JBS S.A. (OTCQX:JBSAY) has established itself as a company that has exceeded meat and food industry standards in the last five years, achieved through a combination of exceptional execution and strategic acquisitions. These efforts have enabled the company to diversify its operations and yield favorable returns.

Nonetheless, the inherent cyclicality within the meat and food processing sector has challenged this narrative since the pandemic. The company has grappled with substantial margin pressure, with its heavy reliance on debt financing amplifying the challenges amidst prevailing commodity conditions.

Gradually, as evidenced in its most recent quarter, JBS has exhibited modest signs of margin improvement. However, this improvement remains notably influenced by the steadiness of demand from its primary revenue source, the U.S.

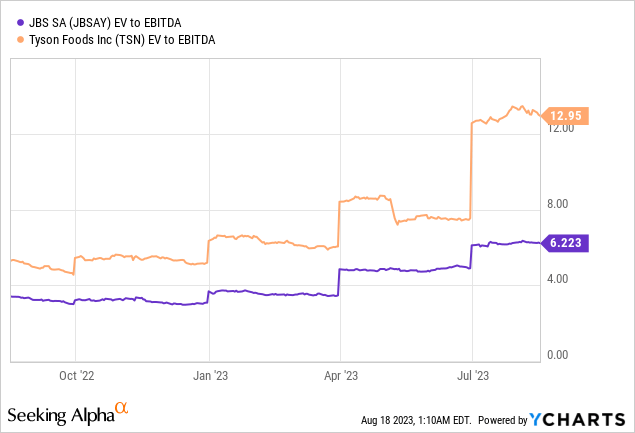

Despite trading at discounted multiples compared to its primary peers, its valuation remains slightly above its historical averages. Given the current scenario, I will be cautious and await a more substantial improvement across the forthcoming quarters.

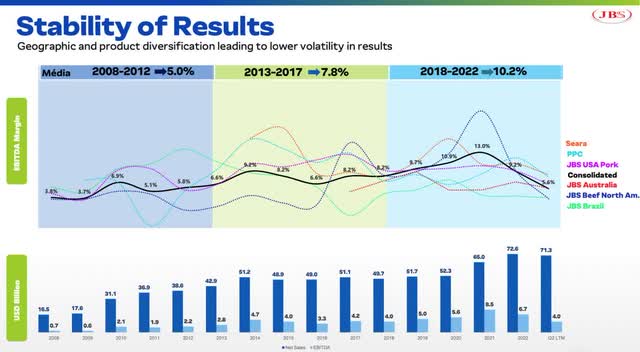

Diversified income and proven stability

JBS derives its net revenue from diverse global regions by engaging with multiple protein sources. Most of its revenues originate from the U.S. market, constituting 51%. Brazil, its country of origin, closely follows closely, contributing 27% to the revenue. The remaining portion is distributed among Australia, Europe, Canada, and Mexico.

Operating within a market characterized by substantial volatility due to fluctuating commodity prices, intricate supply chains, and active participation in a regulated and highly competitive environment, JBS has effectively managed to mitigate margin fluctuations through strategic geographical diversification.

JBS’ IR

Latest results

The most recent financial results from JBS indicate that the company is still working towards achieving solid figures. On the downside, there has been limited progress in margins within the JBS Beef North America and JBS USA Pork segments, which remain notably below historical levels.

Conversely, positive trends are evident in the numbers reported for JBS Australia. This can be attributed to the country’s lower cattle costs, which stand in contrast to the U.S. Furthermore, advancements have been made in addressing the global oversupply of chicken. This scenario had previously hindered the performance of PPC and Seara. It’s conceivable that the most challenging period is now in the past.

In the second quarter of this year, JBS reported total revenues of R$89.4 billion, marking a 3% year-on-year decrease, and an EBITDA of R$4.5 billion, which reflects a 56.9% year-on-year decrease. The EBITDA margin was recorded at 5%, representing a 6.2 percentage point decrease compared to the previous year.

Turning to the bottom line, the financials reveal a high leverage ratio of 3.87x Net Debt/EBITDA compared to 3.1x in the year’s first quarter. This situation impacts the company’s ability to realize net profit, leading to a recorded loss of R$264 million. The impact of elevated financial expenses played a role in this loss. While the losses from the previous quarter have not been entirely reversed, there has been a notable reduction of 81% in the loss quarter-on-quarter.

Beef North America:

- Beef prices increased (+17% YoY) due to resilient U.S. demand.

- However, cattle costs also rose significantly (+26% YoY), impacting margins. Margins remained under pressure, with a slight EBITDA margin expansion (+110bps QoQ).

- Revenues grew 5.2% QoQ and 5.9% YoY, with an EBITDA margin of 1.5%.

- Margins might take time to return to historical levels, depending on U.S. demand and weather conditions.

USA Pork:

- Pork segment faced weak results due to a 21% YoY drop in domestic sales prices.

- Tight margins due to high costs, with an EBITDA margin of 4.4%.

- Volatility in corn and soybean prices contributed to the margin challenges.

- Potential margin improvement as cutout prices rise and the U.S. pork market recovers.

JBS Brazil:

- Revenue growth of 14.6% QoQ despite lower USD/BRL exchange rate impacting sales prices.

- Appreciation of the Real in 2Q23 affected operations.

- Weak comparative base in 1Q23 (export restriction to China) drove the growth.

- EBITDA margin reached 4.8%, indicating signs of stability despite challenges.

Seara and Pilgrim’s Pride:

- Seara reported flat results, expecting improvement amid global chicken oversupply.

- Revenues remained relatively stable QoQ, down 3.5% YoY, with a recovering EBITDA margin (4.1%).

- Pilgrim’s Pride posted modest results, with revenues falling 1.4% QoQ, an EBITDA margin of 8.7%, and optimistic prospects for chicken protein.

JBS Australia:

- Sequential revenue grew by 3.1% QoQ, totaling R$7.5 billion.

- Year-on-year decline of 9.3% due to Asian market price dynamics influenced by China.

- EBITDA margin showed robust expansion, reaching 9.5%, up 9.7 percentage points compared to the previous quarter.

- High animal availability for the slaughter phase led to lower cattle costs, contributing to improved margins.

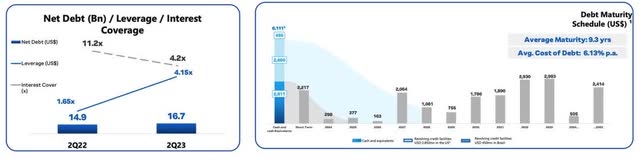

Leverage rises, but EBITDA is evolving

Despite the extended amortization schedule of 9.3 years, the company’s leverage increased to 4.1x in 2Q23 from 1.6x in the previous year.

JBS’ IR

The leverage level remains elevated to provide a fair assessment; however, there is a positive aspect to highlight. EBITDA exhibited an attractive sequential growth of triple digits in the past few years. As most of JBS’s segments are expected to recover margins in the upcoming quarters gradually, EBITDA should align with this sequential progress, moving towards a healthier level.

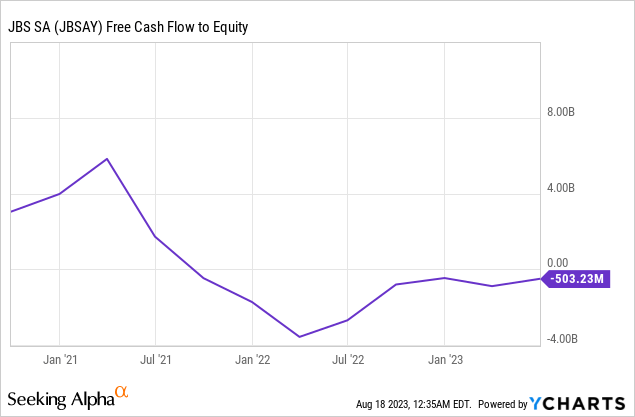

Considering the worst phase might be behind, the company generated R$1.8 billion in cash after interest payments. This represents a significant improvement compared to the over R$4 billion burn experienced in Q1 2023.

What should dictate JBS in the short to medium term

Several noteworthy aspects could shape trends for JBS shares throughout the year.

The demand for beef in the US displays resilience. However, due to limited cattle availability, the prospect of imports from Brazil and Australia emerges as a prevailing pattern. Brazil is envisioned as a source of commodity beef, while Australia is seen as a supplier for premium cuts. Mexico’s willingness to embrace Brazilian beef during a time of scarcity in the US could be a strategic maneuver, raising the prospect of the US importing beef from Mexico.

The overall outlook remains promising within Chinese demand. China’s enduring structural demand trajectory appears optimistic, buoyed by the influence of westernized consumer preferences. Nevertheless, a surge in the volume of beef requested is anticipated without necessarily translating to price increases. The dynamics of the seasons are underscored by provisioning for year-end celebrations, resulting in a pronounced emphasis on the initial three quarters. In contrast, the final quarter exhibits amplified strength in October and November, tapering into December.

Moreover, the imminent plans to dual-list JBS shares on both Brazilian and US stock exchanges are projected for culmination by the conclusion of 2023, potentially occurring in December. This strategic move should augment the stock’s visibility. However, it is essential to note that this dual listing mandates shareholder endorsement, a process contingent upon an upcoming meeting, the scheduling of which remains pending.

Governance needs to be closely monitored

In the not-so-distant past, JBS has grappled with corruption issues involving its top management, significantly denting investor confidence in its recovery efforts.

Back in 2017, brothers Joesley and Wesley Batista stunned Brazil by entering into a plea bargain amidst corruption investigations. Their disclosures of bribes aimed at gaining access to Brazilian public banks and pension funds sent shockwaves through the nation and almost led to the downfall of a president.

Although the Batista brothers stepped away from day-to-day operations, the family’s holding company, J&F, committed to paying substantial sums to Brazilian and US authorities. This commitment, coupled with debt restructuring and asset divestitures, became imperative to avert a potential financial collapse.

While JBS has introduced compliance and control measures, the challenge lingers within the board, which predominantly consists of family members. Therefore, it is vital to emphasize the necessity of a proven track record in governance to assess the implemented changes comprehensively.

Paving the way for the next generation, individuals like Wesley Batista Filho have assumed pivotal roles. He now oversees critical business units, including Seara, upholding the family legacy by starting his career in the operation’s foundational slaughter division.

The bottom line

JBS is progressively demonstrating notable sequential advancement, and the second quarter of this year signals an improvement in its margins, which have faced considerable challenges in recent quarters.

Given the anticipated continued strain on the cattle market in the U.S. over the coming quarters, the company must leverage its income diversification to sustain revenue growth and enhance margins. At present, JBS finds itself in a phase of safeguarding its cash flow.

The company’s forthcoming listing on the American stock exchange has the potential to enhance its visibility greatly. JBS possesses significantly undervalued metrics compared to its primary competitor, Tyson Foods (TSN), despite JBS’s relatively heavy reliance on debt financing.

Anticipating margin improvement across all segments by the end of 2023, except for JBS Beef North America, I observe that JBS is positioned to trade at a forward/EBITDA ratio of 7.4x. This valuation is slightly above the historical average of 5.1x, leaving limited room for upward potential from the current price.

While I believe it’s worth keeping the company on a watchlist, I prefer to wait for a more robust quarter to gain increased confidence in its recovery, especially within the industry’s current period of weakness.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here