Medical Properties Trust (MPW) is a controversial real estate investment trust. First, let us say that we have actively avoided advocating for most REITs for a number of quarters. We hypothesize that REITs generally are getting closer to being strong buys, but we first need confirmation that rates will settle down, and we will become more bullish as the likelihood of rate cuts grow. This is our opinion. We have sought alternative sources of income and trades over the last 5 or so quarters as REITs have been crushed. It has been pretty ugly, there is no denying that. Now, with such volatility in the sector, it has certainly drawn “buy the dip” calls, and for the most part, this has been the entire way down. This in turn leads to common quips like “you have not lost anything if you do not sell.” Maybe not, but even on paper, one of our cardinal rules is to (at least try) to “never lose money”.

Will the paper losses on REITs be recovered? For the most part yes, but in time. So in that vein, buying now for the long-term will likely pay off, especially when you factor in dividends, and for younger investors, the power of compounding. Our personal investing philosophy is to buy when situations arise that set a sector or a stock up for a rebound, and to limit losses, even on paper. We also, however, embrace generating extra income from investments through options approaches, such as covered calls. With that said, even though we think we are close to REITs basing out, and the Fed rate hike campaign is coming to an end, the better time to buy this sector is likely to be in 2024. That is our ‘read of the tea leaves’, and we have discussed this in depth among our investing group membership. However, Medical Properties Trust in our opinion is a higher risk-reward situation. There are a number of safer alternatives, but we believe this stock is going to emerge from the ashes.

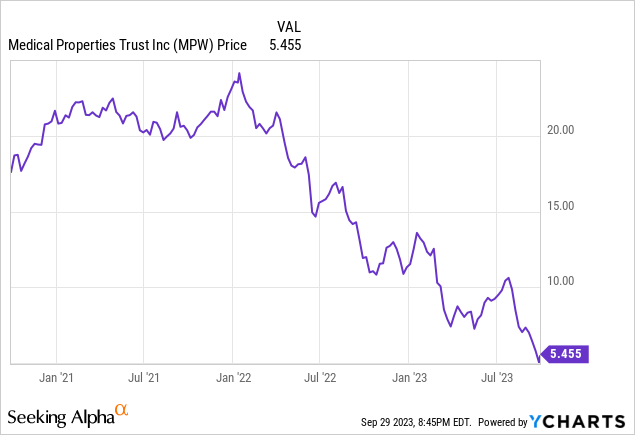

Make no mistake, MPW stock has been absolutely crushed. Some of our investing group took a shot on this stock as it fell to about $8. For a few months, that played out. Despite pressure on the sector, things seemed to be basing out, but with each passing quarter, negative news just piled up. The stock has fallen another 33% from those levels, and touched down under $5 recently with market woes. The medium-term chart is disgusting.

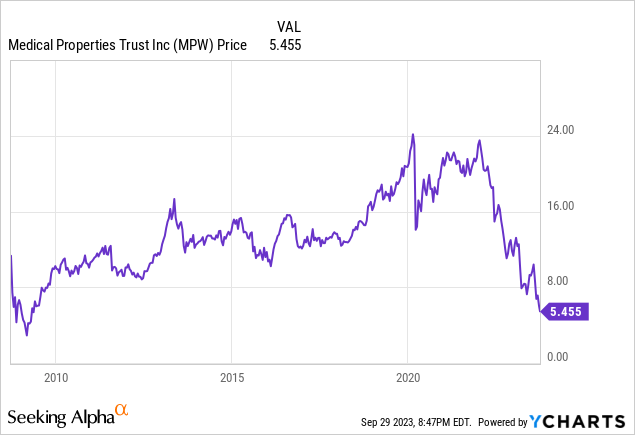

This chart pretty bearish by all accounts. That is why we need to wait for signs of basing in the price action. The long-term chart shows the complete round trip for over a decade in a very short-period, frankly:

The chart is extremely indicative of a company that looks headed for the graveyard. But charting is not everything, despite what even some of our own analysts on our team may argue. We believe if the stock can hold this level over the next few weeks, the bottom may be in. One simply has to ask, “how much worse can it get?” We surmise the answer is “it can go to zero,” but this would mean it was facing down the barrel of bankruptcy. Not quite. From a chart perspective in conjunction with the fundamental work being done to right the ship, if we see signs of a base being confirmed, the stock will be a buy in our opinion, ahead of a sector rally in 2024 that we believe will materialize.

There is still a lot of risk here, we will touch on that, but our reasons for starting to turn bullish are rather simple. First, the stock is oversold. That alone is not a reason to buy. Second is that the income here is still attractive to income investors, even with payout changes. But that also does not mean that this is not a value/income trap. The third and most important reason is that management is taking a ‘kitchen sink’ approach to trying to right the ship. And yes, even because we like what is happening, there is still execution and potential liquidity risk here. However, our opinion, and some may accuse it of being rather speculative, is that better days are ahead as we sift through the rubble.

Our bullish take is simple

Here is the deal, readers. Our opinion is that now that management has made major moves to start to correct the ship, we believe that the stock may start to form a base here. The stock is now back to Great Recession levels. Is the balance sheet and property and tenant profile really his bad? We think not, with diversified health care holdings at over 400 properties in ten countries.

Before delving into why we are now highlighting the stock as a high-risk, high-reward name, we have had our concerns. We grew cautious in our team roundtables with each passing earnings report and conference call since 2022. We try to participate in as many of these calls as possible during earnings season, and since there are many, we scour hundreds of transcripts a season as well.

One thing that management telegraphed when Q2 was reported was that they were most certainly dropping a number of hints that they were having liquidity and leverage concerns. As such, it was obvious that some drastic steps would be taken to reduce leverage and control their long-term cost of debt and working capital. We took this to mean asset sales and that the dividend would need further modification.

If you recall, the company had been raising the dividend each year, but froze it in 2023 at 2022 levels. That was actually controversial at the time. But clearly it had not been enough. Well, sure enough, about a month ago management dropped the hammer and declared a new level of dividend of $0.15 per share. Pretty much cut in half from the prior dividend of $0.29 per share. This move would effectively save around $350 million, since about $700 million was paid out in 2022 at $1.16 per share annually. Of course, there has been a lot of recapitalization efforts, so the savings are welcomed, if not higher than stated. The company targeted an initial payout of projected near-term AFFO of less than 60%. That should be relatively safe, assuming the company can deliver.

In Q2, it became apparent that AFFO would be less than projected in Q1 as guidance was updated. The sees AFFO of $1.53-$1.57. This was a narrowing of a range that saw up to $1.61 in AFFO. Thus, at $0.15, the new annualized dividend is of course $0.60. Thus, AFFO will have to fall much further off a cliff. We are confident that while weakness may persist, we do not see AFFO dropping off to $1.00 for a year (which would be 60%). The 60% target was simply for Q3, to be clear. What is more, AFFO performed better than expected. Q2 saw $0.48 per share, up from both $0.37 in Q1 and from $0.46 a year ago. Now, a chunk of that came from some equity. This comes from Prospect Medical Holdings, a major tenant that has been a headache for lack of a better term.

Rents seemingly are stabilizing. Rent billed increased from $241.2 million to $247.5 million. However, straight-line rent swung from $58.5 million to a negative $39.3 million as there was a major write-down given early termination of leases, with Steward. Steward is the largest tenant, and a cursory review of the news and analysis section will indicate there has been ongoing issues with this tenant as well. As such, total revenue in Q2 was $337.4 million, down from the sequential $350.2 million in and down sizably from $400.2 million in Q2 of last year. There was also an increase in real estate depreciation and amortization lines, which ballooned expenses to $529 million, more than doubling from a year ago.

It has been a bit ugly. What we also have learned is that the company is going to pursue selective transactions to boost asset value. Thus, we can expect further property sales, possible deals and joint ventures, as well as targeted refinancing efforts. We would love to see the company work diligently to really reduce expenses. This is a tertiary goal for the company in our estimation, but it’s on the table.

If management can execute, we have a very bullish set up. However, the debt is a massive risk. We cannot deny this. This is why the risk-reward profile is so lucrative, but possibly dangerous. A higher rate environment is horrific for debt-laden companies, especially those that need to refinance, and constantly make deals. It is one reason the sector has been one to avoid, if not actively short. However, as we noted, the rate hike campaign is coming to an end, and we expect the economy to soften markedly in coming months, leading to rate cuts in 2024. We suspect this will be bullish. So, the debt for Medical Properties Trust is large, but has been being chipped away. Net debt to start Q3 was $9.91 billion, which is down about $10.14 billion to start Q2, a 2.3% decline. We suspect further asset sales will allow more debt to be knocked down. The company does have Australian property sales on deck, and should earn income from a convertible loan. This can help address debt further. However, there is much to be done on this front, and it is a risk. No significant maturities are due until 2025, so there is time for asset sales and income generating deals to be made.

So, there is certainly risk here, like other leveraged REITs, but we believe management has taken proactive steps to preserve capital and improve their financial flexibility. The savings on the dividend payment alone open up hundreds of millions of dollars to tackle debt, while asset sales will provide further income to address debt. The ultimate question is whether the tenants will continue to be able to make their payments, and whether occupancy can be maximized. This is an execution risk that needs to be further acknowledged, but with the underlying asset value in conjunction with the battering the REIT sector has taken, along with the steps being taken to improve the fiscal state of the company, we believe MPW stock is a buy.

Read the full article here