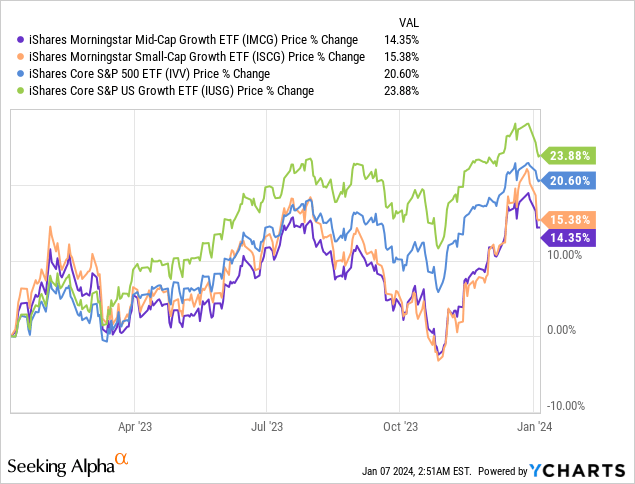

The iShares Morningstar Small-Cap Growth ETF (NYSEARCA:ISCG) represents a commonality that we see across markets, which is that small-cap and mid-cap haven’t participated in the general rallies of the US market and market segment indices. We believe that on account of more incremental benefits to small-cap on the Fed pivot, this market segment should be performing better than it has. As these small-cap ETFs are highly efficient by iShares, we think ISCG should be on ETF investors’ radars as a broad asset class and segment play.

ISCG Breakdown

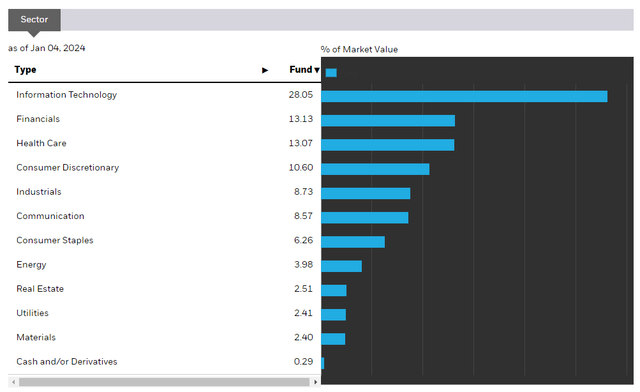

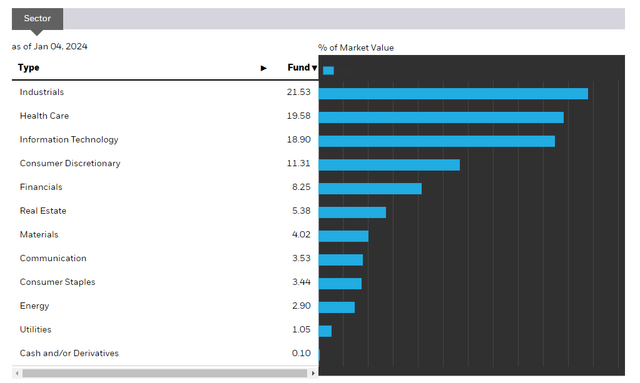

Let’s do a quick comparative breakdown between ISCG and the S&P iShares instrument (IVV). ISCG isn’t that small cap, it’s more appropriately a mid-cap ETF, but it does start dipping into small-cap issues at the margins. The largest holding is Roku (ROKU), for example, with a $12 billion market cap. Both have substantial IT exposure. 19% for the ISCG and the IVV has 28%, driven of course by the mega caps.

IVV Sectors (iShares.com) ISCG Sectors (iShares.com)

Nonetheless, both participate meaningfully in tech and growth, as per the megacap value-weighting in IVV, as well as the growth mandate for the ISCG.

The other major sectoral differential is in industrials. ISCG has a lot more of it. This is typically more cyclical and exposed to inflationary pressure, so having less of it has likely played in IVV’s favor compared to ISCG, although everyone realises that IVV’s performance is driven by the Magnificent Seven more than anything else, which ISCG has no exposure to at all.

Expense ratios are low for both, 0.06% for ISCG and 0.03% for IVV. Both are low, to the point of being negligible, consistent with these passive index ETFs.

Bottom Line

It really comes down to broad index performance. All these ETFs are highly diversified, and even within sectors there’s a lot of diversity. Industrials can include infrastructure as well as more cyclical businesses. In small cap, it could even include the consultants to industrial projects, some of which with smaller and concentrated client books and more scope for idiosyncratic growth.

In general, smaller companies will have more opportunities to attain growth even where broad sector-level performance is weaker, as all it may take is growth in an idiosyncratic regional market, or the addition of one additional major customer or contract.

We posit that in small-cap, or mid-cap which is where ISCG is mostly concentrated, particularly in tech and biotech which is more heavily weighted within ISCG compared to IVV, the announcement of the Fed pivot should have had a larger effect, as these companies are more reflexive and their stock prices should be more associated to funding conditions.

However, ISCG and other broad mid-cap indices from iShares have been underperforming the large-cap indices. While those weighted even more heavily towards the Magnificent Seven have unsurprisingly performed better, the most broad US index captured by the IVV has still gone ahead substantially from the ISCG by more than 5% over the last 365 days.

In addition to the ISCG logically being more levered to financing conditions and to the announcement that the Fed is going to pivot, as well as being more growth and therefore more levered to longer-term cash flows’ discounting rates, ISCG also has an additional benefit in that its expense ratios are a lot lower than other ETFs in the same category. The FactSet average is around 0.36% for ETFs like ISCG, while ISCG is only 0.06%.

We think that granted continued performance of the market, it is conceivable that ISCG has a better increment as it catches up to the rest of the market indices with scope to even move ahead of them.

Of course, there are risks in that general market performance may not occur. Indeed, we continue to worry about inflation and maturity walls, and wonder why the Fed would pivot before inflation has demonstrably been beaten. With the ISCG having an advantage even in terms of PE, at 20x compared to IVV’s 23x (although some of that difference may be explained by companies with negative PEs being excluded from ISCG’s calculation), we think that mid-cap and small-cap in general are a better place to be right now on the prospect of a catch-up.

Read the full article here