Overview

My recommendation for InnovAge Holdings (NASDAQ:INNV) is a buy rating as I expect the business to recover from the sanction with ease, which it is currently experiencing. Doing so should improve valuation as the market sees that INNV’s operations have reverted to pre-sanctions levels.

Business

INNV holds the position of being the leading provider of PACE (Program of All-inclusive Care for the Elderly), offering an alternative to nursing facilities. What sets this apart is that each participant receives a dedicated team of healthcare professionals responsible for managing their individual health needs and offering assistance to elderly individuals in their own residences. INNV’s primary goal is to empower senior citizens to live life according to their preferences, enabling them to age gracefully within the comfort of their homes and communities for as long as it remains safe to do so.

Recent results & updates

To provide further background on INNV, the business was previously hit with sanctions that have impacted the business and stock performance. However, the business gradually showed signs of recovery when the sanctions were lifted in and in May for Sacramento. Fast forward to today, and while the 4Q23 results were quite mixed, mainly due to the weak margin performance, I do see positive traction from a growth perspective (growth turned positive as compared to negative in the past few quarters). INNV beat the consensus estimate of $174.8 million with revenue of $176.9 million in the 4Q23. The contribution margins at the center level totaled $28.5 million, an increase of 20.6% from the previous year. Contribution margin at the center level was 16.1% due to higher costs from external providers than expected growth in revenue. Due to center level poor margin performance, operating loss was -$10.9 million, and adjusted EBITDA was $716k.

Regarding my forward-looking perspective, I anticipate INNV’s ongoing recovery to surpass levels seen before the sanctions, especially in terms of enrollment growth. Management’s comments indicate that in numerous areas, enrollment has already returned to pre-sanction levels. This growth is attributed to INNV’s efforts to expand their sales team and increase investments in digital marketing. INNV expresses confidence in the significant headway made in previously sanctioned regions, particularly noteworthy in Colorado, where the company has experienced pre-sanction gross monthly enrollment growth earlier than anticipated, and in Sacramento, where positive trends indicate progress toward meeting the company’s internal growth objectives. In my opinion, this is highly indicative of the value proposition that INNV offers to patients that enrollment in the key sanctions area tracked back to historical levels within a year of restart. Sanctions, especially in the medical field, tend to have a strong stigma attached to them, so I thought it would take INNV longer to regain the trust of patients. How many, if any, families would send their elderly relatives to a facility that had sanctions imposed on it because of clinical and operational deficiencies? Thus, this is a more encouraging development than the numbers would indicate. However, management has observed that a delay in the state’s processing of enrollment applications is due to Medicaid redeterminations. I also see this as positive news because it indicates that enrollment growth would have been even stronger if the slowdown hadn’t occurred. Put together, the core growth driving metric—enrollment—is actually performing very positively, which bodes well for INNV’s upcoming performance.

During the call, management also updated investors on the progress of the company’s de novo openings in Orlando and Tampa, noting that a state readiness review had been completed in Tampa and that plans were underway to schedule a similar review in Orlando. Financially, this means that INNV can accept more patients. With the completion of its Florida de novos at the end of CY23 and the opening of its new center in southern California in the middle of CY24, management anticipates that these centers will bring on additional capacity in 2024. With the sanctions behind INNV, I see the opening of centers to expand capacity as a positive catalyst that should support growth.

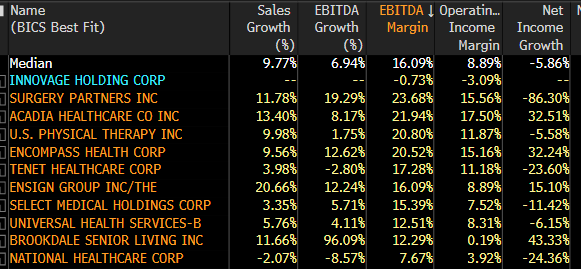

The direction of INNV’s top-line expansion is apparent, but the company’s cost management skills are severely lacking. The company’s continued loss in profit worries me and should keep a lid on the stock price for the time being. The bull case is that the business has a history of being profitable until recently, so there is precedent for it to get back to a profitable region. I would like to point out that the rise in external provider costs from roughly 48% of pre-sanctions revenue to 54.4% of FY23 revenue was a major factor in the poor EBITDA margin performance this quarter. If the 640 basis point difference was taken into account, INNV would already be profitable.

Valuation and risk

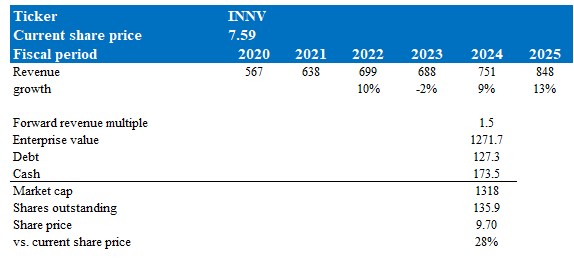

Author’s valuation model

According to my model, INNV was valued at $42 in FY24, representing a 28% increase. This target price is based on my growth forecast of accelerating growth in FY24 and FY25, supported by the normalization of enrollment growth post-sanctions, increased capacity, and organic growth (due to the secular trend of an aging population in the US).

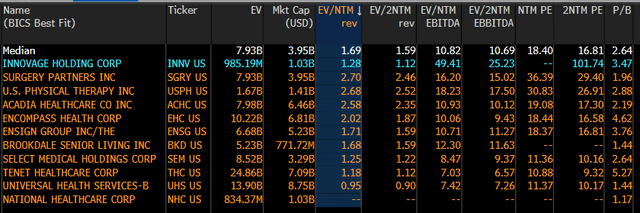

INNV is now trading at 1.3x forward revenue, which I believe will rise over the next two years as I expect the market to value INNV based on its historical average given that the business has fully recovered from the sanction. I modeled 1.5x forward revenue in my model, which is a discount to peers as I believe INNV’s lower margin profile warrants a discount.

Bloomberg Bloomberg

The risk of another sanction hitting the company While INNV has done a great job of operating through the sanctions and recovering from them, I believe the stock will receive a big selloff if it receives another sanction. Investors would lose trust in the company, hurting its valuation, and most importantly, patients would be less likely to enroll with INNV as it would have a bad reputation.

Summary

My recommendation for INNV remains a buy, with confidence in its continued recovery from sanctions. Recent developments indicate positive traction, particularly in terms of enrollment growth. Although the 4Q23 results showed mixed performance due to margin challenges, the company beat revenue estimates, demonstrating resilience. Looking ahead, I anticipate INNV’s recovery to surpass pre-sanction levels, primarily driven by robust enrollment growth in various regions. INNV’s efforts to expand its sales team and invest in digital marketing are contributing to this positive trend. Notably, INNV has made impressive progress in previously sanctioned areas, such as Colorado and Sacramento, exceeding expectations. While INNV’s cost management requires attention, there is a historical precedent for profitability.

Read the full article here