Thesis

With Fed Funds above 5% it is worth revisiting one of our portfolio diversifier favorites, namely the VanEck Emerging Markets High Yield Bond ETF (NYSEARCA:HYEM) which we have covered before here. The vehicle is an exchange traded fund that focuses on emerging markets high yield rather than U.S. debentures:

The VanEck Emerging Markets High Yield Bond ETF (HYEM) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the ICE BofA Diversified High Yield US Emerging Markets Corporate Plus Index (EMLH), which is comprised of U.S. dollar-denominated bonds issued by non-sovereign emerging markets issuers that are rated below investment grade and that are issued in the major domestic and Eurobond markets.

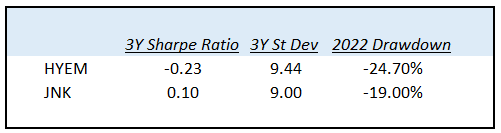

An investor is getting USD exposure to emerging market companies that are rated junk. There is no currency risk to be had here, a risk factor which has negatively affected local currency funds (on the back of dollar strength). The fund is basically a high beta take on high yield when compared to its U.S. counterpart, the SPDR Bloomberg High Yield Bond ETF (JNK):

Fund Analytics (Author)

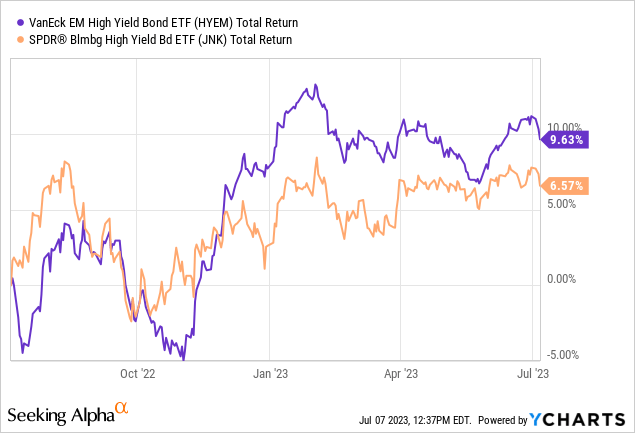

We can observe from the above table that HYEM has a higher standard deviation when compared to JNK, and also experienced a larger drawdown in the 2022 market sell-off. A high beta name tends to exhibit larger moves both on the downside and upside. To that end, HYEM has outperformed in the past 12 months after the October drawdown:

We can see the fund losing more in October when compared to JNK, while at the same time moving higher faster on the back of the recovery driven by tighter spreads.

How to trade HYEM

HYEM is a nice high yield diversifier since it introduces global economic currents in a portfolio. However, the fund is not a real buy and hold vehicle. It is a cyclical instrument that should be purchased around recessionary times and sold when the economy is running full steam. Given the meteoric rise in risk-free rates, the name is now yielding (30-day SEC yield) close to 9%:

30-day SEC Yield (Morningstar)

With rates this high, this fund looks quite attractive from a pure yield perspective, yet its main risk factor now is represented by credit spreads. We are in an extreme greed environment, and we expect some credit event and spike in VIX at some point this year. This type of event will put a dent into HYEM.

However, that type of event would also represent an optimal entry point in the fund. Post this cycle, we will probably not see risk-free rates this high for a while. Concurrently some of the countries representing large exposures in the fund will also be on the mend – and we are thinking here about China which many think is in a recession.

We would lighten up a bit on exposure here but maintain a core allocation to HYEM, set a net target allocation and pounce on the name during the next risk-off event for the market.

Holdings

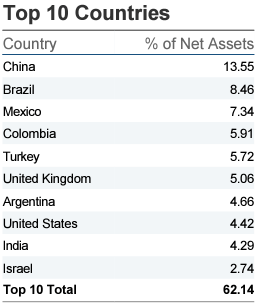

The fund’s main exposures are to the following jurisdictions:

Country Exposure (Fund Fact Sheet)

As discussed above, China is probably in a recession, with its real estate sector being the hardest hit. Turkey has gone through a tough election cycle and is now heavily devaluing its currency by returning to more sane monetary policies. Once they both enter sustained economic recoveries, credit exposed to those jurisdictions will once again outperform.

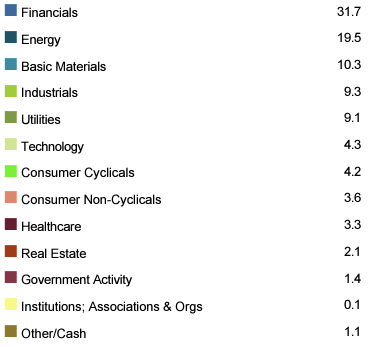

The main sectoral exposure for this fund is represented by financials:

Sectors (Fund Fact Sheet)

While we have reservations in respect to certain U.S. regional banks, we think emerging market banks are better set-up with an implied government back-stop, especially for systemically important institutions. The fall in financial institutions would only compound existing economic issues, a state of affairs which would not be permissible. It is quite interesting to see the following in a Bloomberg article regarding Chinese banks:

A state-owned Chinese newspaper issued a rare rebuttal of Goldman Sachs Group Inc. research after the securities firm’s analysts recommended selling shares of local banks, the latest sign of official attempts to counter negative sentiment in markets as the economy slows.

The market shouldn’t take a bearish view on Chinese banks based on pessimistic assumptions, and negative premises are misinterpretations of the facts, according to a Securities Times report Friday, referring to a Tuesday research note from Goldman. Banks have been actively lowering their exposure to property loan risks, while local governments have stepped up efforts to ease debt risks, the Securities Times said.

We are bullish to energy names in the long term, despite the current pull-back. We think the sector has made huge strides in fixing balance sheets and optimizing capex, and the clean energy transition will take much, much longer than expected.

Conclusion

HYEM is an exchange traded fund. The vehicle focuses on dollar denominated emerging markets debt. This name represents a nice portfolio diversifier when it comes to high yield, adding international exposure and a higher credit spread. The fund has similar analytics as the better known, U.S. centric (JNK), but does exhibit a higher beta. The name is a cyclical play rather than a buy and hold. We like the all-in yields here on HYEM, but fear a second half market risk-off event. We would Hold this name as a core holding and eye to buy to a higher target on the back of a risk-off event.

Read the full article here