Overview

My recommendation for HireRight Holdings Corporation (NYSE:HRT) is a sell rating. HRT’s recent quarterly results were underwhelming, primarily due to macroeconomic uncertainties, especially the impact of inflation on the hiring landscape. Despite these challenges, HRT’s client hiring patterns remained consistent with past trends, though the overall volume has seen a decline. HRT’s strong retention rate underscores its service quality and customer satisfaction. However, while revenue from new customers grew, there was a decline from existing ones. The prevailing inflationary environment poses further challenges for HRT’s outlook, and in response, the company has revised its guidance for the upcoming year downward.

Business

HRT is a premier global provider of technology-driven workforce risk management and compliance solutions. The company specializes in offering a wide range of services, including background screening, verification, identification, monitoring, and drug and health screening. HireRight’s unique selling proposition is its unified global software and data platform, which integrates seamlessly into its clients’ human capital management systems. This ensures streamlined workflows for hiring, onboarding, and monitoring the workforce.

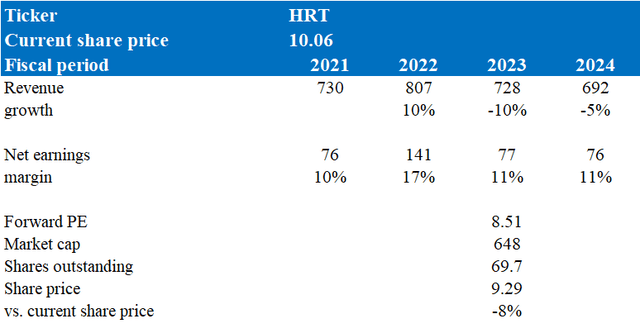

HRT has demonstrated a promising financial trajectory over the past four years. In 2021, the company experienced robust growth of 35%, a resurgence attributed to the easing of the COVID-19 pandemic. As economies reopened and borders became less restricted, hiring activities surged, benefiting HRT’s bottom line. However, 2022 saw a moderation in this growth, with revenues increasing by 10%. This slowdown can be attributed to the inflationary pressures that emerged as governments worldwide took measures to counteract the economic downturn caused by the pandemic. Notably, 2022 marked a significant milestone for HRT, as it reported positive net margins of 18% for the first time. It’s essential to recognize that HRT, having gone public in 2021, is still in its early stages as a publicly traded entity. The journey ahead will be crucial in determining its position in the market and its ability to establish itself as a company with enduring profitability and a sustainable competitive advantage.

Recent results & updates

HRT posted weak results for the second quarter of 2023. The company’s revenue was $192.1 million, reflecting a 13.6% drop from the previous year. This downturn was predominantly attributed to the uncertainty in the hiring landscape, which was influenced by the uncertainty in macroeconomic conditions, primarily fueled by inflation.

Delving further into HRT’s, the management shed light on the prevailing global economic landscape. They highlighted that, in spite of the inconsistent and conflicting economic indicators, hiring forecasts, and projections, the seasonal hiring patterns of their clientele have remained in line with historical patterns. However, it’s important to highlight that although these patterns are in line, the volume has reduced. This underscores the notion that while the overarching economic climate may be riddled with uncertainties, HRT’s business framework demonstrates resilience against such volatilities. Despite the uncertainty in the hiring environment, HireRight’s retention rate remained strong at 97.4%. This speaks volumes about the company’s service quality, customer satisfaction, and the value proposition it offers. Despite the high retention rate, the company highlighted that revenue from existing customers decreased by approximately 16%. On the flip side, revenue from new customers increased by over 36% from the prior year. Given the decline in hiring volume and a decrease in revenue even with a high retention rate due to the uncertain macroeconomic conditions affecting hiring, there’s evident downward pressure on HRT’s topline revenue. With inflation remaining elevated, I foresee challenges for HRT in the upcoming quarters.

From my observations, HRT’s business performance is significantly influenced by macroeconomic conditions. According to recent data, inflation remains high at 3.7% as of September. Notably, it has been on a rising trend since June 2023, even though it has receded from its peak in June 2022. Given this backdrop, predicting the future course of inflation becomes a challenging endeavor, which in turn complicates the task of forecasting HRT’s business outlook. Presently, the economic environment appears somewhat fragile, especially with inflation rates surpassing the central bank’s target. Therefore, it is more likely HRT’s future outlook is negative. Furthermore, insights from HRT’s earnings call reinforce this perspective, highlighting continued market softness. This is evident from the reduced hiring volumes reported by their clients, which are even lower than the previous year’s figures.

Facing these challenges, HRT has revised its 2023 guidance downward. The company now expects its revenue to be in the range of $720 million to $735 million, marking a year-over-year decrease of approximately 10.7% at the lower end of the projection. The adjusted net income forecast is pegged between $75 million and $80 million, a stark contrast to the $141 million reported in 2022, indicating approximately a 46% reduction. Additionally, the diluted earnings per share are estimated to lie between $1.05 and $1.10, compared to 2022’s $1.78, translating to a decline of about 41% at the lower end of the projection.

Valuation and risk

According to my model, my target price for HRT is $9.29, which suggests an 8% decline from its current level. This valuation is rooted in my bearish revenue growth outlook for the upcoming two years. For FY23, I’m drawing from the company’s own projections, with management expecting roughly a 10% contraction year over year, based on the more conservative end of their guidance. As I transition to 2024, I’m forecasting an additional 5% reduction in revenue. This is influenced by the prevailing inflationary environment, which, as of September 2023, remains elevated at 3.7%. However, there’s a silver lining: since the beginning of 2023, inflation has moderated from a January high of ~6.4%, a commendable 42% improvement. While the future course of inflation is hard to pinpoint, for the sake of prudence, I’m assuming that HRT will continue to see inflationary pressures in 2024, though likely at levels significantly below the 2023 peak of 6.4%.

Author’s valuation model

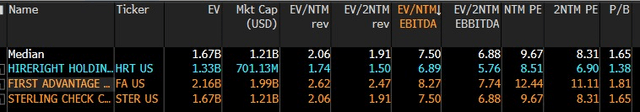

Currently, HRT’s forward price/earnings ratio is trading at 8.51x, which is notably below its peers like First Advantage Corp. (FA) and Sterling Check Corp. (STER). These peers have a median price-to-earnings ratio of around 11x. One can attribute HRT’s lower forward price and earnings to its comparatively weaker net margins. Specifically, HRT registers a net margin of approximately 17%, which lags behind the industry median of about 19.7%. Furthermore, when it comes to the expected 1-year revenue growth rate, HRT is projected to experience a decline of 6%, whereas its peers, on average, are expected to see a growth of 4%. Given these disparities in both metrics, the rationale behind HRT’s lower forward price/earnings becomes evident.

Bloomberg

Using HRT’s current forward Price/Earnings, my target price for the stock is $9.29. This represents a potential decline of 8%. Considering the challenges HRT is grappling with, combined with the overarching uncertainties in the macroeconomic landscape that significantly influence HRT’s revenue trajectory, I recommend a sell rating for HRT.

One of the primary upside risks to the sell thesis on HRT is the potential for inflationary pressures to ease more rapidly than anticipated. If central banks and governments implement effective monetary and fiscal policies that successfully curb inflation, it could lead to improved consumer and business confidence. An environment with stabilized or declining inflation could rejuvenate hiring activities, leading to increased demand for HRT’s services. This, in turn, could bolster HRT’s revenue and profitability, potentially driving its stock price higher than current projections.

Summary

HRT’s recent quarterly results were lackluster, primarily influenced by prevailing macroeconomic uncertainties, especially inflation. Despite these challenges, the company showcased resilience with a strong retention rate and consistent seasonal hiring patterns. However, the overall hiring volume has diminished, and revenue from existing customers has seen a decline. The persistent inflationary environment casts a shadow over HRT’s near-term prospects. This sentiment is further echoed in the company’s revised downward guidance for the year. Given the current economic backdrop, combined with HRT’s performance trajectory and the ambiguity regarding the future course of inflation, I recommend a sell rating for the stock.

Read the full article here