On the eve of the U.S. government potentially shutting down on Oct. 1, 2023, markets rose at the open after the Commerce Department posted core personal consumption expenditure figures. The core PCE rose by 3.9% Y/Y. This is the first time in two years that the inflation gauge fell below 4.0%.

September is the first of two seasonally weak months that are about to end. The S&P 500 (SPY) is on track to drop by 4.39% while up 12.76% YTD. Nasdaq (QQQ) will likely lose roughly 3.89% for the month while rewarding tech investors with 36% YTD. Spooky October will start on a negative development. The shutdown risk will further feed a market that hungers for any bad news.

Bulls are looking for any excuse to take profits. Bears benefited from the Federal Reserve’s punitively higher interest rates for longer policy hurting stock valuations. The upcoming shutdown will shift the market’s focus from monetary policy – quantitative tightening and high interest rates – to fiscal policy.

Impact on Investor Sentiment

Investors should consider the impact of the government shutdown due to the debt ceiling on stock market sentiment first. Since late last year, markets pivoted their bullishness in the prospects of revenue hyper-growth for tech firms offering artificial intelligence solutions. Apple (AAPL) gained one-third in value in 2023, though it started trading at lower highs ($195 to $180 to $173) since August.

The shutdown will have no impact on Apple’s iPhone 15 sales. Only AAPL stock’s price-to-earnings ratio of 29 times risks falling. Long-time Apple investors need not take action on the stock volatility, since the company continues to expand profit margins from its services.

Microsoft (MSFT) introduced practical use cases for Copilot, its AI offering for Bing, Microsoft 365, and Windows. This will increase its average revenue per user. Yet like AAPL stock, MSFT stock pulled back from its July 2023 high. A prolonged shutdown may give investors a chance to take advantage of getting those stocks at a buy zone at lower prices.

To the wider audience outside the technology sector, watch out for the S&P 500 falling to its 200-day simple moving average at around 4195. Throughout the summer, the index failed to break out above 4,500, a bearish sign. The theatrics from the government’s failure to pass the Senate bill will dominate the news cycle this weekend. It will bait investors to gravitate toward one party or another.

If the government averts a shutdown, it could ignite a brief market rally. Markets may overlook its concern about the government debt levels. Instead, its concerns will return to the Fed’s higher for longer interest rate policy. Ahead of that, REIT investors are already averaging down their price paid. They likely anticipate that interest rates will soon peak. A rate-cut pivot will reverse the declines in companies like American Tower (AMT) and Crown Castle (CCI) in my view.

Realty Income (O) may struggle to bounce back. O traded at $56 when it announced its $950 million investment in Bellagio Las Vegas. It traded below $50 on Sept. 28, 2023. Similarly, W. P. Carey (WPC) raised its dividend payment only to announce its exit from the office sector. Just as AT&T (T) cut its dividend when it distributed Warner Bros. Discovery (WBD) stock, W. P. Carey’s dividend yield will fall, too.

Impact on US Economy

Moody’s warned that the U.S. government shutdown would harm the country’s credit rating. The possible event is more evidence of how political polarization weakens fiscal policymaking. Moody’s analyst William Foster said that higher interest rates pressure the government’s debt affordability.

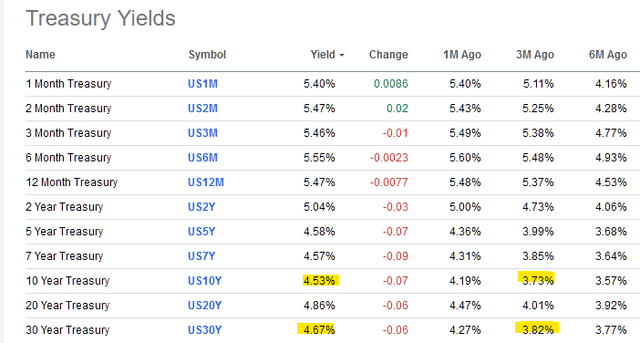

Ahead of the risk of a rating downgrade, U.S. Treasury returns are on track for the worst month this year. Readers may quickly view the bond yields by clicking market data and then bonds. Yields for the longer maturity dates, the 10-year treasury (US10Y) and 30-year treasury (US30Y) increased sharply in the last three months:

Seeking Alpha

Investors who bet on a (rate) pivot too early are down 7.2% for the month on the 30-year Treasury ETF (TLT) and -13.3% for the quarter.

Impact on Economic Data Collection

A shutdown would disrupt the collection of some economic data. Markets should expect delays in the employment report and inflation data (CPI report). Skeptical readers will call those “fake inflation reports,” since true inflation rates are potentially higher. The official inflation figures depend on a basket of goods. Nearly every person reading those reports has a different basket of goods consumed.

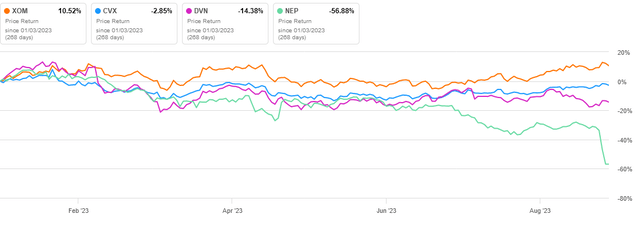

Consumers do not need to rely on economic reports to monitor energy inflation. WTI crude traded at $95 for the first time in 2023 on Sept. 28, 2023. If it crosses the psychological $100/bbl ceiling, they will become increasingly concerned about inflation. Energy investors should continue to accumulate Exxon (XOM), ConocoPhillips (COP), and Devon Energy (DVN). They should be wary of holding NextEra Energy Partners (NEP).

Seeking Alpha

NextEra Energy Partners slashed its full-year outlook. CEO John Ketchum blamed tighter monetary policy and higher interest rates affecting its financing. He said that “tighter monetary policy and higher interest rates obviously affect the financing needed to grow distributions at 12%, and the burden of financing this growth has had an impact on NextEra Energy Partners’ unit price and yield.” On Sept 5., Seeking Alpha user Fred L. predicted NEP stock’s demise. The user questioned the company’s ability to fund both its distributions and capex from internally generated cash flow.

Your Takeaway

Investors may trade stocks following the government averting a shutdown. Contrarian investors may buy the proverbial dip if a shutdown occurs. The parties will eventually need to agree on a deal, which ends the uncertainty and lifts the stock market. Beyond that, markets will focus back on the Federal Reserve’s monetary policy.

Higher interest rates for longer pose a headwind for over-valued stocks in the market today. Income investors will not aggressively average down on their position until rates are meaningfully below 5.0% in my opinion.

Read the full article here