Nike (NYSE:NKE) has lost about 5% since their last earnings release. The stock, however, appears better positioned than recognized.

Topline Results

Overall quarterly results were mixed, with a comfortable beat on top-line revenues but a slight miss on earnings, their first in three years. The company also outlined more cautious forward guidance. The miss and the cautious outlook contributed to the initial declines immediately following their release.

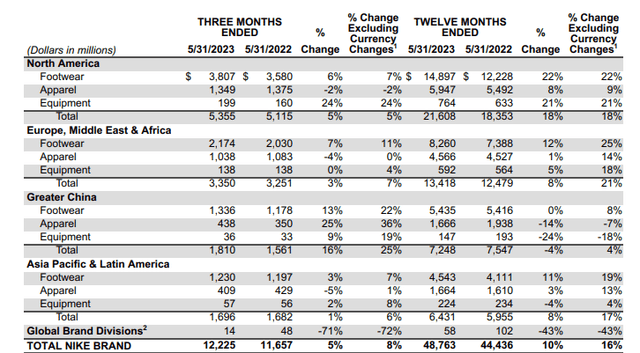

Amidst the decline, their sales strength may have been overlooked. NKE reported an increase in quarterly revenues of 5%. But on a currency-neutral basis, sales were up 8%, well ahead of expectations of 5.4% growth. Total sales in the Greater China region were also up 25% on a currency-neutral basis or +$140M better than consensus.

NKE Earnings Release – Snapshot Of Total Comparative Sales

Wholesale Vs. DTC

Leading up to their release, there were some concerns regarding a potential pivot back to their wholesale partners. In recent periods, NKE accelerated plans to grow their representation of direct sales (“DTC”) to strengthen margins. But commentary from two partners had suggested that NKE may not have been as ready for the DTC channel as had been expected.

Designer Brands (DBI) and Macy’s (M), for example, stated on their recent conference calls that NKE would be back in their assortments. Macy’s chief, Jeff Gennette, stated that an expanded selection of NKE gear would be available online and in key locations beginning in October. Doug Howe from DBI echoed the remarks in their release, stating that their partnership with NKE would be “elevated” and that they would begin carrying a wider assortment of products later in the year.

NKE’s current results should temper any concerns regarding their DTC readiness. The company reported constant currency growth in DTC of 18%. This compares to just 2% growth in their wholesale revenues. Furthermore, sales to their wholesale customers represented about 56% of their sales. That’s an uptick from the prior quarter but still well below the 70% mix reported four years ago. In my view, I see the mix remaining near a 50/50 ratio, even with the return to wholesale partners in some regards.

The Collectors/Resale Market

Where NKE may fall short is in cooling demand for their new arrivals. One way of measuring interest is in the resale market. At the height of the COVID-19 pandemic, there was a flood of participants into the market on hype surrounding sneakers as an alternative investment. This market has since cooled significantly.

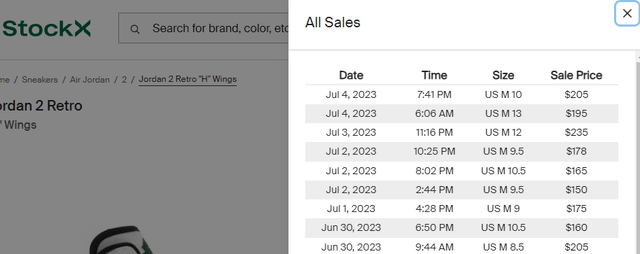

Take the new Air Jordan 2 “H” Wings shoe. A pair retails for $210/share on NKE’s webpage. But recent transactions listed on online resale platform, StockX, shows the sneakers being sold for less. At the height of the market, these sneakers would have been sold out on NKE’s webpage and the sneakers would have commanded a sizeable premium to retail on StockX. The muted interest in the resale market suggests participants have moved on or at least have hopped onto the sidelines.

StockX: Recent Resale Summary Of Nike’s Air Jordan 2 “H” Wings Shoe

Nike Vs. Hoka

Another headwind that NKE faces is competition, namely in their running business. CEO, John Donahoe, noted that NKE is “…more aligned in resource to compete and win,” in this category, citing the 10% growth achieved in the unit. Compared to Deckers Outdoor’s (DECK) Hoka shoes, however, NKE doesn’t appear to be in a position to win anytime soon.

Hoka went from being a +$3M brand in 2012 to a +$1.4B brand over the past fiscal year. And five years ago, Hoka represented 10% of DECK’s net sales. Today, their share accounts for nearly 40%. Moreover, Hoka’s sales were up by 40% YOY in the most recent quarter. NKE looks like it has a long way to go to compete and win.

NKE has also traditionally been recognized for the fashion and collectability of their top footwear brands, as opposed to the more functional aspects, particularly in the running market. There certainly could be some debate on this. Runner’s World Magazine, for example, does list NKE as one of their top running shoes. However, as an avid runner myself, NKE is not the first brand that comes to mind. Rather, Brooks, ASICS, and Hoka, among others, are generally the preferred investments among many in my community.

In my view, NKE faces an uphill battle in their running business. And this battle would be in conjunction with issues in other areas of the business, such as with collectors and the corresponding resale market.

The Future Price Hikes

CFO, Matt Friend, also said that the company is planning on raising prices next year. In one view, this makes sense given their current bleed in the bottom line. In the most recent period, net income was down 28% and operating margins declined 210 basis points to 9.5%. These declines were due to higher costs in inputs and logistics, as well as to higher promotional activity.

But looked at in another angle, the price hikes are curious since NKE and others have been using discounts to boost volume and cut inventory. NKE may feel more inclined to enact the increases now that their inventory balances are more normalized. But the overall macroeconomic environment is less inflationary. To justify the price hikes, then, NKE will need to demonstrate that their products are “worth it.” This may be a tough sell for consumers seeking to pinch unnecessary discretionary purchases.

Is NKE Stock A Buy, Sell, Or Hold?

All considered, NKE is outperforming where it matters. Overall sales are beating estimates, particularly in their Greater China region. And the outlook ahead appears more positive than current results would indicate.

In fiscal 2024, NKE is expecting a 150 basis point expansion at the midpoint in gross margins, which would then translate to a 200 basis point improvement in overall operating margins. NKE also alleviated concerns regarding their wholesale/DTC representation by demonstrating via their results and by also verbally committing to the DTC channel.

Concerns exist regarding inventory levels. But it appears more normalized than the market is letting on. Dollars were up slightly YOY, but units were lower, with double-digit declines in both footwear and apparel. Apparel, in particular, is down 20% compared to last year.

YTD, the stock is down about 10% and little changed over the past month. This compares to gains of 3.5% and 2% over the same periods by the broader Dow Index (DJIA). Investors may not be sensing value in a stock that commands a nearly 30x multiple to forward earnings. But as assessed on their price/sales and enterprise value multiple, shares are trading below their five-year averages. Consensus estimates also peg shares with over 20% upside.

For investors seeking a foothold in NKE, an overly pessimistic market may be providing an attractive opening in this enduring Dow component.

Read the full article here