There’s nothing that stops the French luxury fashion stock Hermès (OTCPK:HESAY, OTCPK:HESAF). Not exceptionally high valuations, not signs of an economic slowdown. Since the last time I wrote about it in January this year, it is up by a significant 32%. Ahead of its upcoming half-year results due later this month, now is a good time to consider if or how much further it can rise.

Far more highly valued than peers

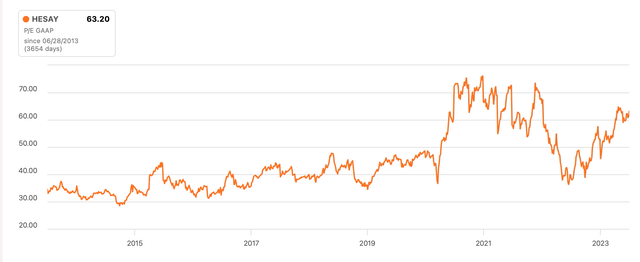

The first point that strikes caution in me about HESAY is that its price is near all-time highs right now. In the past year alone, it has risen by a massive 91%, and in 2023 alone, it is up by 35.3%. This would necessarily be a source of concern, though, if its market multiples were still in balance. They aren’t. The company’s trailing twelve months [TTM] GAAP P/E is at 63.2x. This is way ahead of the consumer discretionary sector at 16.7x.

Source: Seeking Alpha

Now, we can argue that Hermès isn’t any other consumer discretionary stock, it is as much a luxury stock as they come. I buy that. So let’s compare it to luxury peers. LVMH (OTCPK:LVMUY), another French luxury house and the biggest luxury products company in the world today, trades at half of HESAY’s valuations at 31.4x. Similarly, the Swiss Compagnie Financière Richemont (OTCPK:CFRUY), of brands like Cartier and Jaeger-LeCoultre, trades at an even more modest 23x.

Further, HESAY’s valuations are even high by their own historical standards. Over the last 13 years, its P/E has averaged 42.1x. The average itself has been driven up by the huge price increases it saw after the worst of the pandemic period, incidentally.

Historical P/E (Source: Seeking Alpha)

The stock’s forward P/E is slightly more moderate at 52.2x. But a comparison with peers indicates exactly the same trends as those for its TTM P/E. LVMH has a forward P/E of 24.1x and Richemont is at 19.3x. In other words, Hermès’s market valuations, no matter how we look at them, look like a giant red flag.

Strong fundamentals

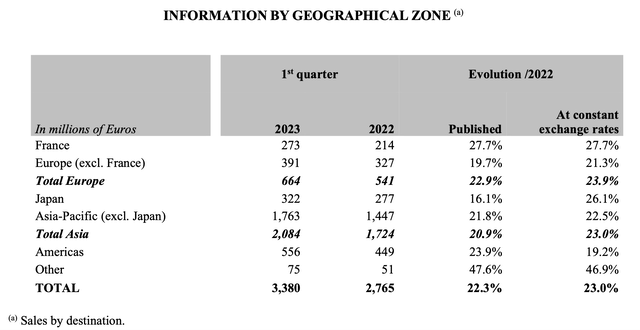

There is a fundamental basis for its strong stock market performance, though. Its sales figures for the first quarter of 2023 (Q1 2023) show that its double-digit growth continues unabated. At market exchange rates, they grew by 22.3% year-on-year (YoY) and at a slightly higher 23% in constant currency.

The key point to note in the details of these sales figures is their geographical growth and distribution, with differing macroeconomic conditions across markets as the backdrop. Its massive Asia-Pacific (APAC) market, which accounts for almost 62% of total sales was the important driver for Q1 2023. APAC-ex Japan sales were strong at 21.8%, which is indicative of the bounce back in demand from China.

In fact, Hermès says that healthy revenue growth from the region followed “a very good Chinese New Year” and adds, it “pursued its strong momentum in Greater China…” along with that in other APAC markets like Singapore, Thailand, and Australia.

Source: Hermes

Further, with the Americas accounting for a relatively lower proportion of sales, at 16.4% for the latest quarter, the company has a good chance of coming out of the potential recession in the US this year or early next year, or even the present slow down, relatively unscathed. In any case, it’s worth noting that demand for Hermès products is still strong even now in the market, with an increase of 23.9% during Q1 2023.

The edge over peers

Compared to peers, the bigger share of APAC-ex Japan and a reciprocally smaller share of Americas and Europe in its sales gives the company a definite advantage for the foreseeable future. Richemont, for instance, has a smaller 46% share of the APAC ex-Japan market, while for LVMH, the number is at 30% as of 2022.

Further, Hermès’s peers have also seen a drop in sales from the Americas in Q1 2023, which hasn’t happened for Hermès. LVMH’s US sales growth dropped to 8% in the quarter while for Richemont it is down to 16%. For both peers, sales from the geography have lagged overall growth, while for Hermès, the Americas have actually shown higher than overall growth.

Hermès also has the advantage of a significantly higher operating margin of 41.5% for 2022. By comparison, the number of LVMH is at 26.5% and Richemont is at 25.5% (for its year ending March 2023). It’s not as if the peers have low operating margins by any stretch, they are pretty good in themselves, which makes Hermès stand out even more.

Positive prospects for now

While the company itself doesn’t offer any numerical guidance for 2023, analysts are clearly bullish about its prospects for 2023 too. Revenue growth is expected to come in at 19.4% while EPS is expected to rise by 22.5%.

With the growth momentum in China having slowed down in recent months, I do believe that there could be some risks to the forecast. In the bigger scheme of things, though, the economy’s growth will still be relatively robust unless, of course, the latest cooling-off in key indicators is a reflection of bigger underlying problems with the economy. In any case, the US and Europe have slowed down this year, which may impact demand in future quarters. I would bear these in mind when thinking of the future trajectory for HESAY.

What next?

Hermès has distinguished itself as a leading luxury fashion company. Not only is it financially robust and fast-growing, it is also far ahead of its peers with respect to key financial metrics like revenue and profits. It is little wonder then, that there is a premium to the stock or its ADRs, which reflects in significantly higher market valuations. Moreover, with a favourable geographical distribution of revenues, the foreseeable future also looks more secure and positive for it compared to other leading luxury companies like LVMH and Richemont.

However, its price is now at near record highs. And its P/E is high even by historical standards. Additionally, one of its big markets, China, has shown recent signs of not being in as robust a shape as was earlier expected. If the economy turns weaker, dragging down consumer demand, it would affect the company, especially as the US and Europe are already in a slowdown.

While the HESAY price momentum is gravity-defying, I would exercise caution at this point to avoid getting my fingers burnt. I retain my Hold rating on it.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here