9M 2023 (nine months ended June 2023) revenues, orders, and backlog all increased for Johnson Controls International (NYSE:JCI), one of America’s leading HVAC manufacturers. Long term prospects appear positive as sustained demand for smart building and data center cooling solutions could support top line growth while an expanding higher-value service business may support margins. Valuation appears fair.

Company Overview

Johnson Controls manufactures and sells retrofitting building products and systems in more than 150 countries around the world. The company’s products include residential and commercial HVAC equipment, industrial refrigeration systems, controls, security systems, fire-detection systems and fire-suppression solutions. Their OpenBlue software platform, launched in 2020 is a smart building management solution that combines the Company’s building products and services with data analytics to enable enterprises to improve energy efficiency and security. The company’s brand portfolio includes YORK®, Hitachi Air Conditioning, Metasys®, Ansul, Ruskin®, Titus®, Frick®, PENN®, Sabroe®, Silent-Aire®, Simplex® and Grinnell®.

The company’s segments are as follows:

Building Solutions North America covers their operations in North America, primarily covering design, sales and installation services of HVAC, controls, building management, refrigeration, integrated electronic security, integrated fire-detection and suppression systems, for commercial, industrial, retail, small business and governmental customers. This is the company’s biggest business by revenue, accounting for 38% of revenues and about a third of EBITDA.

Building Solutions EMEA/LA covers their operations in Europe, the Middle East, Africa and Latin America primarily covering design, sales and installation services of HVAC, controls, building management, refrigeration, integrated electronic security, integrated fire-detection and suppression systems, for commercial, industrial, retail, small business and governmental customers. This segment accounts for roughly 15% of revenues and around 8% of EBITDA.

Building Solutions Asia Pacific covers their operations in Asia Pacific primarily covering design, sales and installation services of HVAC, controls, building management, refrigeration, integrated electronic security, integrated fire-detection and suppression systems, for commercial, industrial, retail, small business and governmental customers. This segment accounts for roughly 10% of revenues and around 8.5% of EBITDA.

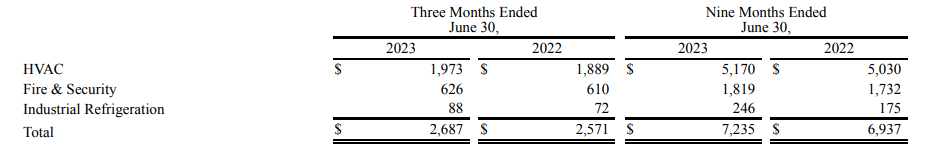

Global Products: covers their operations worldwide primarily covering design, manufacturing, and sales of HVAC equipment, controls software and software services for commercial, industrial, retail, residential, small business, institutional and governmental customers worldwide. This segment accounts for roughly 36% of revenues and roughly over 45% of EBITDA. HVAC is the segment’s biggest revenue generator.

Johnson Controls 10-Q, Q3 2023

Q3 2023: revenues, orders, backlog continue to increase

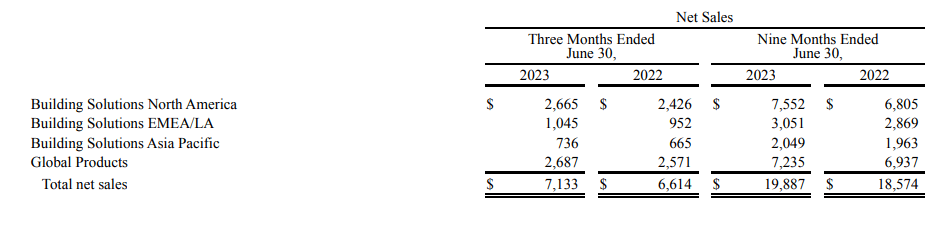

Revenues rose 7% YoY for the first nine months of their fiscal year which ends September 2023 (reported revenue growth of 4%, 10% and 8% for Q1 2023, Q2 2023, and Q3 2023 respectively). All segments reported revenue growth.

Johnson Controls 10-Q, Q3 2023

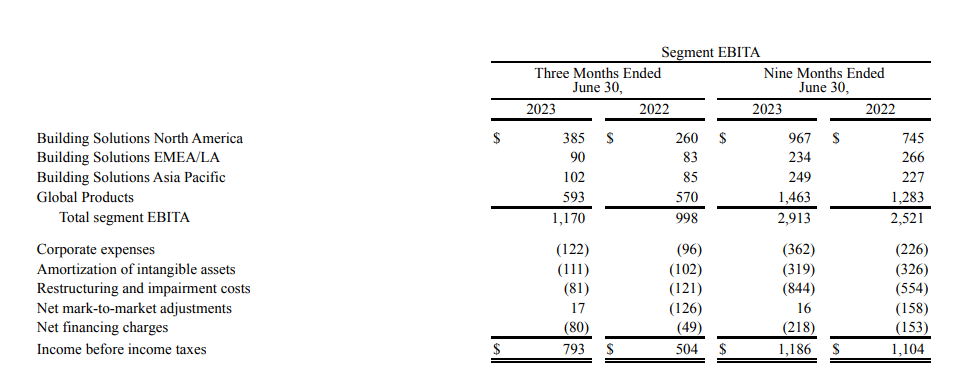

Segment EBITDA increased 15% YoY driven by growth across all segments except Building Solutions EMEA/LA which saw EBITDA drop 12% YoY. Segment EBITDA margin of 14.6% is about 100 basis points better than the 13.5% reported last year. Management attributed the improvement to ongoing productivity savings and the execution of higher margin backlog.

Johnson Controls 10-Q, Q3 2023

Q3 2023 orders rose 8% YoY organically, continuing on consistent order growth so far this year (8% YoY in Q2 2023, 5% YoY in Q1 2023). Order backlog increased to a record $12 billion at the end of Q3 2023. In their Q3 earning call, management said they were confident in the resiliency of their backlog and order momentum

Easing supply chain constraints have helped improve cash flows which at $465 million for the first nine months of FY 2023 is 23% higher than the same period last year.

For FY2023, management expects high single digit YoY organic revenue growth (revised down from 10% previously), and a segment EBITDA margin improvement of around 110 basis points. Near term, a potential interest rate cut next year may boost U.S. residential and commercial construction activity, helping Johnson Controls financial performance.

Looking further ahead, smart buildings is a growing market worldwide, notably in North America, Johnson Controls’ biggest market by revenues and one of the biggest in terms of earnings. Soaring temperatures driven by climate change, along with ESG standards (commercial buildings are the single biggest consumer of energy in the U.S. with most of that going towards HVAC) could drive equipment upgrades.

Additionally, rising demand for data center cooling solutions on the back of an expanding data center market driven by new technologies such as IoT and cloud computing could support continued topline growth. Research reports project a 10% CAGR for North America’s data center cooling market over the coming years. Johnson Controls, one of America’s top three HVAC manufacturers along with Carrier Global and Lennox, could be a beneficiary.

Meanwhile a growing higher-value service business could potentially support margin expansion. Management noted in their Q3 2023 earnings call that the company’s service business has “transformed from a traditional break and fix business to helping customers proactively and more efficiently optimize management of all assets in the building”. In fiscal 2022, approximately 37% of sales originated from product offerings, 39% of sales originated from installations and 24% of sales originated from service offerings according to their 10-K.

Risks

Competitive risks

Johnson Controls competes against numerous other players across all their major products. In HVAC, one of their biggest products, Johnson Controls competes against competitors including Carrier Global Corporation, Trane Technologies plc, Daikin Industries, Ltd, Lennox International, Inc, GC Midea Holding Co, Ltd, Gree Electric Appliances.

Competitive pressures may intensify with the entry of new players in the fast growing data center cooling market; data center demands for AI applications are particularly demanding, not only in terms of bandwidth but also in terms of cooling solutions. Traditional air-based cooling solutions are inadequate and liquid-based solutions are gaining favor. Google has already retrofitted data centers with liquid-based cooling solutions while BT is reportedly trialing liquid cooling solutions. The data center liquid cooling market is forecast to grow at a CAGR of nearly 30% over the coming years, considerably faster than the overall data center cooling market. The competitive landscape however includes a number of new players like Iceotope, and LiquidStack, the latter of which attracted funding from Johnson Controls competitor Trane Technologies.

In building services, Johnson Controls is up against giants like Honeywell, Siemens AG, and Schneider Electric SA. All three companies are considerably bigger than Johnson Controls and may enjoy scale advantages Johnson Controls could find difficult to match.

Conclusion

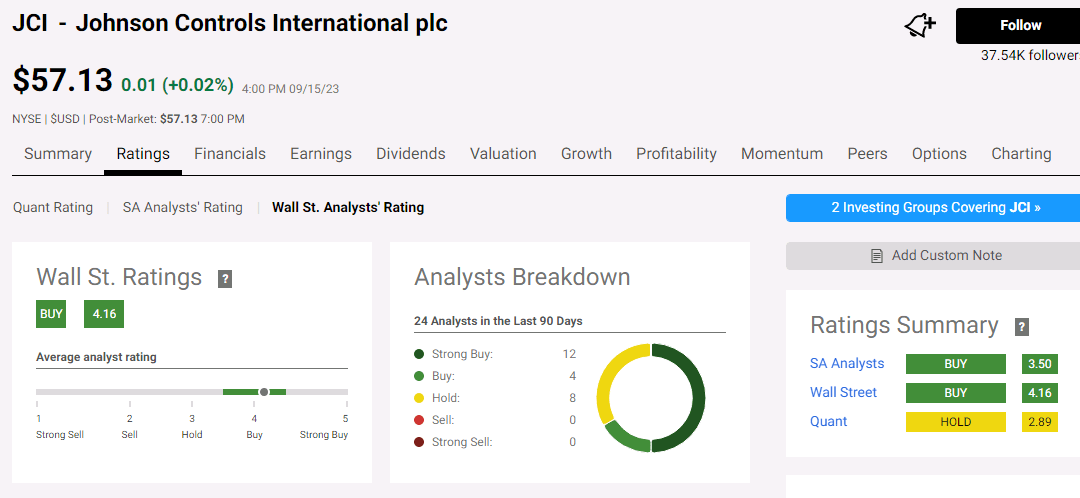

Johnson Controls has a moderate buy analyst consensus rating.

Seeking Alpha

With a forward P/E of 16.1, Johnson Controls is trading just slightly below the sector median of 17.4 and slightly below their five-year average of 19.3. Johnson Controls’ earnings multiple is also below peers like Carrier (CARR), Lennox (LII) and Trane (TT) however Johnson Controls lags in terms of predictability metrics. Their valuation seems fair at this point.

Read the full article here