Overview

My recommendation for Howmet Aerospace (NYSE:HWM) is a buy rating as I believe the outlook remain upbeat, and see any hiccups during the quarter as a once-off blip that should not be a big concern. The thing to focus here is that end market growth remain robust, which I expect to continue driving growth in the near-term. The recent weak share price action is a buying opportunity in my opinion.

Note that I previously rated hold rating because of concern with valuation. However, that was a mistake as I failed to recognize that it was heavily impacted by covid. When compared to peers’ valuation, HWM relative valuation is in line with its historical discount.

Recent Results & Updates

In the most recent quarter, HWM continued delivering in the growth segment this quarter, continuing to beat and raising guidance for the second time this year, estimating ~14% growth year on year vs the previous guidance of ~10% year on year, of ~$6.44 billion (from ~$6.25 billion).

Revenue grew 18% year on year, with the performance across the different segments as follows: a strong performance from Engine Products with a growth of 26% in Q2, and 3% sequentially, reaching $821 million; Fastening Systems up 19% year on year and 5% sequentially, reaching $329 million; Engineered Structures a disappointing 8% growth year on year, but down 4% sequentially, bringing in $200 million; and Forged Wheels up 7% year on year, 3% sequentially hitting $298 million this quarter.

End Markets Remain Robust

Commercial Aerospace robust demand continued to contribute to HWM various segments, with the market increasing 23% year on year and 2% sequentially, rising with the increased production in the commercial aircrafts of 787, 737 Max and A320neo. Defense increased 17% year on year, on the back of the strong demand for F-35 spare parts, and engine spares, drones, rocket motor & howitzer parts. Industrial and Other revenues grew 20% year on year & 3% sequentially (oil & gas was a big driver with 36% growth y/y and 4% sequentially & IGT up 20% y/y), with demand not letting up from the previous quarter, especially from IGT turbine blade demand & O&G segment. I believe that current trend of strong demand from Aerospace, followed by Defense and Industrial will continue into the near term,

Once-off Blip – Not That Big Of A Concern

The quarter is not without its blips, which saw sequencing issues at a titanium plant within Engineered Structures that led to poor volume outputs, resulting in the Structures margins being at 10% from the normal margins of around 14% from fixed costs. Management did mention that it should be a one-off event, with margins to resume in the next quarters of around 15%. I believe that there is a potential to rebound 15-20% in Q3.

Despite this issue, HWM managed to achieve an EBITDA of $368 million including special items, representing 16% growth year on year, even raising EBITDA guide by $30 million (albeit the margins being slightly softer, dropping 20 basis points to 22.4%).

Outlook Remains Upbeat

The near-term future is bright for HWM. Demand continues to remain strong in most of their end markets. Aerospace demand and production continues to expand, with the positive outlook by the management continuing to be supported by the extraordinary backlog of aircraft orders at Airbus and Boeing. IGT & O&G spares are already above 2019 levels, and demand in Defense for spares is well positioned with the F-35 fleet expanding.

I also expect that HWM will be able to improve margins in the longer run – as they continue to expand to meet production demands, the active management of hiring strategies may prove to be farsighted when the labor is fully trained and equipped to handle operations efficiently when the company’s production capability increases. I would rather them face this now and reap the rewards later.

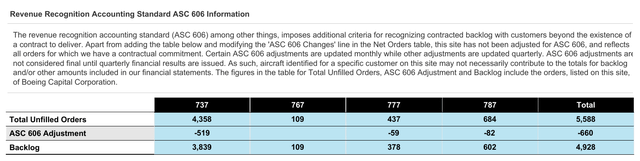

Boeing

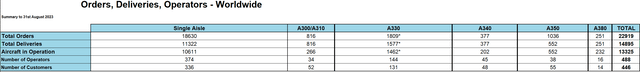

Airbus

Valuation And Risk

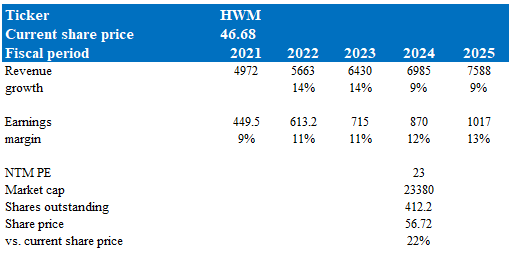

Author’s valuation model

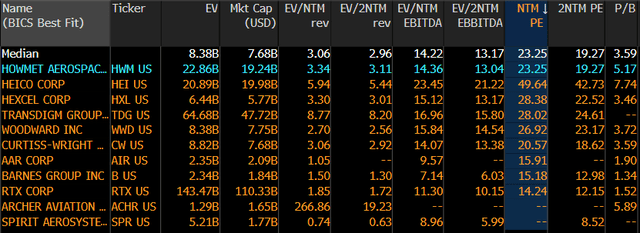

According to my model, HWM is valued $56 in FY24, representing a 22% increase. This target price is based on my growth forecast that FY23 will follow guidance without any issues as any hiccups saw during the quarter is just a one-off, in my opinion. Growth should at the least be able to continue at high-single digit (a slight discount form recent momentum of 10+% growth) given the outlook remains upbeat. I valued HWM using 23x forward PE which is pretty much in line with its historical discount vs its peers group. I note that this is in contrast with my previous view of simply comparing to HWM own historicals, which is significantly impacted by the covid period (my mistake for not adjusting for this – which led to my mistake of not investing through the May to July rally). As can be seen, when compared to peers valuation, HWM is simply trading in line with its historical discount.

Bloomberg

Summary

In conclusion, I upgrade to a buy rating for HWM. Despite some temporary hiccups in the recent quarter, the overall outlook for HWM remains strong. Robust demand in commercial aerospace, defense, and industrial sectors is expected to continue driving growth. The one-off issues in Engineered Structures are expected to be resolved, and margins are anticipated to rebound.

Importantly, HWM’s near-term future looks promising, with a positive outlook supported by a significant backlog of aircraft orders at Airbus and Boeing. Additionally, there is potential for margin improvement in the longer run as the company expands to meet production demands.

Read the full article here