Introduction

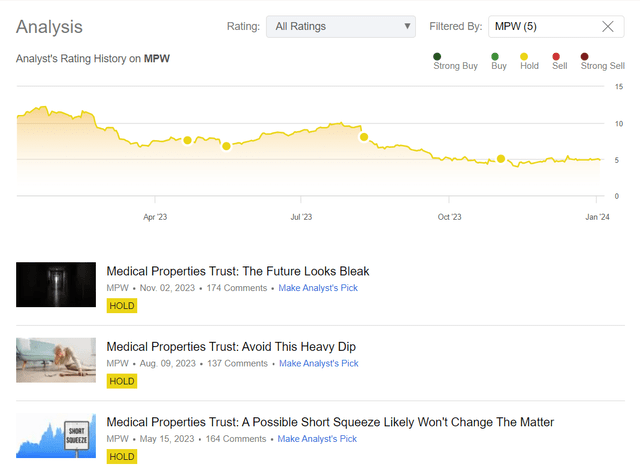

I have been covering Medical Properties Trust, Inc. (NYSE:MPW) stock here on Seeking Alpha since November 2022. Since then, despite all the cheapness the bulls talked about, I have been very cautious when it comes to evaluating the attractiveness of investing in the company.

Seeking Alpha, the author’s coverage of MPW stock

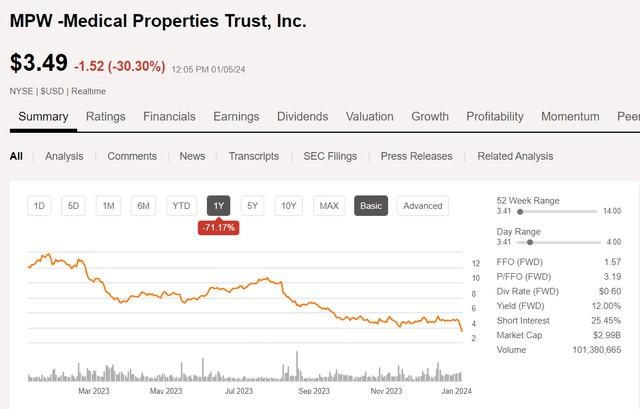

The last time I wrote about MPW was in early November 2023, when the shares were trading at $4.8. At that time, I concluded that MPW’s future looked bleak because the company was shrouded in uncertainty that I felt management couldn’t handle. The dip buyers strongly disagreed with my thesis. But as it turned out over time, it was better for investors to stay away from MPW, because on the recent news that Medical Properties is stepping up its efforts to recover uncollected rents from Steward Health Care System (its largest tenant), the stock is falling by 30% at the time of this writing:

Seeking Alpha, MPW’s main page

This is truly a significant event that I could not ignore. Today I would like to address the concerns of those who are watching the developments at MPW with dismay. Is this a compelling buying opportunity, or merely the progressive manifestation of an inevitable catastrophe with no end in sight?

Why You Still Shouldn’t Touch MPW Stock

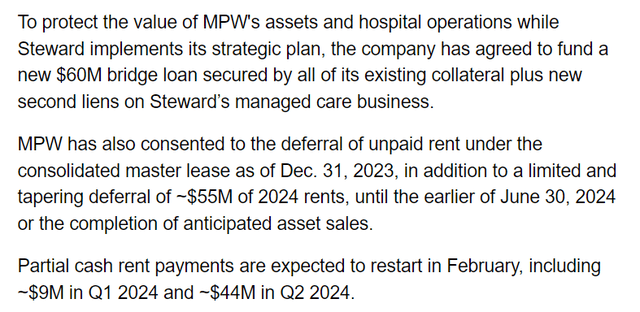

First off, let’s talk about the news itself and why it is so significant that it could cause MPW to fall 16% within a few hours before the market opened.

Long story short, MPW is now intensifying its efforts to recover unpaid rent and outstanding loans from Steward Health Care System, its biggest tenant. Steward cited liquidity issues due to changes in vendor payment terms, leading to approximately $50M in unpaid rent by December 31, 2023. To address this, Steward is pursuing immediate strategic transactions, including potential sales, and seeking a third-party capital partner. In support, MPW is providing a $60 million bridge loan secured by collateral and new liens on Steward’s managed care business. MPW also agreed to defer unpaid rent and taper 2024 rents.

Seeking Alpha News

As a result of these challenges, MPW anticipates a non-cash charge of approximately $225 million in the fourth quarter of 2023 to write off consolidated straight-line rent receivables and other items. The company also expressed uncertainty about potential further impairments to its real estate and non-real estate assets in its upcoming fourth quarter 2023 reporting.

I am not suggesting, but I suspect, that Steward may be on the verge of Chapter 11 bankruptcy, as evidenced by its current financial challenges and the urgency of securing the bridge loan.

And lending money to your tenant who can’t pay an existing debt is, in my opinion, completely inappropriate on the part of the MPW management. All of this also contradicts what we have heard time and time again recently during earnings calls.

John Pawlowski

Okay. And then turning to storage.

Could you just confirm for me, there was another roughly $25 million in loans provided late last year to Steward. And then do you expect additional cash to go to Stuart this year outside of the, I guess, the insurance recoveries, prepayment.

Steven Hamner

Yes. The last question is no.

We do not expect any further again, alternate operating support, liquidity support for Stewart other than what you just described in redeveloping the cost. On the late 2022, there was another $28 million that we advanced.

Source: Medical Properties Trust, Q1 2023 Earnings Call Transcript.

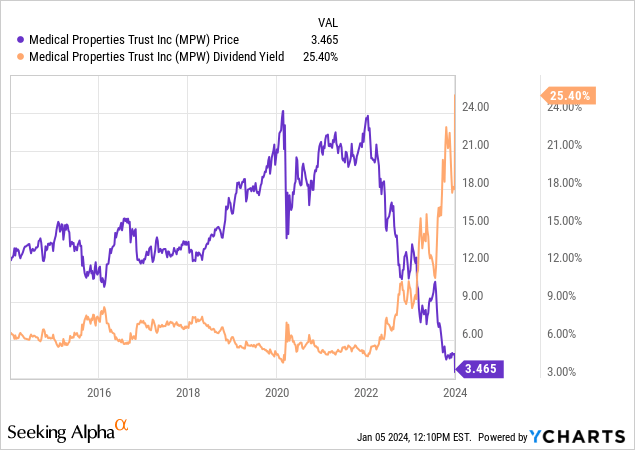

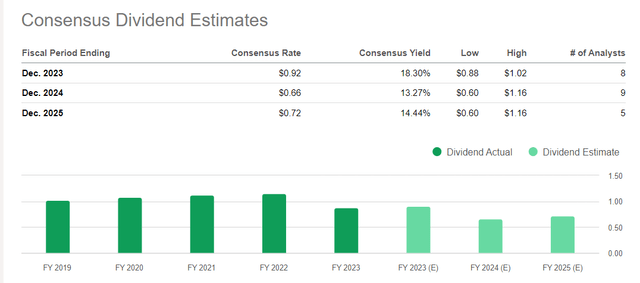

Of course, there is definitely something unimaginable going on with MPW’s valuation, as the current dividend yield is over 25% at the time of writing:

But think about how much that yield translates, say, 2-3 years ahead, when analysts were expecting a sharp drop in payout this year even without the recent news about Steward’s next financing. Now MPW will most likely have to cut its dividend even more drastically under the yoke of the unhappy shareholders, which will reduce the projected forwarding 13% yield even lower.

Seeking Alpha, MPW’s Dividend Estimates

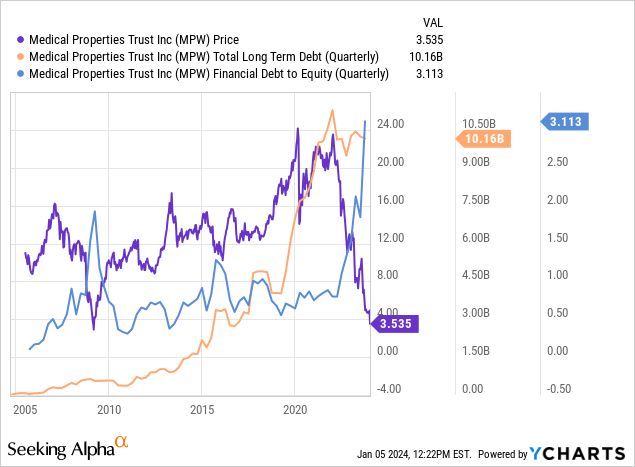

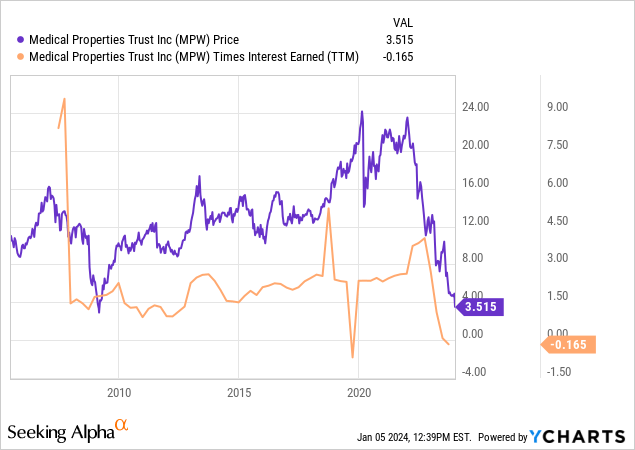

In addition, MPW has broken anti-records in terms of its debt burden in recent quarters: from a debt-to-equity ratio of less than 1 to more than 3 in just less than 3 years.

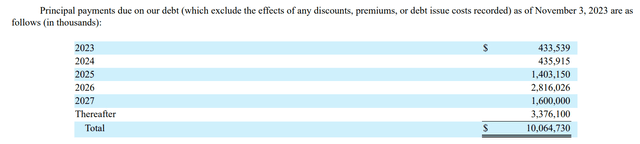

In addition, the company’s repayments will have to more than triple in 2025 compared to 2023 and 2024. Even if interest rates fall, MPW will have to refinance its debt, probably at a double-digit interest rate, further increasing the debt burden.

MPW’s 10-Q

Tenants’ liquidity problems may already be priced in after this sharp slump, but in my opinion, MPW will continue to react very sensitively to the slightest negative news. And to correct the market’s attitude towards itself, the company will have to go a long way, and it is not known when it will end. Rebuilding a good reputation is a much more difficult task than it may seem at first glance.

The Verdict

Medical Properties Trust is undervalued by virtually every conceivable valuation multiple you can think of. This is, of course, a good reason to justify a buy after the 30 percent slump in the share price. But ask yourself: what exactly do you get when you buy MPW? A share in a company whose management is (forced or deliberately) apparently acting against its own words, potential problems with liquidity and debt refinancing over the next year, a damaged reputation, and potential litigation issues.

In my opinion, Medical Properties Trust, Inc. stock shouldn’t be on your “buy list” even when it has fallen as much as it has today. I urge everyone to remain cautious and not give in to greed.

Thanks for reading!

Read the full article here