As iShares U.S. Financial Services ETF (NYSEARCA:IYG) is currently trading around a 52-week low due to the Fed’s hawkish stance, I believe it’s time to follow Warren Buffett’s mantra of buying low and holding a stake for the long term. The buy recommendation is not only based on the drop in share price but is also due to the fact that the sector has already passed the worst. The risk of financial collapse or significant credit deterioration has been outpaced by robust economic growth. Moreover, the recent share price selloff, along with solid financial growth, has left the sector significantly undervalued.

Avoid Panic Selling and Focus on Fundamentals

IYG Price Performance (Seeking Alpha)

Contrary to the expectation of easing, the Fed still believes more tightening is required to get the desired results. Consequently, the entire stock market and, particularly, the financial sector, plunged sharply in the past two months after some recovery between April and July. However, I believe the drop in share price is presenting a buying opportunity as there is no risk of collapse. In my view, high rates alone won’t depress the financial sector until they are accompanied by a steep economic downtrend or regulatory issues. Other than a few regional banks, no real liquidity issues have emerged across the financial sector so far. In fact, robust economic growth has supported the performance of the financial services and banking industries.

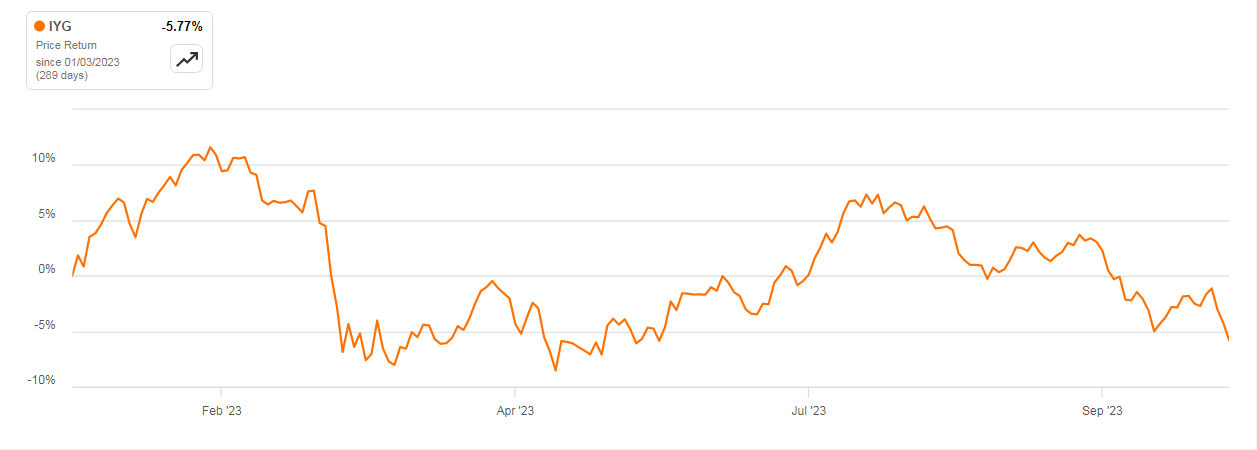

Large Banks Q3 Earnings (spglobal.com)

Companies operating in the financial sector generated healthy revenue and earnings in the last quarter. For instance, the four largest US banking giants, JPMorgan Chase (JPM), Wells Fargo (WFC), Citigroup (C), and Bank of America (BAC) exceeded third-quarter earnings estimates, generated year-over-year earnings growth, and raised their net interest income guidance for the year. Moreover, their total loan value increased compared to the year-ago period.

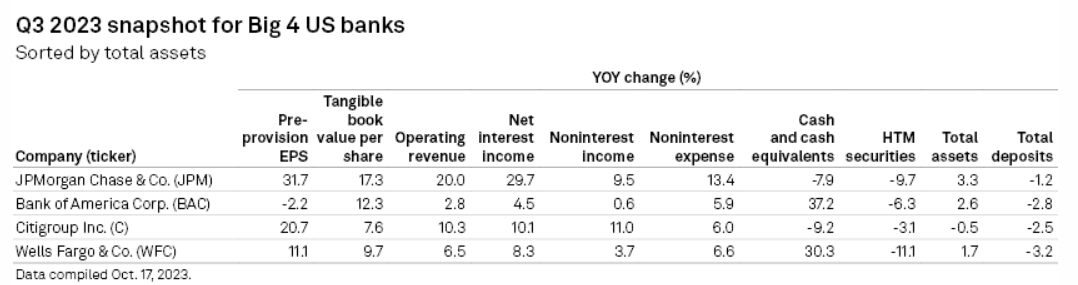

Large Banks Q3 Credit Loss Provisions (spglobal.com)

The risk of higher credit provisions has also declined because consumers and businesses are still in a strong position. JPMorgan’s credit provision declined to $1.4 billion from $1.8 billion in the previous quarter, while Wells Fargo’s credit provision dropped to $1.20 billion compared to expectations for $1.34 billion and $1.71 billion in the previous quarter. According to FactSet data, the financial sector has generated 14% year-over-year earnings growth in the third quarter, compared to expectations for 8%. Moreover, as the Fed seeks to increase rates and maintain them at a higher level for a longer time, there is a high possibility that the financial sector will maintain revenue and earnings momentum into the final quarter of 2023 and 2024.

Why is the iShares U.S. Financial Services ETF the Right Opportunity?

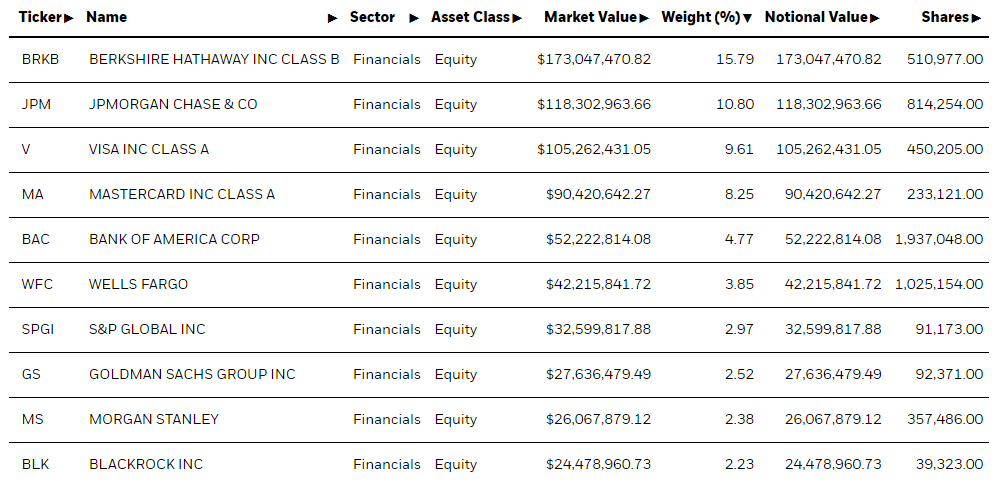

IYG Top 10 Holdings (ishares.com)

Instead of investing in a single stock, it might be a good idea to lower the risk factor by chasing diversified ETFs. I believe the iShares U.S. Financial Services ETF might be the right option because its portfolio is composed of 107 stocks from the banking and financial services industries. Banks represent 30% of the portfolio, while financial services account for the rest.

According to FactSet data, 14% earnings growth of the financial sector in the third quarter was mainly attributed to banks and financial services. Banks experienced 16% earnings growth in the quarter, and the financial services sector was up 14%. For instance, JPMorgan Chase, which is IYG’s largest bank stock holding, generated $4.33 in earnings per share in the third quarter compared to $3.12 per share in the year-ago period. Wells Fargo’s earnings per share of $1.48 also significantly exceeded the past year’s earnings of $0.85 per share. I already discussed the bank’s earnings in detail above, so let’s now move on to financial services.

The financial services industry has been performing better than the banking industry, thanks to economic growth trends and solid consumer spending. For instance, Berkshire Hathaway (BRK.B), the largest stock holding in the IYG’s portfolio, saw a share price increase of 8% year to date. Other stocks from the financial services industry in IYG’s top 10 holdings include Visa (V), Mastercard (MA), S&P Global (SPGI), and BlackRock (BLK). Year to date, shares of Visa and Mastercard have soared 12.5% and 10%, respectively. Wall Street expects Mastercard to generate double-digit earnings growth in 2023, while Visa has topped estimates in the past three quarters due to healthy consumer spending and travel recovery. BlackRock’s third-quarter adjusted EPS of $10.91 grew from $9.28 in the second quarter.

Besides the portfolio, a number of other factors, such as a high dividend yield, make IYG a solid ETF to own for the long term. The ETF currently offers a dividend yield of 2.20%, and it has paid dividends in the past 21 consecutive years. In the past five years, its average dividend growth has been around 11%. Moreover, as the banking and financial services industries are poised to generate healthy earnings growth in the coming quarters, the dividend growth prospects are also high.

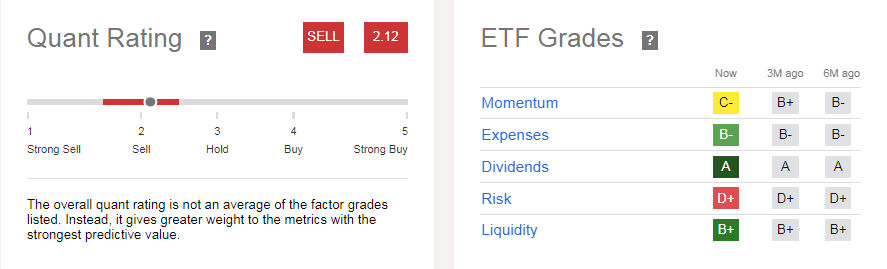

Quant Rating

Quant Rating (Seeking Alpha)

Although IYG earned a sell rating with a quant score of 2.12, I believe the strategy of buying when others fear would help investors over the long term. IYG’s sell rating is mainly attributed to a lower momentum and risk factor score. Its momentum score declined in the last three months due to a share price selloff while poor grade on risk factor is attributed to higher short interest and standard deviation. Momentum is a technical factor, which can improve once IYG’s stock price rebounds. Meanwhile, the ETF earned solid grades on expenses, dividends, and liquidity, which I believe are key when it comes to holding a stake for the long term.

In Conclusion

As the financial sector has always been extremely sensitive to investor sentiment, it might be a good strategy to use the dip as a buying opportunity because there is no evidence that short or long-term fundamentals are deteriorating to a level where collapse is imminent. With the exception of a few regional banks, the latest financial results and economic resilience indicate fundamentals are still strong enough to withstand the pressure of tightening policies. In fact, large banking giants and financial services companies are benefiting from higher rates and economic strength. Moreover, the recent price selloff along with solid earnings growth has made the financial sector significantly undervalued. The financial sector is currently trading around 13.1 times forward earnings. Finally, the iShares U.S. Financial Services ETF’s exposure to financial services and large-cap banking stocks makes it a good option for long-term investors seeking to capitalize on the recent selloff.

Read the full article here