Investment Rundown

Many of the oil companies took a massive hit to their share prices in 2020 as a result of the pandemic, but many of them have rebounded very strongly since. The same goes for Kosmos Energy Ltd. (NYSE:KOS), up from the lows of $0.69 per share to around $6 right now. During the last few months though, it’s seen a steady decline and trades at a FWD P/E of under 7 right now, below the average for the sector.

Operating with the exploration and production of oil and gas properties all along the Atlantic Margins and the United States, KOS has some exciting projects that are looking very promising. Several projects are expected to start generating oil volumes during 2023, and more are progressing in 2024. Production did take a hit during Q1 of 2023, and I would like to see more consistency in terms of volumes before making a buy case for the company, as a result, I will be rating KOS a hold for now.

Markets They Are In

As mentioned earlier, KOS has several projects going on and more that are expected to start producing in 2023. As for now, KOS has its main production of oil coming from Ghana, where oil production averaged 72.200 bopd in the Jubilee region. This was a lower production level on a YoY basis, a result of reduced water injections. This lower production was necessary to properly manage the water reservoir to support Jubilee Southeast drilling.

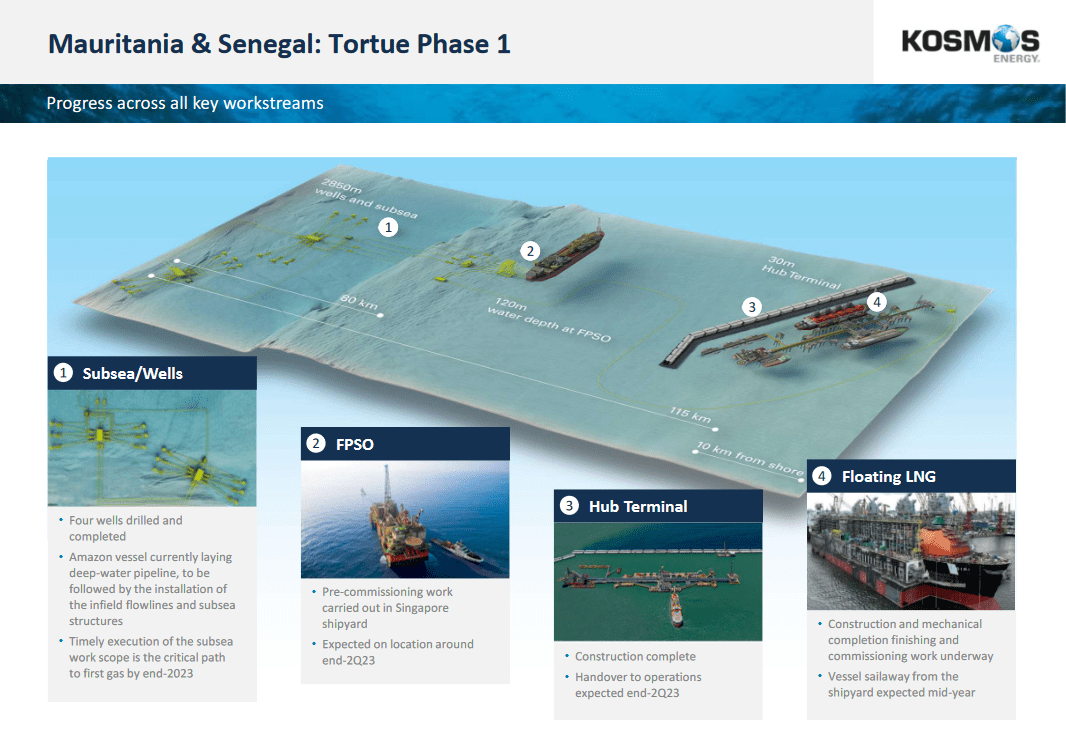

Tortue Project (Investor Presentation)

As for prospects, the GTA project that KOS has announced looks very promising. It’s a solid bet on already existing demand for LNG, but also a bet that it will continue, which certainly seems to be the case right now, I think. The harmful effects of using coal and wood are becoming evident to many and finding better and less emission-introducing sources is key, which is a tailwind for LNG demand.

The strategic location of the GTA projects lets them have direct access to the European market too, but the host countries where the project is being developed are also key customers, those being Mauritania and Senegal. As for what the CEO Andrew G. Inglis had to say about the progress on the project it looked very positive, “We have also made good progress in the quarter on Phase 1 of the Tortue project, and drilling at Winterfell is planned to begin next quarter”. I think what many investors are hoping is to see a strong amount of cash flows being generated from the project, which would be a big catalyst for the stock price, something which it currently seems to need as it’s in a downward spiral the last few months.

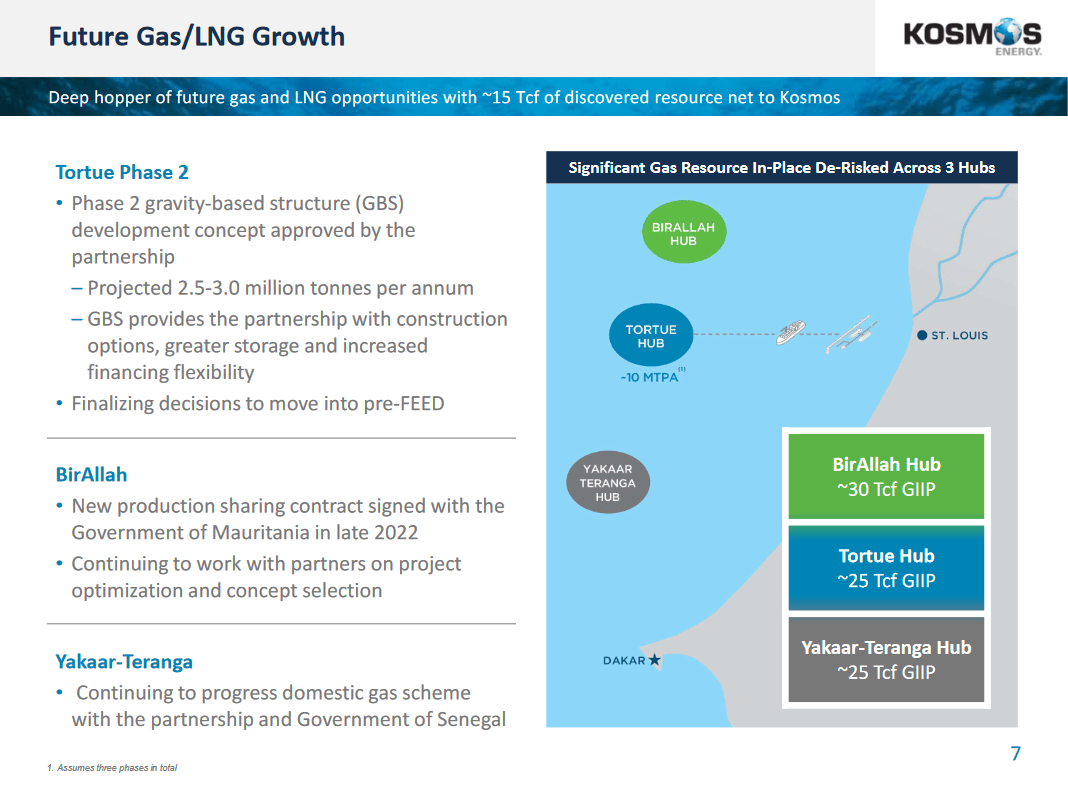

Market Position (Investor Presentation)

KOS remains very positive on the outlook for LNG and its potential. As for the Tortue Phase 2, it’s projected to generate between 2.5 – 3.0 million tonnes per annum, becoming a major source of revenue for the company eventually. KOS has developed strong relationships with the countries that they operate from and this has helped them secure gas scheme progression, and they partner with the Government of Senegal.

Risks

Looking at the risk with KOS right now, I think the lack of cash flows is the most prominent one. It hasn’t stopped the progression of any of its projects, but it does present risk to investors. Levered FCF was positive in 2022 with $84 million, but has in the TTM taken a decline to negative $234 million instead. The management sees the strongest progression of FCF being in Q3 2023 as a prediction in the Jubilee is being significantly increased. But for me, the risk of delays is certainly there.

Apart from the cash flows and the consistency I’d like to see from them, I view the dilution of shares over the last few years as a significant risk factor. Since the lows of 2020 for the share price, the shares outstanding have increased by over 12%. This hasn’t affected the appreciation of inventors that bought at those lows, but with a history of dilution, I think it will continue to happen until there are clear and consistent cash flows generated from the projects the company has underway.

Financials

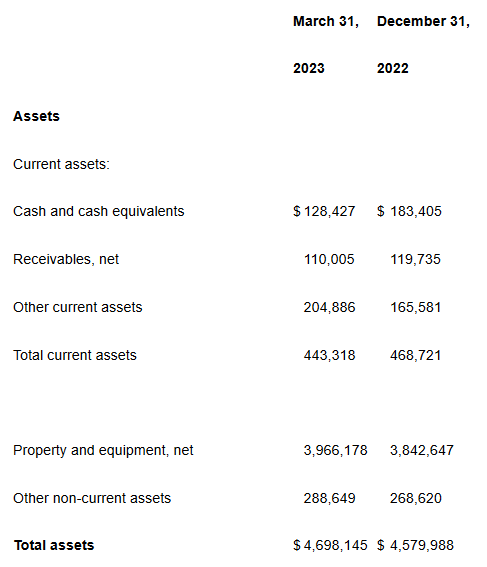

As for the balance sheet of KOS, they have decreased their cash position by over 30% on a QoQ, which is quite volatile, even for smaller companies. But the overall total assets have grown on a QoQ, primarily driven by the value of property and equipment increasing. Now sitting at $3.9 billion.

Balance Sheet (Earnings Report) Balance Sheet (Earnings Report)

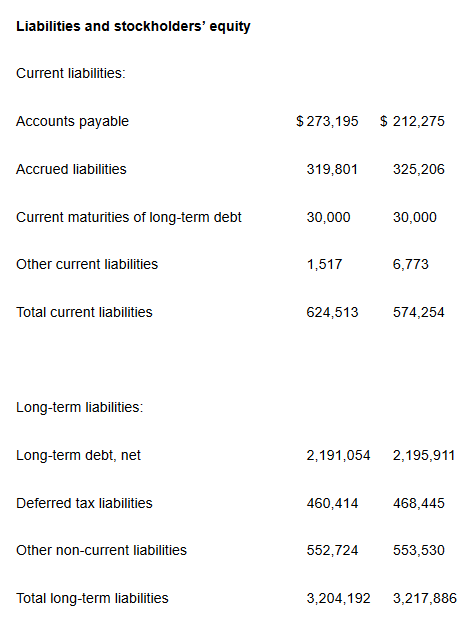

As for the liabilities of KOS, it’s nice to see the long-term debts decreasing at a steady rate. This means that KOS has a net debt/EBITDA ratio of around 2.2 right now, which is decent. It’s under the preferred threshold of 3. But it still leaves a lot of room for improvement. However, I don’t think we will see a significant decrease in the debts until KOS has strong cash flows generated for their projects.

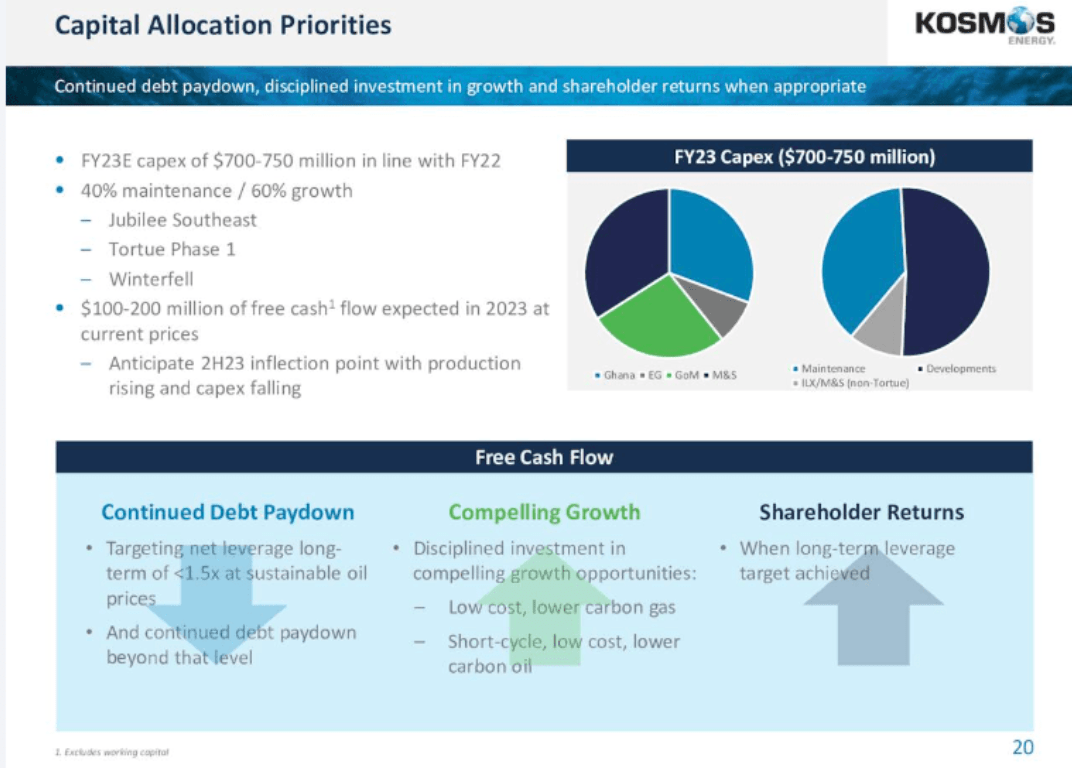

Capital Allocations (Investor Presentation)

KOS has strong priorities though, I have to admit, regarding where they are putting capital to use. They see a large amount of debt as a challenge they need to tackle and lower. This would set them up in a very strong position for the long term to disturb and divert further capital to shareholders through either buybacks or dividends.

Final Words

I think that Kosmos Energy Ltd has some very interesting projects underway right now that are playing on current demand, LNG for notable. The rising need to find better energy sources is creating a solid market for KOS to be a part of. The strong progression they have had on some of their projects is making the management very positive about the future outlook, with expectations for positive cash flows in the second half of 2023, a result of stronger production levels from their Jubilee region.

But I think for me, I’d like to see more positive cash flows before investing. That would help me value more accurately how much could be diverted to buybacks and dividends, for example, which is where I see the value in KOS right now. They are trading a bit under the sector at an FWD P/E of around 7, and I don’t think there is enough risk here to make a sell case. This leads me to rate KOS a hold for now.

Read the full article here