Investment Thesis

Microvast Holdings (NASDAQ:MVST) is a global leader in battery technologies for commercial electric vehicles and energy storage systems. With its vertically integrated model and focus on R&D, Microvast has developed battery solutions with fast charging capabilities, long battery life, and improved safety. The company is seeing tremendous demand growth, especially for its new 53.5Ah battery cell launched in 2022, leading to a record backlog of $675.9 million as of Q2 2023. I believe Microvast’s proprietary technology, large addressable markets, and execution on capacity expansions position it for multi-year high revenue growth and a path to profitability by 2024-2025. However, it faces risks around execution, financial profile, raw material costs, and its China exposure. Due to these uncertainties, I believe risk-averse investors are better off staying on the sidelines for now.

Business Overview: Microvast’s Edge

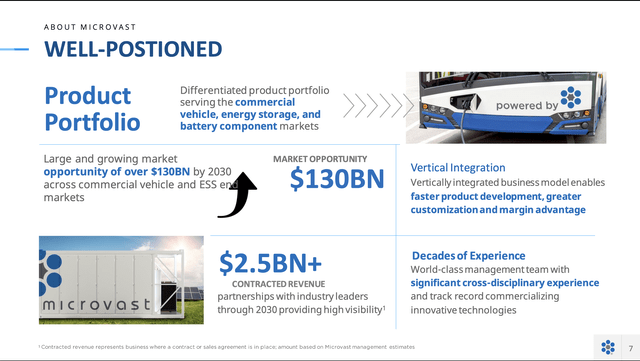

Microvast is a battery technology pure-play founded in 2006 and headquartered in Texas. The company designs, develops and manufactures lithium-ion battery components and systems for electric commercial vehicles and utility-scale energy storage. Microvast takes a vertically integrated approach, developing key battery materials in-house including separators, cathodes, electrolytes and anodes. This gives it tight control over product performance and differentiation.

Market Opportunity (Microvast)

Microvast currently generates approximately two-thirds of sales from China, but is rapidly expanding capacity in Europe at a facility near Berlin and in the U.S. with a new plant in Clarksville, TN projected to start delivering in 2024. The company’s batteries feature ultra-fast charging capabilities, with charge times ranging from 10 minutes to 1 hour depending on chemistry. They also have long battery life of up to 20,000 charging cycles and high energy density. This results in a lower total cost of ownership for commercial vehicle customers compared to alternatives.

As CRO Sascha Kelterborn explained on the Q2 2023 earnings call, over 80% of Microvast’s record $675.9 million order backlog is for its new 53.5Ah battery cell launched last year. He called it “one of the leading future products” focused on commercial vehicles given its combination of fast charging, long life cycling and high energy density. Testing for the 53.5Ah has indicated a battery life of over 4,000 cycles while maintaining significant capacity.

Significant Risks

Microvast faces an array of risks that could disrupt its growth plans and path to profitability. First, the company is still losing money and burning cash flow due to large R&D and capital spending investments. Microvast posted a $158.2m adjusted net loss in 2022 and burnt through ~$90m in cash last quarter alone. It expects to remain cash flow negative in 2023. As a result, Microvast will likely need to take on additional debt to fund expansion plans without further equity dilution.

A key risk facing Microvast is execution risk. The company is guiding for 70-80% revenue growth in 2023 along with expanding gross margins. While the growth opportunity is immense given secular tailwinds, Microvast must flawlessly execute on bringing new capacity online, ramping up production, meeting delivery timelines, and controlling costs. Any missteps, production delays, or demand shortfalls versus forecasts could derail its growth and margin targets. In a hypercompetitive market, execution is everything. Microvast is going up against far larger players who can leverage immense scale advantages. Its limited operating history and cash burn make consistent execution even more important. If Microvast fails to execute on its expansion plans efficiently, its path to profitability could face major delays.

While management targets profitability over the next 2 to 3 years based on capacity utilization assumptions, this relies on flawless execution. Any production delays or demand shortfalls versus forecasts could push out the timeline. And if interest rates stay at these elevated levels, Microvast’s borrowing costs may also increase.

In addition, a substantial amount of Microvast’s revenue comes from China. The company’s Chinese manufacturing operations and local partnerships present regulatory risks, especially amid escalating geopolitical tensions between the U.S. and China. For example, potential U.S. restrictions on exporting certain battery technologies to China could impact operations. And disputes over Taiwan or IP theft charges against Chinese companies could lead to unpredictable impacts. While Microvast is an “American” company, its sizable China dependence remains an overhang.

Meanwhile, lithium prices have surged over the past two years before recently declining. They still remain well above historical levels. Rising raw material costs have been a significant headwind for Microvast’s margin profile. The company is attempting to mitigate this through long-term supply contracts indexed to market pricing. But it has limited ability to influence lithium’s volatile pricing, which constrains profitability upside. Any further supply chain disruptions that drive commodity prices higher would also hit Microvast’s cost structure.

In addition, while Microvast operates in large addressable markets, competition is fierce. Major players with far greater resources like Tesla (TSLA) are targeting the same electric vehicle and energy storage opportunities. This leads to pricing pressure and Technology risk. If competitors commercialize superior next-gen batteries faster than Microvast, it would threaten the company’s position. Execution missteps are magnified in a hypercompetitive marketplace.

Lastly, Microvast went public via SPAC merger in July 2021. Many companies that took this route have floundered since completing those deals amid challenging market conditions. While Microvast has outperformed the broader group of post-SPAC names, previous valuation optimism fueled by the SPAC listing has certainly faded. Continued commercial and financial de-risking is needed to rekindle positive sentiment. The speculative growth story has considerable risks on the path to fruition.

Valuation

Microvast stock trades at a market cap of just ~$500 million despite its leadership position in commercial vehicle batteries and large addressable markets. Meanwhile, utility-scale energy storage deployments are estimated to grow 23% annually this decade. In other words, secular tailwinds are strongly in Microvast’s favor.

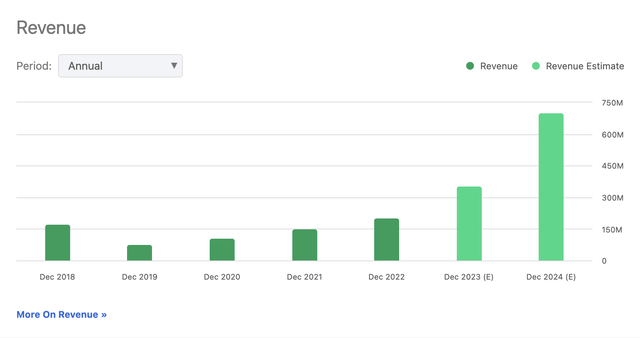

Assuming the company achieves its 70-80% revenue growth target for $348-368 million in 2023 sales, that implies a 2023 price-to-sales multiple of just 1.4x. Further, if Microvast hits its goal of $1 billion revenue from 53.5Ah cells at 75% utilization in 2024, it would be valued at only 0.5x 2024 sales. While forecasts that far out are speculative, the potential upside is massive if Microvast executes in my view.

Revenue Forecasts (Seeking Alpha)

Conclusion

Microvast’s research-driven approach has resulted in differentiated battery technology powering strong order growth. Its vertically integrated capabilities and capacity expansion plans position it extremely well competitively. However, it remains a story stock given the need to demonstrate consistent execution and profitability over the next 2 years. For investors with a high-risk tolerance, MVST offers intriguing long-term upside. But more risk-averse investors may want to wait for additional commercial and financial de-risking. I rate MVST a hold for now.

Read the full article here