Investment Briefing

In my June publication covering Integra LifeSciences Holdings Corporation (NASDAQ:IART) I outlined the case to how it was not an investment-grade company based on a number of outcomes at its Boston manufacturing facility. I’ll re-hash the salient points on this today but the fact is multiple uncertainties remain on the company’s outlook on aggregate. Further, the company’s legacy units aren’t offsetting pressures built by the saga on its Boston facility.

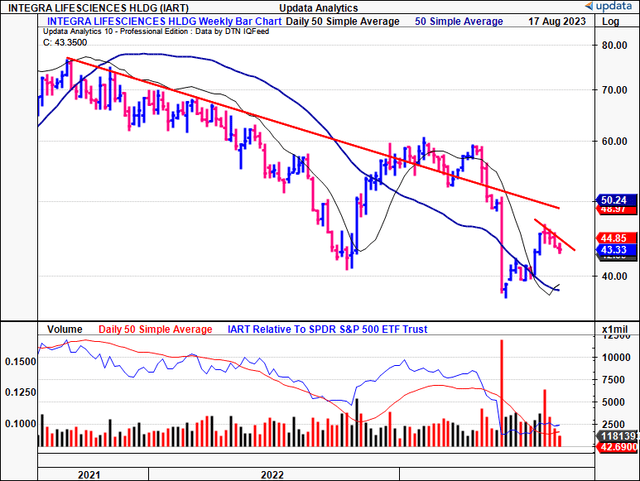

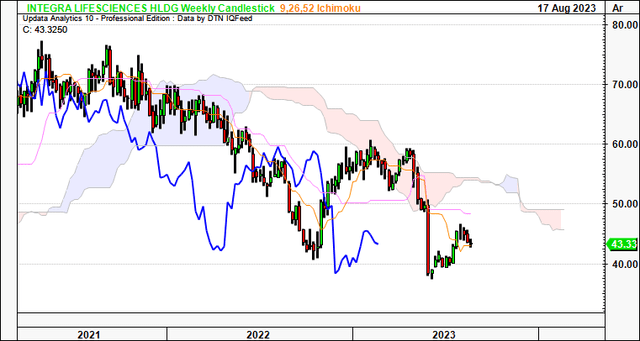

Moreover, the woes for IART’s equity stock aren’t new. It had been sold with weak hands from mid-FY’21 into mid-FY’22. Investors then pulled the floor of its market value at the back-end of H1 FY’22 [Figure 1]. A sharp reversal that started in October ’22—likely beta related, that’s when the SPY rallied—was immediately offset after hearing the poleaxing news on Boston.

Net-net, there’s too many distributions in the potential of outcomes for IART to have me bullish here. This places less accuracy on the market’s expectations baked into the stock, let alone my own investment findings. Here I’ll run through all the moving parts in the investment debate for the benefit of investors’ reasoning here today. Reiterate hold.

Figure 1. IART long-term price evolution, continued downtrend with sharp de-rating in 2023

Data: Updata

Updates to critical investment facts

The major factors currently feeding into IART’s equity stock are fundamentally, sentimentally, and valuation-driven in my view. I’ll start by covering each of these factors in detail before the final investment recommendation.

1. Fundamental factors

Given this is a rolling situation with the Boston risk, analysis of the firm’s latest numbers is integral to scope out the future. First, a reminder of the situation at hand. The decision to halt operations in Boston followed an internal investigation and subsequent consultation with the FDA. After consulting with the agency, the company initiated a global recall of all products produced in the Boston facility. The reason behind this action was the identification of gaps in its endotoxin testing process. These gaps could have led IART to release products with higher endotoxin levels beyond the permitted specifications. The recall encompassed several products, including its PriMatrix, SurgiMend, Revize, and TissueMend lines. For a full dive into what happened, check the previous IART publication [see: “Critical Factors”, and, “Investment implications”].

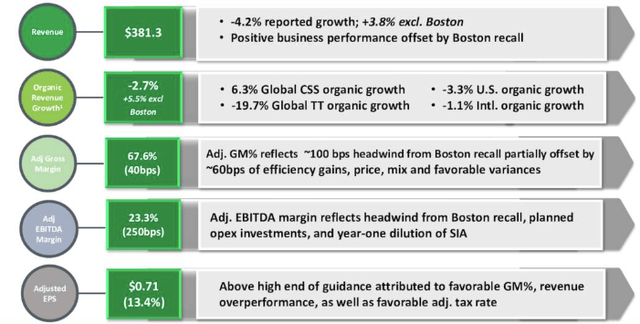

In Q1 FY’23, the impact of this recall was evident in the company’s financials:

- The Company clipped a revenue headwind of ~$23mm due to lost sales and returns. The associated negative impact to adj. EPS was c.$0.20. Management believes that about 10% to 15% of the lost volume can be recovered going forward.

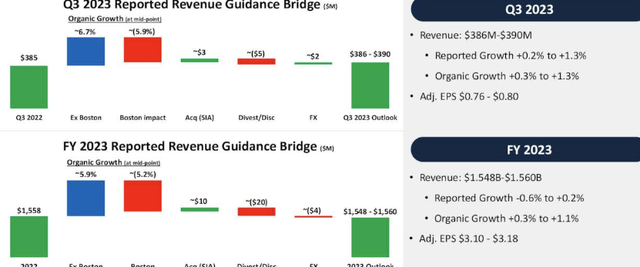

- Unfortunately, the recall will continue to cast its shadow on its numbers downstream in my opinion. The Company anticipates a negative impact of about $60 mm in revenues and $0.35 in adjusted EPS for the entire year. IART also eyes full-year revenues between $1.548Bn—$1.560Bn, reflecting a YoY growth of -0.6%—0.2%. Moreover, the journey to manufacturing restart and ramping up inventory poses challenges, which will extend into H2 2024 at the very least, confirmed by management. Consequently, it also estimates an adverse effect of c.$50mm in revenue and $0.30 in adjusted EPS for FY’24.

Naturally, it’s essential to view the numbers excluding the Boston impact. Excluding the headwind, organic growth remains at a run rate of ~6%. For starters, if you narrow the focus to products outside of Boston’s influence, the rest of the portfolio produced an organic growth rate of 5.5% in Q2.

Second, the CSS business, which includes products such as CUSA, Mayfield, DuraGen, Certas Plus programmable valves, et al., underscored the bolus of growth in Q2. In specific numbers, it booked quarterly CSS revenues of $271mm, marking a 6% increase from the prior year.

Figure 2.

Data: IART Q2 Investor Presentation

Looking ahead, the standouts in my eyes are the following:

- Full-year sales estimates of $1.56Bn at the upper end of range (as mentioned earlier).

- IART to potentially have the Boston saga sorted by H2 next year, removing a large drag on market value and equity performance.

- Net leverage is currently at ~2.6x and thus well within the company’s target range of 2.5—3.5x adj. EBITDA.

- Critically, the firm also authorized a $125mm buyback program to purchase its own stock by the end of Q3 this year. There is potential this may attract some demand if the firm pays a reasonable premium to market, which, I’m presuming it thinks is currently undervalued. There’s no saying at what band it will return the cash to shareholders. But it would need to be at quite the premium to see investors interested on buybacks alone, in my view.

Figure 3.

Data: IART Q2 Investor Presentation

2. Sentimental drivers

One of the three or so catalysts needed to drive a re-rating in market value is sentiment. We see the negative sentiment in IART’s stock in three ways.

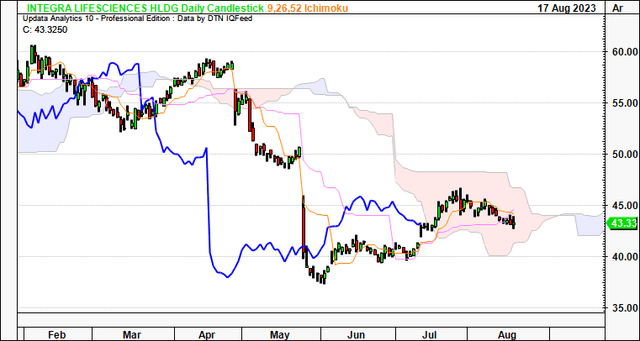

One is the close inspection of price trends on short and long-term time frames. On the daily cloud chart (which shows this data superbly) you’ve got the stock heading into congestion, backing, and filling in a tight set of closes. It trades into the cloud, with the lagging line (in blue) currently testing the cloud base. If it breaks lower, we’re unlikely to see it click higher in my view. On the weekly (which looks to the coming months), both price and lagging line are below the cloud at depth. This will be a large effort to reclaim bullish momentum and at the current trajectory, mightn’t happen this year.

Figure 4.

Data: Updata

Figure 5.

Data: Updata

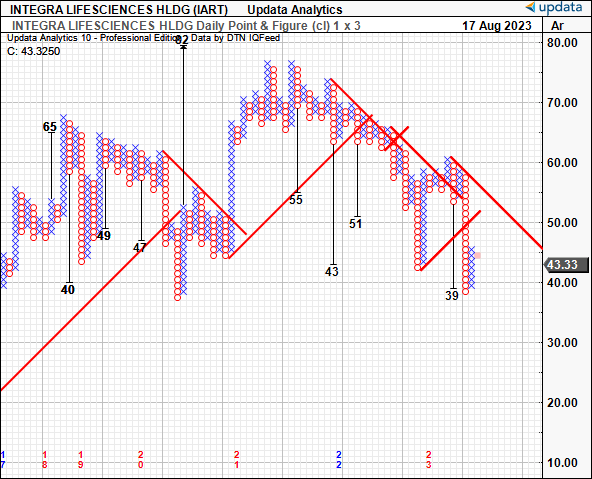

This is corroborated by the price targets to the downside of $39 on the point and figure studies below, which have eyed the movements in price action well so far. These use mathematical formulae to derive price directives and provide an objective view.

Figure 6.

Data: Updata

Two, there’s been 12 revisions to the downside in sales and 11 for earnings by analysts on Wall Street in the past 3 months. These targets represent a large substratum of the market populous and suggest the forward view on the Street is neutral at best. I look for at least 3–5 upward ratings to suggest more positive sentiment inflected in the stock. There have been no such upward revisions.

Three, options-generated data shows that investors are positioned with puts at a $45 strike depth, and bullish positions at a $55 strike depth on the calls side. This implies a split view in capital at risk, and shows investors are undecided each way. The trilemma shown from these 3 points on sentiment corroborates the neutral view in my opinion.

Valuations

If it weren’t enough of a puzzle thus far, the stock also sells at 13.7x forward earnings and 12x forward EBITDA. On relative terms, these are 31% and 7% discounts to the sector, respectively. Thus, potentially attractive. The thinking in buying stocks trading at such respective discounts is 1) that further downside may be limited, and 2) any respective upside is therefore asymmetrical, thus suiting many risk/reward profiles.

Unfortunately, the market doesn’t place a high premium on IART’s net asset value, rewarding it with just a $2 in market value for every $1 in book value. Hence, the discounts may actually be correct on earnings power—investors foresee the forward earnings produced off these net assets to be relatively flat. This does align with what management has said, and, thus, could be priced into the stock.

But the lack of secondary catalysts also implied there mightn’t be much not yet priced into the stock. In other words, expectations are flat in my view. At 13.7x management’s FY’23 EPS estimates, this gets you to $43.80, basically in line with the market price as I write. You’d need it to do $4.00 in EPS to get to a ~25% value gap at this multiple (13.7×4 = $55/43.3-1 = 26%). With all that’s at play I’d be searching for a 25% margin of safety at least here. This is not impossible at all. But with the distribution of potential outcomes weighted to the neutral/downside, on a bounce of probabilities, this is in the ‘less likely’ camp in my opinion.

In short

Corporate securities are priced on expectations in public markets. The sum of known and projected expectations is discounted at a market rate, arriving at an agreed consensus of price. Actual results change forward expectations.

For IART, a combination of actual results and forward estimates has plagued its equity stock since the Boston announcement. Much of the downside is based on the fact investors don’t have a grasp on what to expect. As the saying goes, “time heals all”, and it will likely be the case for IART into H2 FY’24, when it foresees the saga resolving. Until then, the price risk, and risk to investor capital do not outweigh the fact that money can be deployed elsewhere right now, especially with cash yielding 4–5% at the moment, and comparable debt securities in corporates getting you 7–8% in selective opportunities without the volatility. Reiterate hold.

Read the full article here