Kimbell Royalty Partners’ (NYSE:KRP) recent $143.1 million Northern Midland Basin acquisition should boost its distributable cash flow by nearly 20%, adding around $0.05 to $0.06 per unit to its quarterly distribution with a 75% payout ratio.

This results in Kimbell’s expected quarterly distribution during 2H 2023 ending up at around $0.36 per unit at the current strip of low-$70s WTI oil and approximately $2.75 NYMEX gas. This is up from my previous expectations, due to the impact of the acquisition.

The acquisition has a significant positive effect on Kimbell’s near-term distribution, since there is heavy development activity on that acreage right now. However, most of the inventory on the acquired acreage is projected to be used up within a couple of years, resulting in declining contributions from the acquired assets after that time.

I now estimate Kimbell’s value at approximately $19 per unit, while its distributions for the rest of 2023 and 2024 should benefit from a high number of wells being turned-in-line on the acquired acreage.

Northern Midland Basin Acquisition

Kimbell paid $143.1 million (including $48.8 million in cash and 5.93 million Kimbell common units) for mineral and royalty interests from MB Minerals. That company is a subsidiary of Sabalo Holdings, which is an EnCap portfolio company).

Kimbell estimates that the acquired assets will produce around 1,901 BOEPD (77% oil, 12% natural gas, 11% NGLs) in the 12-month period ending March 2024. The acquired assets also consist of approximately 806 Net Royalty Acres on around 60,000 gross unit acres in the Northern Midland Basin (northern Howard County and southern Borden County).

Kimbell mentioned that it expected $43.3 million in next 12 month cash flow from the acquired assets based on mid-April strip prices. Based on current strip prices, this is probably closer to $40 million now. The 3.6x transaction multiple (based on current strip) still appears to be quite a low multiple for a transaction involving mineral and royalty interests.

The low transaction multiple appears to be due to the acquired assets having a lot of near-term development activity (pushing up production over the next year or two), but potentially running low on inventory in a couple of years.

Near-Term Development Activity

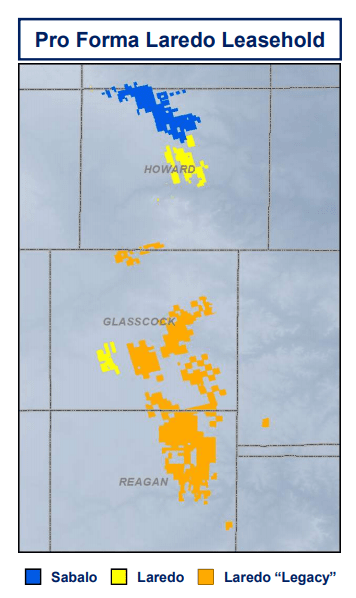

It appears that a large part of the acquired interests have to do with the Northern Howard / Southern Borden acreage that Vital Energy (formerly Laredo Petroleum) acquired from Sabalo Energy in 2021.

Sabalo Acquisition (vitalenergy.com)

Vital is focused on developing its Northern Howard acreage, as that is its best acreage. However, at the start of 2023, Vital was down to only two years of inventory on that acreage due to the large amount of development activity it planned there in 2023.

Thus, the acquired assets might be able to generate $40 million (or more) per year in cash flow over the next couple of years, but then cash flow would start declining due to a large reduction in new development activity.

Outlook For The Remainder Of 2023

Kimbell is now expecting to average around 18,800 BOEPD (33% oil) during the last three quarters of 2023. This includes 18,400 BOEPD (32% oil) in average production in Q2 2023 and 19,000 BOEPD (34% oil) in average production during 2H 2023. Kimbell’s latest acquisition closed halfway through Q2 2023, contributing around 45 days of production to that quarter.

At current strip for the last three quarters of 2023 (including roughly $73 to $74 WTI oil), Kimbell is now expected to generate $174 million in revenues after hedges during that three quarter period.

|

Type |

Barrels/Mcf |

Realized $ Per Barrel/Mcf |

Revenue ($ Million) |

|

Oil (Barrels) |

1,724,448 |

$71.50 |

$123 |

|

NGLs (Barrels) |

723,856 |

$24.00 |

$17 |

|

Natural Gas [MCF] |

16,332,580 |

$2.00 |

$33 |

|

Lease Bonus and Other Income |

$2 |

||

|

Hedge Value |

-$1 |

||

|

Total |

$174 |

Kimbell is thus projected to generate $119 million in distributable cash flow (or $0.46 per unit per quarter) during the last three quarters of 2023, which would translate into a distribution of around $0.34 per unit per quarter with a 75% payout ratio. This is based on Kimbell’s new unit count of around 86.4 million.

|

$ Million |

|

|

Marketing And Other Deductions |

$10 |

|

Production Costs And Ad Valorem Taxes |

$14 |

|

Cash G&A |

$15 |

|

Cash Interest |

$16 |

|

Total Expenses |

$55 |

Kimbell’s quarterly distribution may be around $0.32 per unit for Q2 2023 and around $0.36 per unit during 2H 2023 based on current strip prices.

I now estimate Kimbell’s value at approximately $19.00 per unit using my updated long-term prices of $75 WTI oil and $3.75 Henry Hub natural gas. Kimbell’s distributable cash flow will see a near-term boost from its acquired assets, although this boost will start diminishing after the next year or two.

Conclusion

Kimbell’s recent acquisition should add around $37 million per year (after factoring in interest costs) to its near-term distributable cash flow, while it added 5.93 million units. This is over $6 in distributable cash flow per unit added, compared to under $2 per unit for Kimbell before the acquisition. The acquisition thus boosts Kimbell’s overall distributable cash flow per unit by close to 20% for now.

This boost will diminish over time, though, since the acquired assets may not have much inventory left by the end of 2024. Thus, while the near-term boost to distributable cash flow is welcome, one must consider sustainable distributable cash flow levels too when estimating Kimbell’s value. I thus believe $19 per unit is a reasonable estimate for Kimbell’s value in a long-term $75 WTI oil and $3.75 NYMEX gas environment.

Read the full article here