When I wrote about Immunome (NASDAQ:IMNM) in January, I rated the name a strong buy as it had set up a collaboration to develop antibodies with AbbVie (ABBV), was trading just over cash, and had additional potential catalysts from its own pipeline. IMNM has since experienced a major development, with a merger with another biotech, Morphimmune, being announced. A shareholder vote on the deal is set to take place on Friday, September 29. This article takes a look at where IMNM stands now.

The Morphimmune Merger

An Accomplished CEO

On June 29, IMNM and Morphimmune announced they would merge in an all-stock transaction. The name of the company when merged would still be Immunome, and the ticker would still be IMNM, but the CEO would be Clay B Siegall. Siegall is the current CEO and President of Morphimmune, and was appointed to those positions in March 2023. Perhaps more compelling, however, is Siegall’s history as the CEO and President of Seagen Inc (SGEN). Siegall co-founded SGEN in 1997 and led the company for over 20 years. SGEN was acquired by Pfizer (PFE) for $43B in 2023. It is worth noting that Siegall was not CEO at the time PFE acquired the company.

Having Siegall, who led SGEN to be a major player in the antibody-drug conjugate (ADC) space, as the head of the merged company would certainly attract interest, given his sizable accomplishments. Morphimmune’s Targeted Effector platform delivers payloads to cells in a targeted fashion and pairs wells with IMNM’s discovery engine that identifies new antibodies and their targets.

Ownership Split and Private Placement

Getting into the details of the merger, the June 29 press release stated that an oversubscribed private placement to raise $125M would be conducted, and that the merger and private placement were expected to close in Q4’23.

At the effective time of the merger, prior to giving effect to the private placement, securityholders of Immunome will own approximately 55% of the combined company and securityholders of Morphimmune will own approximately 45% of the combined company on a fully diluted basis, excluding out-of-the-money securities and the inducement grant to Dr. Siegall discussed below.

June 29, 2023, press release from IMNM.

When the merger is completed, the private placement following that will result in further dilution. For example, IMNM had 12,202,516 shares outstanding as of August 7, 2023, although calculations of ownership split are based on diluted shares outstanding, considering options and warrants exercisable (as of June 18, in this instance). Indeed, in a subsequent 8-K (filed September 21) which provides some details on the proposed merger, IMNM notes the basis of the 54.2% ownership split. Note that the 10.9M shares number for Morphimmune is following the conversion to IMNM at the exchange ratio of 0.3042.

… the Immunome ownership split of 54.2% implied by the Exchange Ratio based on (i) 12,908,348 Immunome diluted shares outstanding, utilizing Immunome common stock outstanding and Immunome options and warrants exercisable as of June 18, 2023 all as provided by Immunome management, and then calculated utilizing the treasury stock method and Immunome’s closing price on June 28, 2023; and (ii) 10,909,354 Morphimmune diluted shares outstanding, utilizing Morphimmune stock outstanding (on an as converted-to-common basis) and Morphimmune options outstanding as of May 8, 2023 all as provided by Morphimmune management, as then as converted into Immunome common stock and options to receive Immunome stock at the Exchange Ratio, respectively, and calculated utilizing the treasury stock method and Immunome’s closing price on June 28, 2023.

IMNM 8-K filing, September 21, 2023. Emphasis by Biotech Beast.

Regarding the private placement that will take place, it involves selling an aggregate of 21,690,871 shares for an aggregate price of approximately $125M (some shares sold at $5.75 and others at $5.91).

Table 1: Details of cash, cash based on Biotech Beast’s estimate, diluted shares and shares issued. Morphimmune cash from IMNM Form S-4/A (filed August 25, 2023).

| Cash and equivalents (June 30, 2023) | Estimated cash (end Q3/start Q4) | Diluted shares outstanding (June 18, 2023) | Shares Issued | |

| IMNM | $38.4M (June 30, 2023) | $28.4M | 12,908,348 | |

| Morphimmune | $16M (June 30, 2023) | $12M | 10,909,354 (Converted-to-common basis, then converted to IMNM shares or options, exchange ratio of 0.3042) | |

| Private placement | $125M | 21,690,871 | ||

| Total | $165.4M | 45,508,573 |

I expect the merged company would have about $165M in cash, although this is a little conservative for two reasons. Firstly, I estimated IMNM would burn through $10M cash in Q3, total operating expenses were $10.04M in Q2’23, but that includes non-cash expenses, and the effect of cash expenses on IMNM’s cash balance is offset somewhat by collaboration revenue brought in from ABBV (collaboration revenue was $4.26M in Q2’23). Secondly, I estimated Morphimmune would burn through $4M in cash in Q3, although net cash used in operating activities was just $5.34M in H1’23 (Page F-26, IMNM S-4/A filing, August 25). Further, additional cash could come in the form of the exercise of options. For example, while IMNM had 12.2M shares outstanding at June 30, 2023 (10-Q, page 3), its calculation of the ownership split for the merger is based on 12.9M diluted shares outstanding (as of June 18), because it accounts for the possibility of exercise of in-the-money and exercisable options and warrants.

In any case, if the combined company were to trade at cash ($165.4M) per share (45.5M shares outstanding following the merger and private placement), it would trade at $3.64. Immunome at the time of writing trades at $7.55, with $3.15 in cash per share, but of course it is trading well above cash based on the excitement of this deal going through.

It is also worth considering that the Siegall Employment Agreement comes with the potential to see him awarded with options worth 2,137,080 shares of IMNM with an exercise price of $5.91. Those options would vest 25% at one year, and the remaining 75% monthly over the next 36 months. Of course the exercise of those options would bring in some cash, and they aren’t that far below the current price, so this wouldn’t impact our calculations here too much.

Potential combined pipeline

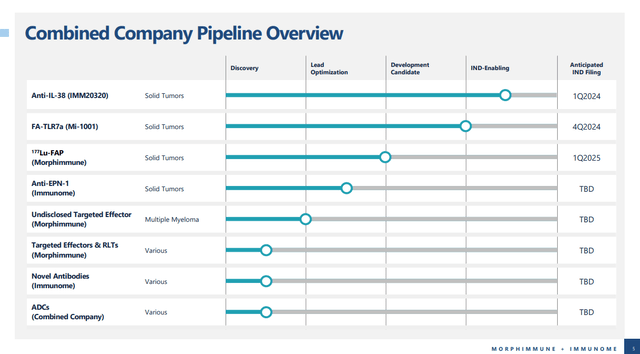

Anti-IL-38

A January 30, 2023, corporate presentation from IMNM, put up on the company’s website shortly after the ABBV collaboration was announced, noted that IMNM intended to file an Investigational New Drug (IND) application for its anti-IL-38 agent, IMM-ONC-01 in mid-2023. IL-38 expression within tumors can play a role in suppressing the immune response to tumor cells, allowing them to divide free from immune attack. As such, an antibody targeting IL-38 is a simple, but potentially effective, means of unleashing a patient’s immune system to attack a cancer.

Unfortunately, the timeline for IND submission has shifted, as the more recent July corporate presentation following the announcement of the Morphimmune deal notes an IND submission for IMM20320 in Q1’24.

Figure: What the pipeline of a combination between IMNM and Morphimmune would look like. (IMNM presentation on Morphimmune merger.)

It isn’t immediately clear if IMNM had to revise its existing anti-IL-38 agent, hence the name change, but in any case a delay can be forgiven, given the size of the merger IMNM has been working on. I remain excited about the potential of an anti-IL-38 antibody like IMM20320, but with no clinical data yet, there is no guarantee it will be successful.

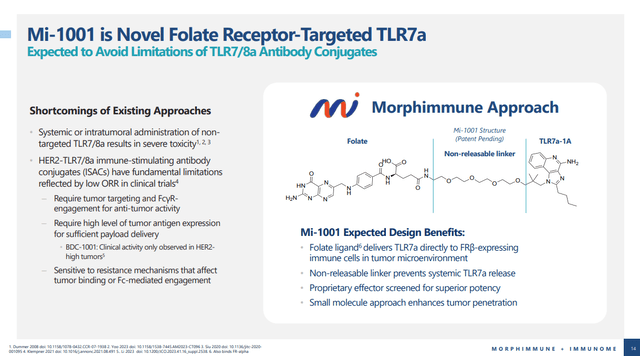

Mi-1001

Mi-1001 is the other agent in the combined pipeline that could see an IND filing in 2024. Mi-1001 is an agonist of toll-like receptor 7 (TLR7), bound via a linker, to the vitamin folate. Agonists of TLR7 can stimulate the immune system to fight cancer. However, it isn’t as simple as giving a patient a TLR7 agonist to stimulate their immune system to fight cancer. Indeed, if administered systemically, without targeting to the tumor site, a TLR7 agonist can cause cytokine release syndrome, an inflammatory response which can be severe and even cause death. Targeting immune cells found within tumors, which may express both folate receptors and TLR7, should be achieved with Mi-1001.

Figure: Mi-1001 is designed to target immune cells within the tumor microenvironment. (IMNM presentation on Morphimmune merger.)

It certainly looks like Mi-1001 has a good chance of improving based on the lessons learned with previous failures of TLR7 agonists.

Conclusions and Risks

Above I mentioned an 8-K filing from September 21, 2023, that provided, among other things, some additional details of the proposed IMNM-Morphimmune merger. Part of the reason that 8-K was filed was because there have been requests for more information and lawsuits filed, following the announcement of the proposed merger.

Following the announcement of the Merger Agreement and as of the date of this Form 8-K, eleven demands regarding the disclosures in the Registration Statement and the Merger and one books and records demand under 8 Del. C § 220, seeking certain documents and information related to the Merger, were received by Immunome. Additionally, two lawsuits have been filed by purported stockholders of Immunome challenging the Merger (the Weiss Complaint (as defined below) and the Thompson Complaint (as defined below)). The demands and complaints assert claims against Immunome and its Board of Directors, and allege that the Registration Statement contains materially false and misleading statements.

IMNM 8-K, September 21, 2023. Emphasis by Biotech Beast.

I think the proposed IMNM-Morphimmune merger will be approved before any shareholder lawsuit causes an issue, and there may not be an issue. As such, in the short term, these two lawsuits aren’t an issue from a trading perspective. For example, Weiss v Immunome and Thompson v Immunome were filed on September 7, and September 8, respectively, and could take a while to play out. Meanwhile, the shareholder vote is likely to result in the merger being confirmed on September 29. Notably, IMNM’s June 29 press release noted that there was already plenty of support for the merger.

Stockholders of Immunome holding approximately 20% of the voting stock of Immunome executed voting and support agreements pursuant to which they agreed to vote in favor of the issuance of shares in the merger and related matters and stockholders of Morphimmune holding approximately 70% of the voting stock of Morphimmune executed voting and support agreements pursuant to which they agreed to vote in favor of the adoption of the merger agreement and the merger and other related matters.

IMNM press release, June 29, 2023.

I still rate IMNM a strong buy as the new company has an even richer pipeline, but more importantly, the oversubscribed private placement gives IMNM the money it needs to progress these agents far through the clinical trials progress. In terms of catalysts, IMNM moving into the clinic in early 2024 with its anti-IL-38 antibody could generate data in late 2024, with safety updates possible prior to that. Further, the leadership and expertise of Siegall is a big part of the bull case, and will likely see the company retain substantial interest from institutions, analysts and market participants for years to come.

The risks of any long are several folds. Firstly, if the shareholder vote results in the merger not closing, the stock could certainly fall to pre-announcement levels. Secondly, developments in the lawsuit could see the stock fall on fears of financial penalties. Lastly, delays in entering the clinic will move catalysts into the future and some investors, while liking the new CEO and the pipeline, might choose to come back later.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here