In this piece, we show that, not-withstanding the Republican Congress extracting spending cuts in exchange for raising the arbitrary “debt” ceiling, the current net-flow of money from Federal Government spending into the economy (private sector) will prevent a recession in 2023, and the SPX could see new highs before the end of the year.

The Problem (not-withstanding)

The 14th amendment (clause 4) was created after the Civil War in order to prevent the very same type of hostage-taking that the Republicans are involved in right now. The 14th amendment was necessary because the losing side (Southern slave-owning oligarchs) were intent on destroying the new Government from within by repudiating the Government debt.

Some commentators are suggesting that if Biden invokes the 14th and directs the Fed to pay all contracts according to Congressional spending legislation, the GOP should take him to court. Imagine going to the Supreme Court and telling it that the GOP wants Biden to renege on contracts with the private sector and other World governments and thereby break his constitutional obligation to “take care that the laws be faithfully executed.” Imagine the court hearing that the GOP wants Biden to break Congressional spending laws and not fulfill his own Constitutionally-mandated responsibilities. The Republicans will not go to the courts if the 14th is invoked, and Biden should invoke it if they refuse to raise the ceiling to pay for previous budgetary spending.

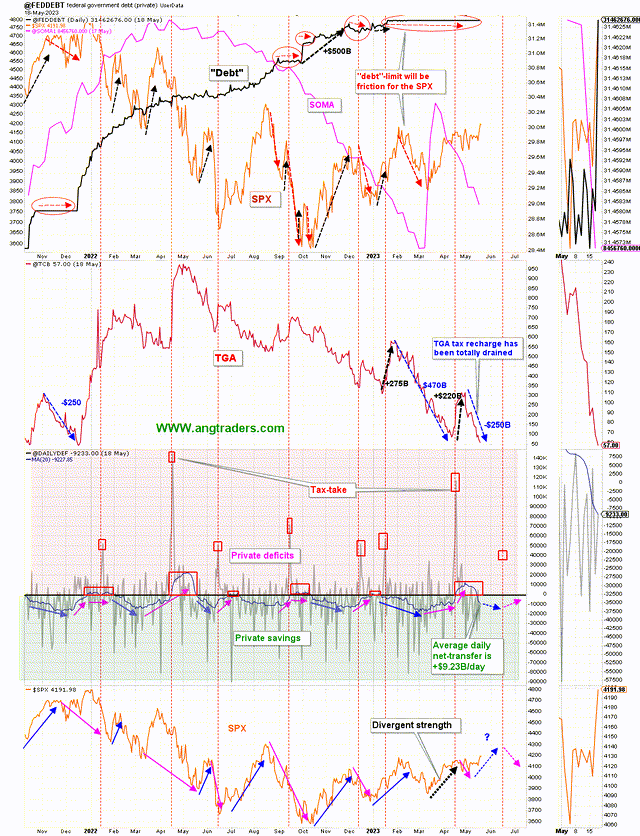

The debt-ceiling will be raised or eliminated. There could be a “sell-the-news” pullback in the market, but unless Biden agrees to significant spending cuts, the pullback will be a buying opportunity because the net-transfers are adding almost twice as much money to the private sector this fiscal year compared to last year.

Fund-Flows

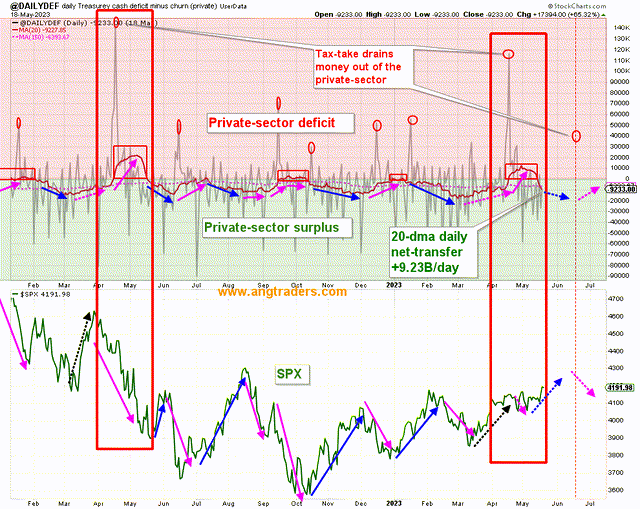

- This year, the April tax-drain was smaller and had less of a negative impact on the stock market than last year; the market traded sideways instead of falling.

- The 150-dma of the daily net transfers stands at +$6.39B/day, compared to only +$3.61B/day on the same date last year. Annualized at those rates, it becomes +$1.60T/year and +$0.90T/year, respectively. And considering that the rate is accelerating this year, the annualized amount should be closer to +$2.0T/year by the end of fiscal 2023.

ANG Traders, stockcharts.com

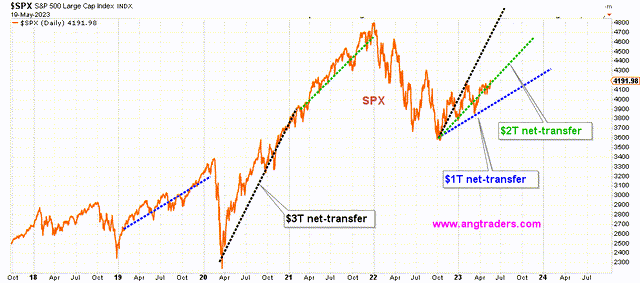

The SPX should be climbing with the typical slope of a +$2T/year net-transfer rate (green line below).

ANG Traders, stockcharts.com

The TGA is down to just $57B which is unlikely to last until the June 15 tax-take. This means that either the GOP agrees to a clean debt-ceiling increase, or Biden evokes Article 14 of the Constitution. Either way, the US will not default on its obligations.

ANG Traders, stockcharts.com

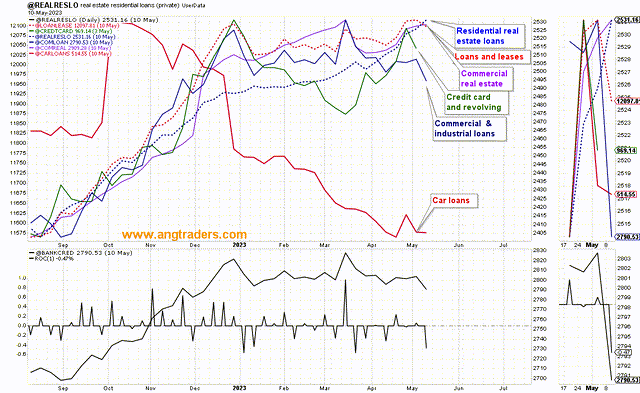

Aggregate bank credit contracted in the latest reported week (ending May 10); both retail and commercial real estate loans increased while all other loan-types decreased.

ANG Traders, stockcharts.com

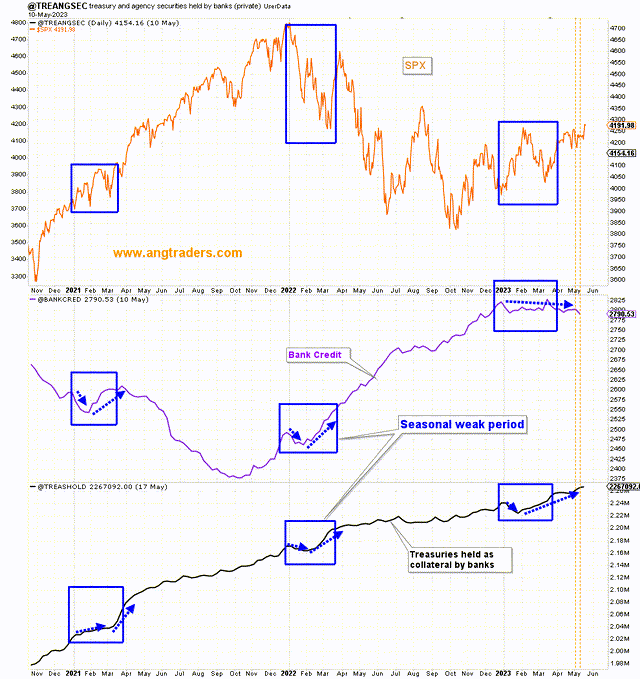

The seasonal weak period in bank credit that occurs in Q1 of most years, shows a positive correlation between aggregate bank credit and the Treasuries held-as-collateral by banks. This year, the treasuries held-as-collateral has recovered normally, but the bank credit has yet to recover. I think that as the debt-ceiling is raised and the Fed pauses rate hikes, the aggregate bank credit will revert to the mean and recover like the collateral held by banks is already doing.

ANG Traders, stockcharts.com

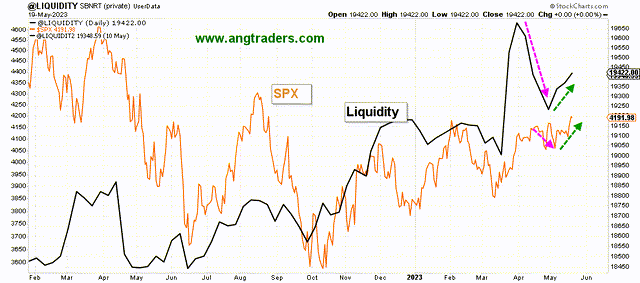

Despite the stall in bank credit and the Fed’s QT, liquidity has trended higher and the SPX has moved in sympathy.

ANG Traders, stockcharts.com

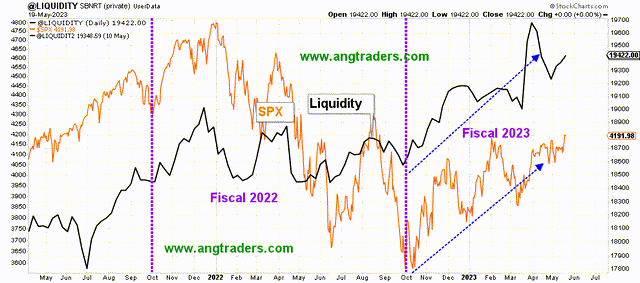

The longer-view shows that liquidity is higher now than it was at the old SPX high of 2022. We expect the SPX to catch up and make new highs as well.

ANG Traders, stockcharts.com

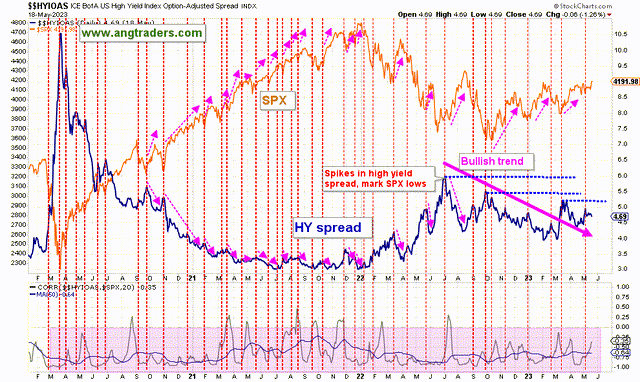

The HY spread continues to follow the bullish trend (pink-arrow below) in spite of all the worry over the health of the banks.

ANG Traders, stockcharts.com

Fund-flows and fear are the drivers of the stock market and, at the moment, we have enough of both. Unless Biden agrees to significant spending cuts, the positive net-transfers will continue, and so will the stock market rally. Investors can invest in this scenario by purchasing broad-spectrum index ETFs such as SPY, QQQ, and IWM.

Read the full article here