Investment Thesis

Mondelez International (NASDAQ:MDLZ) is a global powerhouse in the world of snacking, boasting a rich history and a diverse portfolio of beloved brands. As one of the largest snack food companies in the world, Mondelez is known for its iconic products such as Oreo, Cadbury, Toblerone, and Ritz. With a commitment to delivering delicious moments of joy, Mondelez has become a household name synonymous with tasty treats. Founded in 2012 following its separation from Kraft Foods, Mondelez has since charted its own course, its presence spans over 150 countries, making it a true global leader in the snacking industry.

Brand Map (MDLZ Website)

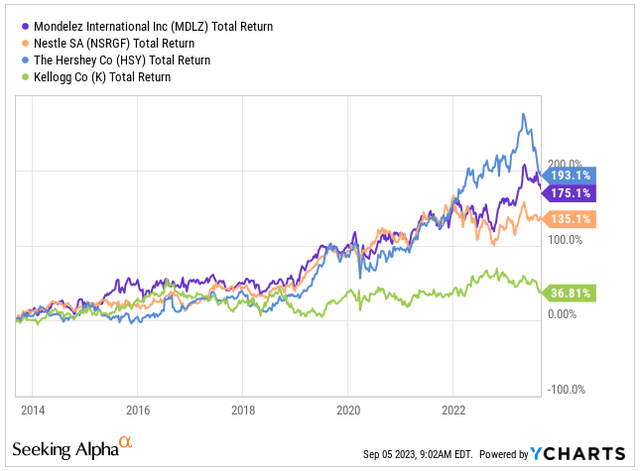

Established in 2012 following its separation from Kraft Foods, Mondelez has consistently delivered reliable performance in the consumer staples sector, akin to its peers such as Nestle (OTCPK:NSRGF), The Hershey Company (HSY), and Kellogg (K). While the company’s total return slightly trails that of the S&P 500 (SPY) over the same period, it provides a secure haven during market volatility with a low beta of just 0.64.

Over the past two years, Mondelez has exhibited significant growth in both its top and bottom lines across all business segments and geographical regions. This growth is underpinned by robust pricing power, despite facing heightened commodity pressures that have impacted the margins of many other food and snack companies.

Given its unique ability to not only withstand but thrive during market uncertainty, I believe Mondelez is well-positioned for the future and has the potential to deliver market-beating results while safeguarding any investment portfolio. Additionally, the company offers a healthy dividend yield of 2.21%, with a payout ratio below 50%, poised for growth over the next decade as the company is expected to achieve a CAGR of at least 3.64% in both revenue and profitability.

To put it plainly, I consider Mondelez an excellent choice for defensive investors seeking stable income and a resilient portfolio addition.

Total Return vs. Peers (Seeking Alpha / YCHARTS)

Business Update

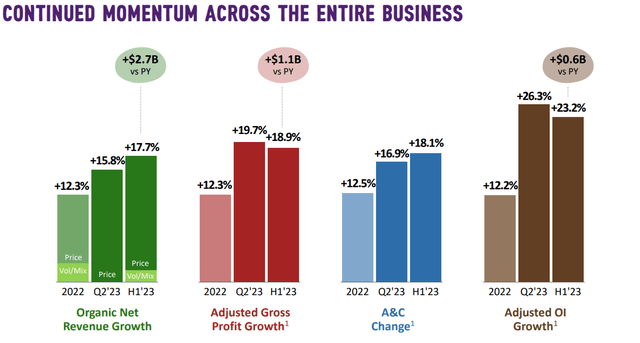

Mondelez has been firing on all cylinders since 2022, primarily fueled by price hikes in their product lineup, with volume and product mix contributing to a somewhat lesser extent to the overall performance. In 2022, the company recorded a remarkable 12.3% increase in organic net revenue. Impressively, this momentum appears to persist well into 2023, gaining even more momentum. So far in 2023, Mondelez has reported a substantial 17.7% surge in organic net revenue. Once again, this growth is chiefly attributed to price increases. It’s noteworthy that despite the prevailing high inflation rates and increased interest rates, factors that would typically affect people’s disposable income and, consequently, their spending habits, Mondelez’s sales have not only remained resilient but have actually thrived. This suggests that the company is positioned as a sturdy defensive stock in these challenging economic conditions.

In Q2 2023, the company posted revenues of $8.51 billion, showing a robust 15.8% YoY – an impressive $300 million more than what analysts had anticipated. What’s particularly noteworthy is that, despite the volatility in commodity markets, which significantly affect Mondelez due to its heavy reliance on sourcing cocoa, wheat, and sugar, the company managed to achieve remarkable growth in its Gross Profit, up by a substantial 19.7%, and Operating Income, which surged by an impressive 23.2% when compared to the same period last year. It’s worth highlighting that this growth rate even outpaced the rise in revenue, indicating that the company is executing its strategies effectively and potentially setting itself up for margin expansion in the years ahead. Adding to the positive picture, the company’s EPS came at $0.76, which represents 16.9% YoY growth after FX adjustment, comfortably surpassing analyst expectations by a margin of $0.07.

Financial Overview (MDLZ IR)

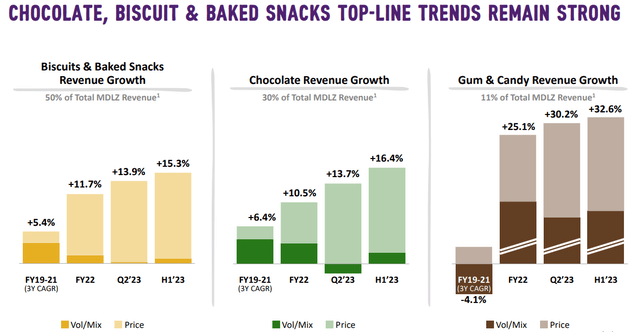

Digging deeper into the segments that have significantly contributed to the company’s performance in the first half of 2023, we find the following:

-

Gum & Candy, constituting 11% of Mondelez’s total revenue, has seen growth, with a revenue increase of 32.6%. This surge is predominantly attributed to the robust performance in emerging markets.

-

The Chocolate Segment, representing 30% of the total revenue, has exhibited a growth rate of 16.4%. This growth is driven by the popularity of well-known brands such as Cadbury Dairy Milk, Milka, Lacta, and Toblerone.

-

Lastly, the company’s largest revenue segment, Biscuits & Baked Snacks, has reported a significant growth of 15.3%. This growth is attributed to the strong performance of brands including Oreo, Ritz, Chips Ahoy!, Give & Go, TUC, and Club Social, all contributing with a double-digit growth.

Financials by Segment (MDLZ IR)

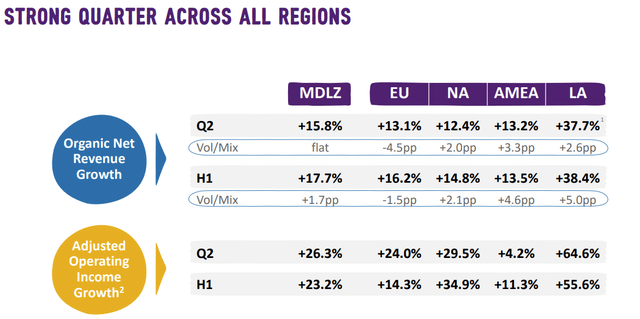

All the regions have demonstrated strong performance as well. In the first half of 2023, Europe emerged as the company’s primary geography, contributing 35% to the total revenue. Despite anticipated disruptions stemming from retailer negotiations, Europe managed to achieve a solid revenue growth of 16.2%. The company successfully executed planned price increases in Europe, concluding negotiations with customers as anticipated. With this hurdle behind Mondelez remains optimistic for the remainder of the year in Europe.

North America, accounting for nearly 31% of total revenue, also demonstrated robust growth, posting a 14.8% increase. This growth was supported not only by pricing initiatives but also by favorable Volume/Mix dynamics.

The standout performer, however, has been Latin America, representing just 13.8% of total revenue but achieving an impressive growth rate of 38.4%, with 5% attributed to Volume/Mix improvements.

In summary, Mondelez remains largely reliant on developed economies, which contribute to 61% of its total revenue. Nonetheless, the growth potential for the future lies in emerging markets, currently contributing 39% of total revenue and displaying stronger growth rates through pricing strategies and market share expansion.

Financials by Region (MDLZ IR)

Financial Outlook

So far, 2023 has proven to be a successful year for the company, despite the macroeconomic challenges that could have potentially had a negative impact on its performance. However, the company has effectively executed its strategy and successfully passed on price increases to its consumers, a feat that many other snack and food companies have struggled with. In my view, this suggests that the company is well-positioned and wields significant negotiating power, which could be crucial if inflation persists for another year or two.

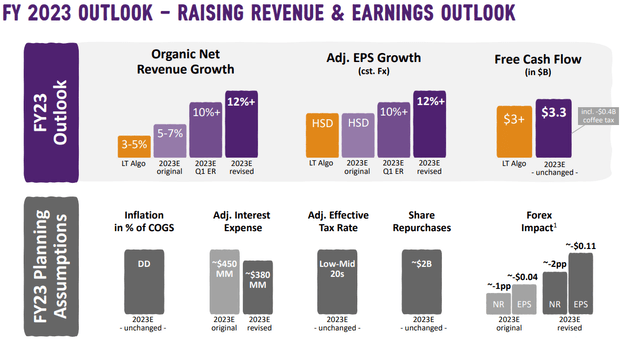

The company remains optimistic about the remainder of the year and has revised its previous guidance upward for the second time this year. They now anticipate an Organic net revenue growth rate exceeding 12% by the year’s end, along with a similar growth rate for EPS. On a less positive note, the company has chosen not to revise its FCF expectation, primarily due to the adverse impact of negative $400 million stemming from cash taxes related to the sell-down of Keurig Dr Pepper (KDP) holdings, where they hold now less than 3.5% ownership.

Guidance (MDLZ IR)

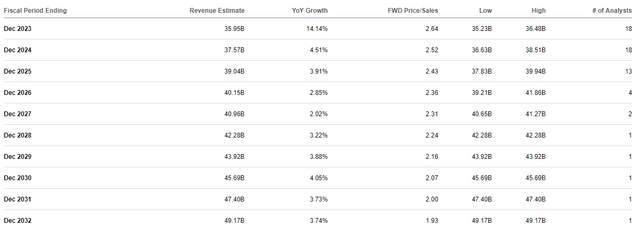

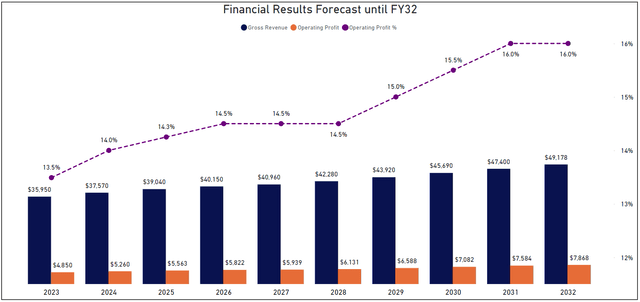

Analysts anticipate a slightly higher YoY growth rate of 14.14% for 2023 than what the company suggests. I tend to agree that the company’s guidance appears to be somewhat conservative, especially considering the strong performance in the first half of the year, and I am more inclined to align with the 14% growth projection.

Looking beyond 2023, over the next decade, the company is expected to achieve a CAGR of 3.54%, which appears reasonable. However, this projection falls significantly short of the CAGR 6.8% observed over the past five years. While I believe that the growth of the past five years was indeed elevated, primarily due to high inflation, I hold the view that Mondelez can reasonably sustain a CAGR of at least 4.0-4.5% over the next 10 years. My confidence is grounded in their well-established brands in developed markets, the growth potential demonstrated in emerging markets, capacity for innovation and potential for M&A activity.

Financial Forecast (Seeking Alpha)

Dividends & Share Buyback

The company’s dividend history goes back to 2001 when it was still a part of Kraft Foods, amounting to 22 years of uninterrupted dividend payments. During this time, the company consistently increased its dividends. However, when the company split into two entities, resulting in a dividend cut by more than half, the data indicates that dividend growth track record goes back to only 2012. Nevertheless, Mondelez has achieved a remarkable dividend growth rate since with a CAGR of 10.26% over the past 10 years, significantly surpassing the industry average of 5.9% for the same period.

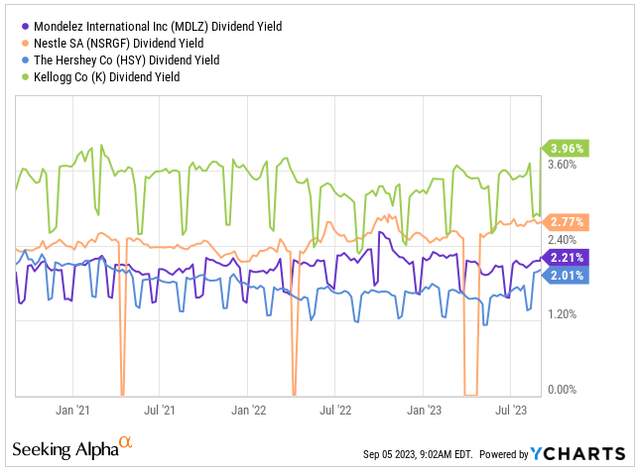

Presently, the dividend yield stands at 2.21%, slightly lower than competitors like Nestle at 2.77% and Kellogg at 3.96%, but higher than The Hershey Company’s yield at 2.01%.

While the current dividend yield may not be the highest, it exceeds its four-year average of 2.11%, albeit falling short of the industry average of 2.42%. Nevertheless, the company’s payout ratio remains comfortably below 50%, indicating that, in conjunction with anticipated future earnings growth, the company is well-positioned to continue increasing its dividend and rewarding shareholders.

Dividend Yield vs. Peers (Seeking Alpha / YCHARTS)

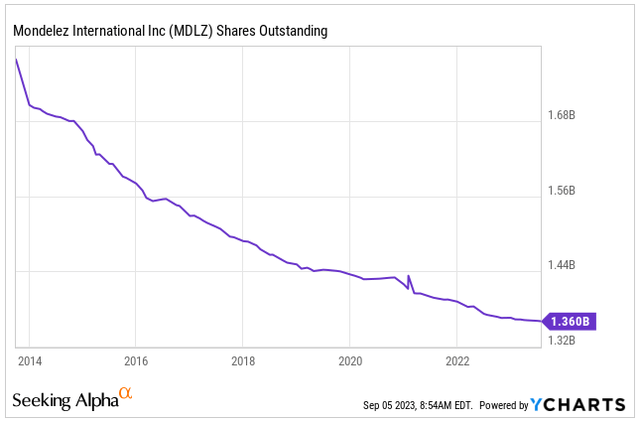

In addition to dividends, the company has been actively buying back its shares. Since 2013, the company has repurchased over 20% of its outstanding shares. Furthermore, in January, the company unveiled a new $6 billion buyback initiative, which remains in effect until the end of 2025.

Shares Outstanding (Seeking Alpha / YCHARTS)

Valuation

If I have not already convinced you about the excellence of Mondelez’s business, its promising growth prospects, and the potential for future dividend growth while buying back its own shares, perhaps the risk adjusted valuation will.

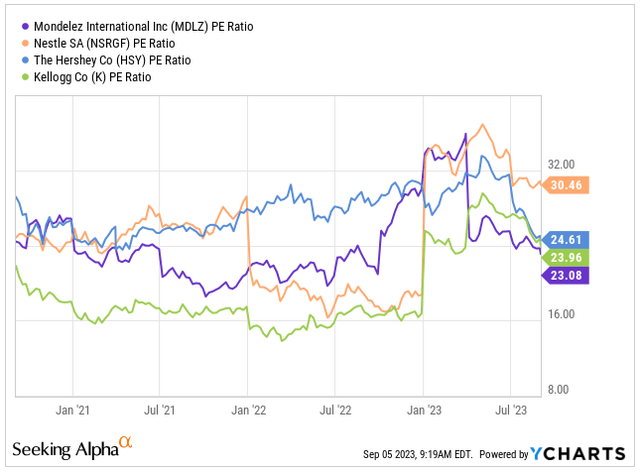

The company’s current PE ratio is 23.08x its 2023 earnings, which is lower than that of its peers: Nestle at 30.46x, Kellogg at 23.96x, and The Hershey at 24.61x. While this valuation may not be the most lowest, especially when compared to the industry’s average of 18.12x, it is justified by the company’s impressive growth. The expected YoY revenue growth of 14.14% in 2023 significantly outpaces the industry’s average expectation of 7.20%, explaining the higher PE ratio and reflecting the company’s high-quality business, even in the face of economic uncertainty.

PE Ratio vs. Peers (Seeking Alpha / YCHARTS)

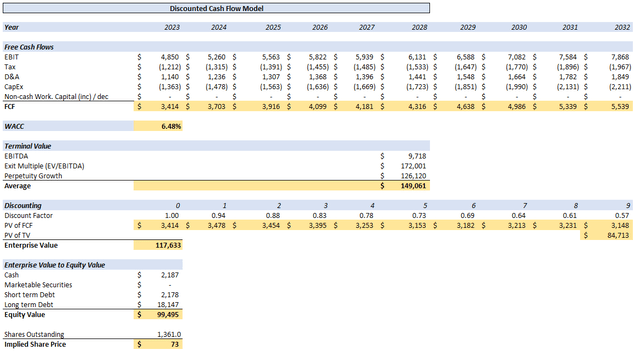

To estimate Mondelez’s Fair Value, I’m using a DCF Model. When creating the Financial Projection for the next decade, I’m relying on the revenue forecasts provided by analysts covered earlier. I anticipate that sales will approach $50 billion by the end of 2032, marking a 36.7% increase from the 2023 expected results. This projection is based on in my opinion conservative assumption of a CAGR 3.54% in revenue from 2023 over the next decade. Additionally, as the company matures, I expect an uptick in the Operating Margin, growing from the current 13.5% to 16%.

Financial Forecast (Author’s Graph (Data SA))

Additional assumptions for the DCF analysis are:

-

A tax rate of 25%.

-

Depreciation and Amortization and CAPEX amounting to 25% and 23.5% of EBIT, respectively.

-

WACC of 6.48%.

-

EV/EBITDA multiple of 17.7.

-

A Terminal Growth Rate set at 2%.

After discounting these values over the next 10 years, the PV of FCF amounts to approximately $33 billion, while the PV of TV reaches nearly $85 billion. Consequently, the total Enterprise Value is estimated at $118 billion. Following adjustments for Cash, Marketable Securities, Short & Long-term debt, the resulting Equity Value is assessed at $100 billion.

DCF Model (Author’s Graph)

According to my calculations, the estimated Fair Value for the company is $73, suggesting an undervaluation of approximately 5% compared to today’s price of $69.2. Considering the Fair Value assessment, combined with the quality of the business I rate Mondelez as a BUY.

Conclusion

Despite the challenging macroeconomic conditions of 2023, marked by factors like high inflation and elevated interest rates, which typically reduce disposable income, Mondelez has showcased remarkable resilience. For the second consecutive year, the company is demonstrating its ability to expand both its top and bottom lines under any economic circumstances.

In my opinion, Mondelez is strategically positioned for future growth while maintaining its reputation as a dependable dividend provider. It is anticipated to continue increasing its dividends in the years ahead, making it a steadfast cornerstone in any dividend-focused portfolio, ready to weather the storms of market volatility.

Read the full article here