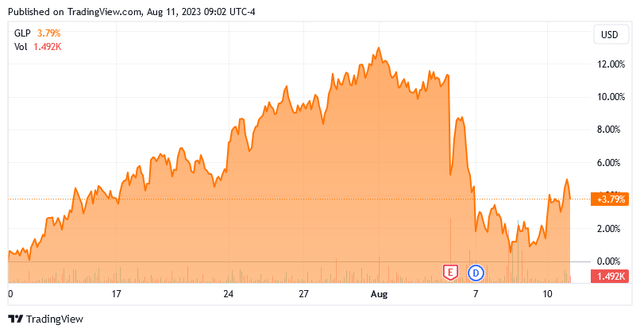

On Friday, August 4, 2023, downstream gasoline distributor and convenience store operator Global Partners LP (NYSE:GLP) announced its second-quarter 2023 earnings results. At first glance, the company’s results were rather disappointing, as the company missed the expectations of its analysts in terms of both revenue and net income. The market appeared to agree, as Global Partners’ units gave up nearly all of the gains that they had achieved over the past month:

Seeking Alpha

With that said, we can still see that the partnership’s units are still up over the past month. This may be partly due to the rise in crude oil prices that we have seen recently. That has naturally had the effect of driving up gasoline prices, as I am sure we have all witnessed recently when we go to fill up our cars. That will have a positive effect on the company’s revenues, although its financial performance was still weaker than last year. However, as we have pointed out in numerous previous articles on this company, it is much more affected by energy prices than the midstream companies that we usually discuss here at Energy Profits in Dividends.

Global Partners is one of those companies that can serve as a hedge against your consumer exposure to high gasoline prices because its revenues and cash flows usually increase in such an environment. This company has a tendency to vary its distributions with its cash flows, so when it costs you more to fill up your car at the pump, the company pays you more money. That helps to offset some of the pain that you are likely to feel. In conjunction with these results, Global Partners declared a $0.6750 per unit distribution, which works out to an 8.59% yield at the current price. As such, this company continues to deserve a place in the portfolio of any energy income investor.

Earnings Results Analysis

As regular readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings results before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Global Partners’ second quarter 2023 earnings results:

- Global Partners brought in total revenues of $3.8317 billion in the second quarter of 2023. This represents a 28.03% decline over the $5.3237 billion that the company brought in during the prior-year quarter.

- The company reported an operating income of $63.6 million in the reporting period. That compares quite unfavorably to the $110.6 million that the company reported in the year-ago quarter.

- Global Partners sold a total of 1.3 billion gallons of gasoline across all of its business segments in the current quarter. That was in line with the 1.3 billion gallons of gasoline that it sold in the equivalent quarter of last year.

- The company reported a distributable cash flow of $51.337 million in the most recent quarter. That represents a substantial 70.62% decline over the $174.726 million that the company achieved last year.

- Global Partners reported a net income of $35.587 million in the second quarter of 2023. This compares quite unfavorably to the $157.178 million that the company reported in the second quarter of 2023.

It seems essentially certain that the first thing that anyone reviewing these highlights will notice is that Global Partners’ financial performance declined in pretty much every category. One of the biggest reasons for this is that gasoline prices were lower than in the prior-year quarter. This may be difficult to believe considering that gasoline prices have been skyrocketing over the past few weeks, but it was a different environment in the second quarter. As I have pointed out in a few previous articles, during the second quarter of this year, crude oil prices were much lower than during the second quarter of 2022:

Barchart.com

This naturally affects the company’s selling price of gasoline, which is its primary product. After all, when crude oil prices go down, gasoline prices go down. The reverse is also true. Of course, the price that the company has to pay for gasoline also goes up with oil prices. Thus, the most important thing is the difference between the two prices since that is the amount of money that is available to cover the company’s other expenses and ultimately make its way down to its profit and cash flow. This is the company’s product margin, which unfortunately also declined quarter-over-quarter. The company reported a combined product margin of $265.558 million in the most recent quarter compared to $301.947 million a year ago. This was one of the biggest factors that was responsible for driving the company’s financial performance down since that was a fairly large year-over-year decline.

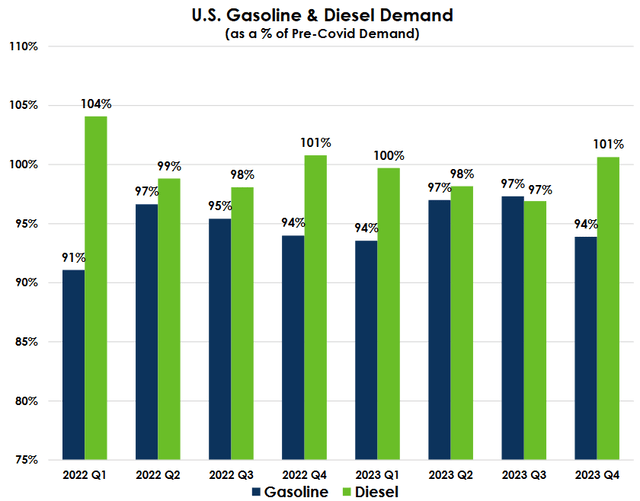

In some cases, the company can make up for a lower product margin by selling more products. After all, making a small amount of money on a huge amount of product can still be very profitable, which is the very basis of the discount store retail model. Unfortunately, that was not the case here. As noted in the highlights, Global Partners sold approximately 1.3 billion gallons of gasoline in the most recent quarter, which was in line with the amount that the company sold last year. This a clear sign that the national demand for gasoline is not growing. That has been the case since the COVID-19 pandemic:

NuStar Energy/Data from ESAI

As we can see, diesel demand has been roughly flat since the start of last year, with demand hovering around pre-pandemic levels. Gasoline demand has generally been below the levels that it had prior to the pandemic; however, it has been relatively stable at 94% to 97% of pre-pandemic levels. There are a few reasons for this, most prominently the work-at-home trend. That is the same thing that has been causing problems in the commercial real estate space. Basically, people are opting to work at home rather than commute to the office every weekday. One of the primary reasons why people drove their cars was to go to work, so the fact that this is happening has naturally reduced the demand for gasoline. In addition, there could be some reasons to think that the higher gasoline prices than pre-pandemic are causing people to cut back on unnecessary driving. That is mostly anecdotal evidence at this time though, but it does make sense.

The fact that gasoline demand is not where it once was shows up in Global Partners’ earnings results. The company’s Gasoline Distribution and Station Operations business unit sold a total of 417.362 million gallons of gasoline during the most recent quarter compared to 422.282 million gallons a year ago. This is the business unit that runs the company’s network of convenience stores and gasoline stations, so it is clearly affected by consumer demand for fuel. As we can see, it clearly points to lower demand. That could be a sign that the economy is weakening, especially when we consider that numerous other indicators are clearly pointing toward a near-term recession.

Naturally, if the company’s total volumes stayed the same but its gasoline stations sold less fuel, obviously one of its other business units would have to report higher volumes. In fact, both the Wholesale segment and the Commercial segment did so:

|

Q2 2023 |

Q2 2022 |

|

|

Wholesale |

809,600 |

792,595 |

|

Commercial |

102,491 |

95,394 |

The wholesale business unit sells home heating oil, gasoline, diesel fuel, kerosene, and other refined products to other companies that then sell them to end users. The commercial segment sells gasoline and diesel fuel directly to large consumers of these products such as government agencies and large corporations. Global Partners did not provide a reason why shipment volumes for these two segments were higher than a year ago, but it could be due to demand for diesel fuel or even from delivery companies. After all, one change in the economy that began during the pandemic lockdowns but appears to be persistent is people ordering things for shipment to their houses.

Anecdotally, I see numerous Amazon (AMZN) packages being delivered to my suburban neighborhood every day. That was not the case five years ago. Shopping malls have been reporting much lower foot traffic than they did prior to the pandemic, so it is possible that this change in consumer behavior is having an impact on gasoline demand. Unfortunately for Global Partners, the total product margin for both of these businesses declined year-over-year despite the higher volumes.

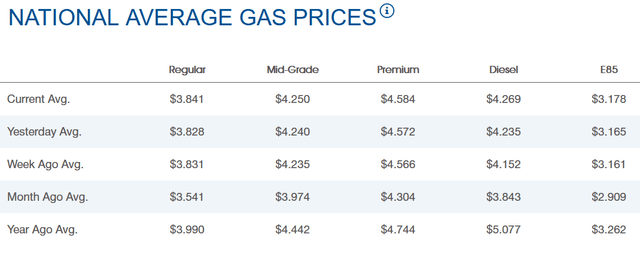

The company might be able to deliver a stronger performance in the third quarter, fortunately. AAA tracks gasoline prices across the country, and as we can see here, they have been increasing over the past month:

AAA

This is a direct result of the rising crude oil prices that we have seen over the past month. There are some reasons to expect that crude oil prices will continue to trend upward over the remainder of the year. I discussed these reasons in an “APA Corporation: Reasonable Results For Current Times, Set Up For Better H2” yesterday, but in short, the demand for crude oil is rising at a time when the supply for it is not and the United States government no longer has the ability to sell crude oil from the Strategic Petroleum Reserve in an effort to artificially drive down energy prices.

This could benefit Global Partners, as its revenue and product margin tend to increase when energy prices do. The risk here is that consumers are more financially stressed than they were back in 2022 so they might cut back on their gasoline consumption much more than they have already done so. If that were to happen, it might be sufficient to offset the benefits of the higher gasoline prices. I am optimistic for now though and expect that the company will deliver a stronger second half of 2023 than the first half.

Financial Considerations

It is always important to investigate the way that a company finances its operations before making an investment in it. This is because debt is a riskier way to finance a company than equity. This is because debt must be repaid at maturity. That is normally accomplished by issuing new debt and using the proceeds to repay the existing debt since very few companies have sufficient cash to pay off their debt as it matures. That process can cause a company’s interest expenses to increase depending on the conditions in the market. As of the time of writing, the effective federal funds rate is at the highest level that has been seen since 2007 so it is a safe bet that any debt rollover today will result in an increased interest expense.

In addition to interest-rate risk, a company must make regular payments on its debts if it is to remain solvent. As such, an event that causes a company’s cash flows to decline could push it into financial distress if it has too much debt. As Global Partners is greatly exposed to changes in crude oil and gasoline prices, which can be quite volatile, this is a risk that we should not ignore with this company.

One metric that we can use to measure a company’s ability to carry its debt is its leverage ratio. This ratio is also known as the net debt-to-adjusted EBITDA ratio, and it basically tells us how many years it would take a company to completely pay off its debt if it were to devote all of its pre-tax cash flow to that task. As of June 30, 2023, Global Partners had a net debt of $1.3584 billion. It had an adjusted EBITDA of $167.586 million in the first half of 2023, which works out to $335.172 million annually. This gives the company a leverage ratio of 4.05x based on its annualized adjusted EBITDA.

This is an acceptable ratio for a midstream company, but midstream companies tend to have more stable cash flows than Global Partners. As such, I would like to see the company’s leverage ratio be lower than we would demand of a midstream firm. For now, it is probably okay because the company’s cash flow should increase over the second half of this year, but I would still feel more comfortable if Global Partners paid its debt down a bit.

Distribution Analysis

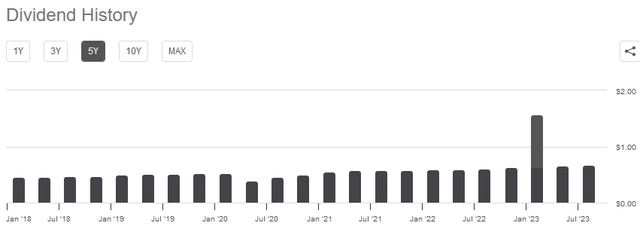

One of the biggest reasons why we invest in master limited partnerships is because of the incredibly high yields that these entities tend to pay out. Indeed, Global Partners yields 8.59% at the current price. The company has not always been consistent with its distribution over time though:

Seeking Alpha

The trend seems to be to increase the distribution slightly every quarter, but occasionally we see an event like the COVID-19 lockdown that crushes the company’s business and forces it to cut the distribution. The company has generally been more reliable than we would expect from a company whose cash flows vary with energy prices like this one, though.

The fact that Global Partners tries to increase its distribution over time is something that is quite nice to see, especially during inflationary periods like the one that we are in today. This is because inflation is constantly reducing the number of goods and services that we can purchase with the distribution that the company pays out. That can make it feel that we are getting poorer and poorer with the passage of time, which is a particularly big problem for individuals that depend on their portfolios for the income that they need to pay their bills. The fact that this company usually increases its distribution over time helps to offset this effect and ensures that the distribution maintains its purchasing power.

As is always the case though, it is important that we ensure that the company can actually afford the distribution that it pays out. After all, we do not want it to be forced to reverse course and cut the distribution since that would reduce our incomes and almost certainly cause the partnership’s unit price to decline.

The usual way that we judge a master limited partnership’s ability to pay its distribution is by looking at its distributable cash flow. Distributable cash flow is a non-GAAP metric that theoretically tells us the amount of cash that a company generates from its ordinary operations and is available for distribution to limited partners. As stated in the highlights, Global Partners reported a distributable cash flow of $51.337 million in the second quarter of 2023. The declared distribution of $0.6750 per unit costs the company $22.940550 million based on its basic weighted average common units outstanding. Thus, the company had a distribution coverage ratio of 2.24x for the quarter. That is quite acceptable and clearly indicates that the company is not straining to cover the distribution. We should not worry much here.

Conclusion

In conclusion, the market was disappointed by Global Partners’ revenue and earnings misses. However, this earnings report was not really that bad. We can clearly see that the company suffered some negative effects from lower energy prices and an apparently weakening economy, but any regular reader likely expected that. At least one of these problems should be corrected very shortly, as the past month has seen gasoline prices trend upward, which should benefit Global Partners.

Global Partners LP can easily sustain its 8.59% distribution yield if it can maintain its cash flow, which seems likely. My biggest concern here is that the debt is higher than we really want to see, but even that should be fixed by the coming cash flow growth. Overall, this company continues to be a good downstream company to include in a portfolio to obtain some diversification and income.

Read the full article here