Before the market open on July 27, 2023, AbbVie Inc. (NYSE:ABBV), one of the leaders in the global immunology market, is expected to release its financial report for the second quarter of 2023. The announcement of financial results at the end of July is standard practice for the company and does not involve the publication of extraordinary data on revenue or operating income. The reason is that pharmaceutical companies with outstanding financial results or significant progress in developing experimental drugs publish information about it 5–7 days earlier than usual.

Starting in the first quarter of 2023, growth in sales of many of AbbVie’s key drugs began to slow down, and sales of Humira dropped by more than $2 billion quarter-on-quarter after Amgen’s biosimilar was launched on the market in late January. Ultimately, AbbVie’s management recently lowered its 2023 adjusted diluted earnings per share guidance range from $10.72-$11.12 to $10.57-$10.97.

This indicates increased competition in the industry and the obsolescence of the business model built under the leadership of Richard Gonzalez. Given modern realities, it is unable to quickly respond to changes in market conditions following the approval of President Biden’s Inflation Reduction Law and bring revolutionary drugs to the market.

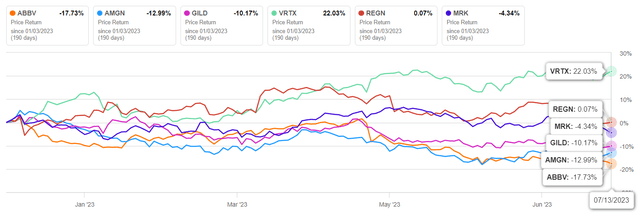

As a result, since the beginning of 2023, AbbVie’s share price has fallen by more than 17%, which is a significantly more negative result compared to major competitors in the healthcare sector, such as Gilead Sciences (GILD), Vertex Pharmaceuticals (VRTX) and Merck (MRK).

Author’s elaboration, based on Seeking Alpha

The date of loss of exclusivity and sales of the company’s medicines, the pace of development of revolutionary next-generation product candidates, and the success rate of clinical trials, are among the many most important factors that predict AbbVie’s long-term prospects. This article will present an analysis of the key things that stock market participants should consider before July 27.

The financial position of AbbVie and its prospects

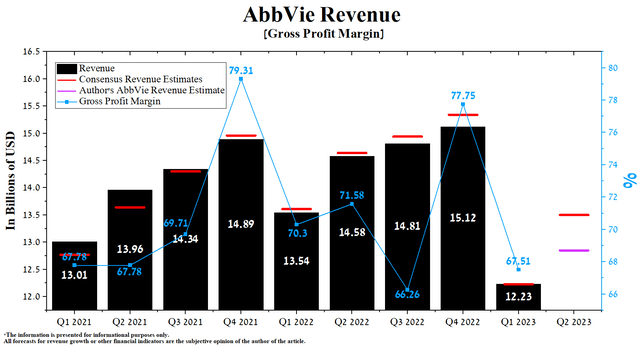

AbbVie’s revenue for the first three months of 2023 was $12.23 billion, down 19.1% from the previous quarter and 9.7% from the first quarter of 2022. Moreover, AbbVie’s actual revenue has been below analysts’ consensus estimates for the past six quarters, signaling Wall Street’s overestimation of the company’s medicine portfolio’s commercial prospects during the current period of declining inflation and flooding the pharmaceutical market with innovative products.

Author’s elaboration, based on Seeking Alpha

According to Seeking Alpha, AbbVie’s Q2 2023 revenue is expected to be $13.35-13.67 billion, up 10.4% from analysts’ expectations for the first three months of 2023. We estimate that this is too high an expectation, and according to our model, the total sales of the company’s products will amount to $12.85 billion.

AbbVie’s slight QoQ increase in revenue will be driven by growth in sales of Rinvoq, Skyrizi, and Botox, which are the company’s flagship medicines that could partially mitigate the damage from more and more Humira biosimilars in the U.S. market. At the beginning of the 21st century, Humira made a breakthrough in treating autoimmune diseases due to its innovative mechanism of action and favorable safety profile. However, the launch of Amgen’s Amjevita at the beginning of 2023 led to a sharp drop in sales of AbbVie’s product and, more importantly, showed Wall Street that Richard Gonzalez did not have a comprehensive and instant solution to this problem. Moreover, the company’s unsatisfactory product portfolio relative to its competitors casts doubt on the current business direction ahead of 2026, when many parts of President Biden’s Inflation Reduction Act come into effect and begin to create downward pressure on the pricing of certain drugs.

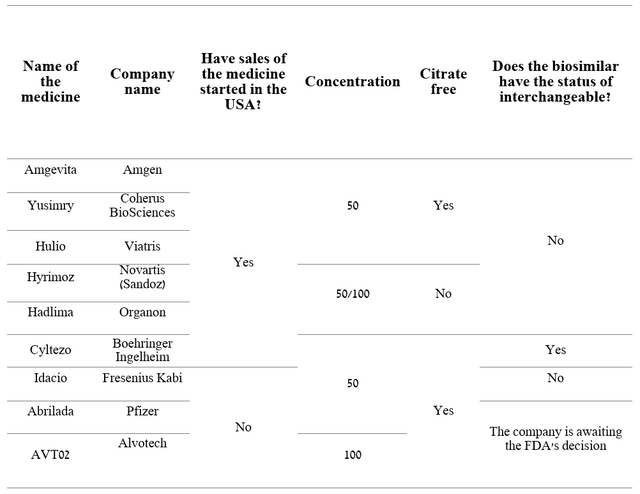

On July 1, 2023, sales of Boehringer Ingelheim’s Cyltezo, the first interchangeable medicine with Humira, began. This drug has a particular advantage over regular biosimilars, as the pharmacist can automatically offer it to the patient instead of the Humira prescribed by the physician. Month after month, the market is flooded with more and more biosimilars, which will not only lead to a decrease in demand for AbbVie’s blockbuster but may also provoke market participants to start additional price cuts for their drugs to increase the market share of tumor necrosis factor inhibitors market, to which Humira belongs. Right now, the list prices of Organon’s Hadlima and Coherus BioSciences’ Yusimry are $1,038 and $995, respectively, which is about 85% lower than the list price of Humira.

Author’s elaboration, based on quarterly securities reports

In addition to lower prices for Humira biosimilars relative to our expectations and FDA and EMA approval of more innovative medicines to fight immunological diseases, a significant risk to the company’s financial position in the medium term is the launch of Stelara biosimilars in the next six quarters. Stelara (ustekinumab) is Johnson & Johnson’s (JNJ) biologic medication, whose action is based on inhibiting the activity of two cytokines, interleukin-12 and interleukin-23. In addition to its superior performance relative to Humira, we expect relatively low prices for its biosimilars, which will pose significant risks to AbbVie’s immunology segment.

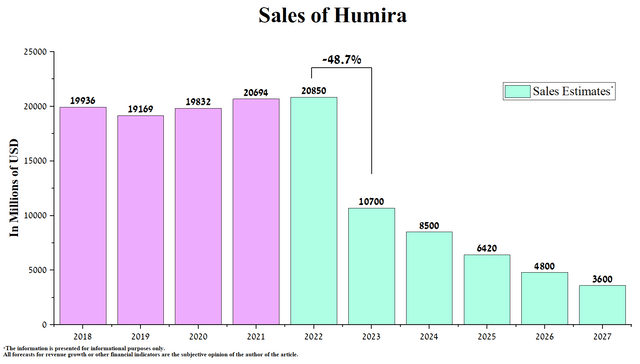

As a result, we are updating our Humira sales forecast for the next five years. Thus, according to our estimates, its total sales will amount to $10.7 billion in 2023, down 48.7% year-on-year, and at the same time, this figure will be just under $3.6 billion by 2027.

Created by author

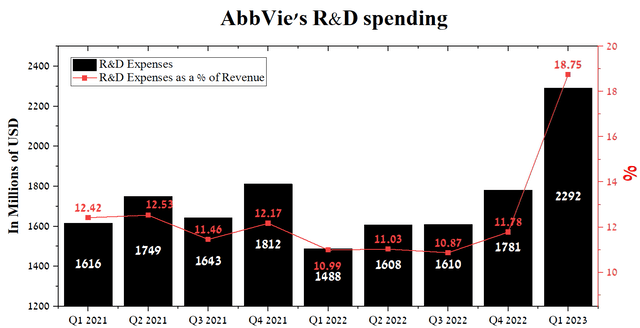

We believe that the key root causes of AbbVie’s decline in revenue are the company’s lack of mechanisms to respond quickly to competitors’ aggressive R&D policies and a strong belief that previous achievements will continue to deliver results for a long time. So, except for Q1 2023, the company’s R&D spending averaged $1.65 billion, which is significantly lower than that of major competitors such as Gilead Sciences and AstraZeneca (AZN), which spend more than 20% of revenue on the development of new experimental drugs and vaccines.

Author’s elaboration, based on Seeking Alpha

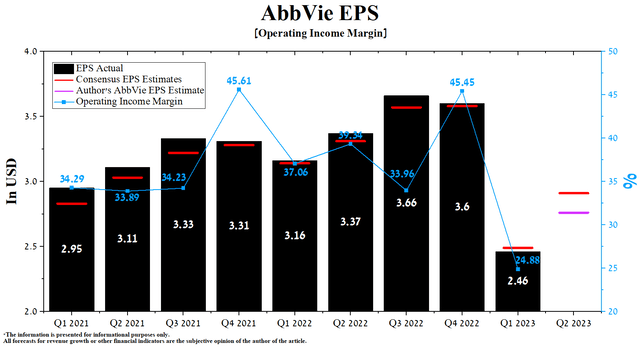

AbbVie’s operating income margin in Q1 2023 was 24.88%, down sharply from previous quarters. The company’s earnings per share (EPS) for the first three months of 2023 was $2.46, down 31.7% quarter-on-quarter and, more critically, breaking the trend of beating analyst consensus estimates.

According to Seeking Alpha, AbbVie’s Q2 EPS is expected to be $2.78-$3.06, up 16.5% from the consensus estimate for Q1 2023. While we believe these expectations are too high, our model puts the company’s EPS at $2.76, even with FDA approval of Epkinly and Rinvoq in May 2023.

At the same time, AbbVie’s Non-GAAP P/E [TTM] is 10.21x, which is 45.42% less than the average for the sector and 4.90% less than the average over the past five years. As a result, this is one of the factors indicating that the company is undervalued in the current period of declining inflation in the European Union and the USA.

Author’s elaboration, based on Seeking Alpha

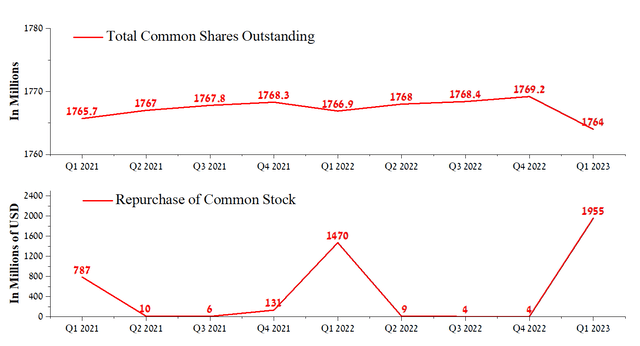

The structural business problems, accumulating year after year, prevent it from getting a positive effect from implementing the share buyback program. In the first quarter of 2023, AbbVie repurchased about $1.96 billion of its shares, but its market capitalization continues to decline, which casts doubt on the wisdom of using this method of returning funds to investors. On the other hand, at the end of March 2023, the remaining buyback authorization for the company’s shares was $4.8 billion. In our estimation, this partially minimizes the impact of short sellers on AbbVie’s share price during the declining sales of some of the blockbusters.

Author’s elaboration, based on Seeking Alpha

Conclusion

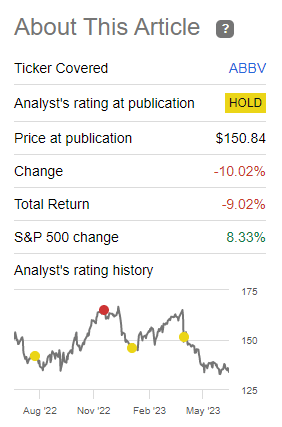

Since the publication of the last article, “What To Expect After The Failed AbbVie Drug Sales,” the company’s share price has decreased by more than 10% and continues approaching $124 per share, which we indicated as a strong support level. On a more global scale, since the beginning of the year, AbbVie’s share price has significantly underperformed the S&P 500 (SP500) and iShares Biotechnology ETF (IBB), despite an active share buyback program.

Nathan Aisenstadt – Seeking Alpha

On July 27, 2023, AbbVie, one of the leaders in the global immunology market, is expected to publish financial results for the second quarter of 2023, which we estimate will be worse than Wall Street analysts expected. During this period, the company has received several FDA and EMA approvals, but they will not significantly impact its revenue in the short term.

On the other hand, from month to month, the market is flooded with more and more Humira biosimilars, which will not only lead to a decrease in demand for it but may also provoke market participants to start additional price cuts for their medicines to increase the market share of tumor necrosis factor inhibitors market. Some of these biosimilars already have a list price significantly lower than we previously assumed when forecasting Humira sales until 2027. For example, Organon’s (OGN) Hadlima and Coherus BioSciences’ (CHRS) Yusimry are priced at $1,038 and $995, respectively, about 85% less than AbbVie’s blockbuster list price.

We believe the next two years will be among the toughest years in AbbVie’s history, requiring the company’s management to undertake an aggressive and risky transformation aimed at rejuvenating the portfolio of drugs and reducing its total debt to over $60 billion. We continue our analytics coverage of AbbVie with a “hold” rating for the next 12 months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here