Japan’s leading agriculture machinery producer, Kubota (OTCPK:KUBTY), has defied expectations this year, with the stock extending its outperformance since I last covered the name on the back of a weak yen and resilient end-markets in Asia (mainly rice farming) and North America (dry-field farming). The mid-term plan to capitalize on the agricultural mechanization trend overseas, particularly in the high-growth Indian and Southeast Asian markets, also remains compelling.

Yet, the near-term headwinds are material, not only due to the extended monetary tightening globally but also seasonally unfavorable weather trends (e.g., the droughts in Thailand in fiscal Q2). Management may have hiked its full-year guidance, but a closer look indicates the delta was largely down to non-recurring factors such as FX depreciation and a cyclical downturn in logistics costs. More fundamentally, Kubota’s lowered volume and pricing assumptions in this year’s guide indicate weaker pricing power and a persistent inventory problem in North America.

Ahead of a new R&D and capex cycle, triggered by the company investing behind its ambitious mid-term expansion targets, these headwinds leave limited safety margin at a time when corporate Japan is also seeing ‘stickier’ inflationary wage pressures. For a company that will probably maintain flat earnings growth through 2025, the stock’s low-teens earnings multiple seems a tad pricey here.

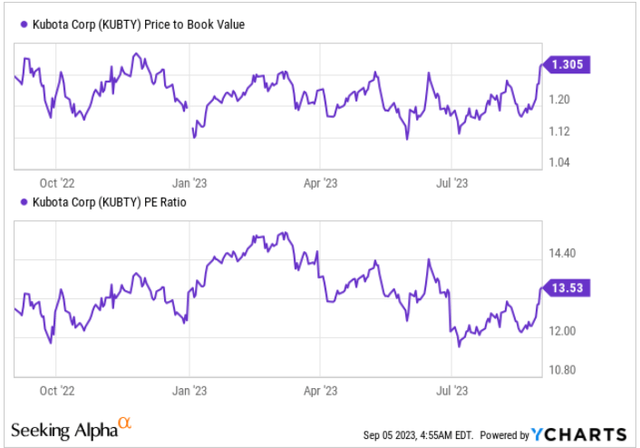

YCharts

Still Riding on the Upcycle, but Cracks Are Emerging

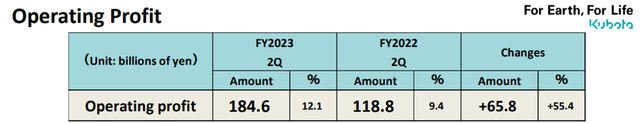

Another quarter of strong machinery growth led to Kubota’s operating profit to date outperforming expectations at JPY184.6bn (up 55% YoY). Leading the way was machinery sales in North America, as resilient construction equipment demand (albeit due to backlog clearing) outweighed inventory concerns heading into the print. That said, management also cited issues in small-scale tractors, where elevated inventory levels are now materializing alongside a broader housing market decline. Still, management deserves credit for realizing higher average selling prices in the meantime. Alongside the large profit boost from yen depreciation relative to the dollar, North America remains the company’s key profit generator.

Kubota

In Asia, where the mid-term expansion strategy is focused, the drag from weather-related headwinds led to a top-line contraction in its main market, Thailand. China was, as expected, also down, although the company isn’t yet seeing the knock-on impact of the country’s property troubles just yet. The bright spot was India, which continues to defy monsoon concerns, with management citing ‘good yields’ this spring season. The FX benefit in Asia hasn’t offered as much of a tailwind (emerging Asian currencies have also depreciated vs. the USD), though lower wage pressure in the region likely contributed to the more benign staff and input cost inflation in fiscal Q2.

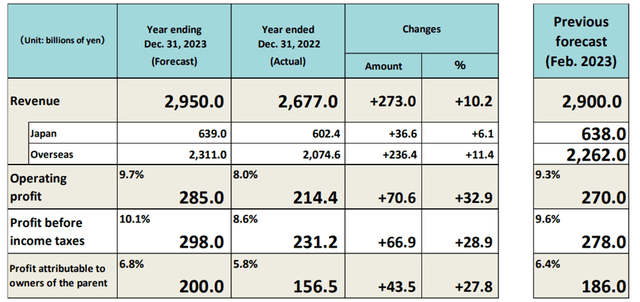

Not Enough Buffer in the Guidance Raise

Building on the robust fiscal Q2 result, management upgraded its 2023 guidance across the board. Most of the delta was, however, down to a boost from yen depreciation rather than fundamental strength. For context, Kubota had (rightly) assumed a lower USD/JPY at the start of the year (i.e., a stronger yen), but with the BoJ, under new governor Ueda, still lagging the Fed by a wide margin on policy normalization, a weaker yen assumption through year-end makes sense here.

Kubota

On the other hand, management expecting a limited input cost inflation impact doesn’t seem quite as conservative. And while volume and pricing forecasts were lowered slightly, Kubota still expects resilience in the US construction equipment market (“expected to continue to perform well”) to allow for more price hikes. By comparison, domestic peer Komatsu (OTCPK:KMTUY) has revised its demand outlook lower (now at a 5–10% decline), citing no signs of a demand upturn in North America. Readthroughs from the rest of the Japanese machinery space also reinforce the notion that inventories are high right now in the region. For Kubota, any downside to expected profits could also have knock-on effects for its upcoming R&D and capex cycle, limiting the company’s pace of overseas expansion (and, by extension, earnings growth).

All Eyes on the Downsized Buyback

Also worth watching is the capital return – along with the rest of Japanese large-caps, Kubota has come under pressure for governance reforms from the Tokyo Stock Exchange this year. Kubota has since responded with more share buyback activity (JPY20bn through fiscal Q2) before more recently following up with a smaller JPY10bn buyback authorization (despite negative free cash generation in H1 2023).

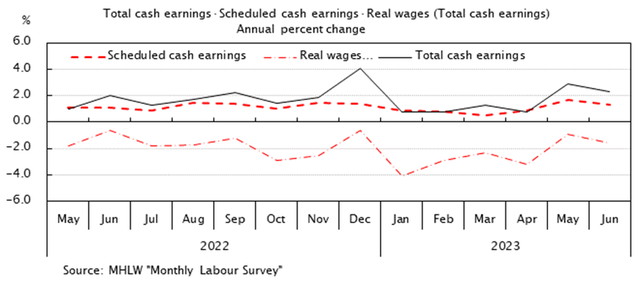

Given the relatively high short interest in Kubota, the smaller second buyback announcement might be disappointing to some investors. But following the significant re-rating in Kubota stock this year (along with the broader TOPIX constituents), management is being rightfully prudent, in my view. It might also reflect some P&L caution – this year’s wage negotiations in Japan have seen uncharacteristically high pay increases, as reflected in the monthly labor survey (+2.3% YoY monthly cash earnings growth).

Japan Institute for Labour Policy and Training

More Risk than Reward as the Cycle Turns

There’s an exciting mid-term growth story unfolding at Kubota, particularly in high-growth geographies like India and Southeast Asia. But for now, it’s hard to look past the headwinds across its key construction equipment markets as the effects of monetary tightening start to bite. While Kubota is perhaps better off given its relatively low China exposure, its ties to the North American residential end-market remain an area of concern, with management already guiding to elevated inventory levels here. The company’s Asian growth engines are also set to stall, albeit temporarily, as seasonal weather-related headwinds hit Southeast/South Asia.

Having upgraded its full-year guidance in fiscal Q2 on expectations of further yen depreciation benefits, I don’t think management has embedded enough buffer here. Going forward, keep a close eye on volume and pricing trends in North America, along with wage pressures domestically. Any shortfalls here could drive downside to current P&L expectations and potentially even delays to planned spending for its mid-term expansion. The stock isn’t cheap either at the current low-teens P/E (~30% premium to book); pending a meaningful valuation reset, I remain on hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here