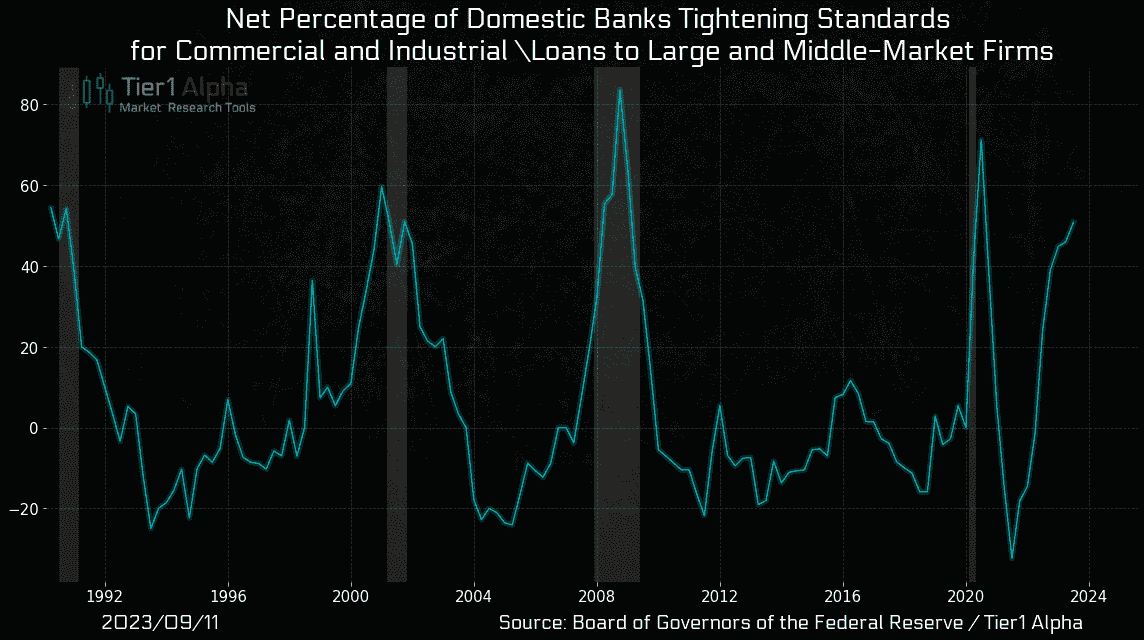

Bank lending is contracting across world economies. The percentage of US banks tightening their credit to large and medium firms (below since 1990 via Tier 1 Alpha) now above 40% – was only seen during the 2020 pandemic, the 2008 financial crisis, the 2001 Dotcom bust, and the 1990-91 recession.

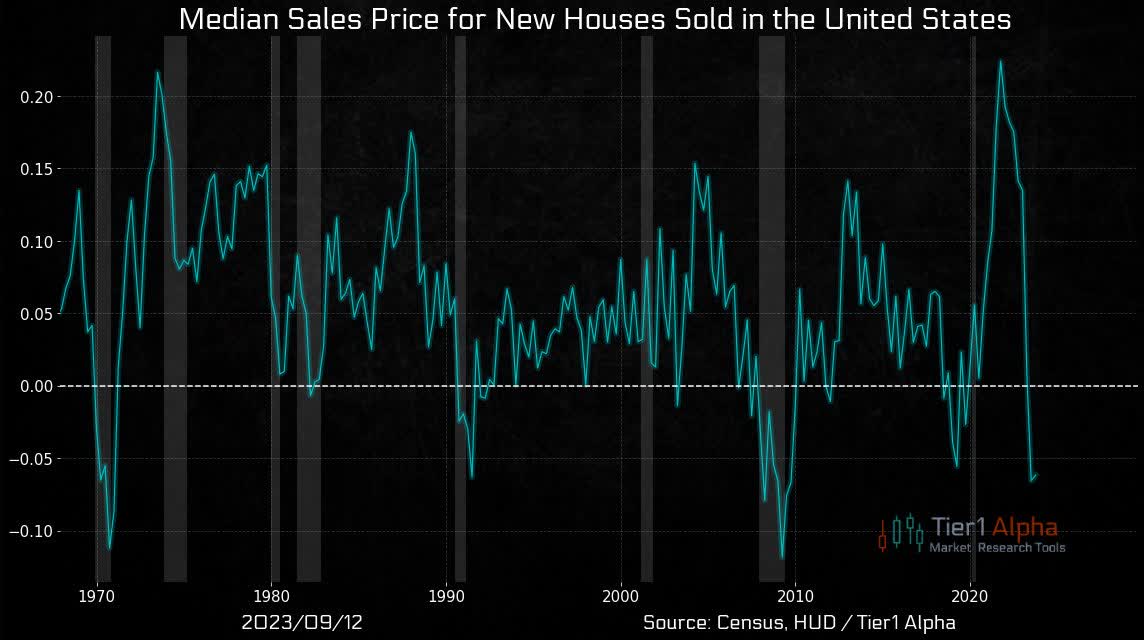

As higher interest rates freeze existing home sales, builders have enticed new home sales through discounts and mortgage rate buydowns. The 12% decline in the median US new home sale price to 436K in July from 496K last October has only been rivalled during the severe recessions of 1970 and 2008.

Prices are back to where they were two years ago, and downward pressure is picking up.

Purchasing power drops 34% to $754k at a mortgage rate of 6% from $1.150 million at 2%. A $603K conventional mortgage (25-year amortization, 20% down) at 6% has the same $3800 monthly payment as an 880K mortgage at 2%.

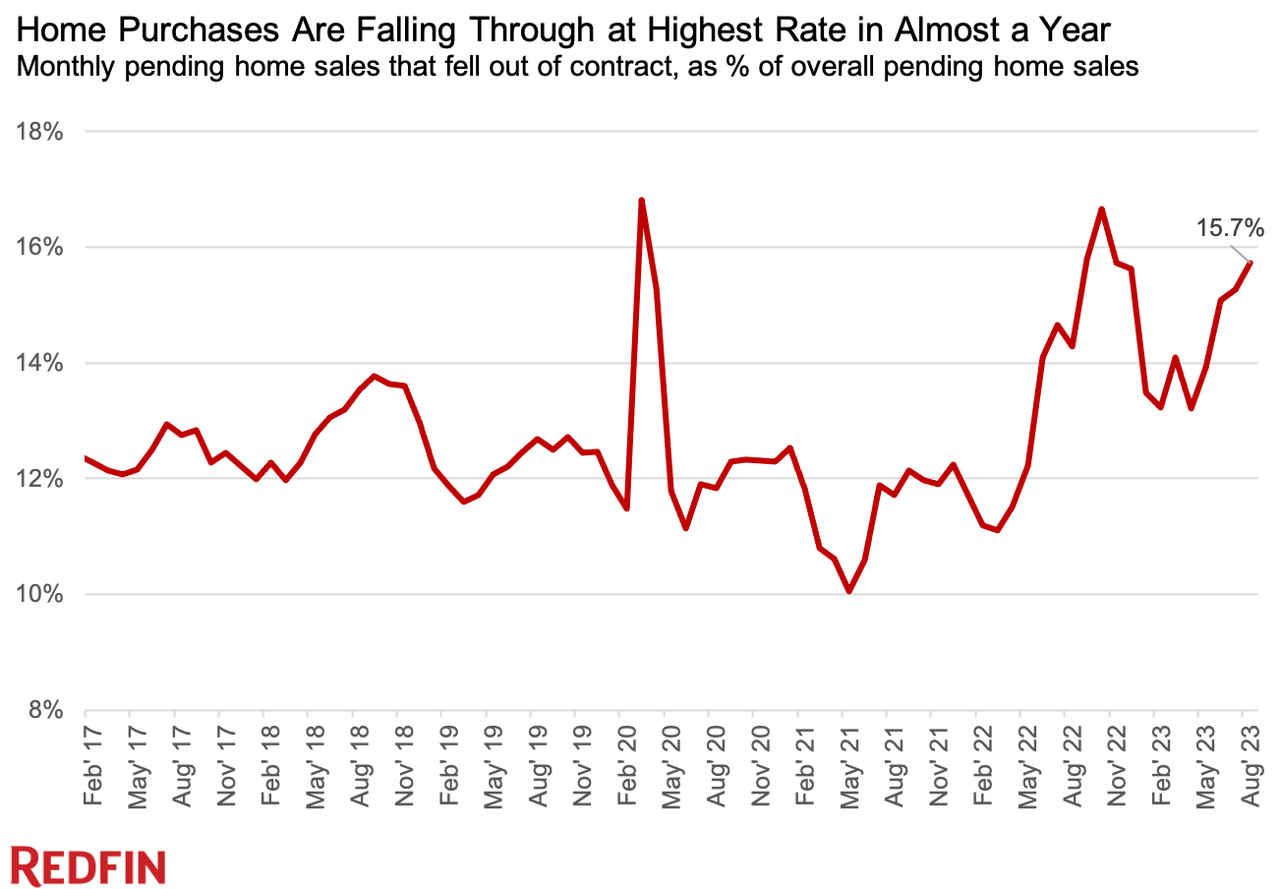

Not surprisingly, some 60,000 purchase deals for US homes fell through in August, according to the latest report from Redfin. That equals roughly 16% of the homes under contract last month and the biggest share of cancellations since last fall and 2020 before that (chart below since 2017).

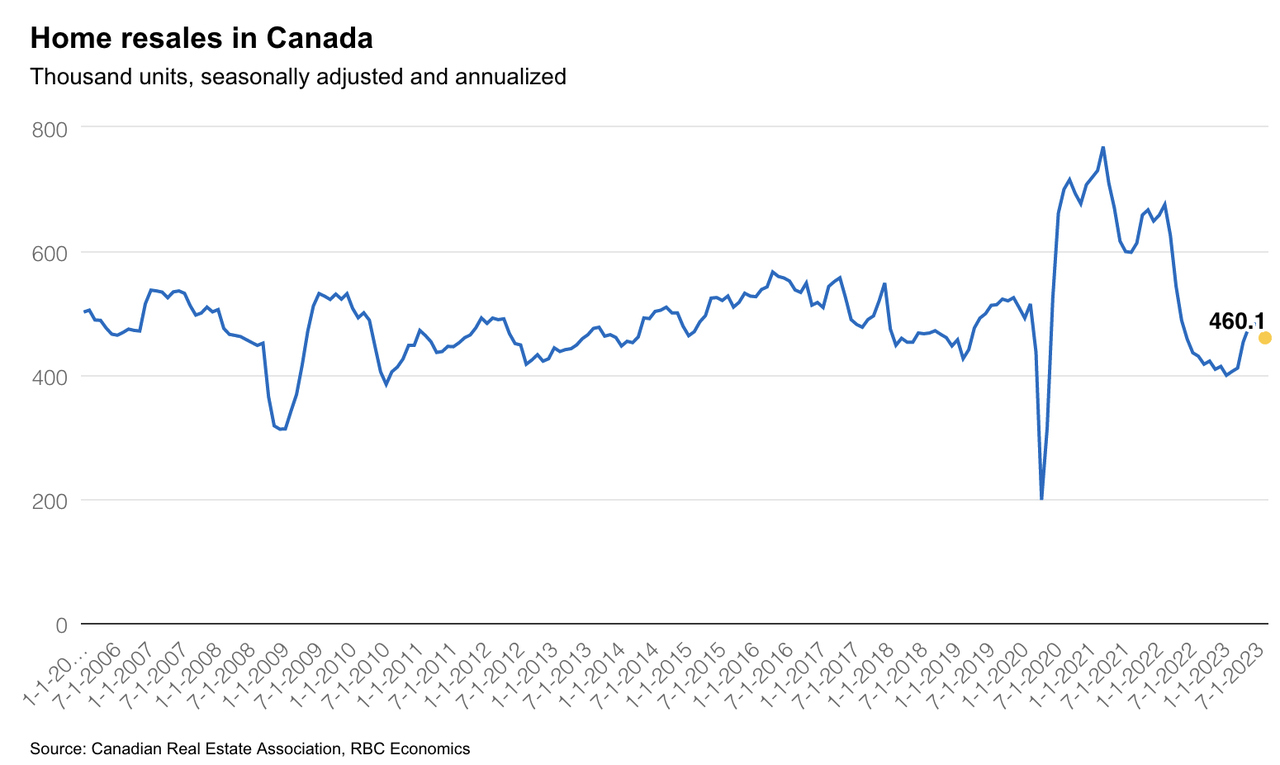

August marked the second straight month that Canadian home resales dipped (RBC chart below since 2006).

Tight supply conditions ease as the number of homes put up for sale climbs. We concur with RBC’s analysis last week in Housing market stagnation setting in: “We think the cooling trend will extend into the fall season despite the Bank of Canada pausing its rate hike campaign.”

As loan defaults and bad debt provisions mount, Canadian banks are retreating from the consumer loan space. The Bank of Montreal (BMO) just announced that it’s winding down its retail auto finance business, resulting in an unspecified number of job losses:

The move, applicable in Canada and the United States, comes after BMO’s bad debt provisions in retail trade surged to C$81 million ($60 million) in the quarter ended July 31 compared with a recovery of C$9 million a year ago, in a sign of growing stress consumers face from a rapid rise in borrowing costs.

The deleterious cycle of escalating credit stress, declining economic activity, rising unemployment and falling asset prices has very likely only started.

Disclosure: No positions

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here