Industrial Logistics (NASDAQ:ILPT) is a bread-and-butter industrial REIT that owns/operates properties used for warehousing and retail distribution. The business was fundamentally transformed (for better or worse) after its $3.8 billion acquisition of Monmouth Real Estate Investment Corporation in February 2022. As we will explore, this fateful acquisition not only added increased operational complexity, but the timing and astronomical sticker price has put the market on edge.

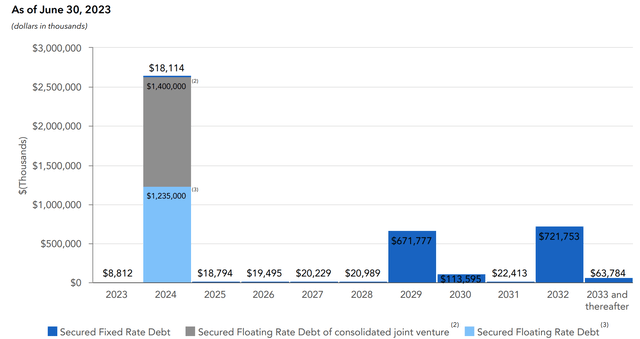

The debt taken out to finance the acquisition expires in 2024, and it’s still an open question of how ILPT will re-pay it. Will they issue equity at dilutive prices? Will they sell additional properties or their economic interest in joint ventures? Will they roll the debt at an interest rate of 6%+, even higher than the implied cap rate of the properties from the Monmouth acquisition?

In general, industrial REITs have fared well compared to the broader REIT sector. The pandemic emphasized the importance of supply chain resiliency, pulled forward e-commerce adoption, and kicked off the latest wave of on- and near-shoring. These trends mean durable growth for the sector broadly, but ILPT will only share in this boom if it can stay in business.

Investor Relations Presentation

The Business

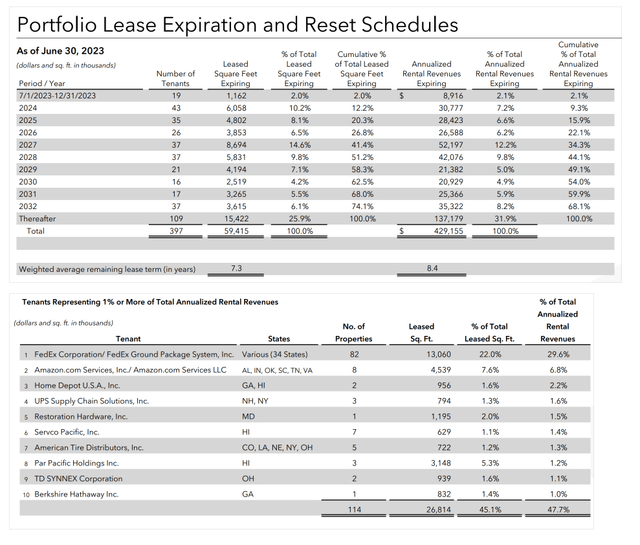

ILPT’s operating business is in top-notch condition. Its consolidated 413 properties currently sit at an impressive 99% occupancy rate, and its lease expirations are evenly distributed throughout the next decade. Its two largest clients, FedEx (FDX) and Amazon (AMZN), account for a combined 30% of leased square feet and 36% of annualized revenue. While these numbers are slightly on the higher side, both customers are reputable and financially well-to-do companies. Besides, there is a fat tail of smaller clients, the majority of whom are also investment grade. Investors should have little concern about ILPT’s customers failing to meet rent obligations or overall customer concentration.

As an aside, earlier in the year, there were headlines and discussion on social media about how Home Depot (HD) plans to break its leases in Hawaii. In reality, Home Depot was re-negotiating terms on a single 2.2 million square foot facility in Hawaii. Even if Home Depot doesn’t renew with ILPT, it still has rent obligations to ILPT until March 2024 and accounts for 2.2% of ILPT’s revenue to begin with.

Investor Relations Presentation

The Merger

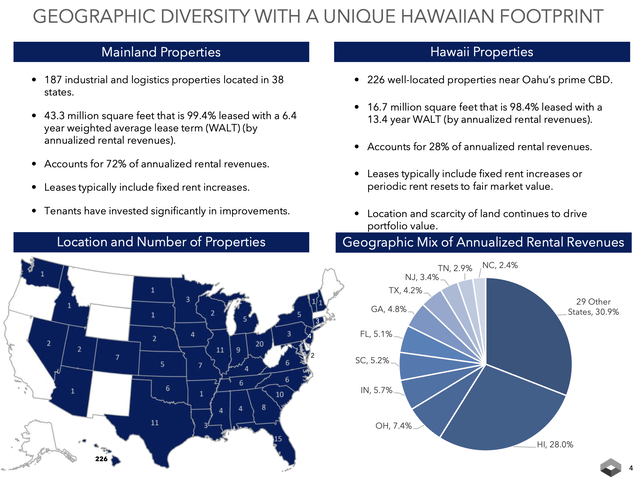

The purchase of Monmouth (formerly MNR) was more so a merger of equals than an outright acquisition. The deal came with 124 properties (most of which are Class A, single tenant, net leased, e-commerce focused) in 32 states that contain approximately 25.7 million rentable square feet. Strategically, the acquisition of Monmouth Real Estate was synergistic: ILPT wanted to diversify from having an extreme concentration in Hawaii.

While Hawaii’s natural supply constraints mean pricing power and its geographic location makes it desirable for commerce, concentration in one locality makes the highs more rewarding and the lows even scarier. Volatility doesn’t bode well with public markets, so acquiring Monmouth was a move in diversification.

The all-cash deal came at a cost of $3.8 billion (which includes transaction costs and the assumption of $323 million of existing Monmouth mortgage debt). At the time of the acquisition, the company had a meager $100 million in cash. REITs, of course, are often cash tight due to their large distributions and it is industry practice to tap the debt markets to grow. However, the magnitude of this acquisition was not one ILPT could easily afford, so it got creative to fund the deal.

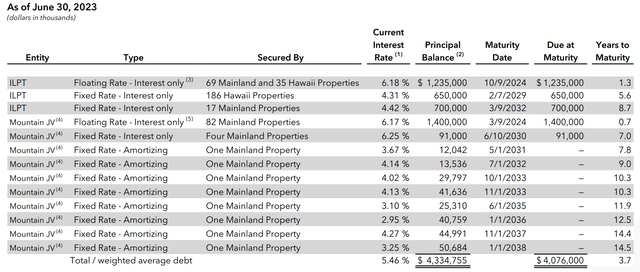

First, the company divested around 30 Monmouth properties. Then it turned a subset of the Monmouth properties (95) into a joint venture with an institutional investor that bought a 39% equity stake for $587 million. The JV was named dubbed Mountain Industrial REIT LLC. In addition, the JV inked a $1.4 billion floating-rate CMBS loan, collateralized by 82 Monmouth properties (row 4 on the table), and ILPT took out another CMBS loan, this one fixed rate for $700 million secured by 17 Monmouth properties (row 3).

Investor Relations Presentation

To account for the remaining gap, ILPT took out a $1.38 billion bridge facility with a maturation date in February 2023 for SOFR plus 2.92%. This bridge loan was paid off early (in September 2022) with cash on hand and proceeds from a $1.235 billion interest-only loan (which further breaks down into a $1.1 billion mortgage loan and a $135 million mezzanine loan), secured by 104 properties (row 1). Lastly, a minor detail: in conjunction with securing the aforementioned financing, management prematurely terminated a $750 million revolving credit facility that had been scheduled to expire in June 2022.

Investor Relations Presentation

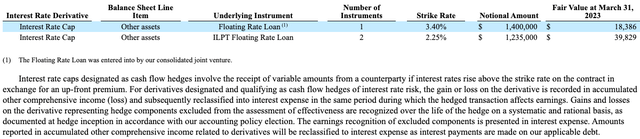

Readers will notice the $2.635 billion floating rate debts in rows 1 and 4 make up the biggest portion of debt. In fact, their size brings ILPT’s weighted average tenor to less than 4 years. Even though they are both floating-rate loans, I believe management was astute when they took them out because they hedged interest rate exposure through swaps. The swaps, detailed below, have equal notional values to the debt and have an expiration in March 2024.

Form 10-K (Annual Report)

While both of the float-rate loans are technically able to be extended by one year up to three times, the rate paid after March 2024 would truly be floating. It would also be extremely expensive: SOFR plus a premium of 3.93% for the loan maturing on October 9, 2024 and SOFR plus a premium of 2.77% for the loan maturing on March 9, 2024.

Even if we don’t consider the principal repayments at maturity, the interest payments themselves have become quite burdensome. In 1H 2023, ILPT paid out $143 million in interest expense, up from $118.5 million in 1H 2022, on $218 million of pre-expense rental income. After paying its regular operating expenses, there is nothing left. This explains why ILPT has had a net loss every quarter for the past year.

Again, it is not unusual for REITs to take out large amounts of debt, but it was unfortunate timing to take out floating-rate loans in February 2022–and then not hedge interest rate exposure for a longer time–considering the Federal Reserve began its hiking cycle in March 2022.

ILPT doesn’t have the liquidity on its balance sheet to pay off the debt outright, and rolling over debt at prevailing interest rates is a scary proposition. I believe investors have been correct in their assessment of ILPT’s financial condition. The sell-off is not an extreme reaction; it’s a well-warranted one. A clear warning sign was the dividend midway through 2022 cut to a penny per quarter, which in my view duly hurt investor confidence and foreshadowed worse things to come.

ILPT’s Manager, The RMR Group

A natural follow-up question is why did the company push for such a large acquisition and what is their stance on the deal today? The answer is that ILPT doesn’t have management (at least in the traditional sense). While the majority of REITs are “internally managed,” ILPT is an externally managed one. As its SEC filings bluntly state, “We have no employees.”

Of course, the underlying operating business of ILPT has employees, but the publicly listed entity is a holding company whose manager is The RMR Group (NASDAQ:RMR), an alternative asset manager that specializes in real estate. This is why in ILPT investor relations presentations and regulatory filings, there are only two executive officers listed: Yael Duffy (CEO) and Brian E. Donley (CFO and Treasurer). Both persons are VPs at RMR. ILPT is just one of the companies that RMR manages, alongside (DHC), (OPI), (SVC), (ALR), and several privately-held real estate businesses. Combined, RMR-managed companies have more than 2,000 properties, 20,000 employees, and $5 billion of annual revenue. An analogy is if RMR were a private equity fund, ILPT would be one of its portfolio companies (or PortCo).

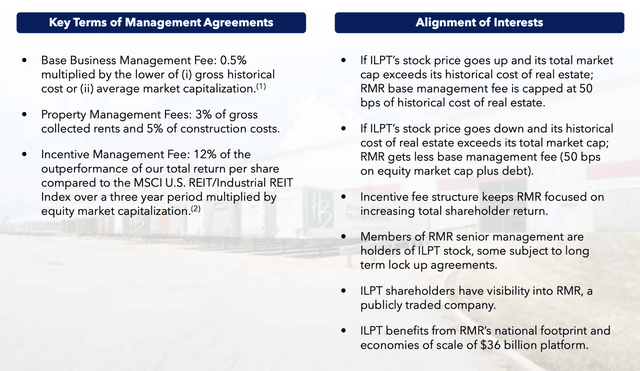

In its financial statements, ILPT’s payments to RMR are found in the “General and Administrative” category. General and Administrative also includes certain legal, audit, and Trustee fees, but is mainly fees paid to RMR. For its management services, ILPT paid RMR $19.5 million in 2020, $16.7 million in 2021, $32.9 million in 2022, and is on track for around $25 million in 2023 (run rate is currently at $6 million per quarter). The fee structure has several components (including an incentive fee dependent on performance), which are spelled out in detail in the following slide:

Investor Relations Presentation

What should ILPT shareholders make of its external manager who has “broad discretion in operating [its] day-to-day business”? It depends on your perspective.

In theory, a real estate management company like RMR has partners who have sharpened expertise shaped by decades of experience. Its partners are able to leverage their unique perspectives and connections forged through time in the industry. Also, a real estate management company can leverage its scale and reputation to further advance ILPT’s business in a way a standalone ILPT would not be able to do.

Separately, the $20-30 million fee paid by ILPT to RMR for its services is most likely in-line with, if not cheaper than, what its executives and corporate employees (e.g., secretaries, accountants, etc.) would make. These factors combined are why ILPT’s regulatory filings (which are procured by RMR) state this arrangement is a “competitive advantage” for ILPT.

Opponents of this arrangement will point out ILPT is one of half a dozen companies RMR manages; if ILPT had internal management, they would be exclusively focused on ILPT’s business. In addition, there is a question of incentives: even though RMR is ILPT’s manager, RMR is by no means a significant owner. Shareholders want to see capital appreciation and a steady stream of (large and increasing) dividends. Of course, RMR also wants to see ILPT’s business thrive, but its fees are largely a function of AUM, so RMR foremost wants to grow that metric in my view.

On this point, I believe the Monmouth acquisition was forced through because RMR wanted to increase AUM and thus its fee stream. The transaction would never have been one that ILPT could afford (unless the U.S. stayed in a near-0% interest rate environment). Earlier, I detailed how ILPT had to sell several Monmouth properties and sell equity in the Monmouth joint venture. These moves weren’t made because of regulatory scrutiny or for strategic partnerships — they were made to make the numbers work in my opinion.

I would argue external management has largely been harmful to shareholders. The opaque management structure creates possible conflicts of interest and severs the link investors normally have with management. This difference in incentives is a textbook example of the principal-agent dilemma. Personally, for me to be comfortable investing in a company long-term, I need to understand management — their background, their current thoughts, their future ambitions. In the case of ILPT, it has been difficult for investors to directly dialogue with management.

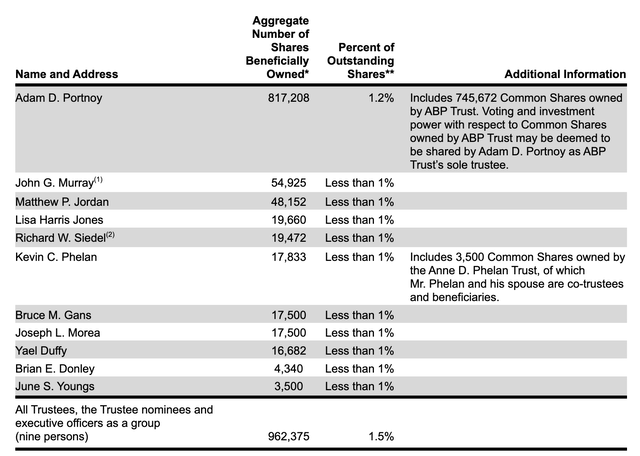

Insiders own very little of ILPT stock. (Definitive 14A (DEF 14A))

Shareholder Revolt

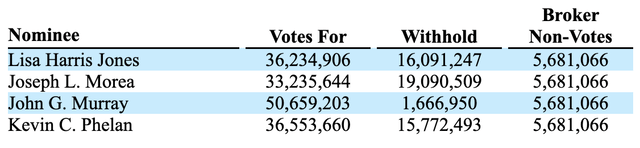

There are concrete signs shareholders have been dissatisfied. In the 2023 annual meeting, three of the four directors faced stiff opposition — much more than is typically seen.

Shareholder Vote Results, Form 8-K

In addition, Stone House Capital Management, an investment fund based in Florida, very recently took a 10% stake in ILPT. This was disclosed on August 31st through a SEC 13D filing (As a reminder, both 13D and 13G are filings made when a larger than 5% stake has been taken. 13G are for passive positions, 13D filings are for non-passive stakes). Founded in 2010, Stone House Capital Management is an investment fund based in Florida that takes concentrated bets in its “long-biased” portfolios and has a “history of working constructively with companies to build value over the long-term.”

Stone House’s involvement is the second instance of interest in ILPT from institutional “smart money” recently. Before Stone House entrance, a firm called Flat Footed LLC purchased close to 5% of ILPT. Flat Footed LLC has a history of butting heads with RMR, and even successfully staged a campaign to stop the merger between two other companies RMR manages (see “Diversified Healthcare Trust and Office Properties Income Trust Mutually Agree to Terminate Merger Agreement”).

ILPT’s Path Forward

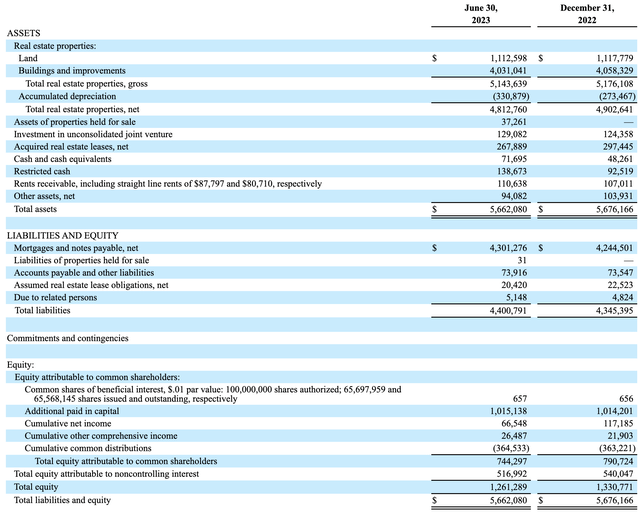

ILPT’s operating business is in great condition by almost any metric you look at, but its financial shape has deteriorated beyond comprehension. The obligations due in 2024 put the company in a precarious situation, one that the balance sheet currently cannot handle in my view:

Form 10-Q (Quarterly Report)

How will ILPT service the 2024 debt maturities? It is unlikely to receive favorable terms through any methods of funding, be it an equity issuance, rolling debt, or selling properties/investments. An equity raise would be extremely dilutive at the current stock price of $3.8 per share, but may still happen to some extent because insider ownership is minuscule. Rolling over debt will be expensive–certainly above the overall portfolio’s implied cap rate–but doable considering the health of the operating business. Selling its investment in JVs is also feasible but doing so would be one step forward, two steps back.

ILPT has a 22% equity interest in The Industrial Fund REIT LLC, a privately held REIT that had a carrying value of $129 million on the balance sheet as of June 30, 2023. Assuming it can fetch the carrying value in a transaction, the proceeds would provide liquidity but it would be a drop in the bucket. A partial or full sale of ILPT’s 61% stake in Mountain Industrial REIT LLC (the joint venture created with Monmouth Real Estate) would cover the bulk of the maturing debt, but then little would remain of the Monmouth acquisition. Perhaps this sunk cost is one it should be willing to take for the longevity of ILPT’s business.

Overall, I arrive at the conclusion that ILPT is too stuck between a rock and a hard place. The business’s financials are stuck in a hole that might be too deep to dig out of. External intervention may be the ultimate fate of this business. Given the difficulty of understanding management’s next moves, as well as the financial hole the company finds itself in, I would advise investors to consider other opportunities. In real estate, I have recently written about the attractiveness of high quality, Class A office owners (VNO) and (KRC) — about how they are priced for imminent death but are actually chugging along just fine.

I will continue to follow ILPT and would be happy to re-analyze future developments, but for now it simply has too much hair surrounding it.

Read the full article here