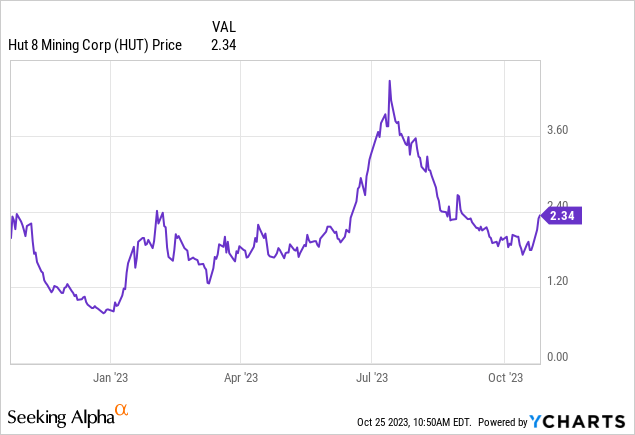

Bitcoin miners like Hut 8 Mining Corp. (NASDAQ:HUT) have been through a rough time since July despite producing a mind-blowing 180% YTD performance, but, based on the latest market action including trading volumes, the aim of this thesis is to show that we could be on the cusp of an opportunity, in the upward direction. Thus, as shown in the chart below, the miner broke through its support level of $2 during the last five days, and Seeking Alpha’s Quant also upgraded its ratings to Buy from Hold on October 19.

However, since investing in Bitcoin implies a lot of volatility-related risks, I first start by going through some of the market actions that have resulted in the current risk-off environment. The objective is also to learn from these in order to confirm the bullish thesis.

Explaining the Volatility Episode

Going back to the August volatility episode, this occurred after crypto-assets were buoyed in June because of the interest shown by financial giants, including asset manager BlackRock (BLK) and the big investment banks like JPMorgan (JPM) and Morgan Stanley (MS) as I detailed in a previous thesis on the ProShares Short Bitcoin Strategy ETF (BITI) on July 5. At that time, I was Bullish on Bitcoin on the basis of institutional interest and since that time Bitcoin (BTC-USD) has been up by around 16%.

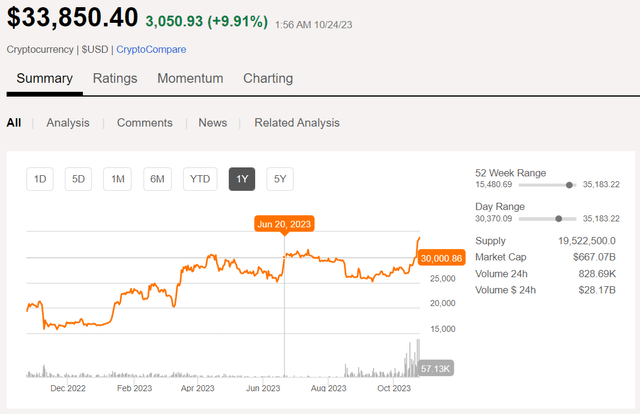

However, between now and then, the cryptocurrency has treaded a highly fluctuating path. Thus, during the second week of August, the value of the world’s largest cryptocurrency by market value fell from around $29,910/BTC to $25,400/BTC according to the chart below, and this occurred within a week. Noteworthily, at certain periods it fell by more than 12% in a matter of hours including episodes where the digital asset recorded its largest single-day decline since November 2022, when Sam Bankman-Fried’s major cryptocurrency exchange platform FTX collapsed. In its fall, Bitcoin dragged down the entire crypto market, including ether which lost nearly 10% in one week.

Bitcoin’s performance (www.seekingalpha.com)

Noteworthily, the chart above also shows the volumes which were traded. This shows that while the upside in June had seen relatively few numbers of transactions (or buys and sells) averaging around 40K, the situation is completely different currently as there is heavy volume which is currently above 700K. This is seventeen times higher than in June and could indicate interest by institutional investors.

The Opportunity

This thought process is confirmed by analysts from Bernstein with the investment firm saying that institutions were “entering the cycle pre-hype” for the first time. Now, by “hype”, it means the enthusiasm instilled among investors when a Bitcoin ETF, more precisely a Bitcoin Spot ETF looks likely to be approved by the SEC (Security and Exchange Commission). In this case, investors will note that a fund like the ProShares Bitcoin Strategy ETF (BITO) trades futures. In contrast, a Spot ETF, if approved, will track the value of the Bitcoin asset in real-time instead of indirectly betting on the market’s position on the cryptocurrency, as is the case with a futures ETF. This bodes well for the value of the cryptocurrency.

Digging deeper, according to Bernstein, such approval could happen by January 2024 or even sooner based on the Grayscale vs SEC court case. Now, some of you may remember that in August, Grayscale, a major cryptocurrency asset manager, won a court appeal against the SEC, which denied it the right to list its Grayscale Bitcoin Trust fund (OTC:GBTC) on the NYSE trading platform by giving it an ETF status. This legal victory opens the door to the creation of a Bitcoin Spot ETF that would allow a larger part of the general public to invest in this asset class without having to purchase it directly, which would in turn boost the whole ecosystem.

Higher Bitcoin Prices Boosting Hut 8’s Treasury

Now the value of Hut 8’s treasury directly depends on the value of Bitcoin and it possesses a large self-mined reserve when compared to other publicly traded miners with 9,366 BTC as I detail later. Based on a unit price of $34,678/BTC, this comes to a fair market value of over $300 million. By comparison, the company had $48.4 million of debt on its balance sheet together with $20.1 million of cash at the end of the second quarter of 2023 which means that by disposing of its crypto assets, the miner can become net cash-positive.

In this respect, the miner consumes money instead of generating cash from operations, but, from -21.3 million in the second quarter of 2022 to -1.0 million in the latest quarter, there has been an improvement. Still, to ensure that it does not run out of cash, the company has entered into a $50 million credit facility.

Pursuing further, for September 2023, 111 Bitcoin were mined which represents an increase from the 103 generated in August thanks to the production capacity of its high-performance computing infrastructure. This capacity was raised to 42.7 BTC/EH in September following the addition of about 2.6 EH/s or exahashes per second of additional ASIC hashrate (production capacity) at its Alberta facilities in Canada. Going into details, according to CoinDesk, EH/s stands for exahashes per second and measures the computational power dedicated to mining operations.

By comparison, Riot Platforms (RIOT), a U.S-based miner produced more, or 362 Bitcoins in September, which represents an increase of 29 in August. However, despite producing more, its treasury boasted 7,327 BTC at the end of last month which is less than Hut 8’s 9,366 BTC. This is explained by the Canadian miner currently privileging a HODLing strategy or holding on to the Bitcoins produced instead of selling them as is the case with Riot which disposed of 340 BTC for net proceeds of $9.0 million.

This strategy to hoard Bitcoins also makes sense given that Halving Bitcoin, the long-awaited block reduction event estimated to occur around April 1, 2024, will involve splitting the reward obtained from mining new blockchain blocks in half, meaning miners will receive 50% fewer Bitcoins for the same amount of effort put in. Another of Hut 8’s strategies to counter the effects of Halving is its proposed business combination with US Data Mining Group, which was approved by both shareholders and the Supreme Court of British Columbia in September.

Therefore, in light of the Halving event that will increase the mining difficulty for the whole industry, Hut 8’s strategy of both holding on to its produce and merging the business to gain from a larger scale are two positives, to be considered when valuing the company.

Valuations of Key Takeaways

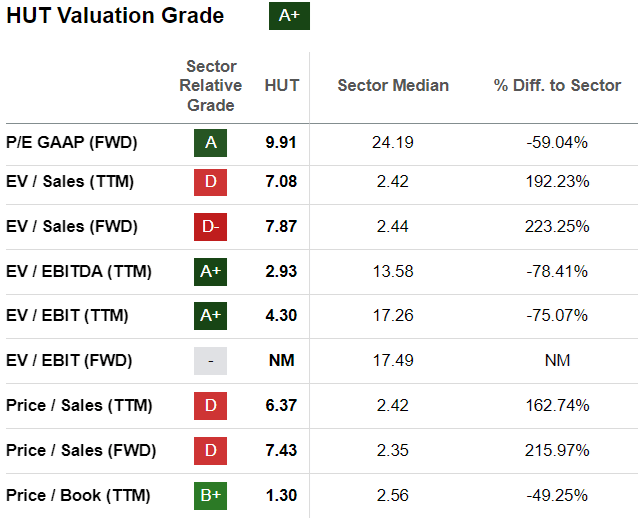

As pictured below, the valuation grade of A+ means that Hut 8 is undervalued. Using the forward GAAP P/E multiple of 9.91x which is discounted relative to IT peers by 59%, I have a target of around $3 (2.34 x 1.3) based on a 30% adjustment of the current share price of $2.34.

Valuation Metrics (seekingalpha.com)

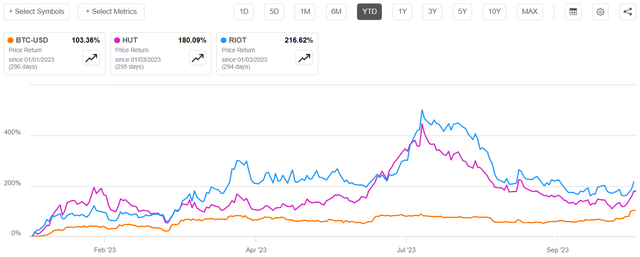

My bullishness is further justified due to the fact that holding on to the miner’s shares constitutes an alternative to buying Bitcoins or owning them through the ETF route. In this respect, its treasury is an important factor to consider and is one of the reasons that it has outperformed the cryptocurrency itself as charted below. Still, with higher rewards also come more risks and the chart also shows that miners carry higher volatility risks.

Comparison of performances (seekingalpha.com)

This is in line with the risk-awareness tone that has been prevalent throughout this publication, and it is important to note that Bitcoin remains a volatile asset class and, as such is prone to risks of capital destruction. This means that it may not be the right investment for those who are more value-oriented and do not have the stomach for risks. Also, given crypto’s correlation to the technology sector, any volatility grappling tech during this earnings season could be contagious to Bitcoin.

Thus, it is important to have a risk appetite to invest and some may wait for a retrenchment before investing as momentum indicators do not indicate the upside to be a smooth one, as the RSI is above 60 which indicates an overbought condition.

Finally, in addition to potential institutional interest, some, including a U.S. attorney have perceived a potentially softer stance by the SEC towards the crypto asset, as its Chair Gary Gensler, who is normally very vocal, did not take the opportunity to criticize the industry after fake news about the approval of BlackRock’s Spot ETF application.

Read the full article here