American denim giant Levi Strauss & Co (NYSE:LEVI) faces a challenging near term outlook but longer-term prospects suggest cautious optimism. Currently trading at an attractive valuation, the shares could be worth a look for long term investors.

Background

LS&Co has had a challenging year so far with revenues down by the low single digits for 1H 2023 compared with the same period last year. Despite price hikes, margins have come under pressure as well with 1H gross margins dropping to 57% from 58.8% the same period last year. The company swung to a loss of $1.6 million during its most recent quarter, compared to a net profit of $49.8 million the same quarter last year. Net profits for 1H 2023 is roughly half compared with net profits from the same period last year. Free cash flows for 1H 2023, has turned negative, compared with a positive FCF of $22 million the same period last year.

Weak demand environment, margin pressure, excess inventory suggest challenging near term prospects

Near term prospects are challenging. On the revenue side, a weak wholesale segment (which accounts for 62% of revenues) is largely leading to the company’s top-line deceleration as budget conscious consumers trade down or skip purchases altogether.

Although inventory levels have been declining sequentially, Levi Strauss’ inventory levels remain quite high and a weak demand environment could necessitate heavy promotions near term to move inventory, crimping margins in the process. The company already warned of weak margins for FY2023 due to rising costs and promotional activity to attract price-conscious buyers.

Weaker than expected performance for the first half of FY2023 prompted management to downgrade their outlook with full year revenues expected to rise between 1.5%-2.5%, (down from 1.5%-3% previously) – weak but comparable to rivals like Kontoor Brands (KTB) which expects revenues to grow in the low single digits for FY2023.

Adjusted diluted EPS was also lowered from $1.30-$1.40 to $1.10-$1.20 for FY2023.

eCommerce penetration, Asia expansion, DTC focus support medium term outlook

Looking further ahead, there are reasons to be optimistic about the company’s prospects. Management is aiming for 6%-8% revenue growth over the longer term with the ultimate aim of reaching revenues of $9 billion – $10 billion (from $6.1 billion currently), and deliver ROIC of over 23% long term, which may be achievable driven by the company’s strategic efforts around eCommerce expansion, DTC efforts and Asia expansion.

Increasing eCommerce penetration to support revenue growth

eCommerce currently accounts for less than 10% of LS&Co’s revenues but there is tremendous room for growth along with growing interest in online shopping worldwide; eCommerce currently accounts for less than a fifth of global denim jeans sales but this share is expected to grow. LS&Co which derives over 60% of sales from denim bottoms, is taking steps to strengthen their eCommerce capabilities from hiring a new chief digital officer, leveraging AI to boost eCommerce fulfillment, and exploring new online sales channels such as live shopping (or livestream eCommerce). Livestream shopping has higher conversion rates, and this particular sales channel is currently underpenetrated in some of LS&Co’s biggest markets; in the U.S., part of LS&Co’s Americas segment which generates more than half of total sales, livestream eCommerce is projected to triple in size between 2021-2023 and continue growing, accounting for over 5% of eCommerce sales in the U.S. by 2026 compared with 10% in China currently.

Higher-margin DTC business could support margins, profitability, and support brand pricing power

Levi Strausss’ DTC (direct to consumer) business, which comprises the company’s offline and online retailing operations directly operated by the company, currently accounts for just over 40% of revenues, but its share is growing fast along with the segment’s rapid growth; for the full year of 2022, Levi Strauss’s DTC sales rose 18% globally, driven by a 19% increase in owned-stores and a high single digit increase in online channels. LS&Co’s DTC expansion efforts which include increasing its owned-store footprint worldwide as well as eCommerce could support this growth momentum. DTC is a higher-margin business largely owing to a relatively higher-value product mix (in contrast to wholesale products which tend to cater to price conscious buyers), and a greater share of DTC sales could be a positive for margins and profitability longer term. Going by Nike’s success with DTC, a greater focus on DTC should have the added benefit of improving customer experience, notably with Gen-Z and millennial shoppers, which could support brand loyalty and pricing power longer term.

Asia expansion a potentially significant growth driver

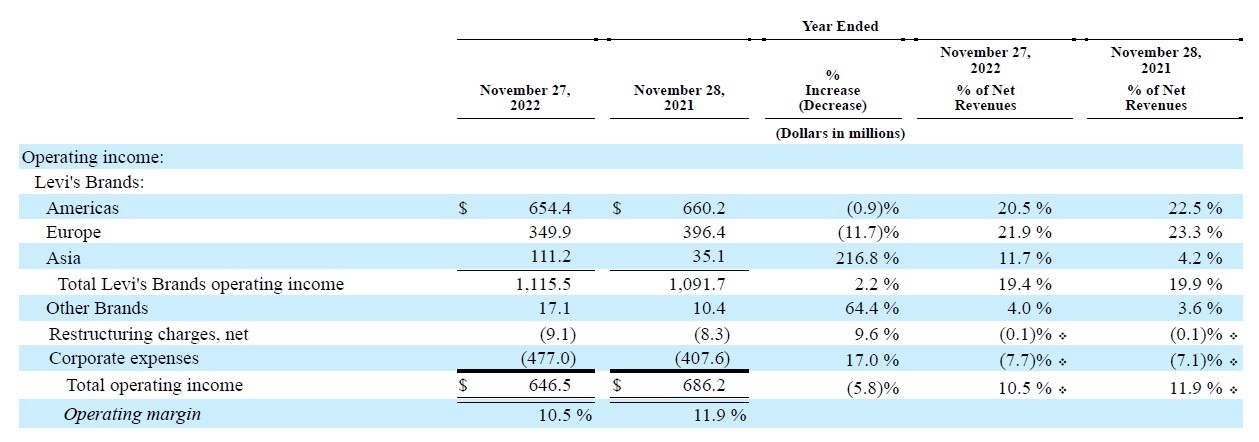

Asia currently accounts for less than a fifth of revenues but it is among the fastest-growing regions. For FY2022, Levi’s Asia segment grew 14% YoY, the fastest-growing major region and the momentum continued in FY2023 with revenues up 18% YoY in Q2 2023 and 12% YoY in Q1 2023. LS&Co was busy opening stores in Asia last year, and the company’s 2023 expansion strategy also focuses on Asia, notably India where LS&Co is enjoying robust growth; LS&Co’s India revenues rose 58% YoY to INR 10 billion (approximately $120 million or just around 2% of total revenues) in FY2022 and with the country’s denim market projected to grow in the high single digits over the coming years, outpacing the global denim market which is projected to grow in the low-mid single digits, prospects are bright. LS&Co’s Asia business carries a relatively lower profit margin compared to other segments but profitability has been improving and could further improve along with expansion as fixed costs spread over a wider revenue base.

Levi Strauss & Co, 10-K, FY2022

Risks

Weaker than anticipated consumer spend could impact near term cash flows, putting dividend at risk

Levi’s currently has relatively high inventory levels and they have so far continued to trend upwards over the past few quarters. If the company struggles to liquidate inventory due to weaker than expected consumer spend, cash flows could be impacted, potentially forcing the company to cut the dividend. The company’s cumulative FCF is roughly negative $61 million for the first two quarters of 2023. Last year’s dividend payment amounted to $174 million. They would need to generate over $200 million in free cash flows over the remaining two quarters to be able to maintain that dividend which is not impossible but may be an uphill climb given current macro conditions. For perspective, FCF during the second half of 2021 (a strong year for LS&Co driven by stimulus and increased savings which drove higher consumer spend) amounted to over $300 million.

In addition, the possibility of an erosion of brand equity (which can take years to rebuild) due to excess discounting and promotional activity cannot be ruled out.

Competitive risks

With low barriers to entry, long term competitive risks in the apparel industry are significant which could limit the company’s long term financial performance. Competitive pressures are high in key growth markets such as India and China which have strong competitors both domestic and international. Over in China where the market is fragmented and highly competitive, LS&Co competes against brands like Guess, and Japan’s Evisu along with a steady stream of new entrants including True Religion and Wrangler. Meanwhile India’s competitive landscape features strong local startups like Freakins and High Star, as well as overseas players like. Lee, Wrangler, Celio and Pepe Jeans.

Conclusion

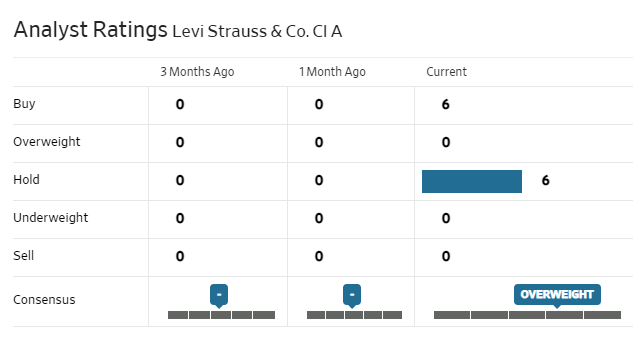

Levi Strauss has a moderate buy analyst consensus rating.

WSJ

LS&Co is currently facing near term headwinds but their long term prospects are more optimistic provided execution remains decent. Assuming a long term revenue growth of roughly 5% (based on 11% growth in Asia, 5% growth in the Americas, 1% growth in Europe, and 3% growth for other brands), a conservative operating margin of roughly 10% gradually rising to 11.2% to account for the possible margin improvement due to increasing DTC focus as well as their expanding Asia business, neutral working capital, depreciation of 2% of revenues, CAPEX of roughly 4% of revenues, and a WACC of 8%, LS&Co’s fair value amounts to around $7.5 billion, significantly more than the $5.7 billion market value today.

On a relative valuation basis, LS&Co’s forward P/E of 12.7, is lower than the sector median of 15.7, and considerably lower than LS&Co’s 5-year average of 24.

The stock could be viewed as a buy for long term investors willing to tolerate the risks.

Read the full article here