The Lucid stock (NASDAQ:LCID) has been on a consistent downtrend since the summer, as investors respond to an increasingly uncertain fundamental outlook blighted by rising capital costs and a waning EV demand environment. Despite Lucid’s best-in-class technology, its prospects for monetization remain limited as affordability challenges grow on the consumer, while the company’s commercial licensing opportunities remain in the early stages of adoption.

And these challenges have become increasingly prevalent in Lucid’s Q3 earnings results. The stock’s slight uptrend observed earlier this month following the seemingly dovish Fed pause and moderating benchmark Treasury yield has been largely erased after the company’s demand and production ramp-up struggles come back into focus. Specifically, investors’ confidence had taken a hit after Lucid downward revised its full year production guidance from 10,000 vehicles to between 8,000 vehicles and 8,500 vehicles to “prudently align with deliveries”. Taken together, we expect elevated return-on-capital compression headwinds for Lucid with limited visibility into its trajectory to building scale in core vehicle sales, which could keep the stock from incremental gains over the near-term.

Topline Compression

Lucid reported deliveries of 1,457 vehicles during Q3, which represented a slight sequential improvement, though remains insufficient to assuage investors’ concerns of demand risks. This was evident in the stock’s subsequent landslide after Lucid announced its quarterly delivery and production volumes in mid-October, reflecting investors’ waning confidence in Lucid’s ability to overcome the demand challenges resulting from both industrywide and company-specific factors.

Specifically, demand risks have ballooned for Lucid in recent quarters, blighted by the combination of macroeconomic uncertainties on consumer affordability, rising competition in the EV industry, and limited brand awareness within its niche premium market. While management had acknowledged budding challenges with growing Lucid’s brand awareness and selling vehicles earlier this year, the modest progress has been met with the emergence of incremental headwinds that have made the company’s demand outlook more dire:

Pricing challenge: As discussed in our previous coverage, Lucid has reinstated its original pricing program during Q3 for its Air sedan line-up – likely in response to the industrywide price war implemented by automakers this year to push volumes. While management had previously stated that the decision has resulted in a 3x increase in orders, the modest pickup in Q3 deliveries underscores a tepid demand environment for Lucid’s vehicles still.

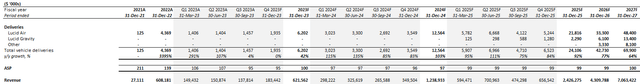

Lucid’s vehicle ASP has also been on a gradual decline in recent quarters, now settling below the $100,000 range after completing the limited production run on the Air Dream top-trim variant, reinstating its original pricing program, and the introduction of lower-priced trims. This continues to highlight Lucid’s struggles in building momentum within its premium niche market, as buyers lean towards the lower-priced trim levels that have continued to weigh on its ASP and, inadvertently, profit margins. Paired with the latest introduction of limited time holiday discounts of as much as 9% across the Air sedan line-up, as well as the introduction of the lowest-priced Air Pure RWD variant into the mix, we expect further ASP compression heading into Q4 while Lucid simultaneously struggles with ramping volumes.

Rising competition: In addition to pricing challenges, Lucid also faces stiffening competition within the EV industry. While EV sales have largely outperformed broader auto market sales this year, the pace of growth has been slowing. In addition to the macroeconomic impact on affordability, the slowing pace of EV sales growth is likely reflective of normalizing demand from early adopters – particularly those who are more affluent with greater discretionary spending power (essentially Lucid’s target end market).

Specifically, Q3 EV sales grew 6% q/q, decelerating from 14% q/q observed in Q2. Paired with the ongoing ramp of new model productions across both EV pureplays and legacy OEMs, the industry is starting to see ballooning inventory levels – automakers reported an average of 88 days’ inventory for EVs, outpacing the average of about 43 days for all passenger vehicle types in September and the historical average of about 80 days. This highlights the potential requirement for further price cuts at Lucid within the foreseeable future to push volumes amid intensifying competition and softening market demand. As a result, Lucid’s valuation prospects see limited respite in the near-term, given fundamental estimates are likely to come down as a result of the impending adverse changes to its prices and sales mix.

Consumer weakness: Lucid’s premium offering is also selling into a weakening consumer spending backdrop as financing costs surge while inflationary pressures persist. This is corroborated by the company’s limited progress made to shoring up delivery volumes, despite the reinstatement of its original pricing program for the Air sedans, which has led to the slashed production guidance for full year 2023. Tightening financial conditions have accordingly squeezed consumers’ discretionary spending power, limiting prospects for big ticket purchase decisions in the near-term.

Specifically, household savings are consistently falling below pre-pandemic levels as they succumb to persistent inflationary pressures and surging borrowing costs. Meanwhile, consumer debt delinquency rates are also on a gradual upsurge. Consumer confidence has also dropped to a “five-month low in October”, with many dialling back on plans to “buy a car, a home or major appliances” as a result of ongoing macroeconomic uncertainties. As demand from the more affluent early EV adopters start to normalize, while the mass market consumer struggles from increasing affordability challenges, Lucid remains vulnerable to an adverse combination of buying trends from its target end-market.

Meanwhile, outside of its core U.S. market, Lucid’s Saudi Arabia volumes are also likely to remain modest and offer limited respite to its topline progress this year. The company has only recently announced start of productions (“SOP”) at AMP-2 in Saudi Arabia. Despite an initial annual production capacity of 5,000 vehicles, output volumes at AMP-2 are likely to remain a limited contribution to Lucid’s full year target for 10,000 vehicles. This is further corroborated by shipments of only about 700 semi knocked-down (“SDK”) vehicle kits in transit during Q3 for final assembly at AMP-2.

And aside from core vehicle sales, the adjacent revenue stream stemming from technology licensing has also yet to materialize into anything meaningful for Lucid’s topline growth. Demand on this adjacent offering is likely to remain limited, as automakers are expected to adopt a “wait-and-see” approach on how the Aston Martin partnership will play out. Coupled with the measured investment cycle among automakers this year, Lucid is unlikely to benefit from a meaningful ramp on commercial technology licensing opportunities ahead.

Ramp Up Cost Challenges

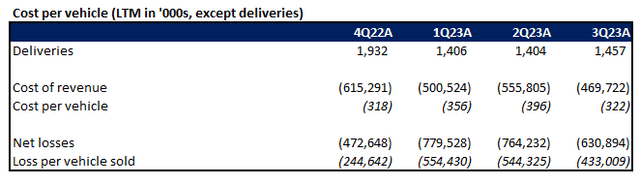

In addition to topline compression challenges, Lucid also faces an inevitable widening of losses in the near-term as production ramp up costs mount. The company has already been consistently struggling with scaling productions, which is evident in the declining pace of output volumes as well as the nominal reductions observed in cost per vehicle sold in recent quarters.

Data from ir.lucidmotors.com

Lucid has only produced about 6,000 vehicles in the first nine months of the year, leaving it about 4,000 vehicles out from its full year production target. Specifically, management has attributed the substantial -29% sequential decline in Q3 production volumes to the allocation of capacity towards building SKD vehicle kits for final assembly in AMP-2, as well as the early-stage ramp up of the newly introduced Air Pure RWD and Air Sapphire trims.

In addition to heightened execution risks on its full year production target, the situation also highlights the mounting ramp up cost challenges for Lucid, as it presses forward with the simultaneous production of multiple vehicle variants and products. The company is also expected to bear incremental production costs coming out of the early stages of manufacturing at AMP-2 within the near-term. This is in line with the elevated spending trends observed during the early stages of SOP at AMP-1 in Casa Grande, and consistent with ramp up cost challenges experienced at even the most experienced volume manufacturers such as Tesla (TSLA) at its newest Berlin and Texas factories last year.

AMP-2’s SOP is also expected to levy incremental transportation expenses for Lucid as it continues to ship SKD vehicle kits overseas for final assembly. Take the Drewry World Container Index, for instance, which tracks global container shipping costs and can be a proxy for Lucid’s SKD vehicle kit transportation costs depending on the freight type used (e.g. roll-on/roll-off shipping typically used for fully assembled vehicles). Despite the declining trend over the last 12 months as pandemic-era constraints start to ease, container shipping costs have seen steep spikes over the same period. As a result, the production strategy for AMP-2 is expected to keep Lucid exposed to volatile freight costs in the near-term as industry continues to adjust to fluctuating inflationary pressures.

Meanwhile, Lucid’s opex spend is likely to stay elevated as well. In addition to increasing R&D costs attributable to the upcoming Gravity SUV, sales and marketing expenses are also likely to see an incremental boost in the current period as Lucid prepares for the new model’s impending launch event slated for later this month. Taken together, Lucid’s cost situation underscores pressing urgency to ramp productions and sales before any accretive value attributable to its competitive technology advantage can be realized into upside potential for the stock.

Fundamental and Valuation Considerations

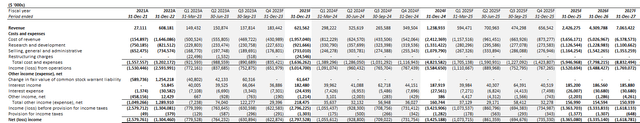

Adjusting our previous forecast for Lucid’s actual Q3 performance, we expect full year 2023 revenue to expand 2% y/y to $621.6 million driven by deliveries of about 6,200 vehicles (+42% y/y). The substantial lag anticipated between revenue and delivery growth in 2023 will be primarily attributable to the introduction of lower-priced trims in recent quarters that have likely dominated the sales mix, as well as the reinstatement of Lucid’s original pricing program for the Air sedans based on the substantial pace of ASP decline observed in Q3.

We expect any upcoming improvements to Lucid’s production ramp-up to be offset by company-specific and industrywide challenges to price/mix in the near-term as discussed in the foregoing analysis. This is likely to translate into a modest topline leverage at Lucid relative to delivery volumes through the first half of 2024, with potential alleviation approaching mid-decade ensuing from the anticipated ramp-up of Saudi Arabia volumes alongside the Gravity SUV which caters to the best-selling passenger vehicle segment.

Author

On the cost front, we expect costs of vehicle sales and operating expenses to stay elevated in the near-term as a result of incremental AMP-2 ramp-up costs, as well as Gravity development costs. This is expected to drive widening losses through the first half of 2025 before anticipated operating leverage improvements start to kick-in in the latter half of mid-decade as volumes start to scale more meaningfully.

Author

Lucid_-_Forecasted_Financial_Information.pdf

Given Lucid’s dour near-term fundamental prospects, we expect the stock to stay susceptible to multiple compression risks stemming from rising capital costs and, inadvertently, a narrowing return-on-capital spread. Investors are also likely to price in an incremental execution risk premium in the stock, as Lucid downward revises its full year 2023 production target by as much as 20%, while also dealing with multiple ramp-up challenges spanning multi-variant vehicle productions as well as SOP at AMP-2.

Author

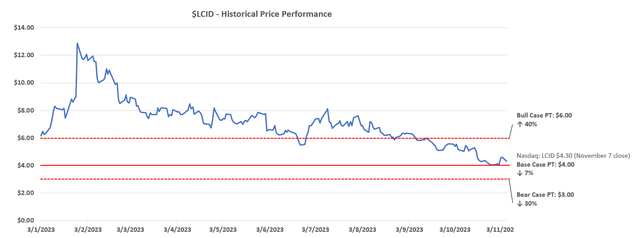

We are revising our base case price target from the previous $5 to $4 to reflect the elevated equity risk premium relative to the higher normalized risk-free rate environment, as well as Lucid’s dour growth prospects coming out of a tepid Q3. The price is computed by applying a 2.5x multiple on projected 2025 sales, in line with the average observed across Lucid’s comparable EV pureplay peers in early stages of production ramp-up. Given limited visibility into Lucid’s longer-term capital structure and cash flow prospects, we believe the multiple-based valuation approach is more applicable than the discounted cash flow valuation approach in determining the stock’s estimated intrinsic value. The multiple-based approach is also a better reflection of the broader market sentiment on the slowing pace of growth and rising capital costs observed across the EV industry, as well as investors’ confidence in Lucid’s prospects in our opinion.

Final Thoughts

Admittedly, Lucid holds one of the most competitive technologies in the EV industry, with its proprietary powertrain boasting best-in-class range capabilities relative to competing offerings. This has been one of the stock’s biggest upside drivers during its heydays, as its range crown effectively addresses one of the biggest roadblocks to EV adoption. Yet Lucid’s premium pricing and limited brand awareness, exacerbated by deteriorating macroeconomic conditions, have also dialled up its exposure to another key barrier to demand – namely, affordability. Meanwhile, Lucid’s elevated vehicle production cost structure in the near-term also leaves it with a nominal margin for achieving price competitiveness against rivals like Tesla. Until Lucid is able to deliver on consistent positive progress in scaling productions and ramping up demand for its products, the stock will continue to struggle with realizing pent-up value attributable to the company’s competitive technology advantage.

Read the full article here