Co-Authored by Treading Softly

I’ve never been one to really get caught up in the latest fads.

It seems that in our modern era, we want to be able to attach a clever name to something that everyone seems to be doing. I can tell you that in my years of banking, I have met plenty of employees who did the bare minimum, simply what they agreed to do when they got hired for the pay they got hired for, and nothing extra. I also met a lot of employees who worked way harder than expected, worked hours longer than they needed to, and received the exact same paycheck.

There was a period of time when companies would reward those employees who went above and beyond, with bonuses or promotions. Unfortunately, as the years went by in my working experience, companies doing that became fewer and fewer – yet still had the same expectation of an abundance of effort put in by employees.

A lot of this came to a head, especially during the COVID pandemic, when employees realized that their employers were expecting more of them than employers were expecting of themselves. So a lot of employees simply scaled back their effort, down to the bare minimum required by the job that they were hired for. This caught on and became the phenomenon known as “quiet quitting.” Essentially, the employee would do what was required and agreed to, but nothing extra, nothing above and beyond.

To be honest, I completely understand that mindset. If your employer is giving you no incentive to do extra work, then why would you do it?

I want to let you in on a little secret: I have been quiet quitting the stock market before quiet quitting was trendy.

So many investors and retirees run ragged trying to game the market or fiddle with their portfolios – trying to trade in and out of securities for an extra couple of pennies or dimes. They are putting in a lot of effort, often for little additional return, and sometimes for lower return! Usually, the only people who win when you do that are your brokerage and institutional investors – the reason is that every time you make a trade or an adjustment to your portfolio, they are skimming off the surface of your trade. You only do better if the new investment outperforms relative to the previous one.

When I created the Income Method, which I use to educate new investors and retirees about how to invest in the market, I created it to be as simple and straightforward as possible. If it was a flavor of ice cream, it would be vanilla – nothing extra, just simply ice cream at its finest. The reason for this is that the easier it is, the more sustainable it will be for each investor; no need for a bunch of extra bells and whistles. The Income Method has one driving purpose, two simple rules, and a profound impact on your retirement.

Today, I want to talk about those two rules and how you can quiet quit the market right along with me.

The Rule of 42

The first rule that many income investors come to learn in the Income Method is The Rule of 42.

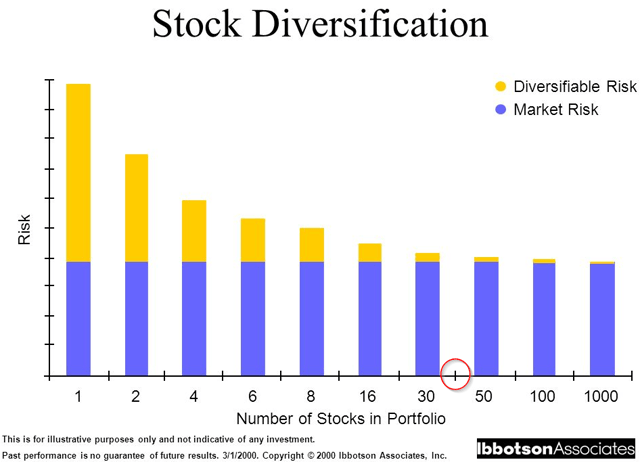

The Rule of 42 dictates that every income investor should have, at a bare minimum, 42 individual unique investments within their portfolio. This means that most of your positions will be between 2-3% of your total portfolio’s value. The crux of this is that once you hit about 40 to 42 investments in your portfolio, adding an additional investment does not reduce one’s risk very much.

The Rule Of 40 – Keeping Diversification In Focus

Seeking Alpha

I personally have over 90 unique investments in my income portfolio because I am long every single pick within my HDO Model Portfolio. I do this because any investment I have, over the first 42 investments, is held because of its unique merits and not to seek greater levels of diversification.

The Rule of 42, at its heart, is meant to be protective. Dividend investing is an exceptionally defensive form of investing because every dividend you receive is a return from your portfolio that cannot be taken away from you. It is a cash-in-hand guarantee locked in return that provides a great level of psychological benefit, especially in a bear market or when there are high levels of volatility. It allows you to walk away from your portfolio, enjoy a game of golf or a trip sailing for the weekend, and not have to worry about the value of your portfolio because your dividends continue to arrive and pour into your account.

The other big benefit of this is that if one of your portfolio holdings fails – it’s not going to sink the ship. While every investor should, as much as possible, avoid dividend cuts or companies that will fail, there will be a time in your investment journey when you will have a holding that’s going to cut its dividend or even go bankrupt. So by following The Rule of 42, you’re able to mitigate the potential damage caused by these poor investments.

The Rule of 42 is a key component in my Income Method. It helps make every investor safer by spreading their portfolio between at least 42 outstanding income investments.

Plus, as Douglas Adams famously wrote, “42 is the answer to life, the universe, and everything.”

The Rule of 25

The second and less well-known rule of the Income Method is The Rule of 25. The Rule of 25, in essence, means that you need to not think about your life as being over. What makes me so sad is that so many retirees treat their retirement finances like they’re already dead. What I mean by this is that so many retirees are too busy unwinding their financial castle, selling it off brick by brick, just to buy their groceries. They are not thinking about the long term.

If you retire at age 65, you’ll, on average, have 15 to 20 more years to live your life – that’s a long time! Some of us will make it 30+ years. You have to remember that during that time, your expenses are going to rise due to inflationary pressures, the stock market will go through 2-3 massive crashes, interest rates will go through several cycles and you’ll see more black swans than you can shake a stick at.

When you retire, your life isn’t coming to an end – it is just beginning! Suddenly you have much more of that most precious resource that you have been trading away: Time. You need to make sure that your portfolio is providing you with the freedom and flexibility to enjoy that time as much as you can.

The Rule of 25 states that all income investors should reinvest at least 25% of all the income they receive from their portfolio back into their portfolio to help it continue to grow.

You do this because you still have life left to live, and you’re going to need more income down the road than you need today. Reinvesting only 25% of all your dividends is not going to make you a millionaire overnight, but it will ensure that your portfolio continues to grow its income stream over time both through organic dividend raises as well as growth from reinvestment. Every year, you will own more stocks than you owned before.

Too many retirees spend retirement dismantling their castle, which used to provide them with financial security. Then when their health is at its worst, suddenly a major health event causes them to be in financial calamity because instead of living safely inside the castle of their portfolio that they built, they’ve been dismantling it for years, exposing themselves to the storms of the market. I don’t want that for you.

The Rule of 25 tells every income investor who follows our Income Method that they need to be reinvesting at least 25% of their dividends back into their portfolio. If you can’t start at 25%, make it a goal to work towards that; if you can do more, that’s even better.

Your life is not over when you retire. You are entering a new era of your existence. You still have a future, plan for it. Stop letting your finances act like you’re already dead!

Conclusion

By following these two simple rules, which comprise part of the heart and the rules within the Income Method, I’m able to quiet quit the market.

You see, being an income investor is not some complicated task that you have to work on for years to become proficient. When you’re an income investor, you are buying investments available in the market that pay you a strong and healthy income. You’re holding at least 42 of them, and you’re reinvesting 25% of everything you receive from the market back into your portfolio. By doing this, you’re able to enjoy the other 75% and spend it on whatever you want – you can pay your bills with it, explore new hobbies with it, or travel with it. You don’t have to constantly look at options or pick what portfolio position to sell to be able to buy groceries; you’re able to enjoy a simple financial situation, a situation that is built around what you have been doing for years. You receive a paycheck from the market, and you live off that paycheck – It’s that simple.

By doing this, you can revolutionize your retirement outlook by accepting that you’re not dead the day you retire and that you have lots of life left to live. So you’re going to need income to do that. At the end of the day, your life’s outcome is in your hands. Don’t let other people tell you how to live your retirement. Don’t let them pigeonhole you into a retirement plan that’s not right for you.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Read the full article here