Intercontinental Exchange (NYSE:ICE) is most well known for owning the New York Stock Exchange and the CRUD Oil futures. It recently came onto my radar due to its merger with Black Knight and its two divestitures to Constellation Software (OTCPK:CNSWF, CSU:CA), one of my largest conviction holdings.

Over the last decade, ICE beat the market by a small margin but has generally tracked the market with faster growth and higher volatility. While the company seems to be priced fairly, I am not confident enough to assign a buy rating due to the recent merger with Black Knight and the divestitures they had to make.

ICE outperformance versus SPY (Seeking Alpha )

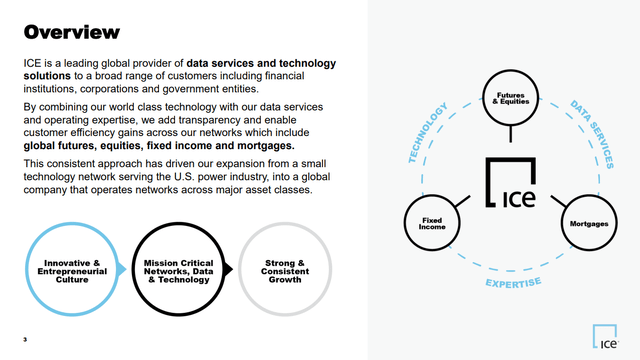

An overview

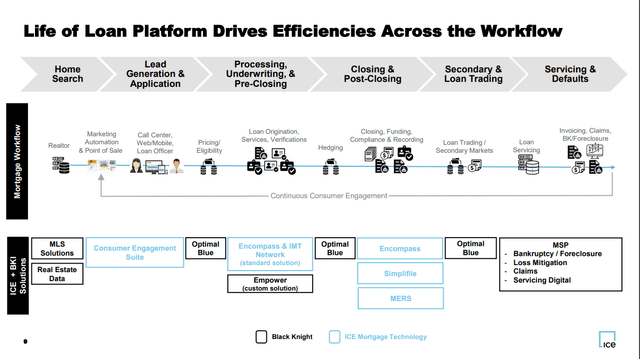

ICE is a provider of data services and technology solutions in a large variety of asset classes. The company focuses on Futures & Equities, Fixed Income and mortgages. With an extensive history of M&A, the company managed to diversify its revenue streams a lot and 51% of revenues are recurring. Through the merger with Black Knight the company wants to expand its offering and create a “Life of Loan” platform, capturing the full value chain of a mortgage. I will dive deeper into this idea shortly. The merger also aims to diversify the revenue further; Exchange revenue/Futures & Equities currently represent 56% of sales.

An overview (ICE Investor Presentation)

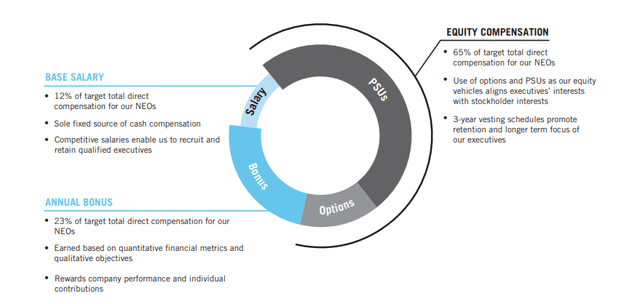

Management incentives

ICE has a history of growing the company via inorganic M&A. I find it always important to know management incentives, especially if it is active in M&A.

Below, we can see that 88% of NEO compensation is at risk with a mix of 3-year vesting shares, options and an annual bonus. I like the high percentage of at-risk compensation to align management with the business.

ICE executive payment mix (ICE proxy statement)

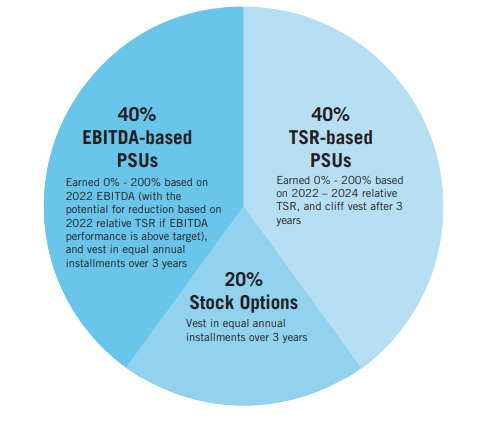

ICE further drills down into its compensation structure: We can see that 40% of compensation is based on EBITDA, 40% on total shareholder return (TSR) and 20% on options without any targets that need to be hit. I do not like this structure as it does not consider the share count or the returns on capital required to achieve this EBITDA growth. This drives incentives to push M&A to grow the business for the sake of growth. Management also does not own a significant stake in the business, 0.46%, according to Seeking Alpha.

Compensation structure (ICE proxy statement)

The Black Knight Merger

ICE agreed to merge with Black Knight (BKI) in 2022. The transaction is meant to create a life-of-the-loan platform that will enable lenders to achieve a “customer for life” according to the transaction presentation.

The deal has seen heavy regulatory scrutiny over the last year but finally closed recently. ICE/BKI had to sell two parts of the acquired Black Knight business to Constellation Software: Optimal Blue and Empower loan origination to appease regulators. The original deal was valued at $13.1 billion and an enterprise value of $16 billion, paid in 80% cash and 20% ICE equity at $85 per share. The deal since then dropped to $75 per share or $11.9 billion.

ICE expects to achieve $125 million in revenue and $200 million in cost synergies over the next five years. In the presentation, ICE stated a 15 times adjusted EBITDA multiple on Black Knights EBITDA, AFTER including the synergies. The deal’s expected return (IRR) was shown at 10%. This is barely over ICE’s cost of capital, according to gurufocus.

Constellation Software (I will refer to the company as CSI/Constellation Software Incorporated) is my second largest portfolio holding, so naturally, I want to dive deeper into this deal and why I think CSI is the real winner of this merger.

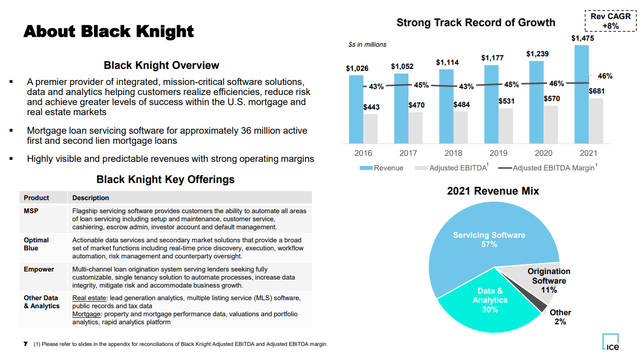

Below, you can see the revenue breakdown for Black Knight. Optimal Blue and Empower are two of the main products Black Knight offers.

About Black Knight (ICE BKI transaction presentation)

Empower represents 11% of Black Knight’s revenue if we use the 11% revenue mix for origination software. This translates to ~$162 million in revenue and $75 million in AEBITDA (AEBITDA stands for Adjusted EBITDA, assuming BKIs companywide margin). The agreement to sell Empower also includes Black Knight’s Exchange, LendingSpace and AIVA solutions. Terms weren’t disclosed for this deal, but I read estimates as low as $190 million.

Optimal Blue was recently fully acquired by Black Knight in February 2022 at a valuation of $3 billion or 28.8 times AEBITDA. This means that Optimal Blue generated around $100 million in adjusted EBITDA. CSI paid $700 million for the business in $200 million cash and a $500 million 40-year promissory note issued to Black Knight at 7% interest. This translates to around seven times AEBITDA for one of Black Knights Crown Jewels, with most of the cash out 40 years. I think this comes close to a daylight robbery and shows how desperate management was to close this deal. Remember that Black Knight only acquired Optimal Blue less than two years ago!

Life of Loan Platform

Below is a model of the Life of Loan platform ICE wants to build with the integration of Black Knight. We can see that Optimal Blue and Empower constitute a large part of this workflow. To me, it does not make sense to pursue the merger without these assets.

CSI paid around $1 billion to acquire two crown jewels of Black Knight that were vital to the Life of Loan Platform idea. These carve-outs come at a significantly lower multiple than the price ICE paid for BKI in the first place.

Life of Loan Platform model (ICE BKI transaction presentation)

The price is fair, but I can’t put a buy on it

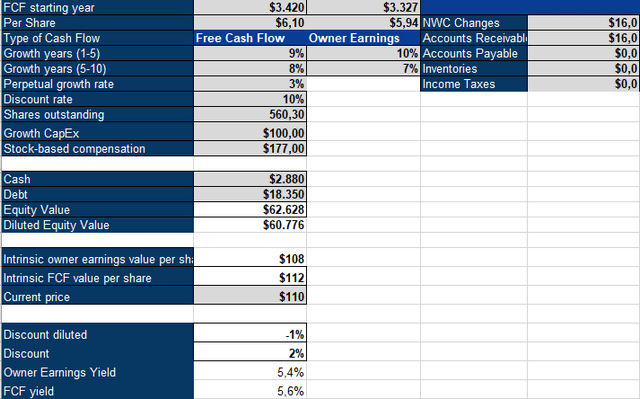

I’ll value ICE based on its trailing twelve-month results in an inverse DCF model. I believe that cash flow matters most, so I use a DCF model over other forms of valuation. I assume $100 million in growth capex because ICE actively invests in and operates data centers for its business. The business had $225 million in capex in FY 2022. The model arrives at a required growth rate of 9-10% for the next five years, followed by five years of 7-8% growth.

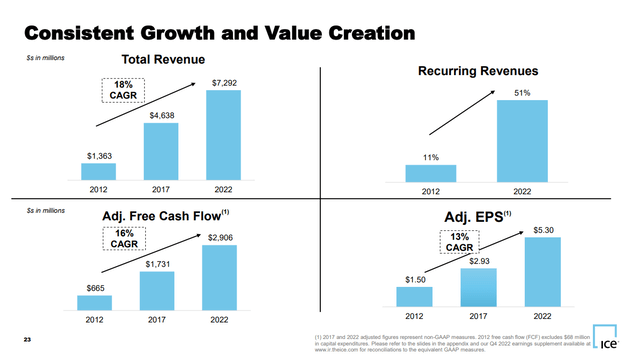

Growth track record (ICE Investor Presentation)

These assumptions are fair and well below the 16% Free cash flow CAGR from 2011 to 2021. EPS also grew faster at 13% CAGR. While recurring revenues increased from 11% to 51%, margins fell as management diversified revenues with M&A and achieved an 18% revenue CAGR over the same period.

The merger is expected to increase Recurring revenue by about 700 bps and improve the revenue streams from transaction-based to recurring sales. A lot of ICE’s growth was based on M&A. After this merger the balance sheet is levered above 3 times net debt/EBITDA. ICE has a track record of de-levering following acquisitions, but this makes more M&A in the near future unlikely. This could impact ICE’s ability to keep up with historical growth rates. Analysts share this opinion and expect earnings growth to decelerate in the coming years, with EPS growing on average in the high single digits. The first half of 23 has seen revenues increase by just 2% and 3% growth in EPS. Free cash flow increased 5%, 18% if we use the adjusted FCF ICE presents which saw a $165 million improvement in Section 31 fees. This is due to a legislative change in February 2023.

While the historical performance makes ICE seem undervalued, I can’t put a buy rating on the stock in light of the, in my opinion, butchered Black Knight merger, as well as the deceleration in growth. It shows that management has misaligned incentives. Considering the loss of Optimal Blue and Empower, a key part of the Life of Loan platform plan, the deal should not have been pushed through. In my opinion, management is incentivized to grow EBITDA and the share price above all else, and this deal shows just that. Even though it is not a good deal (10% IRR after including large synergies in the calculation does not excite me), it does increase EBITDA and thus gets management to its bonus.

That being said, as a Constellation Software shareholder I am very excited about the closing of this deal and hope to see similar desperate carve-outs in the future of the company. In order to move my hold rating to a buy I’d need to see how management integrates the BKI merger. It is at a fair price, but qualitatively I do not want to own shares right now.

ICE inverse DCF model (Authors Model)

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here