Magic Software (NASDAQ:MGIC) is a company we’ve been following for some time as a part of the pretty compellingly valued Asseco Group (OTCPK:ASOZF). The situation in the last quarter was that a strong dollar was making its international revenues less punchy, but less high tech exposure and exposure to lower-hanging fruit in cloud migration and integration kept them healthy, although things were slowing down at the beginning of the year. They were playing hardball on M&A, and this probably hasn’t worked out for them given market evolutions. Finally, we see less pressure in the next few quarters from labour inflation on the professional services business, but there has been general SG&A inflation that hurt results. We think that certainty in the markets may increase deal velocity for MGIC, and the valuation is looking a little lower these days too. Leaning towards a buy.

Key Q1 Points

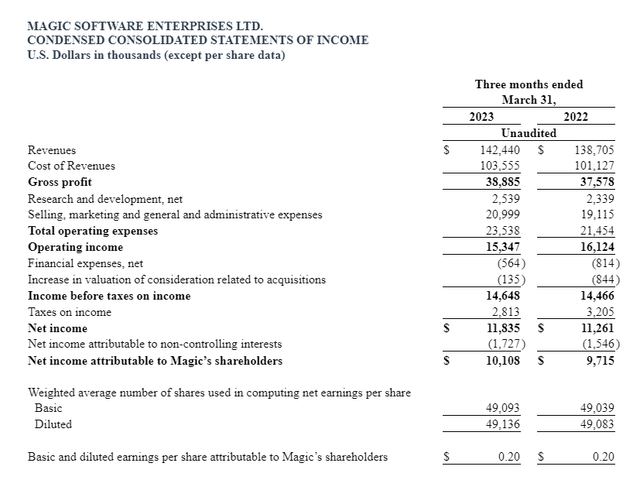

The last quarter showed some certain performance elements that are important to track. The first thing was the gross margin was actually solid, despite increased professional services in the mix by one point. These are lower margin segments, but incremental inflation for employing professionals hasn’t continued in a way that has hurt results. Gross margin actually grew, driven by sales in the US on a headline basis. There was momentum in Israel, although FX effects negated its impact on the bottom line. While sales only grew 3%, CC growth in Israel was 10%, but flat on a headline basis. Resilience in these markets despite the fact that deal velocity had been slowing down for some quarters comes from the fact that MGIC has large exposures to defence, but also healthcare and financials, which are not going to be as volatile as tech spending by other more advanced players. The revenues are mostly from cloud integration and migration services. The operating profit declined, this is all from inflation on the SG&A line.

MGIC IS (Q1 2023 PR)

MGIC gets subcontracted a lot, and the massive defense and government exposures on top of waiting for cash from sub-contractors means massive receivable balances. Thankfully, unlike some quarters ago, there was no sudden receivable jump to tank cash flows. Cash flows are actually looking good, growing on the operating line, and it’s a nicely FCF-positive business with about a 5% run-rate FCFY.

Bottom Line

While the upcoming quarter may have been a bit of a tougher environment, the recovery in broader markets likely comes from companies having more confidence in the economy. Right or wrong, markets are optimistic now about rate expectations. Companies are probably more inclined to budget more for tech spending as we go forward, at least for a little while longer. At any rate, MGIC’s exposures are pretty solid in terms of end-markets. We expect some more low single digit growth in the next quarter, with decent optimism by management in the call about the next Q3.

What probably won’t pan out is M&A plans. MGIC had hoped to see some multiple contraction as they bid for inorganic growth. While we’ve been seeing some multiple contraction in recent M&A, in tech it may be harder to find bargains, and MGIC was playing hardball. They may have missed some deals as a result, which is unfortunate because MGIC has quite a lot of cash and debt capacity to commit to plans. They even grew their debt load in Q1, likely in anticipation of possibly making moves.

The current PE is around 12x. It’s a little low considering resilience as the reliability of cloud integration and migration in MGIC’s end markets, especially in North America likely to be more of a performing market than Rest of World in the coming quarters. On the other hand, MGIC is a tier-2 player, it doesn’t exactly deserve to be part of the broader tech rally, where the true opportunity is accumulating at the top companies. It’s more of a buy than hold on the fact that its price has now been languishing a while.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Read the full article here