Natural Grocers by Vitamin Cottage, Inc. (NYSE:NGVC) recently announced an optimistic outlook, which includes further opening of stores, increasing basket size, and growing consumer interest in nutrition and wellness. In my view, announced economies of scale, discounts, and promotions may accelerate net sales growth and the FCF margins. I did see some risks from concentration of suppliers, failed expansion into new territories, or macroeconomic risks. With that, NGVC really looks undervalued at its current price mark.

Natural Grocers: the Outlook Included Potential Economies Of Scale And More Stores In 2023

Natural Grocers is a company dedicated to the retail distribution of natural and organic groceries and dietary supplements within the United States. The company is currently present in 25 states, and leases the 164 stores, in which it distributes the products. Part of this company’s initiative is to maintain only the sale of natural and organic products, maintaining close relationships with its customers through small stores that allow it to offer products at an affordable price. In the modern trend that consumers are more interested in and the nutritional values of the food they eat, this type of business has had a growing position within the markets.

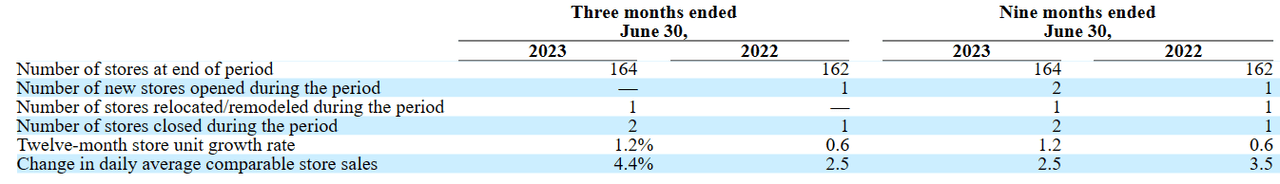

Natural Grocers operates through a single business segment that includes logistics for distribution, supply, and marketing through its retail stores along with a real estate strategy to reduce maintenance costs as well as to open new stores. In this sense, the company has managed to establish a strong financial discipline, and in its calculations and estimates, the cost of opening a new store is projected to be covered in the fifth or sixth year of operation. In the last quarter, the company reported once again an increase in the number of stores.

Source: 10-Q

The company is committed to disclosing nutritional information and educating its customers, which is part of the outreach and loyalty program, on which much of its business model is based. Natural Grocers, in addition to selling only organic or agro ecological products, maintains an active education strategy through brochures and talks that it provides for its clients. It also maintains relationships with local producers for the sale of their products in retail stores.

I think that successful communication of the importance of maintaining a healthy diet is a fundamental factor for growth in sales and reach, especially taking into account the low production of marketing or advertising content in contrast to that of the large food producers that are historical leaders in national and international markets.

The opening of new stores is subject to a scalable real estate strategy, which allowed positioning in highly competitive markets outside the original locations within Colorado. This includes investment in logistics and distribution to supply products and the search for small stores that do not generate large cost margins for their maintenance.

With that about the business model, I believe that the most interesting thing about the company is the outlook given for the incoming quarters. The optimism about incoming economies of scale or opportunities for increased leverage of costs could accelerate FCF generation in the coming years.

We believe there are opportunities for us to continue to expand our store base, expand profitability and increase comparable store sales. Source: 10-Q

We believe there are opportunities for increased leverage of costs and increased economies of scale in sourcing products. However, due to the fixed nature of certain of our costs, our ability to leverage costs may be limited. Source: 10-Q

Diminishing Balance Sheet, But Solid Asset/Liability Ratio

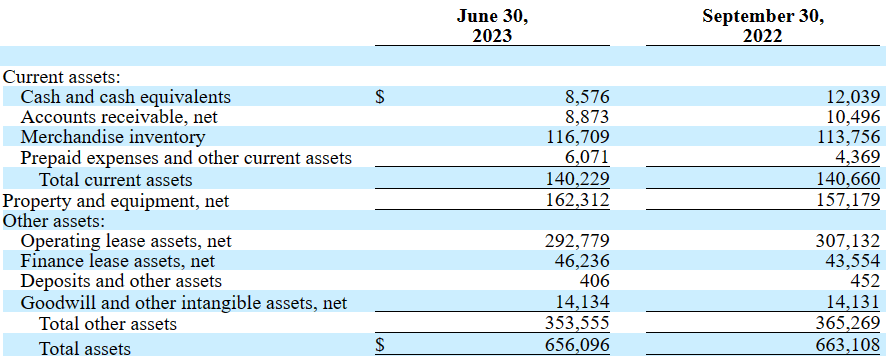

I do not think that investors may appreciate the recent quarterly report delivered for June 30, 2023. I saw a generalized decrease in the total amount of assets.

Cash and cash equivalents declined by -28%, with a decline in accounts receivable close to -15%. Besides, with a decrease in operating lease assets close to -4.67%, total assets decreased close to 1.057%. With that, the asset/liability ratio stands at more than 1x, so I do believe that the balance sheet stands in a good position.

Source: 10-Q

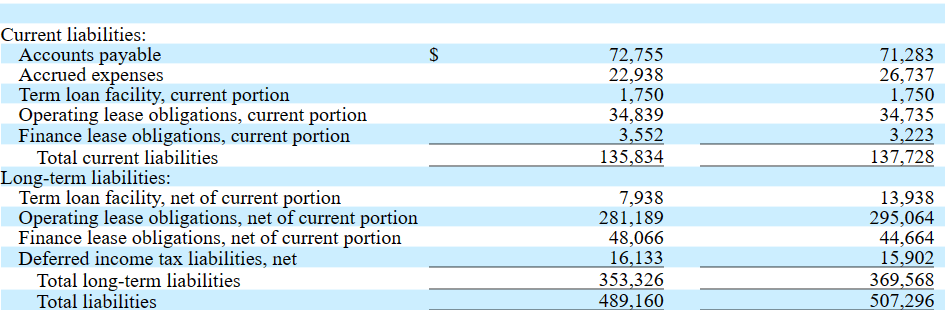

The total amount of liabilities also decreased as compared to the quarter ended September 30, 2022. However, the company reported some increases in accounts payable, close to 2%, current finance lease obligations of about 10%, and non-current finance lease obligations of 7.6%.

Source: 10-Q

Valuation

For the valuation of the company, I took into account the global organic food and beverages market growth, which is expected to be close to a CAGR of 11.7% from 2023 to 2030. It is also worth noting that management appears to benefit from the market growth. In the last quarterly report, management noted that it is opening new stores.

The global organic food and beverages market size was estimated at USD 208.19 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.7% from 2023 to 2030. Source: Organic Food And Beverages Market Size Report, 2030

The growth in the organic and natural foods industry and growing consumer interest in health and nutrition have enabled us to continue to open new stores and enter new markets. Source: 10-Q

In 2023, the company expects to open three new stores, so I believe that even with many analysts talking about economic recession, management continues to be optimistic about the future. With more stores, I believe that net sales growth and FCF improvements could happen.

We plan to open four new stores and relocate/remodel three stores in fiscal year 2023. As of the date of this report, we have signed leases for an additional five new stores that we plan to open in fiscal years 2023 and beyond. During the nine months ended June 30, 2023, we opened two new stores, relocated/remodeled one store, and closed two stores. Source: 10-Q

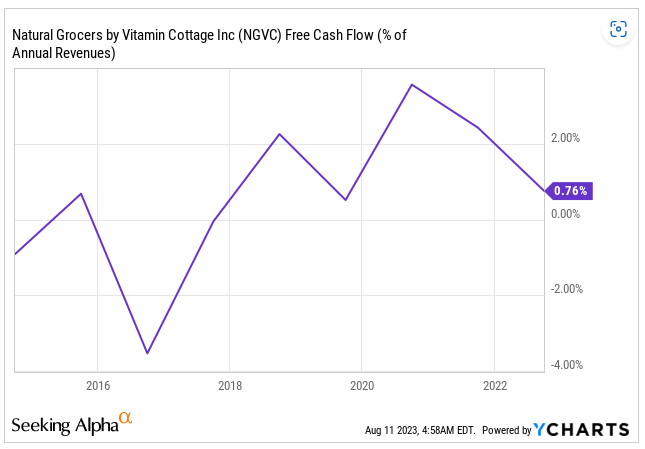

At present, Natural Grocers’ main objective is to increase its number of clients and reach new regional markets, in which it does not have a presence, or has a lower market position. For this, the company carries out a pricing strategy and a real estate strategy, allowing it, on the one hand, to keep the products within the reach of its customers’ economic conditions, and, on the other hand, to reduce operating costs. Taking into account previous increases in FCF margin, I believe that thanks to these strategies, we will most likely observe further margin increases in the coming years.

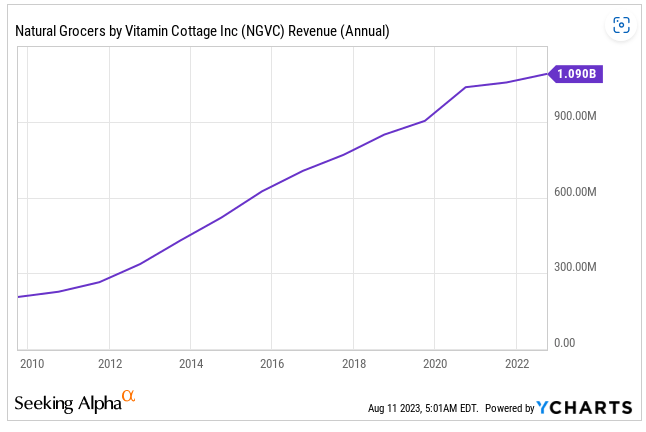

Source: YCharts

Regarding its prices, the company offers discounts for members, discounts, within the premises, for overstock or expiring products, low-cost family food packages, holiday promotions, or targeted campaigns, and joint campaigns with producers on the importance of healthy eating. Under my financial model, I assumed that discounts, promotions, and campaigns will most likely lead to net sales growth and free cash flow growth. Taking into account previous sales growth, I think that these strategies implemented by Natural Grocers are working pretty well.

Source: YCharts

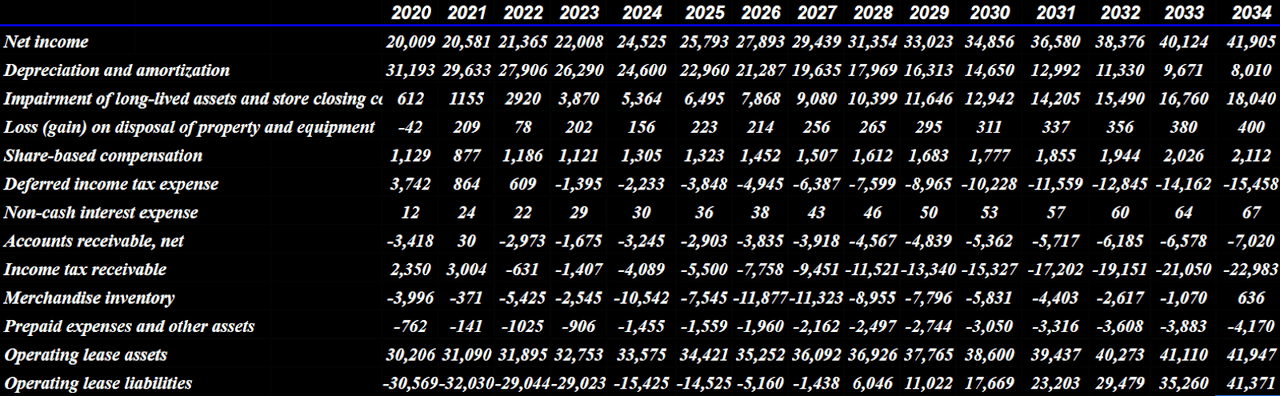

My financial model includes 2034 net income close to $41 million, 2034 depreciation and amortization of about $8 million, impairment of long-lived assets and store closing costs worth $18 million, and share-based compensation of $2 million.

Besides, with accounts receivable of close to -$8 million, income tax receivable worth -$23 million, and changes in prepaid expenses and other assets of about -$5 million, I also included operating lease assets close to $41 million.

Source: Cash Flow Expectations

Finally, with changes in operating lease liabilities of close to $41 million and changes in accounts payable close to -$2 million, the net cash provided by operating activities would be about $91 million. Moreover, if we include 2034 acquisition of property and equipment of close to -$38 million, 2034 FCF would be $53 million.

Source: Cash Flow Expectations

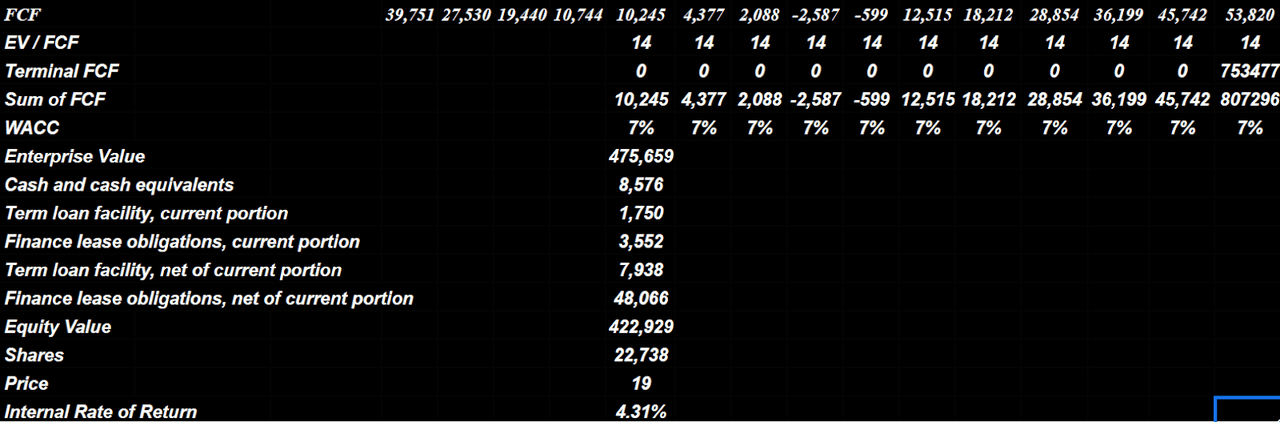

I believe that a terminal EV/ FCF of 14x would be quite conservative. With a WACC of 7%, the implied enterprise value would be close to $475 million.

Now, if we add cash and cash equivalents of $8 million, subtract term loan facility of $1 million, current finance lease obligations of $3 million, non-current finance lease obligations worth $48 million, the equity value would be $422 million. Finally, the implied price would stand at $18.68, and the internal rate of return would be close to 4.3%.

Source: Cash Flow Expectations

Competitors

Natural Grocers participates in a large, highly competitive, and highly fragmented industry that has low entry conditions for participation. Competition varies for grocery vendors in general and natural product distributors in particular. Some mainstream supermarkets like Kroger (KR) offer this type of product on their shelves along with some large ones like Walmart (WMT) or Target (TGT). We can add to this list The Fresh Market, foreign retailers such as Aldi, Lidl, or Ahold Delhaize (OTCQX:ADRNY), and Sprouts (SFM), or Costco (COST), along with another series of retail participants in this market that include stores services, pharmacies, and stores among others.

This industry is subject to changes due to the appearance of new technologies, purchasing dynamics, and the appearance of increasingly frequent digital commerce channels to put customers in contact with their preferred products. Within this framework, the company relies on its difference in authenticity on organic products as well as education and dissemination of information in this regard for its customers.

Risks

Regarding the risks for this company, we can first point out that its strategy of reaching and increasing income margins could not be successful, and depends to a large extent on the ability to read market trends in relation to the preferences of customers as well as the geographical distribution of their future stores.

In addition, it presents a concentration of its product suppliers. If the availability of certain organic products is reduced, its operations could be affected. UNFI, the federal natural foods union in the United States, supplied 67% of the company’s marketable products during 2022.

We source from approximately 1,000 suppliers and offer approximately 3,100 brands. These suppliers range from small independent businesses to multi-national conglomerates. As of September 30, 2022, we purchased approximately 78% of the goods we sell from our top 20 suppliers. For the fiscal year ended September 30, 2022, approximately 67% of our total purchases were from United Natural Foods Inc. and its subsidiaries. Source: 10-k

Similarly, the global and national economic situation is currently in check, with high inflationary statistics. This price volatility applies to the real estate market, and in the event of higher operating costs due to the leasing of stores or factors that produce significant changes in its real estate strategy, the company’s financial results could vary significantly.

Conclusion

Natural Grocers does not only enjoy a market that is expected to grow at a compound annual growth rate of 11.7% from 2023 to 2030. In the last quarterly report, the company made very optimistic commentaries about new store openings in 2023 and incoming economies of scale, which may lead to further free cash flow generation. Even considering that the balance sheet decreased recently, I believe that it appears solid enough and clean enough to finance further expansion into new territories and new markets. I do see some risks from the relationship with suppliers, failed understanding of new trends in the market, or macroeconomic risks. With that, Natural Grocers does look undervalued.

Read the full article here