Last week, Lumen Technologies (NYSE:LUMN) announced their second quarter earnings. The telecommunications company is pursuing a transition away from legacy telecom assets into more modern hardware and services. While the market reacted with heavy selling of the company shares, a deep dive into Lumen’s financial results shows that the company is still outperforming its own estimates.

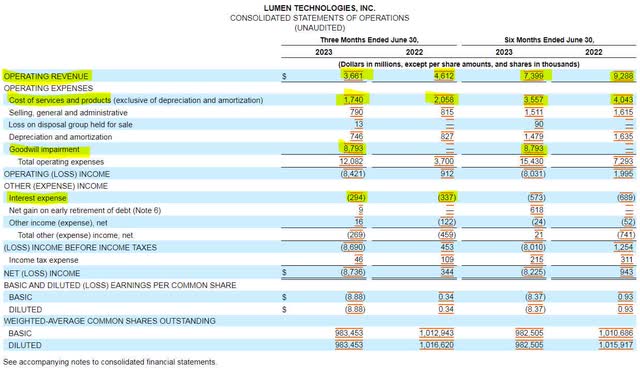

The first look at Lumen Technologies’ income statement can put a good shock into investors. The company recorded an operating loss of $8.4 billion in the second quarter, on nearly $1 billion less revenue than the same quarter a year ago. The entire operating loss was due to a goodwill impairment charge of $8.8 billion. Without the impairment charge, the operating loss would have been a gain of $370 million, which is still $500 million lower than the same quarter a year ago.

SEC 10-Q

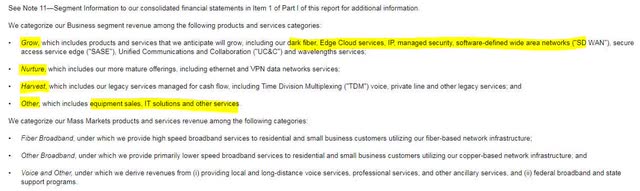

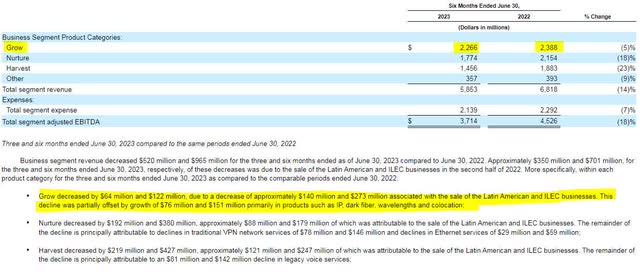

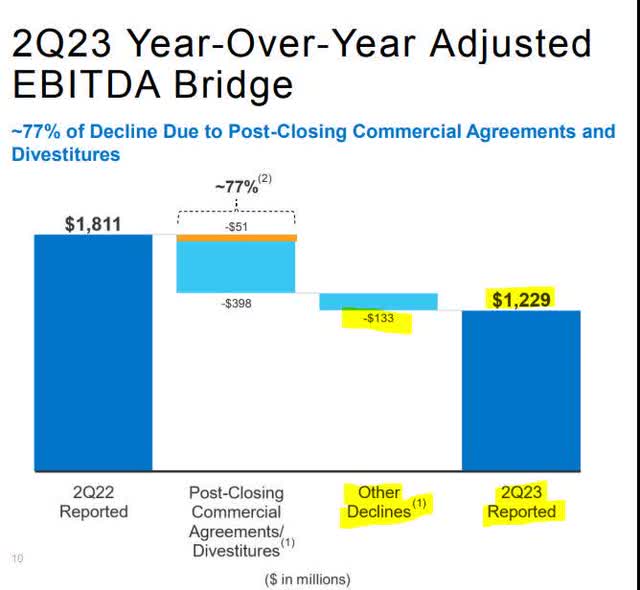

Prior to panicking, investors need to look at how the company is treating revenue through its transformation process. Earlier this year, Lumen divided its revenue into four product and service categories; grow, nurture, harvest, and other. The company is committed to focusing on the growth segment of the business and despite declining 5% year over year, all of the decline was due to the sale of the ILEC business segment. In fact, 72% of the revenue decline and 77% of the EBITDA decline was due directly to the divestiture of assets.

SEC 10-Q

SEC 10-Q

Earnings Presentation

Earnings Presentation

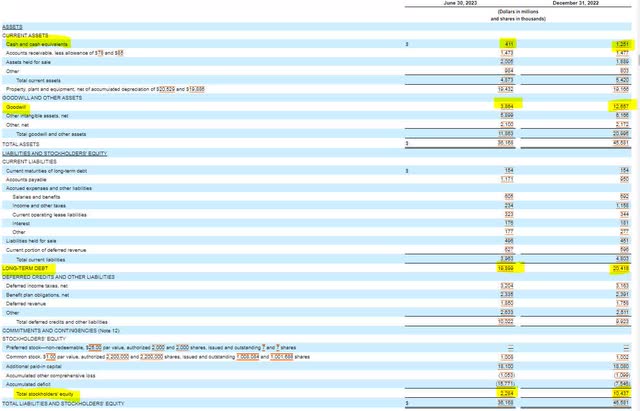

The company’s balance sheet saw the most adverse change during the second quarter. Lumen’s decision to write off nearly $8.8 billion in goodwill (impairment) led to a massive drop in assets and equity. Despite the huge drop in shareholder equity of $8.2 billion year to date, equity has increased by nearly $650 million this year if excluding the goodwill impairment. It’s important for debt investors to note that the value of the physical assets is drawing closer to the value of long-term debt in the event of a recovery situation.

SEC 10-Q

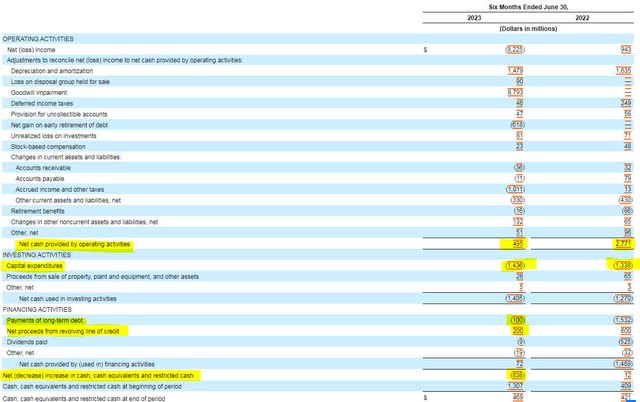

Lumen’s cash flow statement also showed a stark change compared to last year. After posting free cash flow of $1.4 billion in the first six months of 2022, free cash flow was negative $940 million for the first half of this year. The main driver behind the cash flow burn was the $938 million income tax payment made for divestitures last year. If excluding special tax payments, free cash flow is $0 year to date, which is on the bottom end of the company’s guidance.

SEC 10-Q

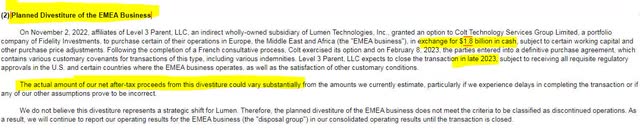

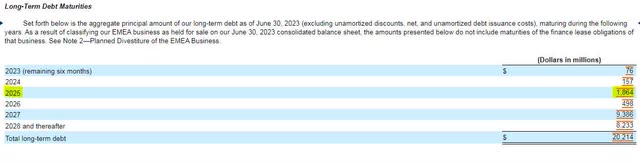

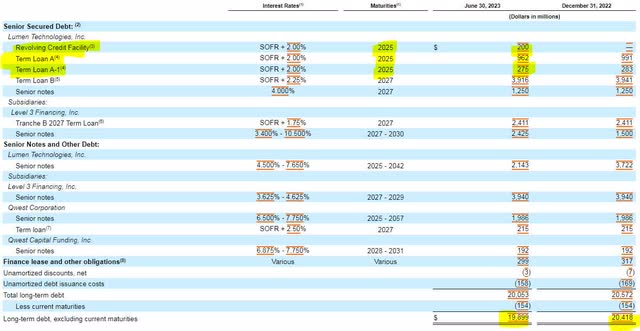

Lumen is planning another divestiture that it hopes to close this year. Late last year, the company announced the sale of its EMEA business for approximately $1.8 billion in cash. The proceeds of the EMEA deal should be enough to cover debt maturities through 2025, although the EMEA transaction’s tax estimates are currently unknown. It’s important to note that a majority of Lumen’s 2025 maturing debt is senior to publicly traded unsecured debt. Should Lumen be forced to pay these loans off (due to an inability to refinance or by choice), it will actually enhance the value of the company’s unsecured debt.

SEC 10-Q

SEC 10-Q

SEC 10-Q

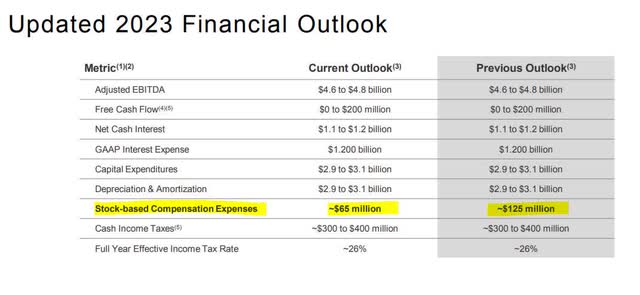

Despite big drops in revenue and EBITDA, management remains steadfast in its turnaround plan. For the full year 2023, Lumen management reaffirmed its guidance, only dropping the expenses related to stock based compensation. This makes sense when comparing the year to date financial results with the detailed guidance provided in June during the company’s Investor Day. While current revenue trends are slightly below guidance, EBITDA is currently projected to drop 10% this year, outperforming a 13% drop from management guidance.

SEC 10-Q

Investor Day Presentation & Earnings Results

Investor Day Presentation & Earnings Results

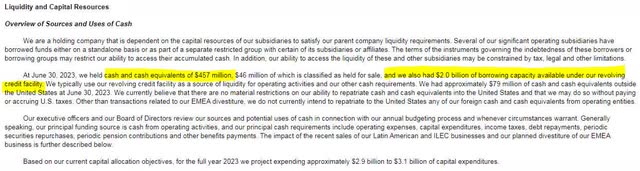

In addition to generating the cash needed to fund debt maturities through 2025 with the sale of the EMEA business, Lumen has an additional $2.4 billion in liquidity that is composed of $400 million in cash and $2 billion revolver capacity that it can tap into. While the company does not need to tap into the revolver at this time, it could become useful if the mitigation of lead based copper becomes a real issue, which Lumen acknowledged in its 10-Q, but stated the financial impacts, if any, remain largely unknown.

SEC 10-Q

SEC 10-Q

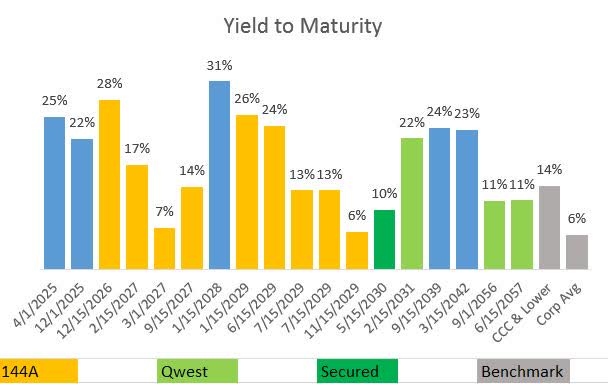

From an investment standpoint, I think investors should look at either the 2025 bonds or the 2039/2042 bonds. The 2025 bonds mature in 20 months and offer an annualized yield to maturity of 25%. With the liquidity to cover near term debts, the April 2025 maturing bond seems to be the safest. For those who believe in Lumen for the long run, the 2039 and 2042 bonds offer the least capital to enter, with notes trading at around 34 cents on the dollar for each and annualized returns similar to the 2025 notes.

FINRA

Lumen’s second quarter financial results weren’t pretty, but management warned us that we would be digesting some ugly numbers through the end of 2024. The unknowns of lead copper line liability and EMEA divestiture taxes make an equity investment very risky. Investors need to watch the next six quarters of financial results to look for revenue stabilization and examine any updates in management’s guidance. Until then, I’m continuing to hold my long-term Lumen debt.

Read the full article here