Graham Corporation (NYSE:GHM) recently delivered beneficial expectations about 2024, including EBITDA growth and net sales growth. GHM is also expected to benefit significantly from recent increases in defense budgets. Besides, management also says that it may reposition its efforts to enjoy the incoming expenditures in the clear energy market. There are obvious risks from its dependence on certain contracts with the US Government and other clients, however I believe that it could trade at much more than the current stock price.

Graham Corporation

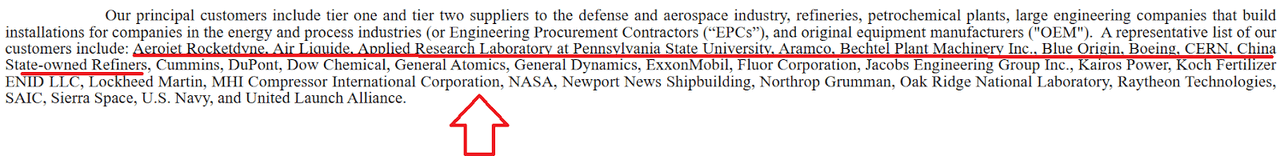

With clients mainly in the field of defense, space, and large industrial processes, Graham Corporation is a company that is dedicated to the design, manufacturing, and marketing of high-tech systems and related equipment for the control of energy flows and circuits in general.

Typically, these products are primarily intended for the propulsion of industrial systems as well as the propulsion of rockets and nuclear as well as non-nuclear power plants. Due to the specificity of these products and the highly complex technological systems that they involve, Graham Corporation has historically gained clients with a large presence in the indicated markets, some of them with great international recognition.

The company works with massive clients that stand out. Graham maintains long-term contracts that ensure the functioning of its operating margins. In this sense, it is important to note that only two of these clients accounted for 10% of the company’s income in recent years.

Source: 10-k

Furthermore, Graham Corporation recently completed the acquisition of BN, a turbine machinery manufacturing company that accompanies the company’s current growth strategy, and contributes to the diversification of its portfolio in the product line as well as its territorial expansion.

Despite the large number of products and the specificity of each of them, the company registers a single segment of operations, in which it covers all these types of activities, including the sale of products through its own team of directly hired salespeople.

The company executes a growth strategy mainly channeled through the diversification of markets and its product line. This strategy is marked by a transformation of the product offering that Graham has been carrying out in recent years to go from being a company with extended sales cycles for a small number of products to having a permanent offer with active sales cycles for the entire year.

Looking towards 2024, the company is committed to continuing to optimize performance besides developing technologies that can be included in their clients’ production chains and ensure their permanent sale. These objectives are accompanied by in-depth market research to precisely develop products that offer differential value over the niches within the industries to which their clients belong.

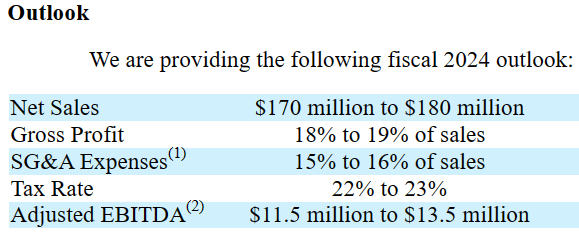

With that about the business model, I believe that the outlook given for 2024 appears beneficial, and it is a great moment for having a close look at Graham Corporation. The company expects both net sales growth and adjusted EBITDA growth. Management noted 2024 net sales close to $170-$180 million, with a tax rate of about 22%-23%, and an adjusted EBITDA of $11.5-$13.5 million.

Source: 10-Q

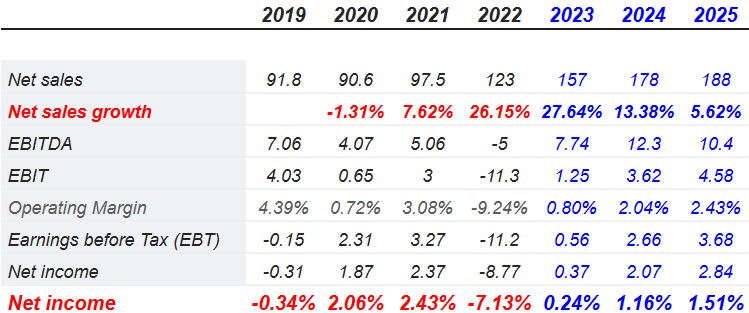

The numbers offered by other investment analysts are also beneficial. They are expecting double digit net sales growth in 2023 and 2024 as well as growing net income from 2023 to 2025.

2025 net sales are expected to be close to $189 million, with net sales growth of about 5.61%, 2025 EBITDA of $10.4 million, net income close to $2.84 million, and net income growth of 1.5%. In my view, considering these beneficial expectations and recent stock price dynamics, running a financial model about Graham Corporation would not harm us.

Source: S&P

Pricing Strategies

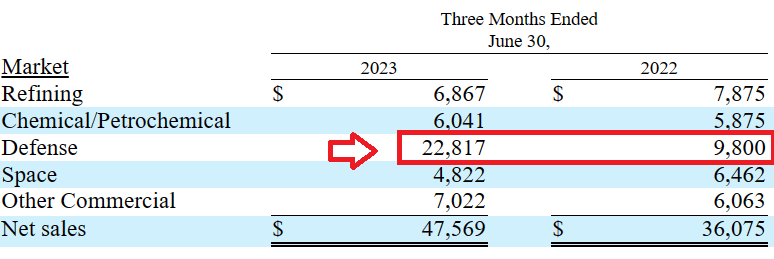

The company appears to be applying an improved mix of higher margin defense projects as well as improved pricing. In my view, further pricing strategies may bring higher net income margins in the coming years. In the last quarterly report, the company reported some beneficial effects driven by previous efforts.

This increase over the prior year was primarily due to sales to the defense industry, which increased $13,017 versus the prior year period primarily due to an improved mix of higher margin defense projects, better execution, the timing of material receipts, and improved pricing. Source: 10-Q

In the last quarter, revenue from the defense industry represented a significant part of total net sales. Hence, I think that the current efforts to improve margins in this particular market could have a significant impact on future FCF growth.

Source: 10-Q

Defense Budget Increases Are Expected To Bring Significant Net Sales Growth

With many countries out there increasing their defense budgets, Graham Corporation will most likely see a beneficial impact on both net sales growth and FCF growth. In this regard, it is worth noting that the World Defense Budget may grow at close to 4.9% from 2023 to 2028. Besides, management did make a remark about the incoming increase in the demand for systems for the defense industry.

The World Defense Budget is estimated to grow at a CAGR of 4.90% from 2023 to 2028. Source: 10-Q

Demand for our equipment and systems for the defense industry is expected to remain strong and continue to expand, based on defense budget plans, the projected procurement of submarines, aircraft carriers and undersea propulsion and power systems and the solutions we provide. Source: 10-Q

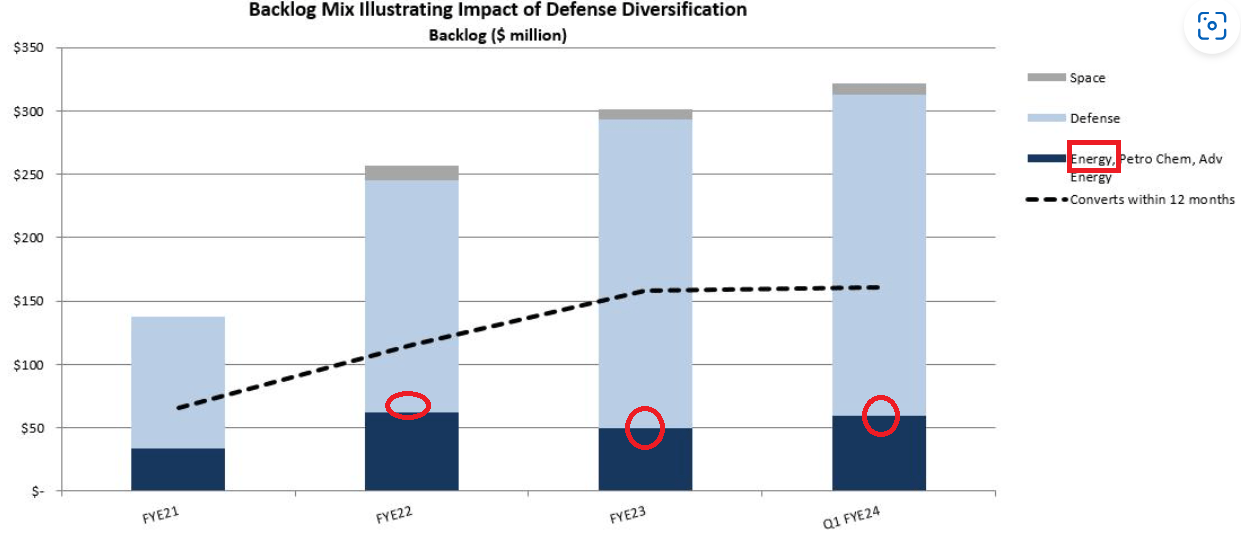

The Orders Booked Increased Significantly From A Major Defense Customer, So I Would Expect Further Net Sales Growth As Orders Are Delivered

Orders for 2024 Q1 more than doubled thanks to follow-on orders from a major defense customer and a vacuum distillation system from a client in India. I believe that the increase in the order book will most likely have a beneficial effect on 2024 net sales growth. Besides, if a sufficient number of investors learn about the incoming net sales growth, we may see an increase in the demand for the stock. As a result, the stock price could creep up.

Orders booked in the first quarter of fiscal 2024 increased $27,625 to $67,933 compared with the first quarter of fiscal 2023. This increase included orders of $22,000 related to a strategic investment and follow-on orders from a major defense customer, and a $9,100 vacuum distillation system order for a refinery in India. Source: 10-Q

Recent Demand For Clean Energy May Also Be A Catalyst For Future Net Sales Growth

Demand for equipment necessary for solar power and storage as well as small modular nuclear systems will most likely increase as new clean energy opportunities increase. Right now, the company does not receive a lot of revenue from these specific markets. However, given the interest shown by investors and the total amount of dollars going to the clean energy sector, I think that Graham may benefit from some positioning in these markets.

The alternative and clean energy opportunities for our heat transfer, power production and fluid transfer systems are expected to continue to grow. Source: 10-Q

We are positioning the Company to be a more significant contributor as these markets continue to develop. Source: 10-Q

Source: 10-Q

Balance Sheet

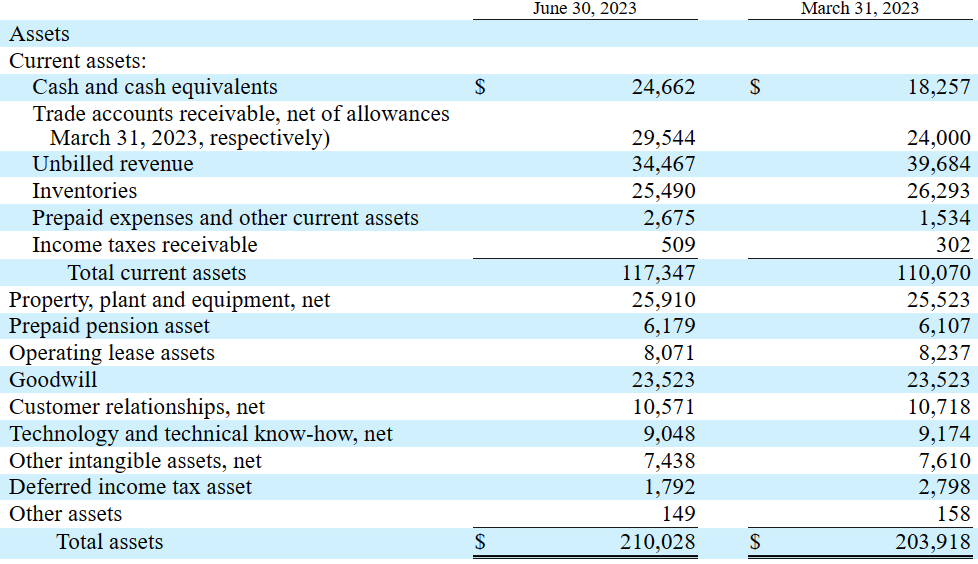

As of June 30, 2023, Graham reported cash worth $24 million, with trade accounts receivable worth $29 million, inventories of about $25 million, and total current assets worth $117 million. With the current ratio being larger than 1x, Graham Corporation does look to have an adequate level of liquidity.

Long-term assets include property, plant, and equipment of about $25 million, prepaid pension assets close to $6 million, and goodwill close to $23 million. Total assets stand at $210 million, and the asset/liability was close to 2x, so I think that the balance sheet looks quite stable.

Source: 10-Q

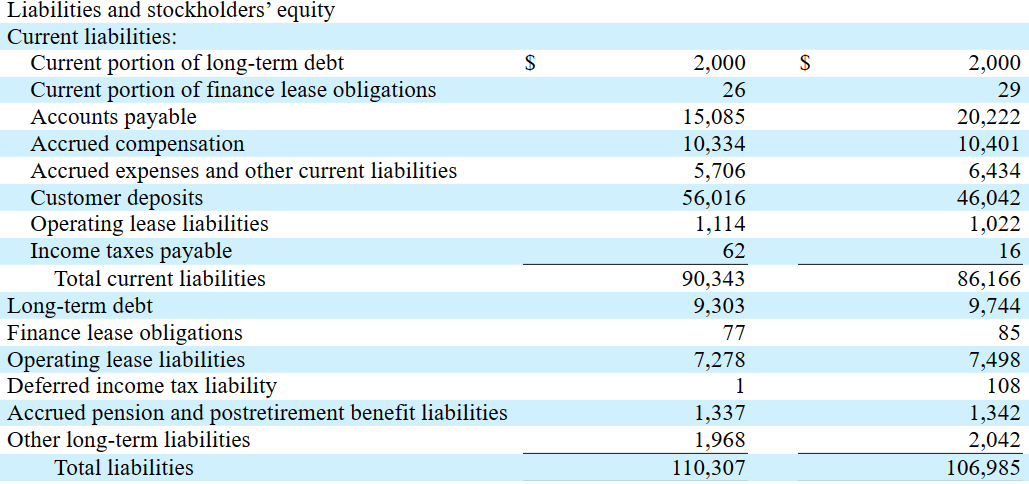

I am really not worried about the list of liabilities, not only because they seem small, but because the total amount of debt is limited. Current portion of long-term debt stands at $2 million, with accrued compensation of about $10 million, and total current liabilities of about $90 million. Long-term debt stands at about $9 million, with accrued pension and postretirement benefit liabilities close to $1 million, and total liabilities of close to $110 million.

Source: 10-Q

With The Previous Assumptions, I Designed The Following Financial Model

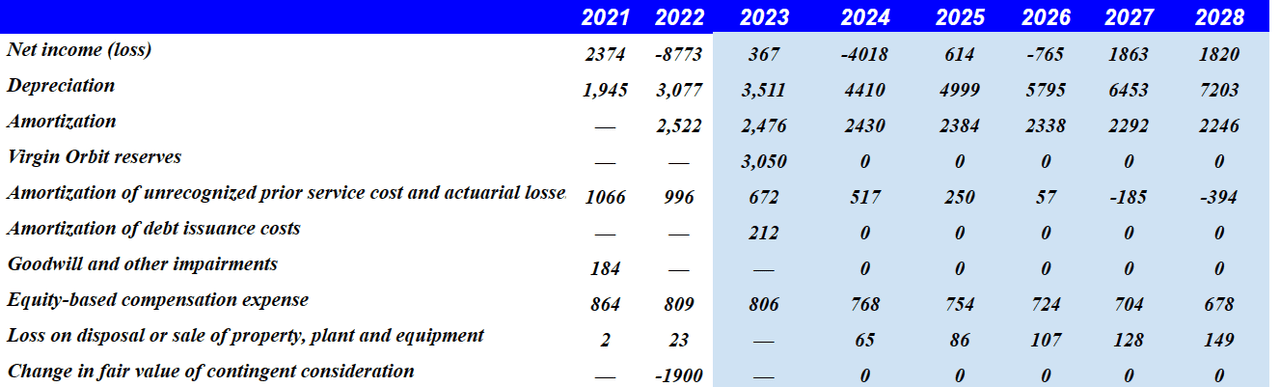

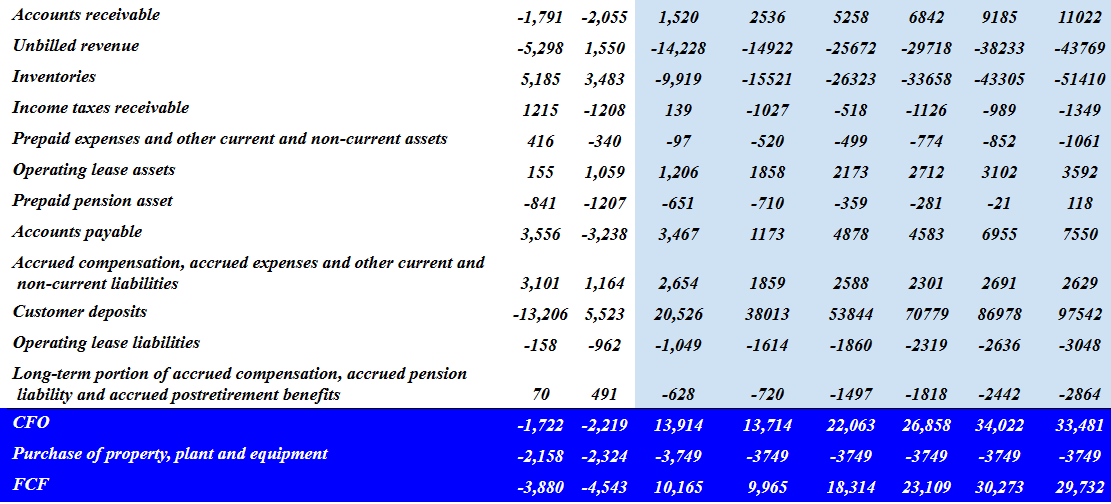

My figures are really not far from the expectations of other analysts and the outlook given by management. I assumed a cash flow statement with net income growth, D&A growth, capex growth, and stable but conservative FCF growth.

More in particular, I included 2028 net income of $1 million, with 2028 depreciation of close to $7 million, 2028 amortization worth $2 million, and changes in accounts receivable close to $11 million.

Source: DCF Model

Besides, with changes in unbilled revenue of -$44 million, changes in inventories close to -$52 million, and 2028 prepaid expenses and other current and noncurrent assets close to -$2 million, I also included accounts payable worth $7 million.

Finally, by including 2028 customer deposits worth $97 million and operating lease liabilities of -$4 million, I obtained 2028 CFO of $33 million and 2028 FCF of $29 million.

Source: DCF Model

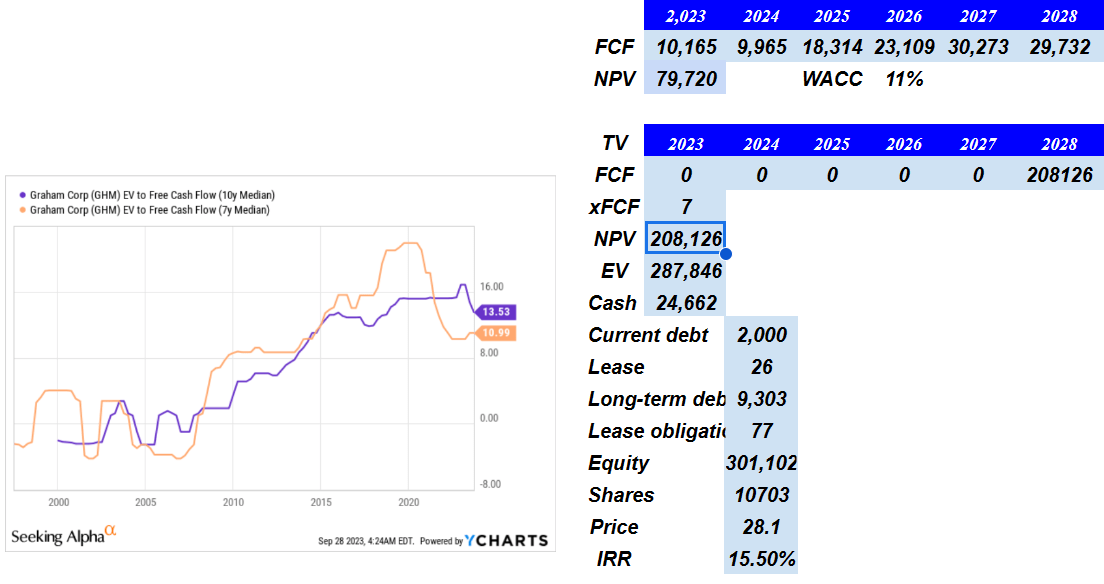

If we assume a conservative cost of capital of 11%, which is in line with the numbers offered by online investment advisors, and a terminal EV/FCF of 7x, the implied enterprise value would be $287 million. Adding cash in hand, and subtracting current debt, long term debt, and leases, the implied equity valuation would be $301 million. Finally, the fair price would stand at $28 per share, and the IRR would be around 15%-16%.

Source: Valuation Model

Competitors

Competition in this industry is fragmented since there are not many companies that offer a broad and diversified portfolio of services like Graham. For this reason, in each of the markets, the competitors that have larger portions and exercise direct competition over the company are different. A few companies such as Croll Reynolds Company, Garden Denver, KEMCO, and Thermal Engineering International have a presence in the US market and internationally.

Risks

First of all, the growth strategy that Graham implements and the integration of future acquisitions involve risks. Along with this, it should be noted that the company has developed a great concentration of its sales in the defense industry, which will represent 42% by 2022 and around 53% of total sales by 2021. Due to the dependence on the activity of its clients, in my view, it is important to note that Graham maintains a series of contracts with the United States Army, and due to the particularity of these contracts, it is difficult to project the conditions of compliance due to the government regulations behind them. Regarding this, it is necessary to know that Graham intentionally seeks to penetrate the market behind the US army, resultantly generating a series of risks such as the one indicated above.

Regarding the concentration, the company declared in its reports that its 10 largest clients reach approximately 50% of the revenue, and in this sense, any disruption to their activity could directly or indirectly generate radical changes in operating margins of the company.

Conclusion

Graham recently delivered a beneficial outlook that includes EBITDA growth and net sales growth driven by recent growth from the demand from the defense sector. I believe that Graham will most likely continue to enjoy decent net sales growth thanks to increases in the international defense budgets and recent growing demand for clean energy. Additionally, we may see certain stock demand given the recent increase in the backlog for 2024 and the optimistic expectations of other analysts. I do see some risks from dependency on certain clients, M&A integration, or failed contracts with governments. With that, I do believe that the company could trade at better stock valuations.

Read the full article here