Thesis

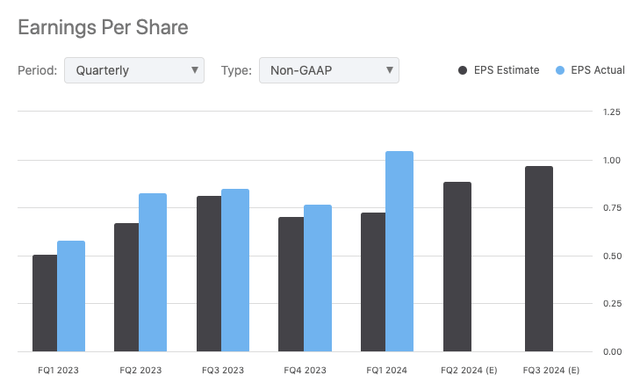

Haemonetics Corporation (NYSE:HAE) reported a strong financial performance in the first fiscal quarter of 2024, with its non-GAAP EPS of $1.05 beating estimates by $0.32 and a revenue of $311.3M surpassing expectations by $18.61M. With adjusted gross margins scaling up to 54.2%, spurred by favorable pricing, volume tweaks, and an optimally crafted geographical and product mix, the company is proving its mettle in the competitive market.

Notably, the advancements in their NexSys Plasma collection system and the consistent innovation ethos have further bolstered their growth. This analysis argues that, while certain risks like fluctuations in adjusted gross margins and external financial market vulnerabilities remain, the current trajectory, performance in relation to the S&P 500 (SP500), and a possibly undervalued P/E ratio, present a strong case for investors to consider Haemonetics as a promising “buy” option.

Company Profile

Haemonetics Corporation, based in Boston and founded in 1971, is a key player in the healthcare sector, providing a diverse range of medical products both in the U.S. and internationally. The company has carved out a presence in various segments from plasma collection systems, like NexSys PCS, to blood management tools such as SafeTrace Tx. Additionally, Haemonetics offers hospital products, including TEG and ClotPro analyzers, as well as surgical solutions like Cell Saver Elite +. Distribution is facilitated through a combination of direct sales, distributors, and sales representatives.

Haemonetics’ Q1 2024 Earnings Breakdown

In the first fiscal quarter of 2024, Haemonetics’ adjusted gross margins rose to 54.2%, an upturn driven by a blend of factors including favorable pricing, volume adjustments, and an optimally aligned geographical and product composition.

An examination of the market trends in the United States reveals a compelling story of growth in the Plasma and Hospital sectors. According to management, the strength behind this growth can be further quantified: evidence comes from tens of millions of collections using the NexSys Plasma collection system, showing a boost in plasma yield of 9% to 12%, accompanied by improvements in donor safety, connectivity, and satisfaction.

Innovation stands at the core of Haemonetics’ strategy. The introduction of a redesigned bowl coupled with the FDA clearance of Express Plus software epitomizes the company’s commitment to enhance efficiency. These changes are designed to tackle specific challenges: reducing the average collection time, which was previously estimated to be 75 minutes, enhancing the performance of plasma centers, and lowering the cost per liter.

The approved modifications to the NexSys PCS system are not inconsequential, with anticipated reductions that translate to an average time frame of 33 to 38 minutes.

These technological advancements have had a tangible impact on financial projections. The firm has recalibrated its expectations for organic revenue growth in the Plasma division for the entire fiscal year, now forecasting an 8% to 11% increase, up from the initial 3% to 6%.

A close scrutiny of the operating expenses also illustrates the company’s strengthening financial stance. The rate of revenue spent on adjusted operating expenses fell markedly from 38.1% to 31.7%, standing flat at $98.5 million year-over-year. The adjusted operating margin improved by 540 basis points, and the adjusted operating income doubled to $25 million, a surge of 56%.

Seeking Alpha

Alongside these metrics, there are other noteworthy shifts. The adjusted income tax rate dropped to 21%, while adjusted net income grew by 78%, and earnings per diluted share rose by 81% relative to the same period last fiscal year.

The backdrop to these developments is the broader landscape of the plasma industry, where operational leverage has excelled beyond expectations. Sales of plasma products (excluding recombinant products) have seen an impressive ascent from just over $5 billion in 2000 to over $26 billion at the start of the current decade. This growth trajectory, fueled by newly diagnosed patients undergoing treatments like IgG, C1-INH, and AAT, appears poised to continue, driven by rising demands for staple plasma proteins and the emergence of new markets.

At the structural level, Haemonetics has embarked on a significant ongoing restructuring initiative called the Operational Excellence Program. The projected gross savings and the adjusted operating margin guidance, hovering between 20% and 21%, outline a coherent strategy aimed at harnessing further efficiency.

Finally, the upswing in both cash and free cash flow in the balance sheet, before restructuring and related costs, lends additional credence to Haemonetics’ improving financial health. It’s worth noting that this trend is likely to be underpinned throughout the year by an escalated output of NexSys PCS devices to cater to an expanding plasma customer base.

Performance

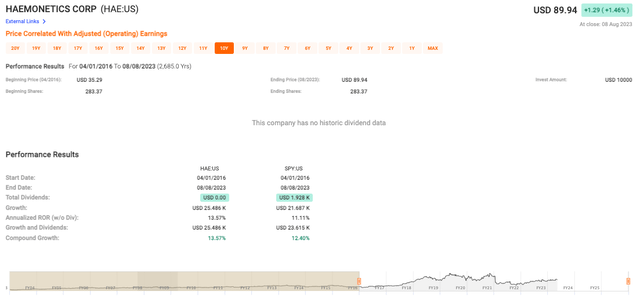

Within the medium-term (see data below), the company’s stock price increased from USD $35.29 to $USD 89.94 reflecting a healthy compound growth rate of 13.57%. This impressive growth, devoid of any dividend payouts, places the company on a solid footing, especially when compared to the broader market’s performance, represented by the S&P 500 Index (SP500) with a compound growth rate of 12.40%.

Fast Graphs

The sheer 13.57% annualized rate of return (ROR) is evidence of an investment strategy that has reaped significant benefits for those holding long-term positions in HAE which beats the S&P’s 11.11% ROR without dividends, underlining the company’s strong ability to outpace broader market trends.

Valuation

The blended P/E ratio for HAE, standing at 27.21x, falls under its normal P/E ratio of 30.69x. This discrepancy may imply that the stock is presently undervalued compared to how it’s historically performed, laying the groundwork for those investors who are keen on seizing opportunities presented by transient market discrepancies.

Fast Graphs

Furthermore, an adjusted operating earnings growth rate of 11.38% is a clear sign of optimism that speaks to a track record of solid performance.

Risks & Headwinds

Although Haemonetics’ report shows mostly promising outcomes, it also presents some areas of concern. Notably, the adjusted gross margin has decreased by 100 bps compared to the same period the previous year. This reduction was somewhat offset by positive changes in pricing, volume, and the regional and product distribution, but the decline still took place.

In the context of the Whole Blood sector, an elective product recall led to a $3.4 million inventory provision. Additionally, the report points out other elements that could lead to temporary challenges, like a rise in depreciation expenses and initial operational investments to cater to the increasing demand.

Lastly, the foreign exchange (FX) slightly affected the adjusted earnings per diluted share, and this potential risk is considered in the revised forecast for fiscal 2024 adjusted earnings per diluted share. For some investors, the company’s vulnerability to shifts in global financial markets might be a concern due to this volatility.

Rating: Buy

With Haemonetics’ adjusted gross margins rising and clear innovation and growth in the Plasma and Hospital sectors, they’re showing strong potential for future financial success. The company’s investment in technology has evidently contributed to their improved financial projections and has showcased their commitment to efficiency. The stock’s outperformance relative to the S&P 500, coupled with a potentially undervalued P/E ratio, strengthens the buy case. Though risks, such as a minor decrease in adjusted gross margins and concerns in the Whole Blood sector, are present, the overall positive financial health and trajectory suggest that the stock offers an attractive buying opportunity.

Read the full article here