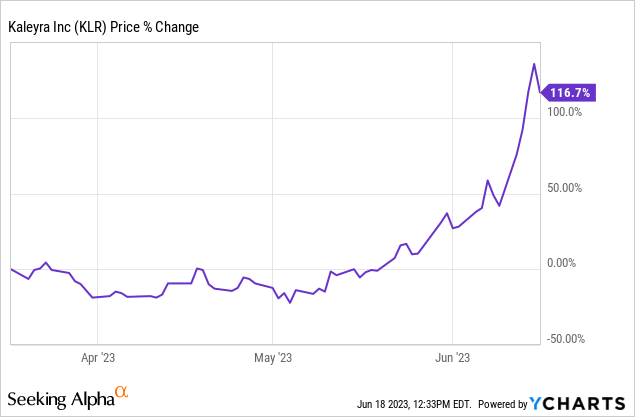

Kaleyra’s (NYSE:KLR) stock has delivered more than a 100% upside since early May as shown in the chart below after rising from less than $2 to above $4.

There are three reasons for this, including the profitability improvement noted in the first quarter of 2023 (Q1), a change in the competitive position as well as leveraging on Conversational AI. Thus, it is the aim of this thesis to explain these in detail as well as determine what value to assign to the stock after such a vertiginous rise. At the same time, since this is currently a loss-making microcap, I will emphasize the cost-cutting objectives, and cash usage without forgetting the product and management forecast.

First, I provide an overview of the business which is mainly about CPaaS, and at the same time differentiate the company’s chatbots with ChatGPT’s Generative AI, which has been attracting most people’s attention lately.

CPaaS and Leveraging Conversational AI

CPaaS is the abbreviation of Communication Platform as a Service. Here, it is basically about platforms accessible directly through corporate applications by using APIs or Application Program Interfaces developed by Kaleyra. Functions covered include notifications, reminders, and any other type of message employees receive through their phone or computer in the form of SMS, WhatsApp, MMS, Mail, etc. This means a diversity of communication channels.

Furthermore, a client can avail of CPaaS platforms without hosting any infrastructure of its own somewhat like leasing a virtual server on Amazon’s (NASDAQ:AMZN) AWS cloud in the form of Infrastructure-as-a-Service. As such, as-a-service communications platforms are disrupting the world of business conversations especially when equipped with AI-based chatbots.

These were released by Kaleyra in December last year and allow customers to automate customer care interactions, provide 24/7 support, and deliver personalized messages. These chatbots use NLP or Natural Language Processing for accuracy and provide relevant responses in commonly used languages in a way that mimics human beings. Thus, they can be customized for individual corporate needs, with the ultimate aim of improving customer engagement, reducing manual tasks, and thus benefiting from better operational efficiency.

Kaleyra’s AI Chatbots (www.kaleyra.com)

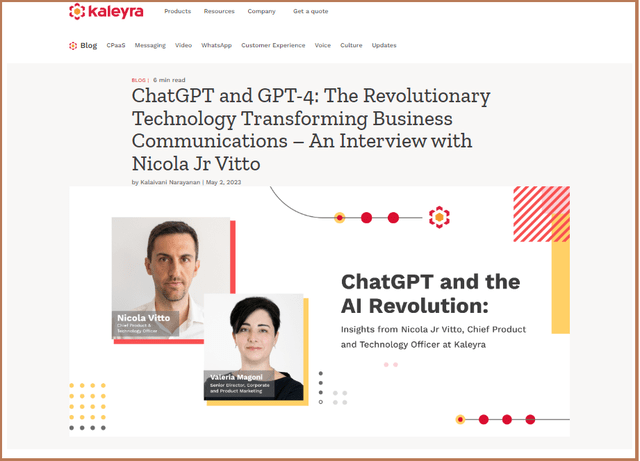

Now, Kaleyra’s NLP does use machine learning algorithms but it relies more on manual and predetermined rules, while, ChatGPT (or Chat Generative Pre-trained Transformer) is more automatic in the sense that it makes use of unsupervised learning or self-learning just like the human brain, in order to provide answers to queries. Consequently, with technology evolution in mind, Kaleyra is also considering embedding ChatGPT in its Conversational AI platform in certain applications as pictured below.

kaleyra.com

As per the above publication entitled “ChatGPT and the AI Revolution”, potential use cases include customer support, marketing as well as for internal business operations, data analysis, and decision-making.

Noteworthily, neither a time frame had been provided for implementation, nor the revenue potential mentioned, but, for my part, I primarily view Generative AI as a product differentiator in a market that remains fragmented market and characterized by few global players. Investors will also note that for the deployment of ChatGPT, additional investments will be needed which may impact profitability.

Focusing on the Profitability For This Microcap

This is an area where the company has been pressured since FY’2020 when its operating losses rose to $26.4 million after delivering profits of $5.3 million the precedent year. Losses eventually mounted and reached $32.5 million during the fiscal year which ended in December 2022. Subsequently, during the earnings call, the management stressed the need to improve margins through a rebalancing of the product mix, improvement of efficiency, and cost-cutting.

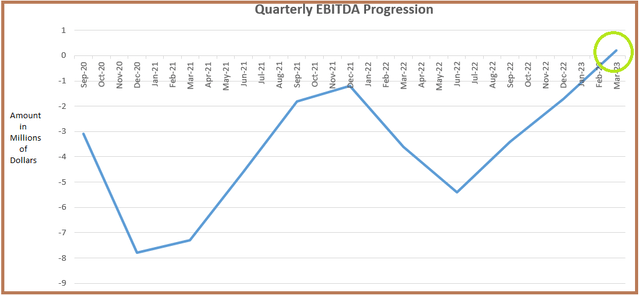

These efforts appear to be paying off as the latest results show that the EBITDA has finally turned positive at $0.2 million, after breaking off with a long string of sub-zero values as shown below.

Charts Built Using Data from (www.seekingalpha.com)

Now, to assess whether the positive figure is sustainable in the balance of 2023, I look at how CPaaS rhythms with cost reductions in the era of digital transformation.

First, it allows client companies to simplify and automate their communication processes, but, looking deeper, there is a need to integrate it into existing corporate functions which implies several IT man-hours of work. In this context, with its platform approach, Kaleyra is able to lower charges which allows even companies with limited budgets to digitalize their own communications channels to profit from as-a-service functionalities. As such, CPaaS is less expensive when built and available through the cloud as users only pay for what is consumed, and, in Q1, the platform delivered 11.7 billion billable messages and connected over 2.2 billion voice calls, which translated into 3.90% year-on-year growth.

On the other hand, Kaleyra has to spend more effort to constantly upgrade its platform so that it offers the most recent services which are in demand. To this end, it recently deployed its global messaging service on Oracle’s (ORCL) OCI (Oracle) Cloud Infrastructure. This signifies that, as an Infrastructure-as-a-Service customer, it has to pay money to Oracle too.

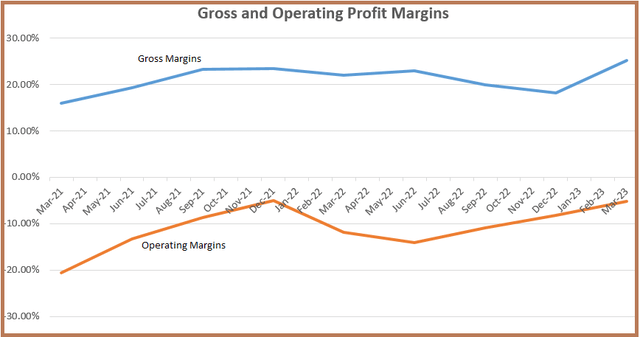

Hence, in order to maximize returns, the company needs to be agile to respond to customer requirements, but, at the same time upgrade its platform in the most cost-effective manner, and for measurement purposes, I use the gross profit margin metric. Now, since these were at a record 25.2% in Q1 (blue chart below) after surging by 19% on a year-on-year basis, Kaleyra has increased platform management efficiency.

Charts Built using data from (www.seekingalpha.com)

On trickling down the income statement, higher gross profits have resulted in better operating margins as illustrated in red above, but these were also helped by the organizational streamlining which I mentioned earlier. This entailed the reduction of monthly cash payroll costs by more than 15% in FY’23 compared to last year. In this connection, considering that adjusted EBITDA for 2022 was $18.7 million and that for 2023, it is intended to grow by 20%, then the figure for year-end should be $22.44 million.

Valuing In view of Competition And Market Positioning

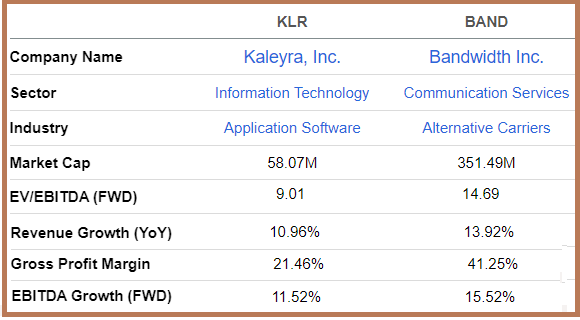

However, the market has not yet priced in this 20% rise as the forward EBITDA growth shows only 11.52% as per the table below. Now, in order to determine a potential acquisition price for Kaleyra, I make a comparison with peer Bandwidth (BAND) which is also in the business of CPaaS despite forming part of the Communication Services sector.

www.seekingalpha.com

Hence, using Bandwidth’s EV/EBITDA ratio of 14.69x as the upper limit, I have a moderated target of 10x for Kaleyra, after considering its lower gross profit margins and revenue growth for the year ending in December 2022. This translates into a target price of $4.88 ((10/9) x 4.4) based on its current share price of $4.4, which represents an 11% upside.

This optimism is justified by its forward EV/EBITDA multiple of 9x compared to the sector median of 14.67x, signifying the stock is still undervalued by 38.59% despite its above 100% upside. At the same time, while Quant’s ratings show a “hold”, the score has been incrementing regularly, from $1.16 on March 17 to nearly triple, at $3.40 currently.

Along the same lines, in addition to internal restructuring and cost reduction programs, Kaleyra is adequately positioned to serve businesses in an environment characterized by higher competition. To this end, market positioning is crucial in order to avoid pricing pressures as tighter monetary policies enforced by central banks throughout the world have rarified the ingredients for economic growth.

For this matter, the IDC Marketplace has positioned the company as a leader in CPaaS, even going to the extent of advising corporations to consider Kaleyra for “global and sophisticated mobile messaging, voice, and/or conversational solution where specific vertical expertise is highly required”.

www.prnewswire.com

The above report also emphasizes the conversational aspect of Kaleyra’s product offering which should help companies better interact with their customer base while driving cost efficiencies. While its chatbots may not be as sophisticated as ChatGPT’s Generative AI, but they still have been able to improve the company’s market position as per IDC.

In addition to taking advantage of AI for client engagement purposes, another differentiator is the partnership strategy with telcos and other service operators so that once customers connect to the Kaleyra platform, they do not have to worry about additional connectivity with third parties. For this purpose, the company has already partnered with more than 1,600 operators so that its clients benefit from direct connectivity in over 100 countries.

This Micro-Cap comes with Risks

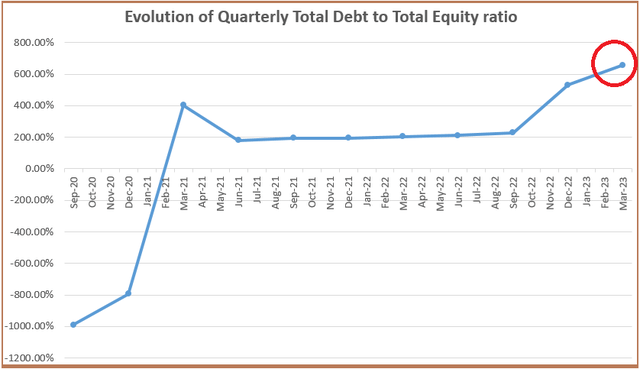

However, in a cautionary tone, since this is a micro-cap stock at only $58 million, it is critical to check the balance sheet as the debt-to-equity ratio has been trending higher as seen in the chart below and is currently above 600%, too high for the comfort of risk-averse investors.

Chart built using data from (www.seekingalpha.com)

Still, looking at the cash generated from operations, FY’22 brought $0.7 million compared to $12.3 million and $11.9 million burnt in 2020 and 2021 respectively, with expectations for more inflows in FY’23 than last year. Furthermore, there were $75.5 million of cash and equivalents as of December 31, 2022, which implies that in the worst-case scenario, the company does not generate cash, it can still operate as a going concern for at least six years (75.5/12.1) assuming an annual cash burn of $12.1 million (the average of 12.3 and 11.9) unless there is some major unplanned expense.

In these circumstances, and given the potential need for additional financing, some investors may prefer to wait for sustained signs of debt control before placing their bets. Moreover, the $4.88 target is conditional on achieving a 20% EBITDA increase, which may prove difficult in case of a protracted economic slowdown.

Still, while not a “Buy”, Kaleyra’s product strategy, which includes a dose of AI, as well as improving profitability metrics, deserves to be monitored given that it is also undervalued. Finally, coming back to the initial price action, after such an upside, expect some volatility and a possible retrenchment to the $4 resistance level.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here