Introduction

If you’re an income investor, and are unfamiliar with the world of ICL Group Limited (NYSE:ICL), an Israeli-based specialty chemicals company, you may be left feeling anxious after visiting the stock’s page on Seeking Alpha. Basically, SA has assigned a dividend safety score of F, implying a high probability of a dividend cut.

In this article, we’ll dig deeper into the status of ICL’s dividend, and what the future holds. We’ll then also conclude with some thoughts on the valuation and the technical narratives for ICL’s stock.

Back To The Norm

Given the stellar FY22, and the cyclical hues of this industry, it was always going to be difficult for ICL to deliver another strong performance this year. For context, on a YoY basis, last year’s sales, EBITDA and bottom line grew at some mind-boggling levels of 44%, 149%, and 168% respectively!

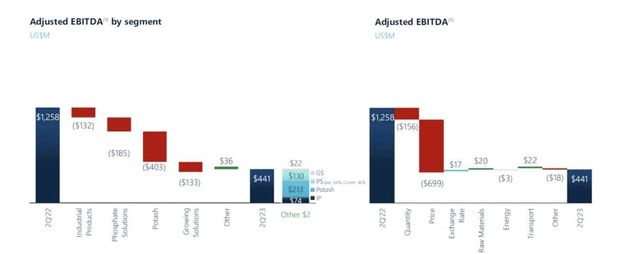

Q2 Presentation

So far this year, it’s been a massive contrast of sorts. For instance, in Q2, the price corrections of key products have been instrumental in shaving off close to $700m of group EBITDA. These effects are most keenly being felt in ICL’s Potash division which alone contributes close to 50% of group EBITDA.

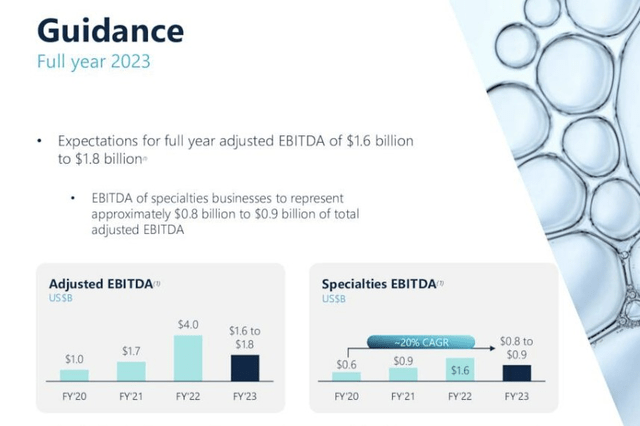

On the Q2 call, management implied that some stabilization in prices was seen as they exited the quarter, but even if you want to believe that the worst is over, ICL is still expected to deliver a drastic contraction in group EBITDA to the tune of 55-60% on a YoY basis

Q2 Presentation

Dividend Outlook

In light of the adverse financial outlook, what about the dividend?

Well, firstly investors should note that ICL has a somewhat flexible dividend policy that will move in tandem with the bottom line performance in any particular year. To be more specific, ICL’s target is to maintain a target payout ratio of up to 50% of annual adjusted net profit. We recognize that a few investors would prefer consistent growth in the dividends over a time, but for a cyclical business, a policy of this ilk feels perfectly reasonable.

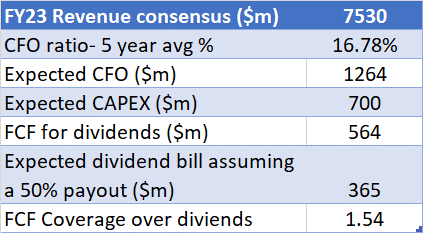

YCharts estimates currently point to an expected FY EPS of $0.565; that would imply an expected dividend per share (DPS) of up to $0.2825. This would translate to a cash outflow requirement of approximately $365m.

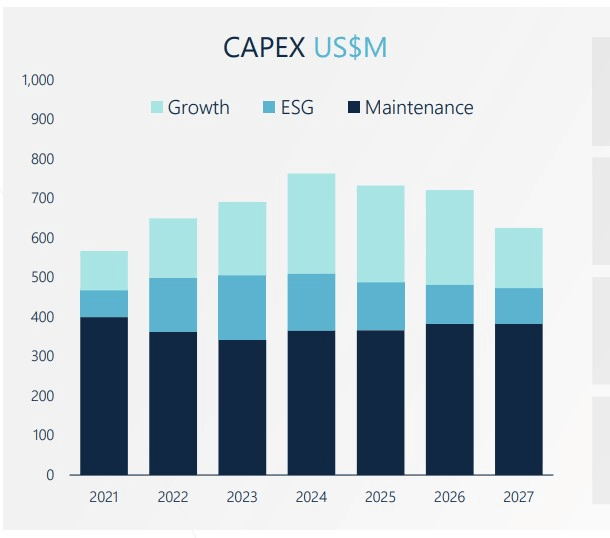

Investor Day CFO Presentation

Given the ongoing weakness at the operating level, and a spike in annual CAPEX commitments this year (see image above), would ICL generate ample cash flow to service this potential dividend bill? Yes, we believe so.

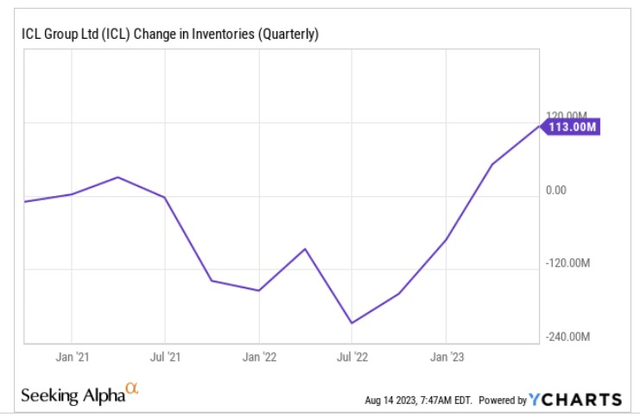

Firstly, note that management plans to continue to reduce the level of working capital and inventories in particular. Inventory builds which had been sucking out operating cash for seven straight quarters, has now started becoming a source of cash over the last couple of quarters.

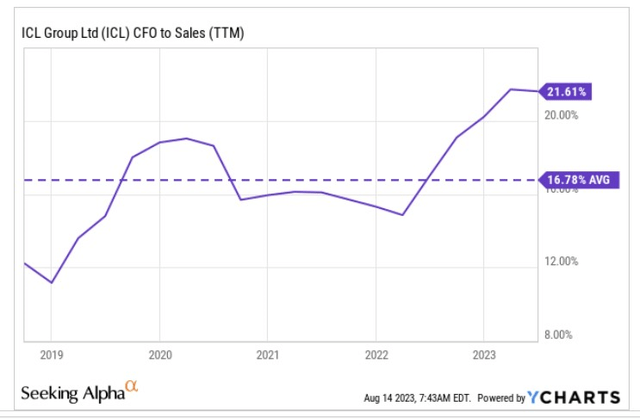

YCharts

Separately if you want to stay conservative and don’t believe inventories can contribute to cash, one may consider looking at the high-level CFO conversion ratio. In recent periods, ICL has been converting over 20% of its sales to operating cash flow.

YCharts

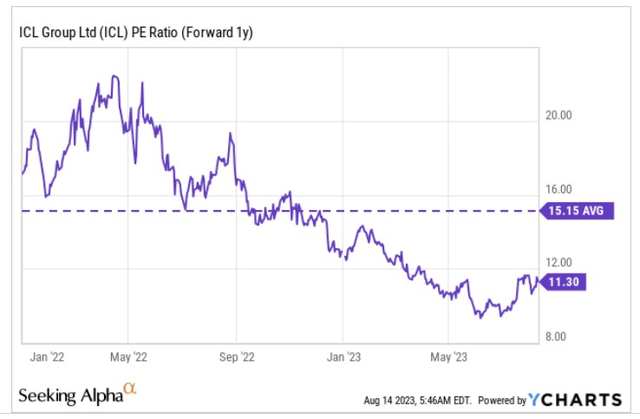

To be conservative, let’s assume a drop in this ratio to historical averages (the 5-year average) of less than 17% this year (implying lower cash generation this year). Taking the expected FY23 revenue estimate of $7.53bn into consideration, you could be looking at CFO to the tune of $1.26bn. As implied in the CAPEX image above, management plans to spend less than $700m in CAPEX this year, leaving around $560m of free cash flow that ICL could use to meet its dividend bill. That would comfortably cover the expected dividend bill ($365m) by 1.54x.

Author’s calculations

Closing Thoughts – Valuation and Technical Considerations

As implied in the previous section, the FY23 numbers won’t be a patch on what was seen last year, with earnings poised to contract quite significantly. However, if you’re willing to look beyond this year and focus on the next couple of years, consensus suggests that you could still be getting some pretty decent earnings growth of 9% or so (2-year CAGR).

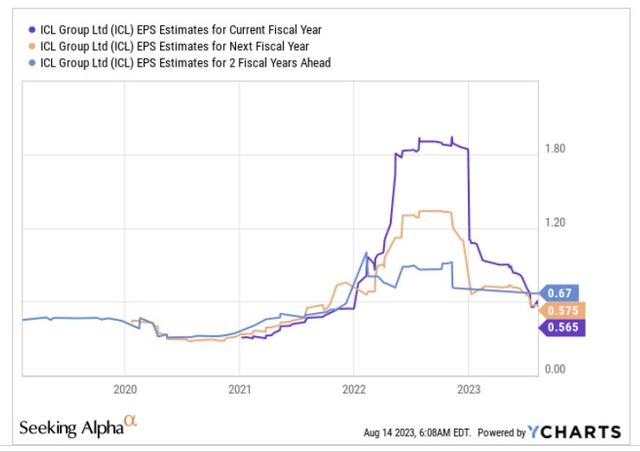

YCharts

It’s also fair to say that the premium valuation narrative that marked ICL for much of 2022 is no longer present. In fact, based on the FY24 EPS you can actually now pick up at ICL at a significant forward P/E discount (approximately 25%) to its long-term average of 15.15x.

YCharts

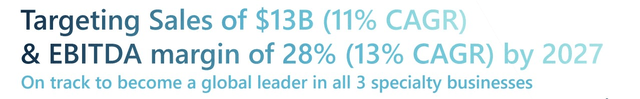

A 11x P/E multiple is not bad for a business that is poised to witness long-term margin expansion of 400bps (to 28%), and also become a global leader in three mineral value chains – bromine, potash, and phosphate.

Investor Day CFO Presentation

Then, if you looked at the ICL stock in relation to the GNR ETF (a product designed to cover stocks from the agriculture, energy, and metals & mining space), over a year ago, one could certainly understand if people were not too keen to dive into ICL, as it looked extremely overbought relative to other options from the natural resources space. That risk is a lot less pronounced now, with the ratio having mean-reverted to the mid-point of its long-term range.

StockCharts

Finally, we’ll conclude by highlighting some of the encouraging developments on ICL’s weekly standalone chart.

Investing

Note that since hitting decade-long highs in April last year, the ICL stock had been trending lower in the shape of a consistent descending channel all through the second week of July 2023. We also saw the stock hitting a bottom around the $5 levels in June this year, after which we saw a flattening out of the price action, followed by a breakout past the upper boundary of the descending channel.

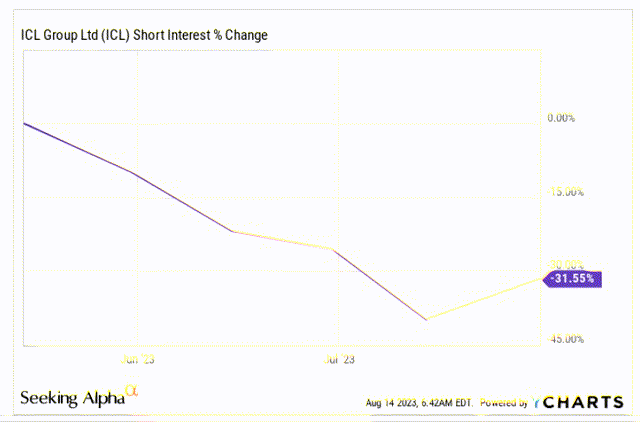

If the bears were in control, we could have seen a drop back into the old channel, but rather, the stock has continued to stabilize and build another base outside the channel which certainly bodes well for the bulls. Also note that the bottom formation followed by a break beyond the channel boundary has also dampened the spirits of the bears, with the short interest declining by 32% over the last three months.

YCharts

Read the full article here