Investment action

I admire Moody’s (NYSE:MCO) business for its robust pricing influence, dedication to innovation (such as AI) for enhancing operations, and impressive cash generation. Throughout the past ten years, MCO has maintained a consistent pattern of annual growth, except for FY22, which was impacted by a sluggish capital market. Nonetheless, I believe this phase of decline is nearing its end, and I anticipate a brighter outlook going forward. The second quarter results of 2023 provide initial signs of recovery, both in terms of growth and the optimistic stance of the management regarding issuances and ratings. I foresee a substantial increase in earnings momentum in the upcoming quarters, contributing to a favorable sentiment and as the EPS experiences strong growth. It’s important to note that FY22 was notably weak, so the headline EPS growth percentage will be further amplified.

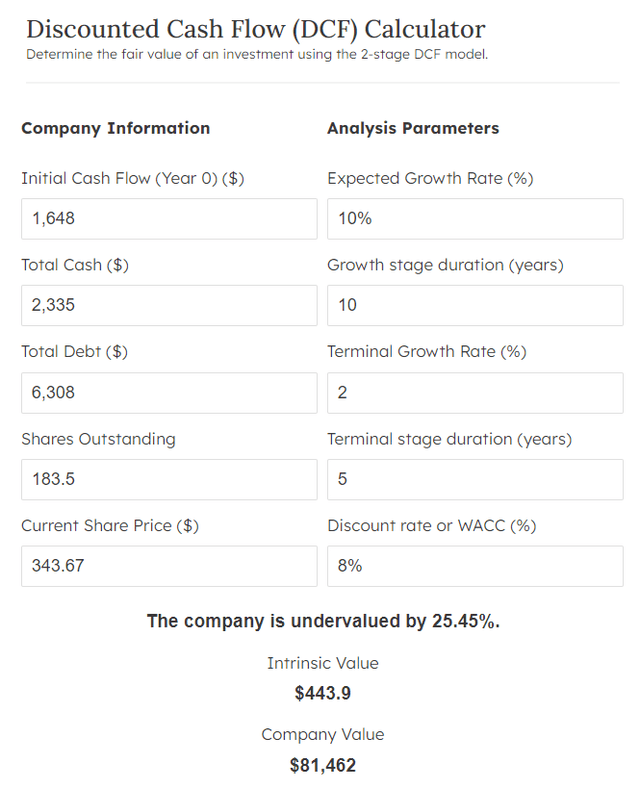

Based on my current outlook and analysis of MCO, I recommend a buy rating. Based on my DCF model, MCO has a potential 25% upside. I believe the near-term catalyst would be MCO performing as guided, specifically issuance revenue growing as expected, indicating a return to a normalized environment in the debt issuance market.

Business overview

MCO is a credit rating, research, and risk analysis firm. It provides credit ratings and related research, data and analytical tools, quantitative credit risk measures, risk scoring software, and credit portfolio management solutions and securities pricing software and valuation models. The business has 2 core segments: Moody’s Analytics [MA] and Moody’s Investors Service [MIS], each representing roughly half of the business in terms of revenue, but MIS has higher weigh in terms of operating profit, 57% vs MA with 43%. MIS is the core independent credit rating segment that houses over thousands of credit analysts that issue credit ratings on debt issuers. The MA segment produces financial analytics, risk management and compliance solutions across a diverse client base.

Duopoly

There are only two major players in the credit rating industry, and they are MCO and SPGI. I think new entrants will find it challenging to enter the credit rating market due to the industry’s strict regulations and the difficulty of establishing a sizable and reputable operation with a well-known brand. In my opinion, the competitive landscape of the credit rating industry will not change significantly over the foreseeable future.

Review

Revenue saw a growth of 8.2% to reach $1.49 billion, surpassing the anticipated 5.7% growth. Moody’s Investors Service [MIS] experienced a 5.8% increase in quarterly revenue, with substantial rises of 13.4% in corporate finance, 13.3% in financial institutions, and 4.1% in project, public, and infrastructure finance, but also faced a decline of 17.1% in structured finance.

During the second quarter of 2023, the volume of debt rated by MCO increased by 3% globally. Moody’s Analytics [MA] revenue showed an impressive 10.7% year-on-year growth, primarily driven by strong performances in Decision Solutions (13.6% growth), Research & Insights (6.9% growth), and Data & Information (10.1% growth).

However, EBITDA margins experienced a decline of 120 basis points year-on-year to 43.7% due to strategic sales deployment and product development investments in MA. This decline was partially offset by operating leverage in MIS. Notably, MIS showcased an impressive 55.9% increase in EBITDA margins, which stands in stark contrast to the 28.0% decline in MA’s EBITDA margins. EPS amounted to $2.30, exceeding the expected $2.25.

Management has taken an optimistic stance toward issuance and ratings revenue for the first time since 4Q21. In 2023, management is anticipating a hsd% increase in MIS revenues for the full year, up from a y/y growth rate in the low to mid single digits. Management anticipates and increase in MIS-rated issuance in 2H23 combined with a positive revenue mix, will result in low- to mid-20s% y/y growth in 2H23 MIS revenue. When compared to the 11% drop in 1Q23, this is a significant improvement in expectations. When we consider the low bar set by last year, the possible peak in interest rates, the accumulated demand for refinancing that hasn’t been met in the past 12-18 months, and the rise in M&A volumes, I think MCO can easily achieve this target.

On the other hand, the growth of MA’s ARR remained healthy at 10%, with 11% of that growth coming from decision solutions in the banking, insurance, and KYC. Management has restated their target growth of 10% for MA revenue in FY23.

Overall, I think MCO reported a very good 2Q23 result. Although the 2Q’s strong performance was due in part to a pull-forward in debt issuance activity (for more information, see the 2Q23 earnings call), I anticipate a net improvement in overall issuance this year as a result of the factors I’ve already mentioned. Long-term improvements in MIS and MA revenue and margin performance can be also expected given MCO’s expanding generative AI initiatives (read on for more details).

Investment in AI

Management’s interest in utilizing AI to enhance the company’s business model is encouraging. You can see it with even the most basic search of the 2Q23 earnings transcript (many references to AI). Management is pushing forward with a generative AI strategy fed by its own data and Microsoft (MSFT), which I anticipate will eventually boost MIS and MA’s bottom lines and profit margins. Since MCO data will be integrated into MSFT applications, I believe that MCO has greatly increased the number of potential customers it can reach as a result of this partnership. This is beneficial for both companies because MCO’s LLMs will be powered by MSFT’s validated data sets and proprietary databases like Orbis, resulting in more accurate results and fewer false positives. The man in charge of this project at MCO used to work for Microsoft, so I don’t think there will be any problems with its implementation.

“And we have appointed a Chief Architect with 20-plus years of experience at Microsoft who is developing an overall technology architectural blueprint, and he is who — he is building out our platform engineering layer.” 2Q2023 earnings

Valuation

Finmasters

I believe MCO can grow FCF at 10% annually in the growth stage, just as it has done so for the past years (average growth of around 10% historically). There should be no issues for MCO to grow its top line in the high single digits, as I expect capital markets health to recover eventually, and MCO to track back to historical levels. Given the scalability and high incremental margin nature of MCO businesses, I expect margins to improve over time as well. Putting it together, a combination of high-single-digit revenue growth and margin expansions should easily translate to ~10% FCF growth.

Risk and final thoughts

The debt capital market is notoriously unpredictable due to its high degree of volatility. Transactions account for the bulk of the MIS segment’s revenue generators. High incremental margins are typical for credit rating agencies, but it’s important to remember that transactional revenues also typically display high decremental margins. As a result, MA will be hit hard if the capital market situation worsens again, like what happened in 2022.

In conclusion, based on the better than expected performance in the second quarter of 2023, I recommend a long position on MCO. The revenue growth of 8.2% exceeding expectations, along with the positive outlook for issuance revenue and ratings, indicates a potential return to a normalized environment in the debt issuance market. Additionally, management’s focus on generative AI initiatives further supports the positive investment outlook.

Read the full article here