult, and put the dividend at risk.

While they may manage through this problem, a prudent reduction in dividend payout, coupled with a systematic capital recycling effort, could provide a more robust platform to weather higher interest rates, and eventually resume growth.

I’d like to see them adopt a longer term view, cut the dividend to a conservative and sustainable level ($0.60), and pay down debt. However, I suspect they will defer this as long as possible, hoping for lower interest rates. I’d estimate that “as long as possible” is about 2 years, until refunding the $350 million fixed rate term loan breaches the analyst’s one year time horizon.

Another string in their bow in the current interest rate environment is selective capital recycling; buying properties for 7.5% cap rates and selling for 6.5%. They have demonstrated the ability to do this, but growing that way is going to be a slow and less certain process.

Even with a reduced dividend, most of the near-medium term return is likely to come from the dividend rather than share price appreciation.

Under the Seeking Alpha system, I’d rate it a strong Hold. A cautious investor might look for a bigger margin of safety and a buy price closer to $8.

Personally, I have a full position in Global Medical REIT Inc. acquired in several tranches between January 2018 and September 2022, at an average cost of $8.54, and giving a current yield on cost of 9.8%. After researching this article, I initiated a limit order to double that position at $7.50, recalling that the 52 week low was $7.01, and that $7.50 would provide an 8% yield with a $0.60 dividend.

Read the full article here